Belt And Road CPEC Projects In Pakistan That Financiers & Investors Should Be Looking At

CPEC Is Open For Foreign Investment To Exploit The Opportunities

Op/Ed by Chris Devonshire-Ellis

China’s Belt & Road Initiative officially kicked off in 2013, some seven years ago, under the initial title of ‘One Belt One Road’. That was later dropped as it became apparent that the scale of demand for projects would be rather more than single Eurasian and Maritime routes. While there has been some controversy over China’s financing and the exporting of its construction SOEs to build these projects, closer examination of the so-called ‘debt trap’ issue by US Universities such as John Hopkins and William & Mary have revealed this not to be the case; their studies failing to produce any evidence of debt trap problems created by Chinese loans. It is however encouraging that such finance is being monitored and it will help keep Beijing straight.

This is good news for Pakistan, as it has been a significant recipient of Chinese infrastructure funding, with US$62 billion being spent on the China-Pakistan Economic Corridor (CPEC) alone.

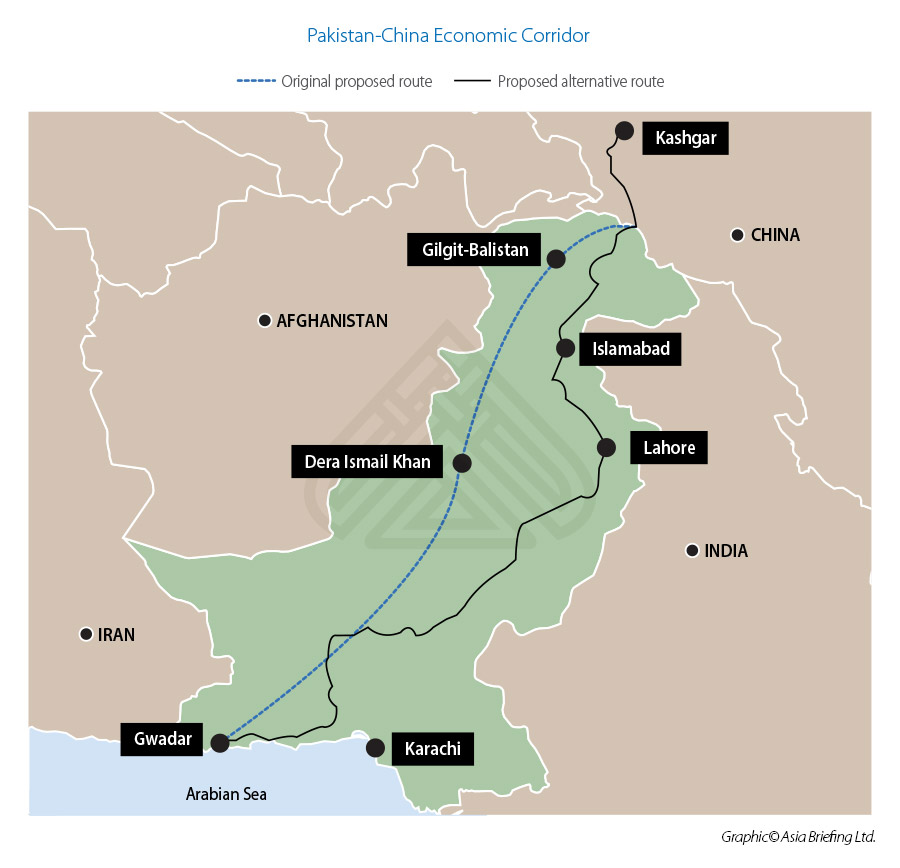

The China–Pakistan Economic Corridor (the Pakistan Governments CPEC website is here) is a collection of infrastructure projects that are under construction throughout the country. CPEC is intended to rapidly upgrade Pakistan’s required infrastructure and strengthen its economy by the construction of modern transportation networks, numerous energy projects, and special economic zones. CPEC became partly operational in late 2016 when Chinese cargo was transported overland to Gwadar Port for onward maritime shipment to Africa and West Asia, while certain nationally important power projects came onstream in late 2017.

