China-Europe Rail Freight Doubles In 2020. These Are The 44 Key And Emerging European Freight Hubs To Watch

Op/Ed by Chris Devonshire-Ellis

The China-Europe freight trains, first launched in 2011 from China’s southwest Chongqing city, are running more frequently than ever in 2020, as supply chains divert from air to overland routes due to the Covid-19 pandemic. They have been an important and developing part of the Belt and Road Initiative proposed by China in 2013.

The number of China-Europe freight trains hit a record high of 1,247 in August this year, up 62% over 2019 figures, transporting 113,000 TEUs of goods, itself an increase of 66% over the year.

The Chinese silk road city of Xi’an, a major manufacturing powerhouse in Shaanxi Province, has sent a staggering 2,305 freight trains to date this year, transporting a total of 1.79 million tonnes of goods, nearly double the number of trains sent on their way last year.

It’s a similar picture elsewhere in China. In the period to July this year, central China’s Henan Province saw its trade with Belt and Road countries increase by 28.8%, reaching RMB76 billion (€9.61 billion) while trade between Shandong Province to the east with countries along the Belt and Road reached RMB 346.3 billion (€43.77 billion).

Outbound trains carry goods like daily necessities, equipment, medical supplies and vehicles while inbound trains transport milk powder, wine and automobile parts among other European sourced products. In fact, China has been exporting more than it has been importing from countries that it has signed a Belt & Road MoU with, with Eastern European countries having the fastest export growth rate to China after Central Asia.

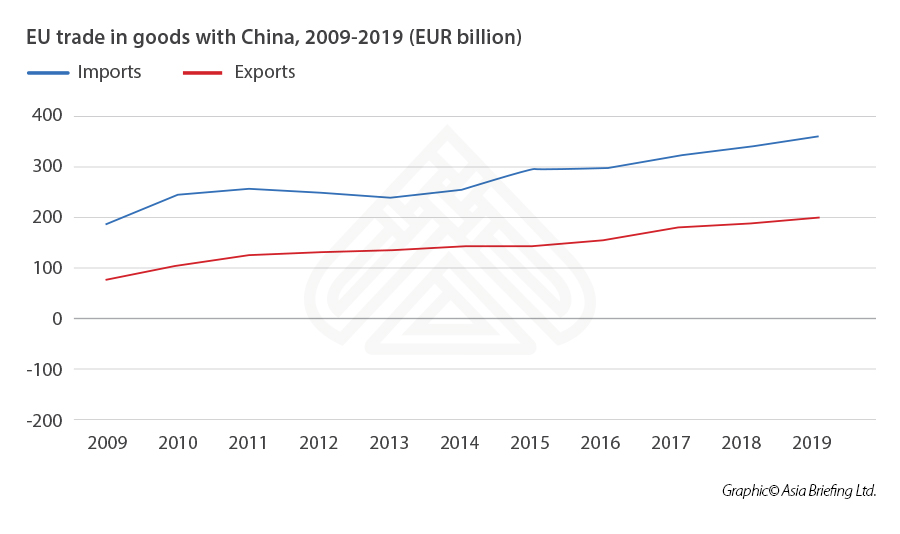

European Union exports to China meanwhile have doubled in the past ten years – and are growing at a faster rate than China’s exports to the EU. The graphic below from the EU’s EuroStat shows the fundamentals.

Brussels may grumble about the trade figures but the growth is healthy. If both parties can compromise on the on-going negotiations concerning the China–EU Comprehensive Agreement on Investment then this would further enhance bilateral trade. With rail freight taking an increasing share of the traffic, the opportunities for investment in the key transport hubs where this occurs makes sound investment sense.

During the year, new technologies such as blockchain have been introduced, allowing Chinese customs authorities to improve the efficiency of customs clearance and save companies’ time in packing containers. Tao Qing, an officer with Shenyang Customs District’s Liaozhong Customs Office has stated that “We have improved the function of the check point. The check point used to identify goods by trucks as the unit, now it can identify goods by each container as the unit. The check point can verify multiple trucks and containers at the same time with automatic feedback of data. The application of such a system has effectively avoided the complicated procedure of frequent entry of redundant information in the entry-exit of trucks. Now, the duration of time required of packing a whole row of containers has been reduced to less than three hours now from eight hours in the past.”

The question is whether this trend will last – will air cargo bounce back after the Covid-19 pandemic? The simple answer is that rail freight is more cost effective. This means that we can expect the rail freight phenomena to continue. The added value of new technologies, new income streams for rail and the financial devastation wreaked on airlines and airports mean that Covd-19 has almost certainly ushered in a new era of rail transport and the associated services this needs.

That means there are new opportunities as rail freight is growing – and later, passenger services can be expected too as well as more high speed routes are introduced and passengers prefer to let the train take the strain. Here are the current 44 European rail hubs that are benefiting from this new trade dynamic:

Western Europe

- Great Britain: London, Immingham, Harwich, Tilbury

- France: Lyon

- Belgium: Antwerp, Brussels, Liege, Zeebrugge

- Holland: Rotterdam

Northern Europe

- Finland: Kouvola

- Sweden: Hallsberg

- Denmark: Fredericia

- Lithuania: Klaipeda

Central Europe

- Germany: Hamburg, Duisberg, Dusseldorf, Leipzig, Nuess, Nuremburg, Wackersdorf

- Austria: Vienna, Linz

- Hungary: Budapest

- Czech Republic: Prague

- Poland: Warsaw, Dobre, Lodz, Malaszewicze, Slawkow

- Ukraine: Kiev

Eastern Europe

- Russia: Moscow, St.Petersburg

- Belarus: Brest

- Bulgaria: Sofia

- Serbia: Belgrade

- Slovakia: Bratislava

Southern Europe

- Spain: Madrid

- Macedonia: Skojpe

- Greece: Pireaus

- Turkey: Istanbul

Caucasus

- Azerbaijan: Baku

- Georgia: Tbilisi

This is an impressive list and illustrates the coverage well. There are notable exceptions, with direct services to a number of major European cities not yet established. However there are logistics issues and many, such as Paris and Berlin are served by routes coming in from other hubs, thus negating the need for direct services to some cities.

However, there are notable exceptions, not yet directly connected are key markets and distribution hubs in cities such as Lisbon, Barcelona, Rome, Marseille, Munich, Cologne, Bonn, Zurich, Oslo, and Bucharest among others.

Black Sea ports such as Constanta, Kherson, Odessa, Erdemir, Filyos, Sochi and Varnos will all in time start to emerge as players, while on the Adriatic, ports such as Bar, Split and Trieste are additional emerging shipping/rail hubs.

There are investment opportunities here. While this may not be so obvious in the well-established major hubs such as London, Hamburg and Rotterdam, all are experiencing an upturn in volume. Lesser known hubs however present local opportunities for businesses involved in logistics, warehousing, packing and distribution together with all the human and ancillary business services needed to support these.

Taking advantage of where these regional hubs are is a smart move. Getting involved, in Europe in the Belt and Road Initiative isn’t an issue to do with partnering with China. It is an issue of providing support services to exploit the infrastructure and the growing demand and trade that is developing along these routes.

To obtain a complimentary subscription to Silk Road Briefing please click here. For market research services concerning routes and hubs along the Belt & Road Initiative please click here.

Related Reading

- The European Belt & Road: Railways, Roads & Ports That EU Investors Should Be Examining For Post-Completion Investment Opportunities

- China Connects Rail to Europe without Russia as BTK Route Runs South via Caucasus and Turkey

- China’s High Speed Rail Silk Route Connecting Oslo and Stockholm

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com