China’s Belt And Road Initiative: Infrastructure Developments To Expect In 2021

Op/Ed by Chris Devonshire-Ellis

China’s Belt and Road Initiative has resulted in China spending some US$4 trillion on projects since its inception seven years ago. Among these, 1,590 projects – valued at US$1.9 trillion – were BRI projects, while 1,574 other projects with a combined value of US$2.1 trillion have been classified as “Projects with Chinese involvement”. That amounts to a total of 3,164 projects in total.

The sheer scale of the BRI has been unprecedented, with maps of the type we display here to illustrate the countries that have signed up to China’s BRI with an MoU being similar to old maps of Empires – hence the often too obvious criticisms of the BRI being a type of Empire building. It isn’t, although such criticism will continue.

Part of this has come from accusations that in terms of these projects, China has been saddling BRI countries with debt. Again, that has recently been debunked. In July and August this year, two significant and independent studies were released confirming there were no signs of “debt trap” diplomacy by China along the BRI. In fact they found that in most cases the recipient country erred in its own calculations. In July, the Johns Hopkins University (USA) launched its China-Africa online/interactive database of Chinese loans into Africa (2000-2018) totaling US$148 billion in commitments, built by SAIS-CARI. This database also includes data from the World Bank’s DSSI database (40 African countries) and the AID data (from William & Mary). This study did not produce any evidence of debt trap and found that only 3 of Africa’s 54 countries have any Chinese debt issues, and only one of these is significant.

In August, Chatham House (UK) released a study “Debunking the Myth of ‘Debt-trap Diplomacy: How Recipient Countries Shape China’s Belt and Road Initiative”. They examined Chinese loans at selected BRI countries, which have been recipients of Chinese loans. One of its conclusions was “Malaysia has been portrayed as both a victim of China’s debt-trap diplomacy and as leading a backlash against the BRI. Neither narrative is accurate”.

So where does this lead the Belt and Road Initiative as we come into 2021?

Much has been made of a slowdown in China’s BRI spending. A Financial Times article last weekend stated “It has not taken long for the wheels to come off the Belt and Road Initiative” and that “Lending by the Chinese financial institutions that drive the Belt and Road, along with bilateral support to governments, has fallen off a cliff, and Beijing finds itself mired in debt renegotiations with a host of countries.” But is that true?

The Rhodium Group also found that in October this year, requests for the renegotiation of repayments have been increasing after the onset of the Covid19 pandemic, amounting to a total of US$94 billion during the year. Of that, US$66 billion has been dealt with, currently leaving twelve countries in talks with Beijing as at the end of September, covering US$28 billion in Chinese loans pending renegotiation. That amounts to less than 1% of the US$4 trillion spend on projects that require adjustment.

However, these are still sizeable sums of money. Beijing is recalibrating to limit and rationalize future flows, at least in the medium term. This will only be amplified by Covid-19. However the completion of BRI projects also means that the lending rate will naturally slow down, and Beijing can pick and choose with more deliberation about the projects it wishes to pursue. The onus of lending will now be more about returns on investment opportunities rather than securing additional supply chains and clients. The slow-down of China’s spending on the BRI isn’t because they are running out of money. It is because the initial driver of the first 3,164 projects are coming to completion; Phase one of the BRI build is over.

So what of Phase 2? 2021 will see a change in China’s stance towards, and involvement in the BRI. With projects completed or shortly to be done, Chinese investors, instead of piling in with new loans, will be content to sit back with equity stakes and reap the dividends. There will be some new projects, most notably in Africa, to coincide with the new African Continental Free Trade Agreement (AfCFTA) that starts from 1st January, as well as in Latin America, although China will be treading warily for now, right on the new President Biden’s doorstep. Other projects will be directed to further cement Eurasian trade, and beef up trade and connectivity with Russia, Central Asia (including Pakistan and CPEC) as well as the Northern Sea Passage to Europe via the Arctic.

Some of these developments will be in soft infrastructure, and especially in the continuing promotion of regional free trade. China already signed off on the RCEP agreement last month, which links the ten ASEAN nations, China, Australia and New Zealand together with Japan and South Korea.

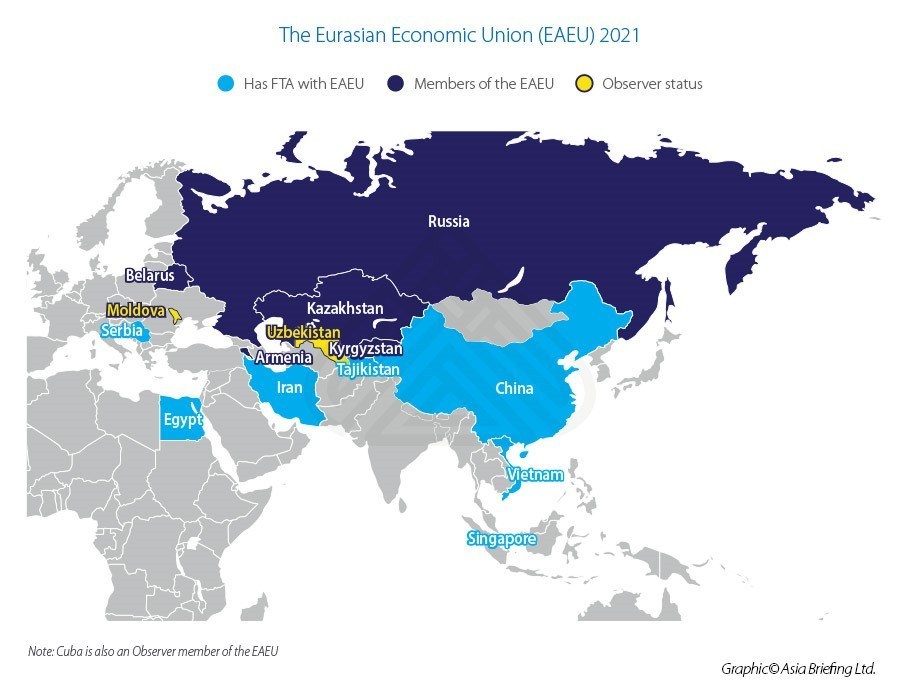

Upcoming in 2021 could well be free trade developments with the Eurasian Economic Union, which includes Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia. If a deal on tariffs is reached, a China-EAEU FTA will see free trade in a region that extends from China to the borders of the European Union. Russian President Putin announced this week that discussions on this matter would commence ‘very soon.’

Phase 2 then of China’s Belt and Road Initiative is likely to see the introduction of softer infrastructure being put in place in the form of trade deals, while finishing off outstanding projects, and looking from an increasingly strategic perspective at the need for any new ones. The bulk of the Belt and Road Initiative build is over.

This also means that finally, there are opportunities for foreign investors along the Belt and Road. China, in conjunction with many local contractors, is completing the work. As we start to move beyond Covid, and the global economy starts to warm up again, shiny new roads, rail, ports, airports, buildings, free trade zones, new supply chains, trade corridors and markets await. The good news, for foreign investors at least, is that exploiting the infrastructure build and taking advantage of what the Belt and Road Initiative has created is now a viable opportunity. How non-Chinese companies can exploit the Belt and Road Initiative will become an increasing realization during the new year.

Related Reading

About Us

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates. The practice advises foreign investors throughout Asia and has 28 regional offices. It is a member of the Leading Edge Alliance of global professional firms with partnerships with additional practices throughout Africa, including Egypt, Kenya, Nigeria and South Africa. Please contact us at info@dezshira.com for assistance or visit us at www.dezshira.com