The Belt & Road Initiative Central Asia: The Tax Implications

Op/Ed by Chris Devonshire-Ellis

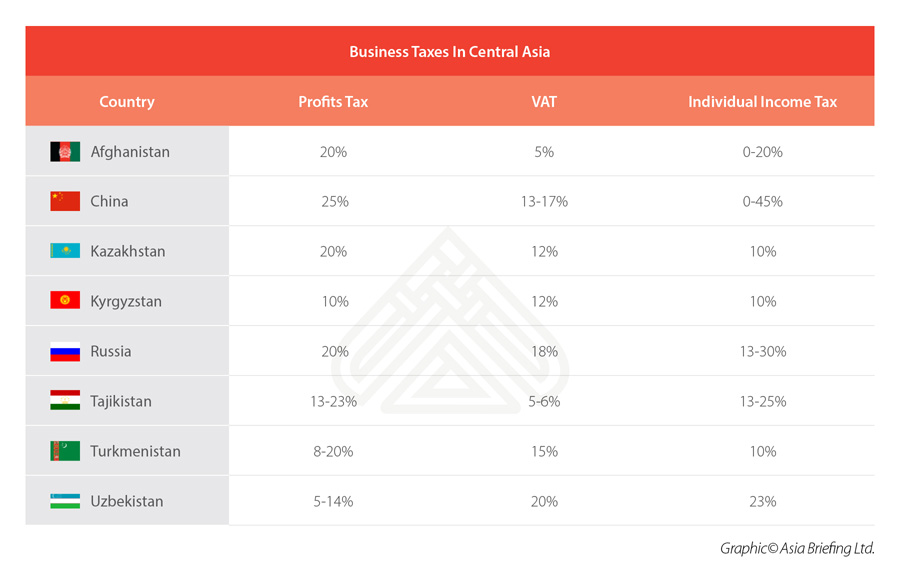

Profits, Income Tax & VAT Across China’s Belt & Road In Central Asia

As we have seen over the past few weeks, China is opening up the Belt & Road Initiative to Foreign Investors. It has done this by changing its foreign investment law, and including in this the ability, for the first time, for Foreign Investors to participate in Chinese procurement contracts and bidding for tenders. We discussed this situation in the article China’s New Foreign Investment Law & The Impact On The Belt & Road Initiative

That has lead us to examine the roles in which Foreign Investors can play in looking to negotiate and secure Belt & Road Initiative contracts, which was further discussed in the articles Best Practice & Negotiation Issues When Handling Belt & Road Initiative Contracts and in Preparing Foreign Investors For Procurement In Belt & Road Contracts

In this article we can examine the tax implications of doing business in Central Asia itself. Below is a chart explaining the basic tax structures in each of the respective Central Asian nations.

As can be seen, there is some considerable leeway in the amounts due, depending upon various levels of income or the type of business involved. Some of the countries mentioned also impose additional taxes on sales, social security and so on which also add to the overall tax burden, and are too complex to list here in a simple graphic. Readers interested in the subject and requiring a more detailed analysis pertinent to their specific needs should contact us silkroad@dezshira.com for clarifications. There are other caveats too. Of the countries mentioned, Kazakhstan, Kyrgyzstan and Russia are all members of the Eurasian Economic Union which reduces some elements of trade between, this being especially applicable to duties. This could impact upon the desired location a Belt & Road project office be located in.

All of the countries mentioned also employ a variety of Double Tax Treaties (DTA), both with each other and with other countries. It is worthwhile establishing if such DTA are applicable to your business. Of these, all bar Afghanistan have a DTA with China, while all have committed to sign off with China on a Belt & Road Initiative MoU. The latter may have some negotiating leeway, while the applicable DTA can be used, through the imposition of Withholding Tax mechanisms and the using of this tax (applied to Royalty items such as Trademarks and Patents) to minimize the overall Profits tax.

Structuring contracts therefore with Belt & Road contracts in Central Asia requires a knowledge of applicable DTA, in addition to the local Central Asian tax regime. Professional advise should be obtained.

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. The firm provides business intelligence, legal advisory, tax advisory and on-going legal, financial and business operational support to investors throughout China, India, ASEAN and Russia, and has 28 offices throughout the region. We also provide advice for Belt & Road project facilitation. To contact us please email silkroad@dezshira.com or visit us at www.dezshira.com