A vast network of highways and railways are currently being constructed as part of CPEC that will span the length and breadth of Pakistan. Inefficiencies stemming from Pakistan’s current, mostly dilapidated transportation network are estimated by the government to cause a loss of 3.55% of the country’s annual GDP with little investment having been made since the days of the British Raj.

Modern transportation networks built under CPEC will link seaports in Gwadar and Karachi on Pakistan’s southern coast with northern Pakistan, as well as to routes and cities further north in Western China’s Xinjiang Province and onto Central Asia. This includes a 1,100 km motorway being built between Karachi and Lahore, while the Karachi-Peshawar main rail route is being upgraded to allow for high speed train travel.

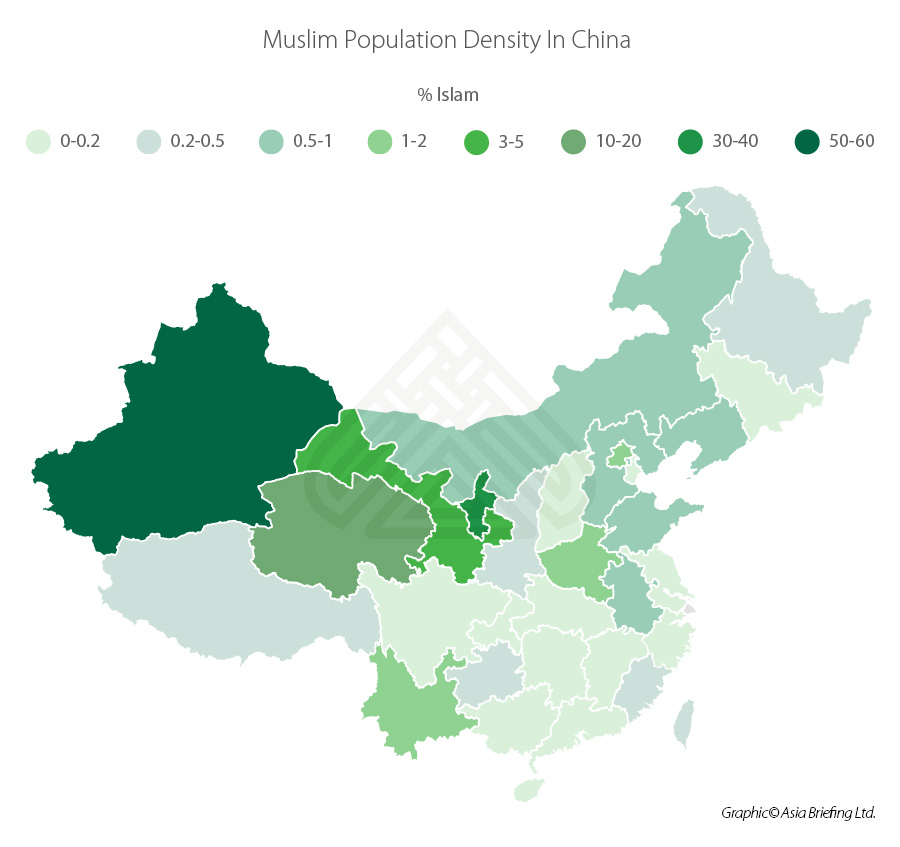

To the north the Karakoram Highway from Gilgit to Taxkorgan and Kashgar is being completely overhauled while Pakistan’s railway network will also be extended to eventually connect to China’s Southern Xinjiang railway in Kashgar and from there onto China’s national rail system and its majority Muslim Provinces of Xinjiang, Gansu, Qinghai and Ningxia – all of which lie in a West-East axis, following the ancient overland trade routes of the ancient silk road. China’s Muslim population is about 80 million with significant hubs in cities such as Xián and Beijing.

