Preparing Foreign Investors For Procurement In China Belt & Road Projects

China’s New 2020 Foreign Investment Law Gives Equal Rights To Foreign Investors In Procurement. But What Are The Procedural Steps To Enable Participation?

Op/Ed by Chris Devonshire-Ellis & Hazel Wang

China’s new foreign investment law kicks in from 1st January 2020 – just 6 months away – and promises equality for foreign investors in China when it comes to competing with China’s domestic companies for procurement contracts. In doing so it has changed the landscape for foreign investment in China by offering foreign investors a more level playing field “equal” to Chinese companies. There will be doubters that this will be implemented, however there are also reasons for this shift – academic studies globally have shown that fairer procurement results in better end results, and lessens the opportunity for corruption. It also upgrades engineering and other applicable standards. This is of importance to Beijing, embarrassed by shoddy Chinese works overseas resulting in several collapsed buildings, bridges and towers. Getting foreign investment into China’s overseas infrastructure build is seen as minimizing risk.

I explained the rationale behind this in some depth in this article:

Why Get Involved In Belt & Road Procurement?

The Belt & Road Initiative, coupled with the new FIE law, provide significant opportunities for Foreign Investors in China, as estimates of the impact of the Belt & Road just this year alone suggest it will increase global trade by US$117 billion. The overall impact on Global trade since the Belt & Road Initiative was announced has been an estimated US$460 billion since 2013. That figure is not going to slow down any time soon. Foreign Investors can get involved by providing products and services to the myriad of projects that are being undertaken around the world.

Although the spectre of unfair competition will always raise its head when domestic money is being made available in procurement, at present just under 40% of all procurement contracts linked to the Belt & Road Initiative do go to foreign companies. The new FIE law can be expected to increase that, and it specifically states in its Article 16: “The State protects foreign-funded enterprises’ participation in government procurement activities through fair competition. Products produced and services provided by foreign-funded enterprises within the territory of China shall be equally treated in government procurement according to law.”

What Does China’s Procurement Law Say?

Our firm, Dezan Shira & Associates has a 27 year old history of servicing foreign investors in China and has a sizable Business Advisory team packed full of Chinese and international lawyers to assist such investors in the China market. We have cross-referenced the new Article 16 in the FIE against the existing Chinese laws regulating Government Procurement (“GP”), and can deduce the following:

According to the “Government Procurement Law of the People’s Republic of China” (amended in 2014), legally speaking, GP shall abide by the principles of transparency, fair competition, impartiality and good faith.

The law says, suppliers engaging in GP in China activities shall fulfil the following criteria:

- Have the capacity to independently bear civil liability;

Note: The “Independent capacity to bear civil liability” is a legal concept. All limited liability Foreign invested enterprises in China possess this capacity.

- Have a good commercial reputation and sound financial accounting systems;

Note: Normally the commercial reputation could be checked on China Government Procurement Website (http://www.ccgp.gov.cn/), and the financial audit report of the last year issued by a third party is required to prove a “sound financial accounting system.” - Possess the equipment and professional and technical competence required for performance of the contract;

Note: Concerning the equipment, normally the equipment list is required; for the technology, the relevant certificates shall be provided, including but not limited to, the qualification certificate, relevant personnel certificate, and cases/experiences. As GP, there is no uniform standard. The requirements/measurements depend on the services/products in the GP. - Have a good record of paying taxes and social insurance premiums in accordance with the law;

Note: This requires providing copies of relevant audit documents, checks may also be conducted. - Have no record of major violations in its business activities for the three years prior to participation in GP activities;

Note: Background checks would be conducted with the PSB and local courts. - Other criteria stipulated in laws and administrative regulations.

Foreign Investors in China should also take note of the “Bidding Law of the People’s Republic of China” and “Implementation Regulations for the Law of the People’s Republic of China on Tenders and Bids”.

Elements To Consider When Looking At Foreign Invested Belt & Road Procurement

In addition to these, buyers may, in accordance with special requirements of procurement projects, specify particular requirements for the supplier, such as providing the relevant qualification certificates and information on commercial achievements. In addition, GP shall assist the realization of national policies on economic and social development, including environmental protection, support for undeveloped and ethnic minority regions, and promotion of small and medium-sized enterprises on so on – China’s way of asking you to show you are an upstanding business in the Chinese community. Meanwhile, when engaging in GP activities, commercial interests such as a procurement price lower than the average market price, procurement efficiency and high quality are also considered.

That said, Beijing has an eye on Chinese contractors providing shoddy work and has been embarrassed by several Belt & Road Initiative projects built to sub-standards. This is embarrassing for the Government and they want it stopped – hence the reason to encourage foreign investment in this area. Xi Jinping doesn’t want his Belt & Road legacy to go down in a mound of collapsed buildings and bridges, as has happened recently in Cambodia, Kenya and South Africa. The new FIL encourages foreign investors to come in and help – investors that can provide the required due diligence, a rise in standards, and better operational and QC standards being put in place. There is an obvious stress between China’s requests for “lower than market average prices” and “high quality”. Its the latter that will become the more important in upcoming projects, and the tendering of materials for them.

