Sourcing Chinese Capital For Belt & Road Initiative Projects

Op/Ed By Chris Devonshire-Ellis

Obtaining Chinese capital for overseas investment projects has proved to be a mixed bag – Beijing keeps a tight lid on the procedures concerning the transfer of Chinese capital overseas. Our firm is often asked to assist with the sourcing of capital from China, and with the needs of the Belt & Road Initiative – by their very nature, cross-border project financing – increasing, such capital remains in demand.

Getting hold of it though is a rather difficult matter. Many of China’s Belt & Road projects are conducted for this reason on a G2G basis, and take the form of Government sanctioned loans or other aid as an alternative. In essence, much BRI project finance is obscured in Government to Government deals primarily because of the difficulties imposed by China’s own Government in moving money through the official banking and regulatory channels.

To some extent this suits China, as it means there is scope for permitting “unusual requests” (read corruption) by prominent officials in foreign countries who may wish to siphon part of the funding off into private accounts. When those same officials are required in order to sign off on G2G contracts, Beijing will often acquiesce. Such deals are best left out of the arms of the more transparent banking regulators, and especially if these involve foreign banks. Beijing likes dealing with other Governments, and not their institutions or businesses. Too much regulatory compliance can spoil a deal that Beijing wants completed, and it is a Chinese conundrum that this includes its own financial regulatory regime. It also remains an enigma that it is often democratically elected leaders who are the more corrupt in asking China to satisfy such requirements. If that need wasn’t there, China might be more amenable to easing up on its tendency to work around regulations.

China Project Financing With Overseas Funds

As most requirements for Project Financing come through overseas based funds, with a need for public transparency, the results when looking for Chinese funding are not very promising: all the solutions allowed by China regulatory scheme are rather difficult for domestic investors to pass through. Only large Chinese SOEs or significant overseas listed companies are capable of meeting the criteria. Other, more practical ways that are workable to transfer funds are risky in grey areas such as the Chinese Underground Banking system and Ant moving. The Chinese government has tightened up forex control in the past two years to increase penalties for using such routes.

An alternative has been to develop China Joint Venture Funds, in China. These are often structured with Government approval, and usually include significant VC funds or other private institutions. An example of this is the “China-Russia Regional Fund” which combines monies from institutional players in both countries and re-invests this in vetted projects in Russia’s Far East and China’s North-East. Its a model of combining Government needs to the Private sector.

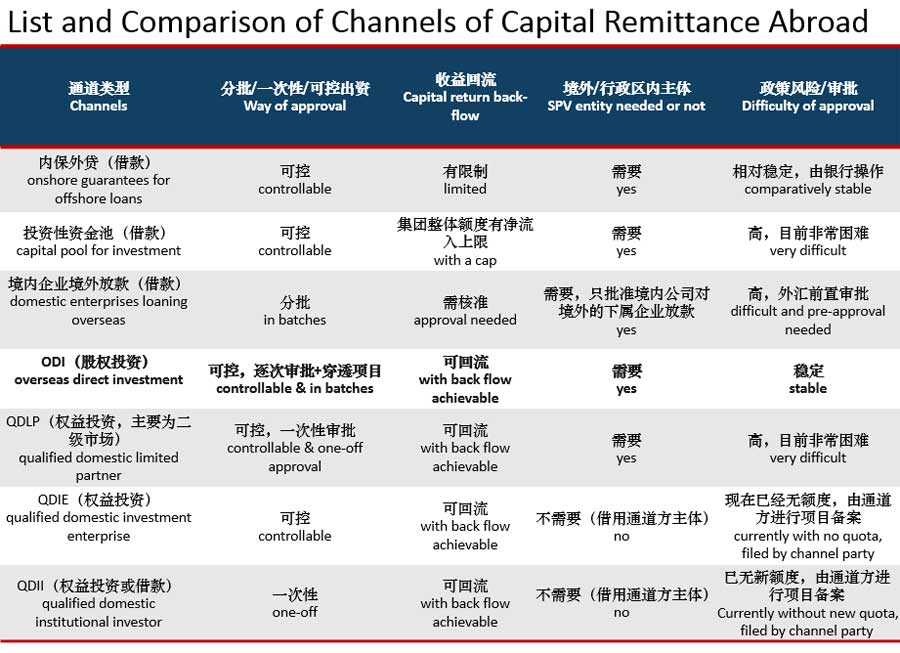

That doesn’t mean to say all is doom and gloom for other funds. A recent easing of the regulatory regime, or at least its application has started to develop, not least due to the US-China trade war. China will need to open up channels for Chinese investors to send money overseas, especially along the Belt and Road if it is to meet development growth targets. A list of the applicable channels through which Chinese investment can be secured is below:

