Latest News

Showing 3 of 3 articles

-

The Belt and Road: Planning Regional Tax and Investment Incentives

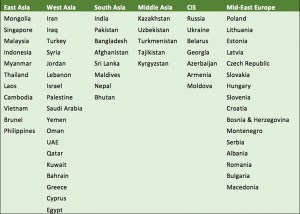

China’s Belt and Road Initiative now comprises over 70 countries, making the task of analyzing available tax incentives along the routes somewhat complex.

-

The Eurasian Economic Union – Applicable Double Tax Treaties for Foreign Investors and Traders

Businesses in countries having signed DTAs with the EAEU can apply for tax exemptions and reductions under the terms of the specific agreement.

-

China Issues Tax Guidelines For OBOR Trade

China’s State Administration of Tax (SAT) have issued 59 tax guidelines for Chinese companies wishing to trade along the OBOR routes to cover the main overseas investment destinations of Chinese companies along the overland and maritime routes. The SAT said it will continue to update the guidelines and expand coverage of the series. The guidelines are aimed to familiarize Chinese investors[…..]

Showing 3 of 3 articles