Other factors to consider when competing are elements such as whether of not your country of business origin has signed off a Belt & Road MoU with China, or is a significant investor in the Asian Infrastructure Investment Bank or New Development Bank. If so, it would be helpful to mention this in the qualifying documents. A list of countries who have signed MoU with China concerning the Belt & Road Initiative and also have a Double Tax Treaty with China is here:

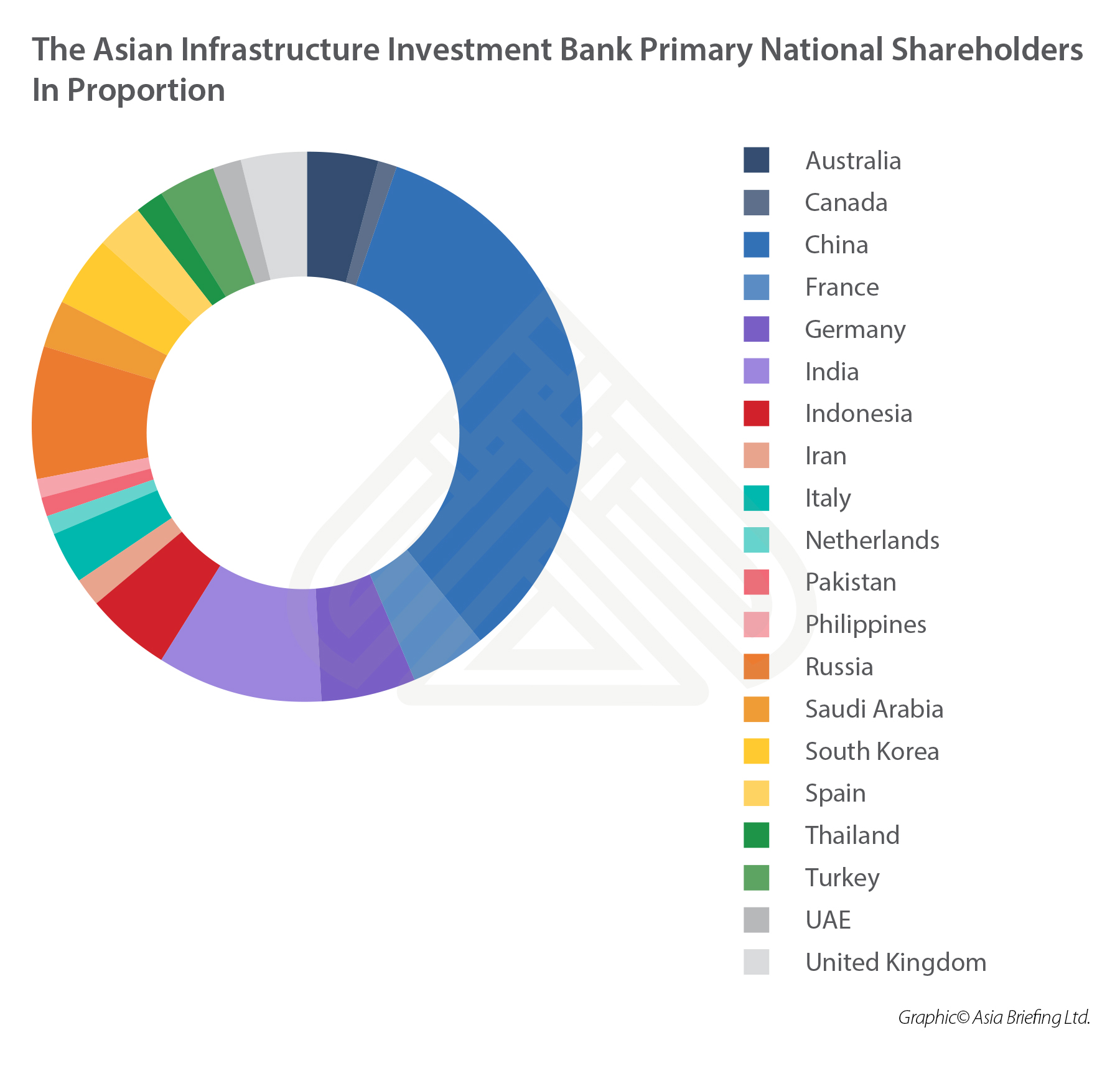

A list of the major shareholders (at least 1% of equity) in the Asian Infrastructure Investment Bank is here:

Thus, from the policy aspect, in addition to the general criteria, the buyer may also consider other factors, like special qualifications for the project, economic and social development, efficiency and so on.