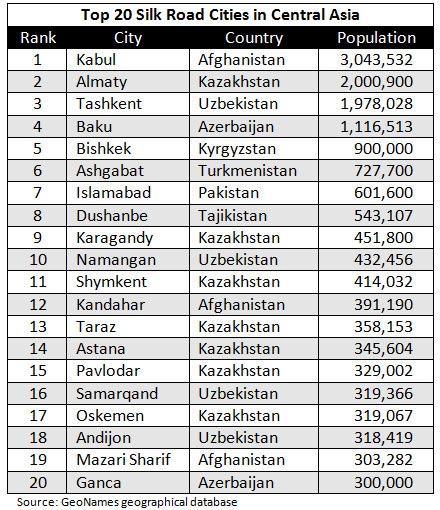

To the West from Xinjiang, China is connected to Kazakhstan, Kyrgyzstan, Afghanistan and Uzbekistan, all Muslim countries. Urumqi, the capital city of Xinjang, is a major Central Asian hub and reaches out via road, rail and air to many Central Asian destinations.

Pakistan’s Export Manufacturing Potential

What this means for Pakistan – world renowned traders extraordinaire – is that the Belt and Road build in their own country can be used to service the business and human footfall needs now being created in hubs across the country, as well as vastly improved trade interconnectivity with similar cultures and values throughout China and Central Asia.

Pakistan’s south coast Ports also offer shipping access and trade to Southeast Asia including the Muslim countries of Malaysia and Indonesia – offering a combined market of 300 million people. Then there are India’s Muslims – another 172 million. The opportunities for Pakistan’s business export sector to grow and develop are immense.

This is important as Pakistan currently has a growing current account deficit. This is driven by a widening trade gap as import growth outstrips export expansion and could draw down reserves and dampen GDP growth in the medium term. That said, Pakistan is currently undergoing a process of economic liberalization including privatization of all government corporations, being aimed to attract FDI and decrease the budget deficit. Pakistan is generally regarded as one of the ten emerging global economies with a particular focus on its manufacturing hub.

The economy of Pakistan is the 23rd largest in the world in terms of purchasing power parity (PPP), while the country has a significant population of 220 million, and is expected, along with the BRICS nations to be among the world’s largest economies in the 21st century. Clearly, China has been investing in a friendly, emerging and significant economy. So too notably have expatriate Pakistani’s based in the UK and United States, as well as investments coming in from the UAE and Turkey. Investments from the West and mature Asian economies have tended to be big-ticket and restricted to MNC’s – while the CPEC builds, when completed, offer more opportunities for SME’s and medium sized investors as well as the big players.

Islamic Financing

Asian regional hubs have seen what is happening and have begun offering Islamic finance services as part of their portfolio. Hong Kong has been placing Sukuk (Islamic bonds) to raise capital for several years now, some into the billions of dollars. HSBS and Standard Chartered are often utilized as global advisers, with banks such as Malaysia’s CIMB and Abu Dhabi’s National Bank involved in Islamic countries. Singapore has had less success, with DBS closing its Islamic Bank of Asia in 2015 and folding Islamic finance facilities into core operations. Nonetheless, facilities are available in Hong Kong and the regional Muslim economies in Asia.

The major projects China has helped finance and build in Pakistan that would be of interest to Islamic and global financiers and businessmen are as follows:

Gwadar Port – The World’s Deepest Sea Port Combines Tax Free Export Manfacturing With Global Shipping Access

Pakistan’s Gwadar Port (گوادر بندرگاه) is the deepest sea port in the world, and is under the administrative control of the Maritime Secretary of Pakistan and the operational control of the China Overseas Port Holding Company. The port is a link between the Belt & Road Initiative and the Maritime Silk Road.

It includes the Gwadar Special Economic Zone currently being built on a 2,292 acre site adjacent to the Port.

