How To Obtain Tax Incentives & Funding For Belt & Road Project Contracts

Op/Ed by Chris Devonshire-Ellis

Tax Reductions & Financing Await For Belt & Road Investors – If You Know Where To Look And Who To Ask

China’s Belt and Road Initiative now includes over 125 countries, making the task of analyzing available tax incentives along the routes somewhat complex. By definition, this means referring to the available bilateral and multilateral agreements that are either in place between a company in a Belt & Road nation (such as Italy, Russia Estonia or any of the other 122 nations involved), and the country in which the work is being conducted. This could be China or any permutation of 125 companies doing business in any 125 countries or more. That is a potential calculation of some 15,625 different tax applications right there, and far too many to deal with in just one article. So where to start?

Belt & Road Free Trade And Double Tax Reducing Mechanisms

For Belt & Road companies operating in China, the answer is fairly straight forward: take a look at the applicable tax incentives offering by Free Trade Agreements (FTA) and Double Tax Treaties between China and your country or region of origin. For example, China has FTA with several regional blocs including ASEAN and the Eurasian Economic Union. These outline a whole raft of products that may be imported at preferential or even zero rates – important to know if part of the contract involves equipment supplies. FTA also apply to services, so it is well worth examining specific categories within them and see what can be included under which category. This has two benefits – making tender processes more competitive – and reducing overheads. Examining the potential of existing FTA should be part of any costings process. It is also important to have a strategy for dealing with customs and the tax bureau in any applicable country to make sure they know you intend to apply FTA status to parts of your contractual supplies. This is especially true in China. It is the duty of the foreign party to know their tax structures and rights, and is not the tax bureaus job to act as tax reducing advisors to foreign investors. Being well prepared and well armed is an essential part of knowing how much things are going to cost and how much you can expect from revenues. Having advisors let you know what can be permissible (note I used the word “can” and not “is” should be part of any Belt & Road investors due diligence in terms of pre-project tax structuring and costings.

Reducing Profits By Using Withholding Tax Clauses In DTA

In terms of DTA these are arranged on a bilateral basis, are rather more specific and cover areas to ensure both individuals and businesses operating between two countries are not taxed twice for the same liability (I:e: incurring a profits tax bill in both countries). They may also lower tax thresholds in certain areas, including VAT, import duties, and so on. A good way to reduce profits taxes of income earned under DTA applications is to insert agreements into contracts that the supplier intends to charge royalties of the use of brands, trademarks or patents to be used in any Belt & Road project contract. This does require legal and tax advisory advise to fully understand the considerations to be met, however this can typically be done in a manner that doesn’t impact upon the overall amount to be paid by the vendor. What is does do though is shift the onus of part of the contract away from a pure profits tax base and onto a withholding tax base. As the tax rates due on these are different (withholding taxes are lower than profits taxes) clever structuring of contracts can allow the supplier to manipulate the contract terms in a manner that allows them to strip money out via royalties (attracting withholding tax) rather than income (which attracts profits tax). Such contractual structuring requires not just input concerning the relevant contractual laws, but also knowledge of the applicable DTA and the pertinent tax laws. It’s something that firms such as Dezan Shira & Associates

China Isn’t Hong Kong. And Especially When It Comes To Taxes.

It is important to note that Hong Kong and mainland China employ different tax systems, operating at different rates, and also have their own specific tax agreement between them, called the Closer Economic Partnership Agreement (CEPA). This is modified on a regular basis but essentially provides Hong Kong based companies with preferential rates of doing business in China. It is a complex subject and there are qualifying criteria that need to be met. We cover this extensively over on our China Briefing portal (type in CEPA on the search function) while we also maintain an office in Hong Kong that can assist with making a business CEPA applicable. Hong Kong can also be a good project office location for Belt & Road and other China work, please see our complimentary 2019 guide to Doing Business In Hong Kong for further details.

