Awaiting On Kyrgyzstan To Allow China’s Railway Through Central Asia And To The Middle East

Op/Ed by Chris Devonshire-Ellis

- The China-Kyrgyzstan-Uzbekistan Rail Corridor back on the agenda

- Issues over routing and cost

- Would connect China with the Middle East

- Awaiting political reforms and new Government in Kyrgyzstan

A long held dream along the Silk Road both old and new has been a railway that links China to Central Asia and the Middle East. Actually getting it done however is proving difficult: Kyrgyzstan lies in the middle. Anyone that has visited the Chinese city of Kashgar and even beyond to Taxkorgan will understand the difficulties of travelling across the Pamir mountain ranges; huge, jagged peaks prone to shale and slate landslides in a geologically unstable region.

These mountains have long been home to secret mountain paths, with Central Asian traders criss-crossing them on donkeys even today to trade goods. I have driven along the Friendship Highway that leads from Kashgar to Taxkorgan, and seen the ruins of mangled trucks that fell off it. “I knew him” my driver simply said as he pointed out the wreckage of an old Tata lorry 200 feet below, as he touched Muslim, Buddhist and Christian symbols on his dashboard. Building a railway across this terrain seems suicidal. Yet the Chinese, with the technology learned from constructing a railway to Lhasa, have the technology and skills to do so.

The problem then isn’t the expertise, its Kyrgyzstan, and the cost.

In fact, a commercially viable – and used – route already exists – the China-Kyrgyzstan-Uzbekistan (CKU) railway is open for business and the first cargo, US$2.5 million worth of electrical goods – left Lanzhou in China’s Western Gansu Province to Kashgar and onto Tashkent back in June this year. It’s just that from Kashgar, the goods were loaded onto trucks for the journey westward across Kyrgyzstan to the city of Osh, where they were reloaded onto a train headed for Tashkent. Part of that route used the Pap-Angren railway line in Uzbekistan that the Chinese helped build and which opened in early 2016. The total route was about 4,400 km and took seven days to complete.

The Road Trucking Section Of The Pan-Kyrgyzstan Railway

The Angren-Pap Railway Line

The reverse journey also saw the loading and unloading of goods onto and off trucks, when the train from Tashkent left back for China with 525 tons of Uzbek cotton worth US$1 million. Clearly, the trade demand is there. Kyrgyzstan wants the line built, and stands to benefit from transit fees, while the Government is keen to re-position the country, one of the poorest in Central Asia, as a transportation hub. It has existing experience of this, the reexport of Chinese manufactured consumer goods to Kazakhstan and Russia, centered on the Dordov Bazaar in Bishkek, and on to Uzbekistan, centered on the Kara-Suu Bazaar in Osh is particularly important; and makes up a significant part of Kyrgyzstan’s economic activity.

Kyrgyzstan’s exports are estimated to be worth about US$2 billion, and include gold, cotton, wool, garments, meat, mercury, uranium, electricity, machinery, and footwear. It imports about US$4.5 billion worth of goods, including oil and gas, machinery and equipment, chemicals, and foodstuffs.

For countries such as Uzbekistan, also keen to develop markets in the East, the Kyrgyzstan route also makes sense – Uzbekistan is currently connected to China by railroad through Kazakhstan’s Khorgos via Almaty, however that is an estimated 20% more expensive compared to the Kyrgyzstan option.

There are issues that both Kyrgyzstan and its neighboring countries need to solve. Kyrgyzstan has not had the most stable of political situations, and local political alliances have interfered with route planning. The Chinese want to build the shortest route across the country, while two years ago, then Kyrgyz President Almazbek Atambaev proposed the railway take a different route so that trains would also serve the remote Kyrgyz towns of At-Bashi and Kazarman, a significant deviation north from the original plan and one that would add US$1.5 billion to the construction costs. He now appears to be out of the picture, imprisoned from October this year and facing charges of corruption.

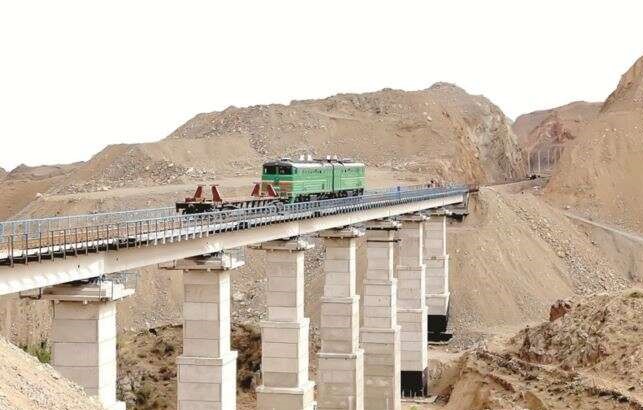

The Chinese route would use the Irkeshtam Mountain pass, about 230 km west from Kashgar, and the route that trucks currently use as part of the road-rail link. Kyrgyzstan’s Minister of Transport has estimated the cost at US$4.5 billion. The route is not long, running about 450-500 km, however passes through mountains with altitudes of up to 3,500 meters. The route requires the construction of nearly 50 tunnels and more than 90 bridges. That is a huge cost burden for Kyrgyzstan.

However, if the route can be agreed, its usage would provide a direct rail link between China and the Middle East. Currently, that route is served by rail passing through Kazakhstan’s Khorgos, but estimates show that the Kyrgyz route would save five days from the transshipment time. That prospect might not be great news for Kazakhstan, but several other countries stand to benefit from such a route if a route can traverse Kyrgyzstan. Proposed extensions would run through Afghanistan, Iran, and Turkey to Europe, while another would run through Turkmenistan and, by ferry, across the Caspian Sea to Istanbul and to Europe.

Financing the route then becomes the issue. There are ways that China can assist. It benefits longer term as its trade through Central Asia and onto the Middle East will increase. It will win via security as well; settling down Uyghur unrest via creating wealth through trade is an on-going process. It also provides China with a third corridor West, and keeps both Kazakhstan and Russia competitive. Low-interest loans are a given along BRI projects, and China can either waive or partially waive these by taking a mortgage against Kyrgyzstan’s future transit fees.

Other countries could also be persuaded to chip in – Uzbekistan for sure is supportive of the route, but it too has financial issues, not helped by the Covid-19 situation. In the meantime, Kyrgyzstan is undergoing political changes after elections in October resulted in riots with the incumbent Government winning a “super-majority”. The situation has calmed down since, with a re-run of the election due in June next year after constitutional reforms are enacted.

China – and Uzbekistan along with the Middle East will have to wait to see what happens. Kyrgyzstan needs the increased interconnectivity a completed railway will bring, both in terms of the transit fees it can earn, and also in increased trade viability of its own products. For now however, we’ll have to wait and see.

Related Reading

- Potential Revolution In Kyrgyzstan As China’s Belt & Road Frays At The Edges

- Kyrgyzstan Cancels China Logistics Super-Hub Investment After At-Bashy Protests

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com