The Gwadar SEZ will include manufacturing zones, logistics hubs, warehouses, and display centres and is modelled on the successful Chinese SEZ model which launched cities such as Shenzhen into global recognizance and shipping importance. Business established in the special economic zone will be exempt from Pakistani income, sales, and federal excise taxes for 23 years, while a 40-year tax holiday will be granted for imports of equipment, materials, plants, machinery, appliances and accessories that are to be for construction of Gwadar Port and SEZ.

The SEZ is being completed in three phases. Manufacturing and processing industries should start to be operational by 2025, while further expansion of the zone is intended to be complete by 2030. While the Chinese are building the Gwadar infrastructure, it should be noted that opportunities exist both for foreign investors within the SEZ and especially those who wish to target either the Pakistani domestic market or for reexport manufacturing to take advantage of the lower operational costs.

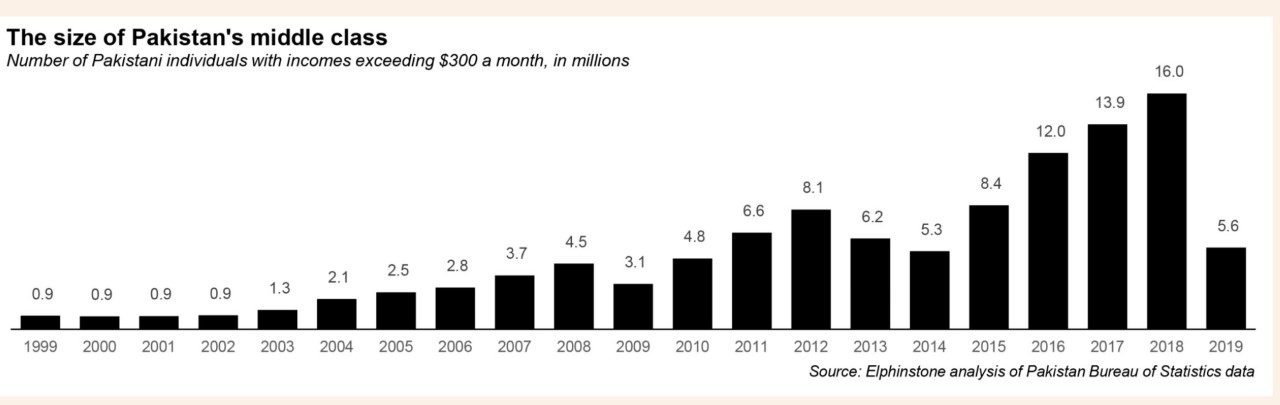

The good news for manufacturing in Gwadar to sell onto the domestic market are the tax incentives and low worker costs, coupled by the growth of the Pakistani consumer market, which although volatile, and has been impacted by Covid-19, has also been on an upwards trend. Estimates now suggest that Pakistan’s middle class has reached about 16 million. That may be small beer to many, but it is expected to grow, and now would be a good time to develop brands in a total market size of 220 million.

Gwadar SEZ is useful and extremely valuable to investors as component parts will be able to enter the zone duty free, with import duty not payable unless goods enter the domestic market. VAT breaks and refunds are also available to businesses setting up shop there. The fact that English, that global language of commerce, is widely spoken is another ”ease of doing business” advantage. That has been noted, the World Bank stating earlier this year that ‘‘due to a concerted improvement in business regulation, Pakistan climbed 28 places and rose to a rank of 108 in the global ease of doing business rankings in 2020″.

The same economic drivers suggest Gwadar will become an important Asian SEZ and ideal for export manufacturers. Under Chinese and Pakistani management, security will be tight, and the incentives make it attractive.

The other aspect to Gwadar that local Pakistani and their overseas counterparts overseas can make an investment case for are the facilities outside the SEZ and Port. These include business and human services to support these facilities, as well as property investments – they can be expected to significantly increase in the immediate Gwadar area. That is exactly what has happened in Sri Lanka’s Colombo Port City – another BRI project whose time has come. Investors both local and international are putting money into the surrounding area. Profits are being made, and the same will happen at Gwadar.

