Free Trade Zones Linking China, Russia & The Eurasian Economic Union

Op/Ed by Chris Devonshire-Ellis

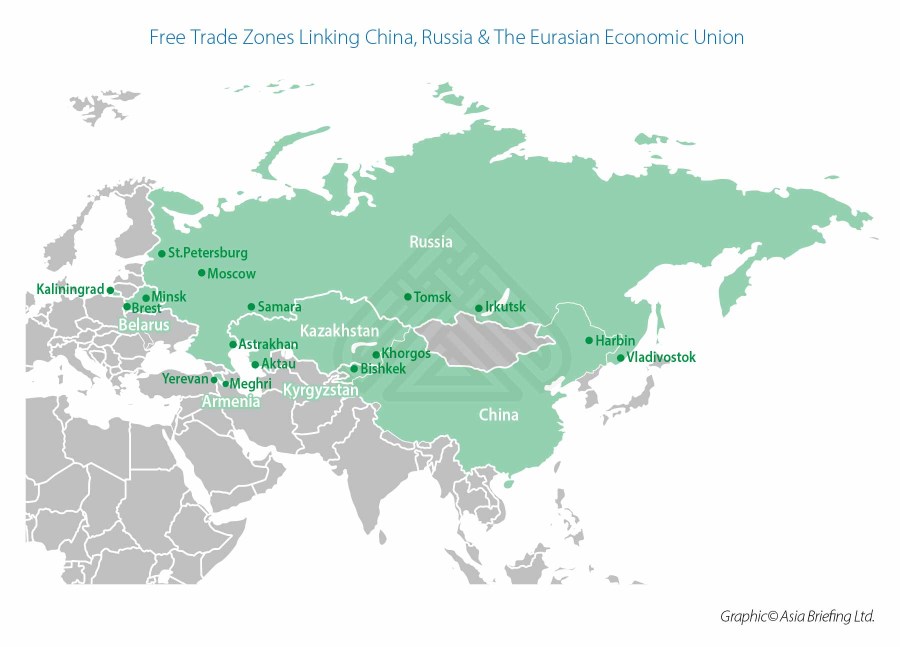

Connecting China With Europe Via The EAEU

The increasing bilateral trade ties between Russia and China – growing at half a billion dollars a month, and set to double to US$200 billion by 2024 – are seeing a parallel interest growing in how this trade can best be serviced. Russia and China are often in the position of supplier and consumer, especially for energy, however that is now being joined by other manufacturing, IT and new hi-tech industries on both sides. This is partially driven by China’s Belt & Road Initiative, partially driven by a need to divest from trade with the United States (Russia and China) and partially with the EU (Russia). Both are also developing new export markets within the Eurasian Economic Union. Russia’s bilateral trade, mostly in its favor, has seen significant increases the past two years with fellow EAEU members Armenia (30%), Belarus (10%) Kazakhstan (21%), and Kyrgyzstan (17%). China, for its part, has also seen bilateral trade increases with Armenia (29%), Belarus (35%), Kazakhstan (48%) and Kyrgyzstan (31%). These are significant increases and can be expected to accelerate further – China is currently in the process of negotiating product tariffs on the Free Trade Agreement it signed last year with the EAEU.

This growth of trade requires free trade and related zones to be put in place, and especially near the borders of these countries. Goods from one another’s factories and suppliers can be combined without the need for duties, VAT or other taxes, and a finished product then made ready for export. If these are destined for markets with the EAEU, no further duties will be payable (as and when China agrees details to the FTA). Alternatively, it means that products can be sourced from less expensive labor pools with the EAEU with again the ability to reduce the overall manufacturing cost and remain competitive for both domestic EAEU markets in addition to markets nearby, such as Japan and South Korea to the East, and the European Union and Europe to the West.

The salary issue is of interest here as there is some disparity among the EAEU:

| EAEU Member States – Skilled Factory Worker, Monthly Salary | |

|---|---|

| Country | (Amount, USD) |

| Armenia | 345 |

| Belarus | 287 |

| Kazakhstan | 520 |

| Kyrgyzstan | 231 |

| Russia | 758 |

We can look at the available Free Trade Zones within the region, commencing with Chinese zones on the border with the EAEU, and head West towards Europe.