Other Forms Of General Procurement In China

Concerning the general GP process, in addition to Public Invitation, Foreign Invested Enterprises can be expected to encounter several other forms of GP:

- Private invitation of bids;

- Competitive negotiations;

- Single-source procurement;

- Requests for quotations.

In terms of becoming aware Public or other GP, a compliant many Foreign Investors (FIE) have is that they find it difficult to obtain any information about them. In actual fact, this is often a sign of local weakness in the FIE itself as they simply do not have, or have not instructed staff to look out for notices of invitation for bids in Chinese publications, information networks and other media designated by the State. This needs to be corrected. There is no point in complaining about not receiving information of tenders if your company isn’t looking for them in the local language – Chinese.

It is also possible for FIE’s to form a Joint Venture with other legal entities in China to take part in GP as a single supplier and therefore combine resources. FIEs also have the right to file complaints about and report violations of laws in the course of GP activities.

Becoming Part Of The Procurement Process In China’s Belt & Road Initiative Procurement Intelligence

The obvious starting point in analyzing whether there is demand for your businesses products and/or services. Large MNC’s may already be aware if they have an existing on-the-ground presence in China, companies that are yet to enter the China market will instead need to conduct research, and especially of the type of procurement projects that have already been awarded. Our firm has an effective Business Intelligence division, spread across China and several Eurasian countries, and can provide this background. Websites such as this one are in fact part of our Business Intelligence division. We can also keep you updated on upcoming or just announced General Procurement requirements as they are announced in the Chinese media and state organizations. We also keep tabs on Procurement activities in other Belt & Road nations and have an idea of what is coming down the pipeline.

Getting Established In China

There are several different options, although to take part in GP a limited liability corporation is a must. As many of the Belt & Road Initiative projects are overseas, it makes a lot of sense to place your business in a Free Trade Zone in China, as these permit the importation of products duty free into the zone. Component parts from China can then be added (and VAT claimed back on those) and processing carried out within the zone. When the applicable final product is finished, it can then be shipped to the project destination. China has many such zones, right across the country and in different industry sectors. Many also offer investment incentives. Contact us with descriptions of what you want to do and the feasibility of it and we’ll provide advice on the best solution for your business.

Partnering With Chinese Companies

It will be possible from next year to establish short term Joint Ventures with Chinese partners for the purpose of combining expertise and materials in order to provide a single face when looking to bid for Procurement contracts.

Due Diligence & Contracts

The Chinese are very familiar with the legalities of their own contractual system, foreign investors may not be so well informed. Due diligence should be carried out first on any intended partners – legal, financial and operational, the latter requiring site visits and document inspection to ensure they can do what they say they are capable of. We have teams on the ground that can conduct this, and have had for nearly three decades. Contracts will be in Chinese law and need examining and negotiating to bring them to Foreign Investors understanding. Our legal team can assist.

Belt & Road Project Profit Repatriation

This is a tax issue and needs to be dealt with as part of the incorporation process. An important aspect to this is whether or not your business country of origin has a Double Tax Treaty (DTA) with China and if so, its contents. These often provide for tax relief, lower duties, and even reductions in standard profits taxes by 5-10%. We maintain a database of DTA and have a large tax advisory team familiar with bilateral work. Making your China operations tax efficient and maximizing the profits that can be made is an important part of the establishment process.

China’s Belt & Road Initiative changes again the dynamics of Foreign Investment into China. 27 years ago, when our firm began operations, it was all about inexpensive production for sending back home. 15 years ago the ability to sell to produce in China and sell to China was introduced. Now the changes involve using China as a Manufacturing and Services base from which Global infrastructure projects can be managed. It is time to get aboard the Belt & Road train.

About Us

Silk Road Briefing is part of the Asia Briefing series of websites, owned by Dezan Shira & Associates. Chris Devonshire-Ellis is the Founding Partner & Chairman. The firm handles Foreign Investment throughout China, India, ASEAN, Russia and the Belt & Road, with 28 regional offices and partners throughout Eurasia. Please contact us at silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

![]() “Great Eurasian Partnership” Back On Track As Putin And Xi Commit

“Great Eurasian Partnership” Back On Track As Putin And Xi Commit

![]() Chinese Use Of Lobbyists To Win Belt & Road Influence And EU Construction Contracts

Chinese Use Of Lobbyists To Win Belt & Road Influence And EU Construction Contracts

China’s New Economic Silk Road

This unique and currently only available study into the proposed Silk Road Economic Belt examines the institutional, financial and infrastructure projects that are currently underway and in the planning stage across the entire region. Covering over 60 countries, this book explores the regional reforms, potential problems, opportunities and longer term impact that the Silk Road will have upon Asia, Africa, the Middle East, Europe and the United States.