Gilgit SEZ – Access To China & Central Asia

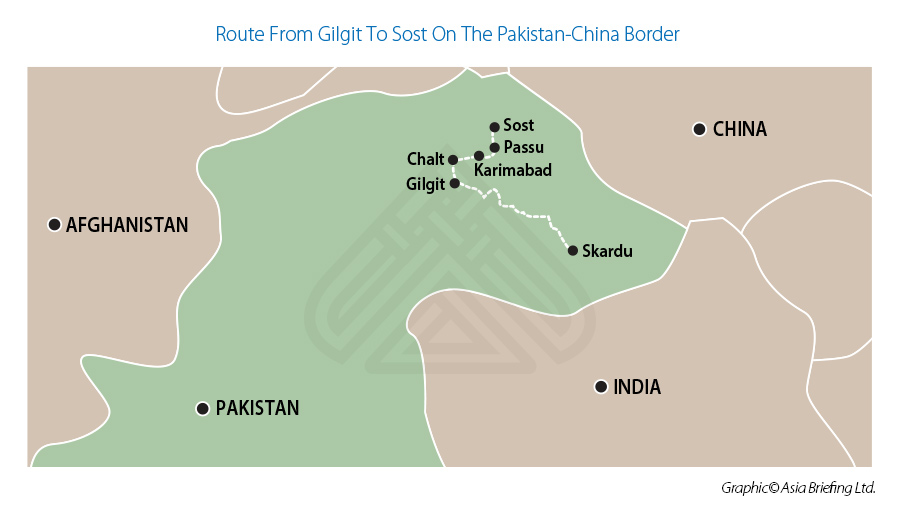

The Moqpondass Gilgit SEZ is a priority development under CPEC in Gilgit in Pakistan’s northern Baltistan Province. It borders Afghanistan to the north, China to the northeast, and the Pakistani administrated state of Azad Jammu and Kashmir (AJK) to the south. It covers an area of about 750 acres. Construction work has begun.

The area is naturally rich in precious stones, ore and fruits. The proposed SEZ would be connected with Gilgit Airport, about 30km distant and also scheduled for upgrades as well as being on the route to Sost, the last Pakistani border town to China. It is also connected to the important trade and supply route through to Skardu to the east, itself a Gateway to the Karakorum Mountain range. The town is located on the Indus river, which separates the Karakoram Range from the Himalayas.

The SEZ is being designed for processing marble and granite, iron ore, steel, (to be used in later regional construction projects) other minerals as well as fruit processing and added value such as packaging and so on.

The SEZ is significant as Gilgit has suffered from Taliban attacks in the past and was heavily infested with weapons as a result. There has been a mass cleanup, while the SEZ is intended to give inhabitants the ability to turn their time back towards trade and production and towards relative wealth in what is a naturally productive region. With the China border so close, it is an excellent opportunity. China also wishes to secure the region as train routes and major highways can then pass through to Xinjiang Province.

Securing regional trade and developing wealth creation opportunities in Central Asia and Northern Pakistan is important for Beijing as it, like Pakistan, seeks to deal with the worst aspects of Islamic fundamentalism.

Additional incentives may also come to the region as the Pakistan Government is considering declaring Gilgit-Baltistan as a Province, giving it more funding and a greater status within the country. That would upset India, pre-occupied with a military standoff with China in nearby Ladakh. That said, despite complaints, India is unlikely to interfere. However it would be good news for Gilgit and help advance regional trade, commerce and security. The opening of the Gilgit SEZ would probably coincide with news confirming Provincial status, expected to be ‘soon’. State funds can then be expected to be freed up to further develop the area. Investors can take advantage, as always occurs when following State encouraged funding.

