China’s New Foreign Investment Law And The Impact On The Belt & Road Initiative

Op/Ed by Chris Devonshire-Ellis with assistance from Qian Zhou

China is set to introduce a new Foreign Investment Law to take effect 1 January 2020. What will change and how will this impact Belt & Road Initiative procurement?

China is set to introduce a new Foreign Investment Law (FIL) to take effect from 1st January 2020. This law, which was passed on 15th March this year, is a landmark legislation with the stated aim of improving the business environment for foreign investors and ensure that foreign invested enterprises participate in market competition on an equal basis. The FIL will be a new guiding document governing foreign investment in China.

After the reform was announced, the in-country foreign investment community struggled to assess its meaning. Foreign investment groups in the country largely criticized the reforms opacity, while overseas media placed the reform within the larger debate on the US-China Trade War. To date, commentary on the impact of the new FIL has been muted.

However, the FIL has important areas of interest to all Foreign Investors in China, including the reclassification of all as “Foreign Invested Enterprises” and previous distinctions of “Foreign Invested Commercial Enterprise”, “Wholly Foreign Owned Enterprise” and “Joint Venture” will be abolished. New terms and conditions regarding the permitted scope of business will be introduced and measures to place Foreign Invested Enterprises on the same, non-discriminatory footing as domestic Chinese companies also enacted.

We will cover the entire issues related to the new Foreign Investment Law in the upcoming issue of China Briefing Magazine, due out in two weeks time. A complimentary subscription is required if you want to access this publication.

As a legislative effort to improve the foreign investment climate, the new FIL shows China is getting more serious about protecting foreign investor’s rights. As examples, it lays emphasis on the equal national treatment of foreign investment, putting foreign investors on a more level playground with domestic investors, and giving them equal protections, explicitly banning forced technology transfers, promising better intellectual property rights protection, and ensuring equal treatment for foreign firms in government procurement.

Although at this stage not all areas of enforcement of the new law have been worked out, this tends to happen over time, and typically within 12 months of the law coming into effect. China often issues changes to laws and applies the “implementing rules” afterwards – something critics of the new FIE law need to understand is a legislative procedural issue rather than an inherent weakness.

What Has Driven China To Introduce These Changes?

There have been several drivers towards why China needs to completely revise its Foreign Investment Laws. These are as follows:

- *China is the world’s second largest recipient of Foreign Direct Investment at US$142 billion (2018) amounting to 11.9% of all global FDI inflows, yet only ranks 46th in the World Bank’s Ease of Doing Business Rankings;

- *Existing laws are no longer sufficient to support China’s economy. For example, the laws concerning JV’s were bought into place over 25 years ago and do not cater adequately the changed environment, especially as regards IT.

- *China’s growth is slowing and regions such as ASEAN are becoming more competitive. For example, in 2017, FDI inflows into ASEAN countries increased by 11 percent, far more than the two percent FDI increase that China had in the same period.

- *Key FDI sectors are also changing. The proportion of FDI into general manufacturing and real estate sectors are declining, while the proportion of FDI into high-tech industries such as IT, A.I; the Internet, and Financial sectors continue to rise.

How Does This Affect China Procurement?

An important aspect of China’s new FIE law is the position concerning procurement. This is of especial interest to foreign investors who have been struggling to get a toe into the often billion-dollar contracts that are entered into as Belt & Road Project Contracts, and should be of interest to both foreign investors already extant in China as well as larger overseas corporations who fall under the Belt & Road banner but who have not yet invested in the country.

Chapter 2 of the FIL establishes several pro-investment policies for foreign investors. These include:

- Article 9 states that pro-business policies for domestic enterprises shall apply equally to FIEs;

- *Article 14 mentions that foreign investors and FIEs may enjoy preferential treatments according to laws, administrative regulations, or provisions of the State Council;

- Article 15 says FIEs can participate equally with domestic enterprises in the setting of standards;

- Article 16 suggests FIEs could participate in government procurement activities through fair competition, and that products produced and services provided within the territory of China by FIEs shall be equally treated in government procurement;

The general theme throughout the new FIE law is that Foreign Investors in China shall have the same rights as domestic Chinese companies, and this is apparent throughout the document. Of additional note however are Articles 15 and 16.

