China Issues Tax Guidelines For OBOR Trade

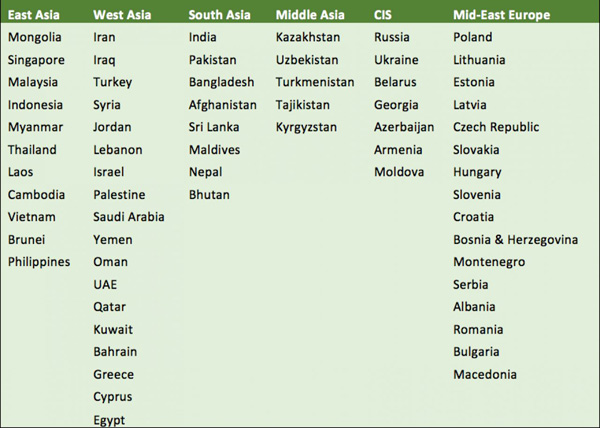

China’s State Administration of Tax (SAT) have issued 59 tax guidelines for Chinese companies wishing to trade along the OBOR routes to cover the main overseas investment destinations of Chinese companies along the overland and maritime routes. The SAT said it will continue to update the guidelines and expand coverage of the series.

China’s State Administration of Tax (SAT) have issued 59 tax guidelines for Chinese companies wishing to trade along the OBOR routes to cover the main overseas investment destinations of Chinese companies along the overland and maritime routes. The SAT said it will continue to update the guidelines and expand coverage of the series.

The guidelines are aimed to familiarize Chinese investors with policies in investment destinations, prevent taxation risks, and promote healthy development of companies overseas, the SAT said in a statement. The batch of guidelines introduces each local business environment, the main types of taxes, rules of taxation, and applicable bilateral tax agreements between China and the investment destinations.

Official data showed China made US$14.53 billion direct investment in 53 countries along the routes last year, while China’s exports to Belt and Road countries reached 6.3 trillion yuan in 2016. China also signed US$126 billion worth of contracts with the related countries last year.

“This shows how far ahead the Chinese Ministry of Commerce is in promoting outbound investment intelligence to their domestic companies.” says Chris Devonshire-Ellis of Dezan Shira & Associates. They even provide details of Double Tax Treaties entered into by the Chinese government. This level of communication and advise is beyond services provided by trade institutions to commercial businesses in the EU and USA”

China is also taking steps to further trade along the OBOR routes. It already has a significant Free Trade Agreement with ASEAN (for full details please click here) and is negotiating an FTA with the Eurasian Economic Union which will cover large parts of the overland routes with Kazakhstan and Russia. A similar FTA is being discussed between the EAEU and ASEAN. India is also negotiating a FTA with the EAEU which could lead to a better tax and fiscal understanding and agreement between China and India on how to best collaborate.

“China needs India to supply it with cheap consumer goods” says Devonshire-Ellis. “The next step will be Double Tax and Free Trade Agreements between China and the EAEU. When this happens the global supply chain will convulse. There is no FTA between China and the EU or US, meaning they will be left with China cherry-picking the products it wants to buy from them. To survive, Western manufacturers in the business of selling to China will need to base their businesses in China, ASEAN, India, or the EAEU.”

About Us

Silk Road Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Eurasia, including ASEAN, China, India, Indonesia, Russia & Vietnam. For editorial matters please contact us here and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates provide business intelligence, due diligence, legal, tax and advisory services throughout the Asian and Eurasian region. We maintain offices throughout China, South-East Asia, India and Russia. For assistance with OBOR issues or investments into any of the featured countries, please contact us at silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Silk Road and OBOR Business Intelligence

Dezan Shira & Associates´ Silk Road and OBOR investment brochure offers an introduction to the region and an overview of the services provided by the firm. It is Dezan Shira´s mission to guide investors through the Silk Road´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.

Using China’s Free Trade & Double Tax Agreements

In this issue of China Briefing, we examine the role of Free Trade Agreements and the various regional blocs that China is either a member of or considering becoming so, as well as how these can be of significance to your China business. We also examine the role of Double Tax Treaties, provide a list of active agreements, and explain how to obtain the tax minimization benefits on offer.

China’s Silk Road Economic Belt

China’s Silk Road Economic Belt is the largest and most ambitious undertaking yet proposed by Beijing. With financing and the value of resources across Eurasia running into hundreds of billions of dollars, we outline the fundamentals of China’s plans. Included are details of the overland route from China through Central Asia, Russia and to Europe, and the maritime and overland routes through South-East Asia and beyond. Includes maps.