China

Heilongjiang Free Trade Zone

China announced it would be establishing a zone near the border with Russia last month. The Heilongjiang FTZ would boost trade cooperation with Russia by easing the movement of goods and people across the border and encouraging Chinese companies to look for opportunities in Russia and the EAEU according to plans released by the Chinese State Council. The 119.9-square-kilometer Heilongjiang FTZ is divided into three parts. The first is the 80 square kilometers in the provincial capital of Harbin, the second roughly 20 square kilometers in China’s largest border city of Heihe, and the third almost 20 square kilometers in Suifenhe. Under the plan, Harbin will facilitate activities with Russia in high technology, the production of new materials, biomedicine, finance and tourism. Heihe will focus on energy cooperation and the production of environmentally friendly products, as well as the development of border infrastructure. Suifenhe will be mainly engaged in the import of wood and grain.

Russia

Russia is not especially well developed in terms of Free Trade Zones on its eastern and southern borders, a situation the regional Governments concerned might wish to look at, especially concerning attracting Chinese investors and linking through to the Trans-Siberian and its various subsidiary lines. A region that would certainly benefit from such an initiative is close to Vladivostok near to the Chinese border at Mudanjiang. However there are Free Trade and Special Economic Zones as follows:

Vladivostok Free Port

Vladivostok is a Free Port, and offers reduced 5% Profits Tax for the first five years of operations and 12% the next five years, (national rate is 20%), zero land and property tax exemptions, reduced social insurance payments and tariff-free imports. The free trade zone has become popular with light manufacturing industries and also houses the Eurasian Diamond Exchange, a trading platform for Siberian diamonds, with additional processing facilities. It is possible to obtain 8 day electronic visas for the region (check for qualifications). Vladivostok is the main terminus for the Trans-Siberian railway and is well connected to China, Japan and Korea.

The Vladivostok Free Port website is here

Irkutsk Gate Of Baikal SEZ

This SEZ covers 757 hectares, and offers incentives for investors in the regional tourism industry. It provides close-to-zero land use rights, in addition to 0% land and property taxes,

A promotional video can be seen here.

Tomsk Industrial SEZ

Tomsk is in Siberia, and connected to the Trans-Siberian railway. The SEZ comprises two parts, a northern area dedicated to petrochemicals and chemicals, and a southern section designed to attract hi-tech industries. It provides discounts on profits tax and social security in addition to zero duties on tariffs, property taxes and so on.

The Tomsk SEZ details are here

Samara Togliatti SEZ

Samara Togliatti SEZ is the gateway to the Volga region of Russia and is connected by road, rail and navigable river to Russia’s heartland and most major cities. The SEZ specialises in mechanical engineering for aerospace, automotive and other machinery, food processing and light industrial products. It offers 2% profits tax rates, zero land and property taxes, reductions in social insurance and duty free imports.

The Samara Togliatti SEZ details are here

Astrakhan Lotus SEZ

The Astrakhan Lotus SEZ is based on the Caspian Sea and is connected to the Eurasian Land Bridge and ports from Kazakhstan. See the Aktau Port entry for Kazakhstan below.

The Lotus SEZ provides oil and gas processing, other chemical and raw materials processing facilities, shipbuilding and other engineering facilities. It provides 2% Profits tax rates for the initial ten years, reduced social insurance, zero land and property taxes and import free tariffs.

The Astrakhan Lotus SEZ overview is here

Moscow Dubna SEZ

The Dubna SEZ is based close to Moscow and consequently to the major transport infrastructure of the country. It is a hi-tech scientific zone, handling fundamental and applied sciences, medical equipment and communications. It provides zero profits tax rates, discounts on social welfare, and 0% property and land taxes, in addition to duty-free imports.