Article 15’s statement over the ability for Foreign Investors to work together with Chinese companies over the “setting of standards” is vague and will no doubt be tightened up. However an implication is the sharing of both IP and the working together to create standards in line with those required by other countries or regions, such as the Eurasian Economic Union or European Union, whose technical standards often differ from China’s.

Article 16 ensures foreign-invested enterprises equal participation of government procurement, which is regarded as a huge improvement by relevant observers. However, the Article doesn’t define what will constitute ‘products produced or service provide within the territory of China’. In the future legislation, investors are suggested to pay close watch to the ratio requirements of local composition in the matching laws as to government procurement. As mentioned, the upcoming “implementation rules” will no doubt clarify these issues.

Regardless, these two areas in particular should be of interest to foreign investors in China, both in submitting proposals for domestic procurement and for Belt & Road Initiative Project Contracts. It remains the case that often, foreign expertise and standards can be superior to Chinese in a large variety of technical and engineering applications. China needs access to that if it is not to be responsible for a series of shoddy BRI infrastructure builds that cast the country in a globally bad light. Having foreign investors in China as part of procurement lessens the likelihood for such projects to fail – with embarrassing consequences for the Chinese government. A Chinese built building collapsed in Cambodia’s capital city for example just two days ago, killing 28. Beijing wishes to avoid such dramas, and this therefore opens the door for foreign investors in China to take part in such deals.

China’s Need To Change Its Belt Road Initiative Procurement Practices

Beijing has also recognized China’s need to change its BRI procurement activities. Currently, over 60% of Chinese-funded BRI contracts go to Chinese firms, compared to 30% for non-Chinese funded BRI projects. China is not alone in the practice of awarding contracts to its own firms, but many countries have agreed that in the development finance context, this is not good practice. This is reflected in the 2005 Paris Declaration on Aid Effectiveness which calls on donor countries to move away from tying aid to sourcing goods and services from national firms. Instead, donors should rely on in-country resources and create a level playing field for all suppliers, regardless of their ownership or nationality. A similar decision by China with regard to the BRI would provide greater assurance that BRI procurement awards go to the firms best placed to execute a project. Given the competitive strengths demonstrated by Chinese companies in procurement contests around the world, this may not result in a major shift in the share of contracts going to Chinese firms. But it would provide greater assurance that winning firms are those that put forward the strongest bids.

The World Bank Group released a white paper last year, Public Procurement In The Belt & Road Initiative that illustrates how procurement practices used for BRI projects could be further aligned with procurement provisions that BRI countries have made in their preferential trade agreements (PTAs) and international standards embodied in the WTO’s Plurilateral Agreement on Government Procurement (GPA) which has also been endorsed by China and Hong Kong. This further underlines the commitment that China has made in its own new FIE laws to improve foreign investor access to procurement, and ties in with Beijing’s own concern that some of its own SOE’s do cut corners in a bid to maximize profits. When this is also linked to Government to Government relations, as it always is in BRI contracts, this can prove extremely embarrassing for Beijing and can result in awkward political questions being asked – something Xi Jinping absolutely wishes to avoid. Allowing foreign contractors more participation in BRI projects lessens China’s risk.

Who Will Benefit From The New China Foreign Investment Procurement Law?

