China-Russia Great Eurasian Partnership on Development Track as EAEU Agree to Regional Free Trade

Op/Ed By Chris Devonshire-Ellis

China and Russia’s dreams of shaping the destiny of the entire Eurasian landmass, ultimately including Europe and Africa are taking shape as the Russian supported Eurasian Economic Union agrees new free trade deals.

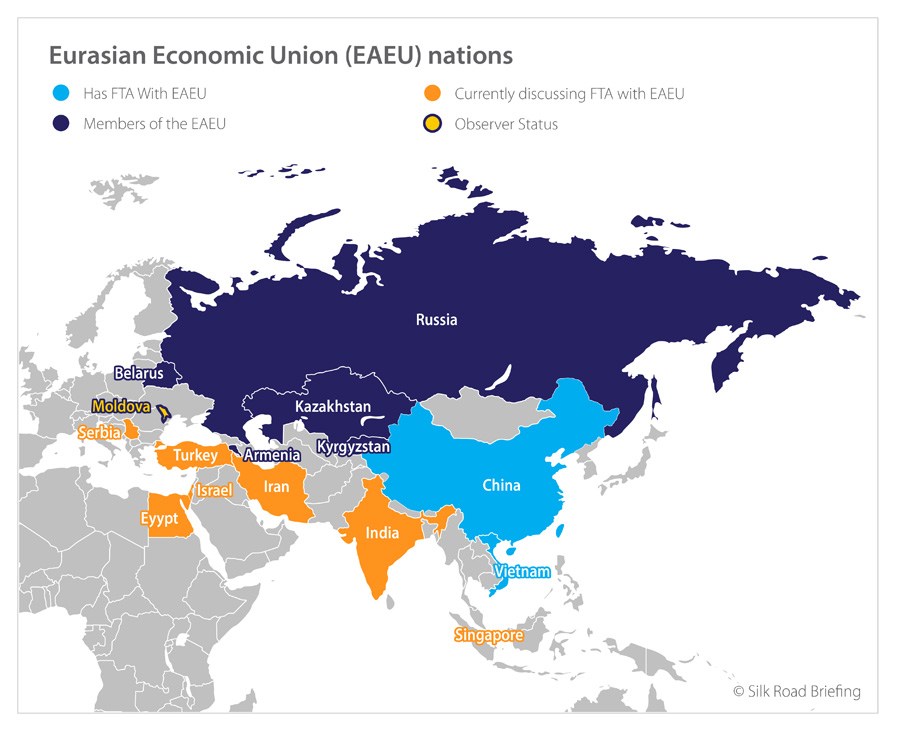

The EAEU, which includes Armenia, Belarus, Kazakhstan, Kygryzstan, and Russia covers the bulk of the Eurasian land mass and is geographically placed between the European Union and China. The EAEU has a population of some 183 million and a GDP of some US$5 Trillion. Intra-EAEU trade has been significantly increasing and rose 38 percent last year. Vietnam signed off on an FTA with the EAEU two years ago, while China signed onto a non-preferential FTA with the EAEU last year.

The Eurasian Economic Union (EAEU), often described as Russia’s equivalent to the EU, is poised to sign off Free Trade Agreements with Egypt, Iran, India and Singapore. Announcing the EAEU Free Trade talks progress, Russia’s First Deputy Minister of Industry Sergey Tsyb said Israel will also be joining the EAEU in the near future, according to his comments. “It would be very productive if we actively move towards the conclusion of agreements on the free-trade zone. This would make it possible to promote exports within the framework of regional trade hubs, and will definitely help in this challenging and highly sensitive situation on global markets to provide the opportunity for promotion of Russian export initiatives.”

The EAEU also includes Moldova as an observer state, while Tajikistan, Uzbekistan, Mongolia, Turkmenistan, Turkey, Syria, and Tunisia are also all reportedly planning to join the union. Other Asian nations, including Indonesia and Turkey are also negotiating FTA with the Union. Thailand upgraded its trade ties with the EAEU earlier this year.

The concept of a Great Eurasian Partnership began with Russian President Vladimir Putin, proposing an effective enlargement of China’s Belt and Road Initiative in discussions with Chinese President Xi Jinping back in 2016.