The Karachi to Peshawar Railway

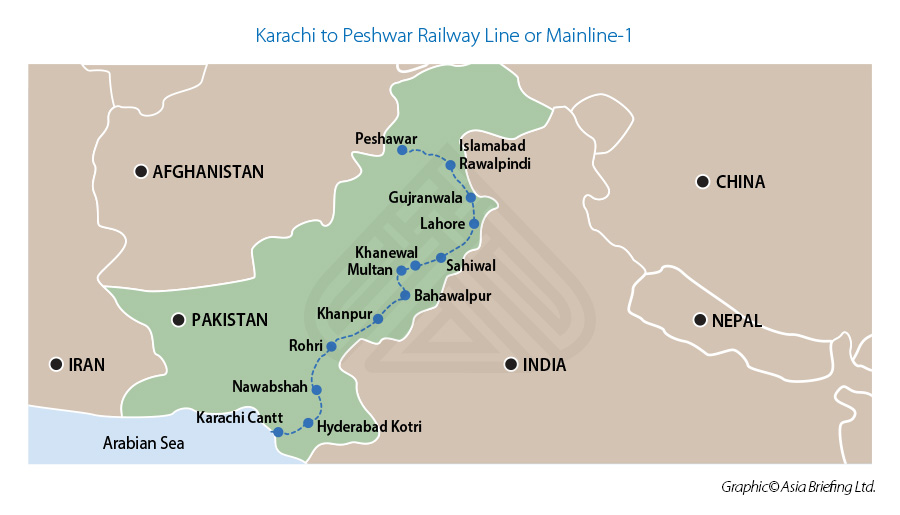

The Karachi–Peshawar Railway Line (کراچی–پشاور مرکزی ریل راستہ) is one of four main railway lines in Pakistan, being operated and maintained by Pakistan Railways. The line begins from Karachi City Station and ends at Peshawar Cantonment Station, with a total length of 1,687 km. It passes 184 railway stations and serves as the main passenger and freight line of the country. 75% of the country’s cargo and passenger traffic uses this route. It is currently undergoing a US$5.4 billion upgrade and renovation as part of CPEC with average rail speeds expected be doubled to 160 kilometers per hour upon completion.