Be Prepared And Know Your Tax Boundaries Before You Sign Off Belt & Road Contracts

It is additionally important to note that it is vital to discuss the application of applicable treaties with the pertinent tax bureau before any shipments or business has been transacted. We discussed the use of bilateral and double tax treaties in this issue of China Briefing magazine, here in India Briefing Magazine, here in Vietnam Briefing Magazine, and a general examination of Asia here. A breakdown of the applicable Double Tax Treaties entered into by Russia can be read here and by the Eurasian Economic Union countries here.

China has also promulgated various incentives to assist local exporters and state-owned companies. Foreign businesses operating in JVs with Chinese companies may on occasion be able to access these – it often depends on the equity split in the JV and the terminology of the specific tax law – many are exclusively for Chinese companies only. Beijing has issued 59 tax guidelines for Chinese companies dealing with Belt and Road issues; a summary of this and the countries affected can be viewed here.

China tends to view countries that have signed off its Belt & Road MoU with appreciation, and although not codified in terms of tax incentives, this does tend to yield a more ambivalent approach to assisting foreign businesses in Belt & Road projects. A list of Belt & Road Countries with a China DTA can be found here

But looking for the optimum in Free Trade and Double Tax Treaty benefits is only one part of the bilateral search for maximizing your return on Belt & Road Project Investments. There are other, sometimes more subtle approaches that can be made.

Using Belt & Road MoU As An Influential Tool

Has your parent company’s Government signed off a Belt & Road MoU with China? It is important to know. Such documents are usually in the public domain. While Belt & Road MoU are often quite bland, as we discussed in the article Understanding China’s Belt & Road MoU they can also sometimes be very specific, and even refer to projects agreed to on a G2G basis. If you come from such a country, mentioning the Belt & Road MoU when tendering for project contracts or dealing with the tax bureau in China can sometimes produce a more lenient agreement with them. Make sure you know what is in any Belt & Road MoU and use it to wield leeway.

Encouraged Industry Incentives Along The Belt & Road

China is not alone in providing tax incentives for encouraged industries. Does your business sector fit into one of these? China updates its Encouraged Industries list every year. Details of the current encouraged industry sectors can be found in the article China Releases New 2019 Draft Of Encouraged Industries. That is just one example. Do the other countries involved have similar agreements? You might find it benefits you to find out.

Applicable Belt & Road Export Incentives

Most Governments like their domestic businesses to export their wares. Have you considered what incentives your own government provides? This can range from receiving domestic grants, tax incentives and even credit (Exim banks exist for this reason). Government bodies such as Singapore’s excellent International Enterprise unit for example provides huge amounts of assistance to Singapore based companies in reaching out overseas. Other Governments have similar initiatives. Have you researched the available benefits open to you on your own doorstep?

Belt & Road Public-Private Partnerships

We see these as an under-utilized mechanism along the BRI, where Governments partner directly with the private sector to jointly develop infrastructure projects. The private sector could of course involve the participation of more than one company, and potentially to joint-partners. This concept, which is not new, has the benefit of having Government support, which can help clear away a lot of obstacles. They are starting to become more prominent in Eurasia; Russia’s new Meridian Road, which connects Russia to the EU and Kazakhstan (a Kazak highway already leads directly to China) is a PPP project, while Uzbekistan has also taken up the PPP mechanism when it comes to foreign investment. They are useful as they reduce political risk while adding valuable national support. Upcoming PPP’s should be on the radar of larger MNC’s when looking for work along the Belt & Road Initiative.

Applicable Funds

An increasing number of PE and VC funds are also now looking at Belt & Road projects for their investors, our firm is engaged in assisting some of these in terms of structuring the deal as well as conducting due diligence and ensuring compliance. I wrote about this from the perspective of sourcing capital from China in the article Sourcing Chinese Capital For Belt & Road Projects. Our firm can also assist with evaluating the potential for investment funds.