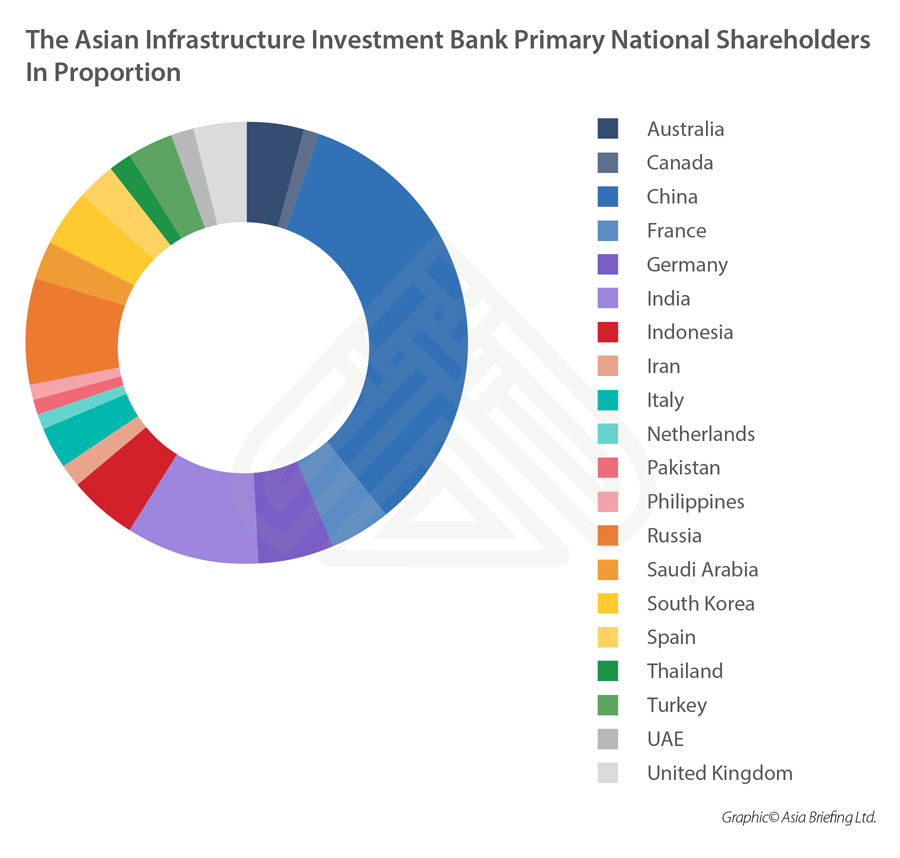

The result at present is a moving target, and political considerations can come into play. Attracting such capital – and receiving permission for it to be transferred, is more likely should the parent companies home of origin be Belt & Road friendly. There are a number of ways to ascertain that, the basic step having signed off on a Belt & Road MoU. But there are others, such as being a primary investor in Beijing’s Asian Infrastructure Development Bank. A list of countries making up the primary investors (at least 1% equity) is as follows:

Funds and other institutions looking at Chinese funding therefore need an advisory report, from professionals on the ground who can analyze the applicable channels and structures to allow Chinese LPs to remit money to the overseas fund. These typically cover other models, such as QDII, QDIE and QDIP depending on different structures and requirements.

It should be noticed that most regulations for QDII, QDIE and QDIP are initial, pilot policies and vary from region to region, which is one reason why it is not easy to obtain clear and practical answers from Chinese authorities. Deeper regional analysis is required to look for possibilities.

Offshore Based China Project Funding

However, due to the difficulty of remitting money abroad from mainland China, there are Chinese LPs that have funds pooled in various overseas jurisdictions, in addition to others in Hong Kong. These should not have problems to remit capital abroad, and can be contacted.

Sourcing Chinese VC is a two-way problem – getting to the source of the funds, and then working out how to navigate the Chinese regulatory system to get the money overseas where it is needed. Provided this is above board, and crucially, doesn’t interfere with the Central Governments own needs (which may differ from the regulatory ones) Chinese money can be acquired and put to good use, with a return on investment. It can be expected that demand for this will only grow, and that over time, Beijing will introduce a new series of regulations – which will still be strict, but more easy to comply with for qualified investors. It is well worth keeping track of the issue. In the meantime, such requirements have to be dealt with on a case-by-case basis, and one that includes on the ground capabilities in China.

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. The firm has 27 years of experience in China and 12 offices throughout the country, in addition to offices in Hong Kong, Singapore, India and the ASEAN countries. We also have a presence in Russia. To contact us please email china@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

![]() China, United Kingdom Planning RMB10 Billion OBOR Development Fund

China, United Kingdom Planning RMB10 Billion OBOR Development Fund

![]() Best Practice & Negotiating Issues When Handling China’s Belt & Road Initiative Projects

Best Practice & Negotiating Issues When Handling China’s Belt & Road Initiative Projects

![]() Central Asian Cash Flow Remittances from Russia Increase as Belt and Road is Restricted to a Project Based Source of Funds

Central Asian Cash Flow Remittances from Russia Increase as Belt and Road is Restricted to a Project Based Source of Funds