Greater Peshawar’s Mass Transit System

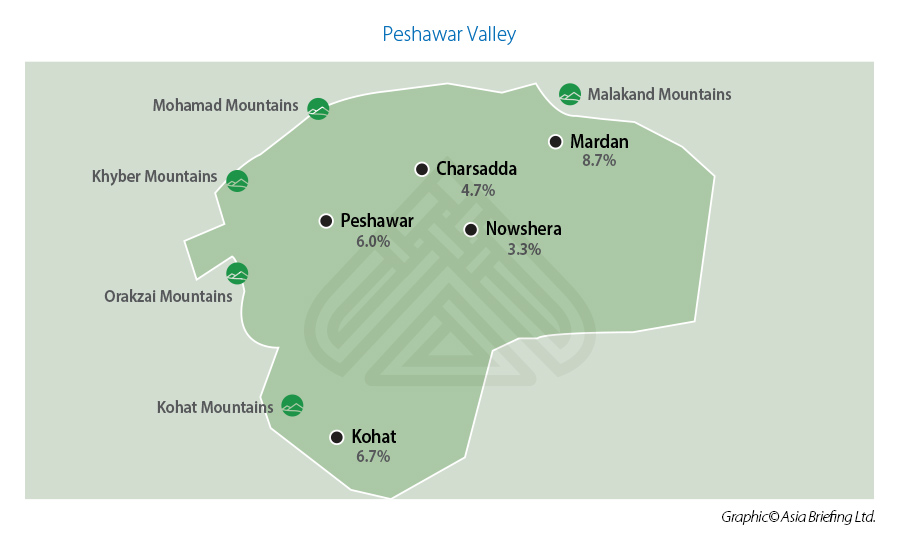

The Peshawar Circular Railway (پشاور مداری ریلوے ) Project is an inter-regional commuter rail system for the Greater Peshawar metropolitan area which will connect several industrial and commercial districts within Peshawar to the outlying suburbs and cities of Jamrud, Charsadda, Mardan, Nowshera and later, to Swabi. In August 2016, the regional Government agreed to a US$1.6 billion MoU with the China Communications and Construction Company (CCCC). This railway is expected to resolve transportation problems in the Peshawar region and generate jobs leading to the overall economic revival of the province. It will impact 11 million people in the Peshawar Valley. To the West lies the Khyber Pass to Afghanistan, it is hoped that the proximity will further settle tribal areas and better influence regional trade on a broader scale.

The Karachi-Peshawar Motorway

The Karachi – Peshawar Motorway is a construction and development of a six lane, access controlled highway of 1,100 km. It is a tolled facility, and originates in Karachi through Motorway M-9 (136 km) to Hyderabad. From Hyderabad onwards, it comprises new build for 345 km to Sukkur, then from Sukkur to Multan follows the left bank of the River Indus for 392 km.

It opened at the end of last year, and is intended to allow speeds of up to 120 kmh. It is Pakistan’s first bi-directional six-lane motorway with an intelligent (smart) transportation function. It cost US$2.9 billion to build and took 36 months. There are 100 bridges, 468 underpasses, 991 culverts, 11 interchanges, six pairs of service areas, five pairs of rest areas, and 24 toll stations. The motorway was divided into seven sections for simultaneous construction. The project was undertaken by the China State Construction Engineering Corporation (CSCEC).

Multan and Sukkur are important cities in Pakistan, and they are now connected by the motorway. Multan is a major area for producing mangoes, dates and other crops, while Sukkur is an important transport hub. The motorway reduces the commuter time between the two cities from 11 hours to less than four hours, thus expediting travel between China and Pakistan.

Exploiting CPEC’s Infrastructure – Enhanced By Favourable Tax & Trade Conditions

These are just a handful of the Belt & Road projects that China has invested in Pakistan that are about to come to fruition; there are many more in terms of Special Economic Zones, road, rail and other infrastructure facilities that are being built and that will project Pakistan into an Asian manufacturing hub during this decade. This is further enhanced with China in particular as Pakistan has a Free Trade Agreement with China. Pakistan is also a member of SAFTA, a free trade bloc that also includes Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal and Sri Lanka. All countries completed the respective Trade Liberalization Program (TLP) under the Phase I and II of SAFTA, meaning that tariffs fell to 0-5 percent on all traded products other than those in the respective ”sensitive” lists. Although there has been some horseplay over what are and are not legitimate ‘sensitive’ products, a further 100 items are due to be exempted from tariffs in 2020. Please contact us for intelligence about these matters.

I was invited to meet with Mr.Shebhaz Sharif, the Chief Minister for the Punjab back in 2008. I suggested to him that Pakistan should consider improving road and rail connections to China via Gilgit as I had seen the Chinese infrastructure build on their side of the border. There was some consternation among his advisors about this, however a decade on that concept is now becoming a reality. Minister Sharif today is the leader of the Pakistan Opposition Party and Head of the Pakistan Muslim League.

As the Chinese SOE contractors pack up their equipment and go off in search of new projects, their influence is subsequently restricted. This leaves the infrastructure in place to be exploited by savvy local, Pakistan national and international companies.

These builds all offer opportunities for both small and large investors to service the human needs of the people that will now be flocking to use them — and this is where the real benefit to investors lies in such BRI projects. We will be continuing to bring readers up to date with these developments, please click here to obtain a complimentary subscription.

In terms of Pakistan, our firm has a significant presence throughout Asia, and has a strong partnership with eight practices in Pakistan via our membership of the Leading Edge Alliance. Please contact us here to talk to us about market intelligence, how to get involved and exploit the Belt & Road infrastructure assets now coming onstream.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com