The Dubna SEZ details are here

Moscow Technopolis SEZ

This SEZ is sited in the Zelenograd area of Moscow, covers 207 ha, and handles investments into hi-tech industries, including micro-electronics, biotech, robotics, medical devises, and energy efficiency. It provides 2% profits tax for ten years, zero land and property taxes, discounts on social insurance and zero import duties.

The Moscow Technopolis details are here

St.Petersburg SEZ

The St.Petersburg SEZ is on the Baltic Sea and provides shipping access to the EU. It is divided up into different sections, the Noydorf area being an engineering and IT based zone, while the Novoolovskaya zone is also engineering and experimental industrial based. The SEZ offers a reduced profits tax rate, reductions on social insurance, land and property taxes, and duty free importation.

The St.Petersburg SEZ details are here

Kaliningrad SEZ

Kaliningrad is a Russian enclave on the Baltic Sea coast and surrounded by the European Union. It offers 0% profits tax for the first six years of operations, followed by a reduced rate of 10% for the next six. It also provides reduced social insurance, land and property taxes and zero import duties. It is possible to obtain 8 day electronic visas for the region (check for qualifications).

The Kaliningrad SEZ details are here

Kazakhstan

Khorgos Eastern Gate Special Economic Zone

The Khorgos Eastern Gate SEZ was established in 2011 and sits just 15 km from the Chinese border. It covers 46 square km, including a 1.3 sq km waterless port, a 2.25 sq km logistics park, a 2.24 sq km industrial area and the Atenkeri railway changing station, which converts container bogeys onto the Kazakh rail gauge, which operates a different width to China rail. The SEZ was designed for the development of warehouse logistics and to manage other areas such as food product production, textile manufacturing, chemicals, mechanical equipment, and related businesses. It is on the main China-Europe rail link, coming in from Yining, and also has rail connections onto the Capital, Nur-Sultan. Businesses operating in the Eastern Gate SEZ are exempt from import tariffs, land tax, property tax and value-added tax. Kazakhstan is also a member of the Eurasian Economic Union, providing manufacturers based there with Free Trade access to markets in Russia in addition to Armenia, Belarus and Kyrgyzstan.

The Khorgos Eastern Gate SEZ website is here:

Aktau Special Economic Zone

The Aktau SEZ lies on Kazakhstan’s Western coast on the Caspian Sea. Formed in 2002, it comprises significant port facilities to accommodate ever larger quantities and more diverse types of cargo. The intent is for cargo to transit by ship over the Caspian Sea and then by rail through Russia at Astrakhan, Azerbaijan and Georgia for delivery in Turkey and beyond. This new route was made possible by the opening of a railway connecting Georgia and Turkey in 2014. The SEZ provides processing facilities, warehousing, customs, a bonded zone, and exempts businesses operating in it from import duties, land and property tax and VAT. It is a major hub for Chinese goods transiting overland to the Caucasus, Turkey and EU. See also: Aqtau Port, Kazakhstan’s Caspian Sea Belt & Road Window To Europe.

The Aktau SEZ website is here

Kyrgyzstan

Kyrgyzstan has had mixed results with Free Trade Zones, of five established, only the Bishkek Free Trade Zone is currently operational. The FEZ is close to markets in the Kyrgyz Republic and the Bishkek-Lugovoy railway, connecting it to Kazakhstan, and has power reserves in electricity supply. The Bishkek FEZ has recently partnered with the Xi’an International Trade and Logistics (ITL) Park who are in the process of upgrading and expanding facilities in the Bishkek FEZ. It offers reduced taxes, and facilities for manufacturing electronic products.