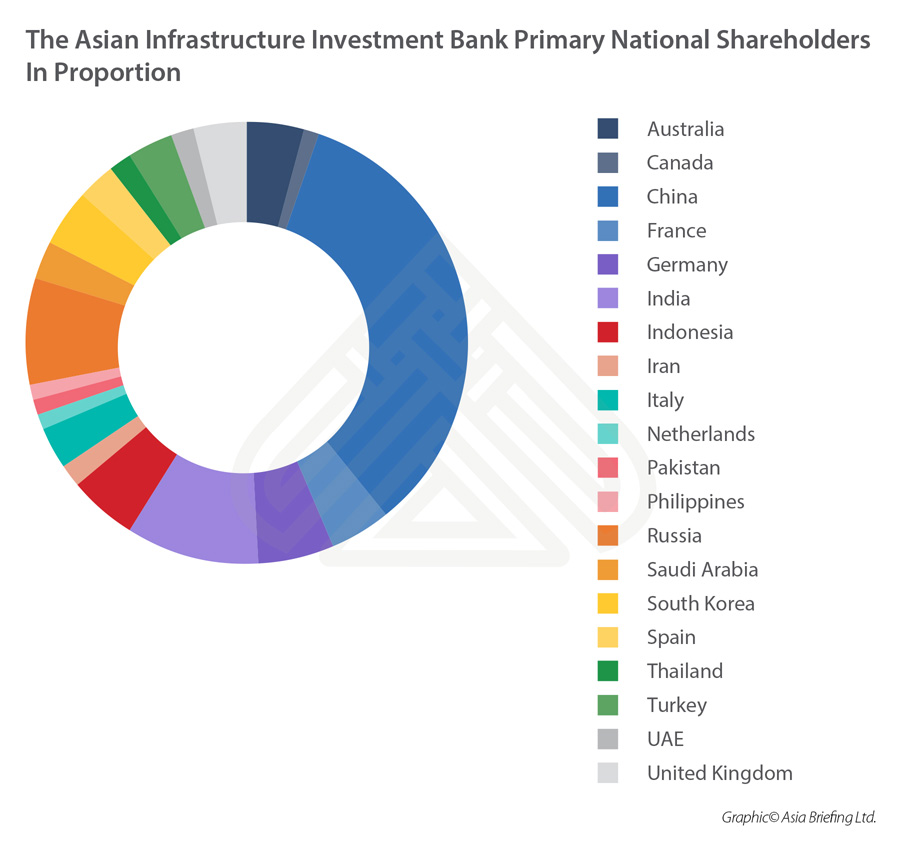

China has also been instrumental in setting up a number of bilateral funds specifically to assist foreign investors in Belt & Road projects. These have often been agreed on a G2G basis. Examples are the new African Belt & Road Fund and the Russia-China Regional Fund both of which have US$1 billion to play with. There are others, so ask around. In addition to this, there is the Silk Road Fund as well as financing available from the BRICS New Development Bank Asian Infrastructure Investment Bank the Eurasian Development Bank and several other regional investment banks, some of which we covered in the article Who Is Financing The New Silk Road? In terms of the Asian Development Bank, that has been invested in by over 100 national Governments thus far, and they will expect to see some of that be returned to companies from their own country. I list the primary shareholders of the bank in this chart below, although there are many others. Do you know if your national Government is a shareholder of the AIIB? You should, it can give you a competitive advantage, leeway and potential financing.

As can be seen there are numerous ways to get real financial assistance when looking, as a foreign investor, at getting involved in Belt & Road projects. Your own Government will likely have some export-related incentives on offer, while the use of Free Trade and Double Tax Agreements can help structure tax-efficient contracts. China and other Belt & Road project recipient countries also have their own incentives designed to encourage exactly what the Belt & Road Initiative is all about: Foreign Direct Investment. The tax efficient protocols and incentives in many cases already exist – all that needs to be carried out is a logical sequence of financial due diligence steps as follows:

- Find what tax efficient structures and incentives are available home and abroad;

- Analyze them to understand the financial implications and how they work;

- Get them inserted into relevant documentation;

- Have them approved by the applicable tax and / or customs bureau

Professional advise will be needed. However, in the vast majority of cases, the amount spent is far exceeded by the fees involved. Get prepared. Get applicable tax and other incentives into the Belt & Road.

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 27 years experience of assisting foreign investors throughout China, and Asia as a whole in legal, tax and other professional services. We also advise foreign governments and businesses on conducting business along the Belt & Road Initiative. Please contact us at silkroad@dezshira.com or visit us at www.dezshira.com