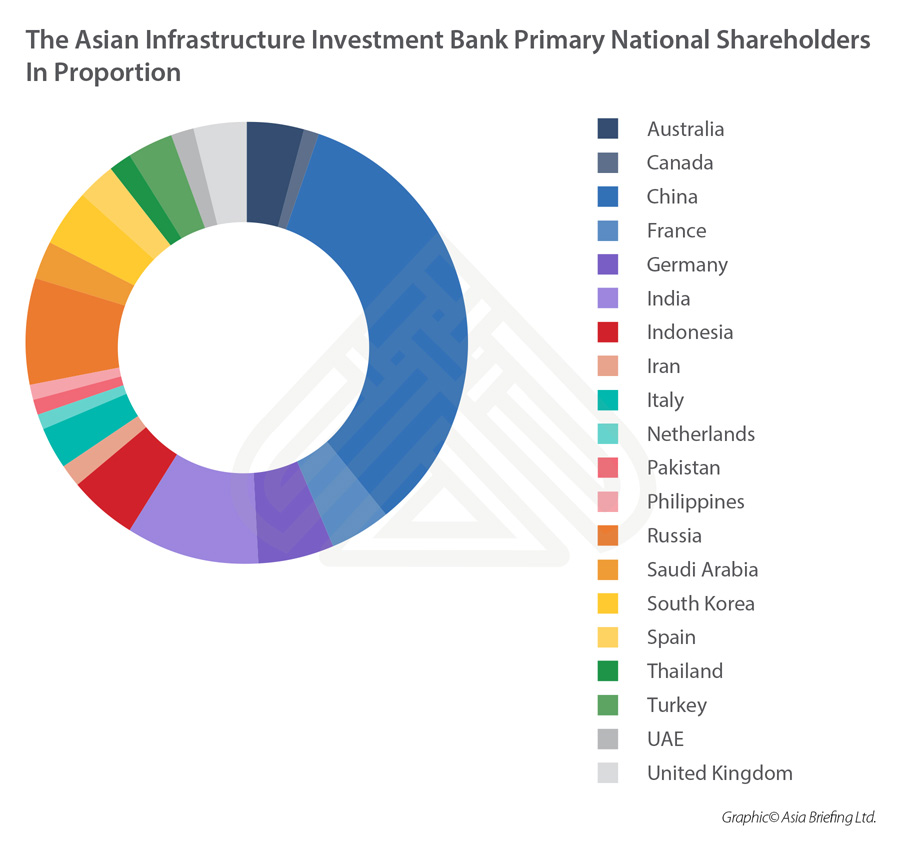

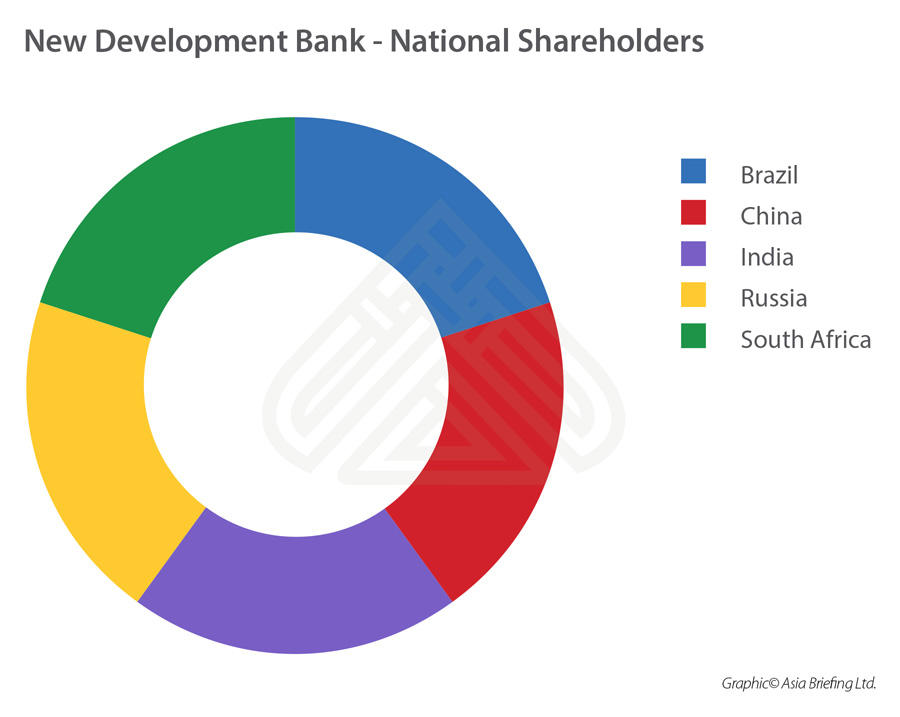

The new FIL gives such overseas investors in China an impetus to consider that, while they may wish to supply materials in Belt & Road contracts, it also opens up doors to projects financed by the Asian Infrastructure Investment Bank, the BRICS New Development Bank and so on. There are political considerations, and China does tend to reward countries that have come into alignment with some of its policies. In terms of businesses who can be expected to be given a warm welcome in China are those from countries who have also subscribed to shareholdings in its major Belt & Road related financial institutions. Of these, two major players stand out, the Asian Infrastructure Investment Bank and the New Development Bank (formally the BRICS bank). The major shareholders in these are as follows:

Are There China Investment Tax Benefits For The Belt & Road Initiative?

China has a large raft of applicable investment tax benefits for foreign investors. These vary depending on region and also whether or not your business in sited in a Free Trade, Processing or Special Economic Zone, of which China has many. These are useful as being sited in such zones means that important component parts can be imported to the zone duty free, worked on to include Chinese component parts, then reexported free of duty directly to the Belt & Road Project location.

Apart from this, China has also signed off Double Tax Treaties (DTA) with a large number countries that have also signed off on China’s Belt & Road MoU. DTA are useful as they can provide for lower taxes on a variety of defined products and services (each Treaty is different) as well as effectively reduce profits tax in China by permitting a withholding tax mechanism that when used properly can shave another 5-10% off profits tax. Professional advise is needed to do this, and applications need to be made to the Chinese tax authorities at the establishment stage to advise them your China subsidiary will be claiming relief under a pertinent DTA. We discussed using China’s Double Tax Treaties in this issue of our China Briefing Magazine “Using China’s Free Trade & Double Tax Treaties” which can be downloaded free of charge upon completing a complimentary subscription form.