The Bishkek FEZ website is here

Armenia

Armenia has three working FEZ, with a fourth shortly to open in Hraztan, within the Kotayk marz. Hraztan is expected to attract over 50 companies by 2021, with an estimated 15 million USD investment. The focus will be production, High Tech and Blockchain. Those currently in operation include two in Armenia’s capital city Yerevan, the “Alliance” FEZ in the High Tech/Pharmaceuticals and “Meridian” FEZ in the Jewelry/Watchmaking sectors, with the Meghri FEZ allowing for deepened relations with Iran. The latter is geared towards agriculture, manufacturing, trade, cargo shipment, and storage, among others. Meghri’s unique location puts it 2 km from the Iranian FEZ “Aras” as well, making it a strategic cooperation point. Companies operating out the different FEZ’s are exempt from profit tax, value added tax, excise tax and customs fees. Multi-usage currencies are also permitted. Armenia has a Comprehensive and Enhanced Partnership Agreement with the European Union, which aims to further improve EU-Armenia trade by enhancing the regulatory environment for businesses, and removes barriers in trade in services between the EU and Armenia.

Belarus

Minsk Great Stone Industrial Park

Minsk is the capital of Belarus and well connected by road, rail and air to both Moscow and to the EU with nearby borders with Latvia, Lithuania and Poland. The Great Stone Industrial Park is Chinese invested and ideally situated to access markets on both the EAEU and EU. It offers profits tax reductions at 0% for ten years, and at 50% until 2062. Income tax is payable at 9%, however most other taxes are zero rated. There are no import duties on goods arriving in the Park.

The Great Stone Industrial Park website is here

Brest Free Economic Zone

Brest is on the border of Belarus and Poland and is the largest crossing point between the EU and EAEU. The site is intersected by a motorway with heavy freight traffic from Europe to Russia. A first class international airport handles and services even heavy aircraft. Trains are transferred to the European gauge rails in Brest. There is a river port in Brest, and the cargoes reloaded here onto river vessels can travel further on along the waterway that includes the Dnieper-Bug Canal, as far as the Black Sea ports. The Brest FTZ covers 107 sq km and provides income tax exemptions as well as reductions on land, property and related taxes. Goods can be imported duty free into the zone. It handles automotive, engineering and other manufacturing and IT facilities.

The Brest Free Economic Zone website is here

The development of Free Trade and related zones in the Eurasian Economic Union goes hand in hand with China’s Belt & Road Initiative. I discussed this in the article Free Trade Zones Along The Belt & Road Initiative Eurasian Land Bridge which also includes details of FTZ in Azerbaijan, Georgia and Turkey. This growing interconnectivity, although variable in terms of actual tax deliverables, does illustrate and developing trend towards free trade throughout the Eurasian region, and principally between China, Russia and the European Union. In this article I have listed purely the ones most obviously connected, it fact in total the EAEU has a considerable and increasing number of FTZ:

| Number Of Free Trade Zones In The Eurasian Economic | |

|---|---|

| Country | Amount |

| Armenia | 5 |

| Belarus | 6 |

| Kazakhstan | 12 |

| Kyrgyzstan | 1 |

| Russia | 18 |

It is of interest to note the Chinese involvement, both in the recent decision to develop FTZ in its northern Heilongjiang Province, principally to service Russia, and also its investments in Bishkek (I suspect to take advantage of low Kyrgyz wages for LED products to resold on China’s domestic market) as will as Belarus and the Great Stone Industrial Park. The Great Stone park is of special interest – it is sited next to Minsk international airport, and the volume of trade expected to be generated at Great Stone is requiring the building of a second runway at the airport. The Chinese obviously see Belarus as a strategic hub for the manufacturing and production of largely Chinese owned products such as Geely automotive (who own European brands Volvo and Lotus) and using this as a hub from which to sell to the EU market – and elsewhere in the EAEU itself. This will get even more interesting when China agrees tariffs on products within its own FTA with the EAEU, which are currently being negotiated.

The development of Free Trade Zones across the region has been little monitored – however there is no doubt that the reshaping of supply chains throughout Eurasia is happening – and several of the areas mentioned here will be playing a significant role in this occurring.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm assists foreign investors and advises Governments throughout Asia in facilitating trade and investment into the region, and maintains 28 offices throughout China, India, ASEAN and Russia. We also provide Belt & Road advisory and intelligence services. Please email us at silkroad@dezshira.com for enquiries or visit us at www.dezshira.com