That original concept was to invite members of the Shanghai Cooperation Organisation to develop a free trade area, however the Great Eurasian Partnership has essentially taken flight in two pillars, the Chinese infrastructure development and financing by Beijing, which China can both afford and provides benefits to its SOE’s as they expand internationally, and Russia, which in the face of perceived Western hostility is taking steps to develop markets elsewhere, and especially so in Asia and Africa through the financing and development of export processing zones and the diplomatic promotion of free trade with the Eurasian Economic Union, which has a GDP of some US$5 Trillion in its own right. Notably, China doesn’t possess or control a Free Trade Area of its own, having relied in the past on individually negotiated free trade and bilateral trade agreements with specific countries or other trade blocs such as ASEAN.

The development of the EAEU is catching many analysts by surprise. The EAEU-China FTA signed off last year was largely dismissed in academic and trade circles as it was non-preferential, meaning it didn’t include any specific categories of goods. However this rather misses the point – getting the FTA agreed is the salient point, as products can simply be added at a later date without the need for intensive negotiations. This means the China-EAEU FTA can be gradually rolled out in terms of product specifics as and when China and Russia can determine the time is right. In Trumpian terms, it is in fact “locked and loaded” – all being needed is the addition of product categories. When enacted it is likely to take many analysts by surprise.

In terms of the additional countries being added to the EAEU FTA, Egypt already possesses a Russian financed export processing zone in Port Said, while Russian-Egyptian bilateral trade rose by 37 percent in 2018.

Russia and Iran have long held strong diplomatic ties, and the prospect of a US sanctions busting FTA with Iran may prove a spur for the investment by EU businesses in Russia aiming to take advantage of that through localisation of some of their business units to Russia. The Iran FTA, which is already in force via a temporary agreement until the complete documents can be finalized, is worth an initial US$2 billion per annum.

India, which is heavily invested in Iran through the Chabahar Port and the International North-South Transport Corridor has also been discussing with Moscow the Egyptian export processing zone model and is currently looking at establishing, jointly with Russia, similar trade zones for Russian investors. Russian-Indian trade was up significantly in 2018 and importantly, has plenty of room for growth.

Singapore meanwhile as a matter of Government policy has been actively encouraging its businesses to invest overseas and has made specific overtures to its domestic corporates to invest in Russia and take advantage of the huge domestic market,especially in the wake of the EU withdrawal, which has left Russian opportunities to be invested in by Asian rather than European entrepreneurs. Singapore is the regional financial and services hub for ASEAN, and will have noted how Russian businesses have invested US$10 billion into Vietnam since the EAEU-Vietnam FTA, now in its third year, was concluded.

The longer term implications are significant. While, as mentioned, there is still some time to go before China’s EAEU FTA adds in product categories, the main achievement with the EAEU has currently been one of patient strategy in developing what is fast becoming a powerful free trade tool. While the naysayers suggest the EAEU is withering these recent developments and the commitment shown by Russia, China and several other nations to it as a platform for regional trade suggest just the opposite. In some ways, it is developing as an alternative to the US damaged Trans-Pacific Partnership as well as the proposed RCEP and FTAAP agreements. Either way, it is becoming clear that Russia, with the Eurasian Economic Union now beginning to take shape as a free trade bloc, and China, with its Belt and Road Initiative, are jointly taking the Eurasian landmass to a game changing era of trade and development. That leaves significant questions for the EU as to whether it wishes to be part of the United States or whether it wishes to ultimately embrace the East.

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. Chris Devonshire-Ellis is the practice Chairman. The firm has 26 years of China operations with offices throughout China, Asia and Europe. Please refer to our Belt & Road desk or visit our website at www.dezshira.com for further information.

Related Reading:

Related Reading:

![]() In The Future, Eurasia Will Rule The World (The Economist)

In The Future, Eurasia Will Rule The World (The Economist)

![]() Eastern EU Turns Back on Brussels, Re-Engages with Russia; Eurasia, China Lie Beyond

Eastern EU Turns Back on Brussels, Re-Engages with Russia; Eurasia, China Lie Beyond

China’s New Economic Silk Road

This unique and currently only available study into the proposed Silk Road Economic Belt examines the institutional, financial and infrastructure projects that are currently underway and in the planning stage across the entire region. Covering over 60 countries, this book explores the regional reforms, potential problems, opportunities and longer term impact that the Silk Road will have upon Asia, Africa, the Middle East, Europe and the United States.