A list of the countries that have signed off on China’s Belt & Road Initiative MoU and also have a Double Tax Treaty with China is here:

A Boost To China’s Foreign Direct Investment

It makes sense for engineering, architectural, construction and other infrastructure related businesses from the countries mentioned to be taking a new look at investment into China especially given the upcoming FIL and the need for China to provide a better welcome mat for Foreign Investors into the country. It makes sense that foreign investors from countries who also own part of the Belt & Road Initiative financing mechanisms are also likely to be fast tracked, and especially when it comes to participating in procurement contracts. It also means that FDI into China is about to take on a new, third dimension by the foreign investors themselves; in addition to the tried and tested method of using China as a cheaper manufacturing base for export back home, or manufacturing for the Chinese domestic market, they are now able to export, either on their own or in conjunction with a China BRI project partner, materials and services to third country destinations. The new FIL means it is a pertinent time for foreign businesses attracted to the opportunities that China’s Belt & Road Initiative represents to get into the market, establish a China subsidiary, and start to get involved in a Belt & Road Procurement market and tendering for contracts.

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. The firm provides business intelligence, legal advisory, tax advisory and on-going legal, financial and business operational support to investors throughout China, India, ASEAN and Russia, and has 28 offices throughout the region. We also provide advice for Belt & Road project facilitation. To contact us please email silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

![]() How Chinese Contractors are Winning EU Infrastructure Projects

How Chinese Contractors are Winning EU Infrastructure Projects

![]() BRICS New Development Bank on Course to Lend US$40 Billion in Green Infrastructure Projects

BRICS New Development Bank on Course to Lend US$40 Billion in Green Infrastructure Projects