Securing Cheap Labor Resources Along China’s Belt And Road Initiative

Op/Ed By Chris Devonshire-Ellis

Low Wage Demographics Are Driving Chinese FDI Along The Belt & Road

One of the less understood aspects of China’s Belt & Road Initiative is China’s need to secure cheap labor resources to boost both its domestic economy as well as provide Chinese manufactured, overseas produced export products.

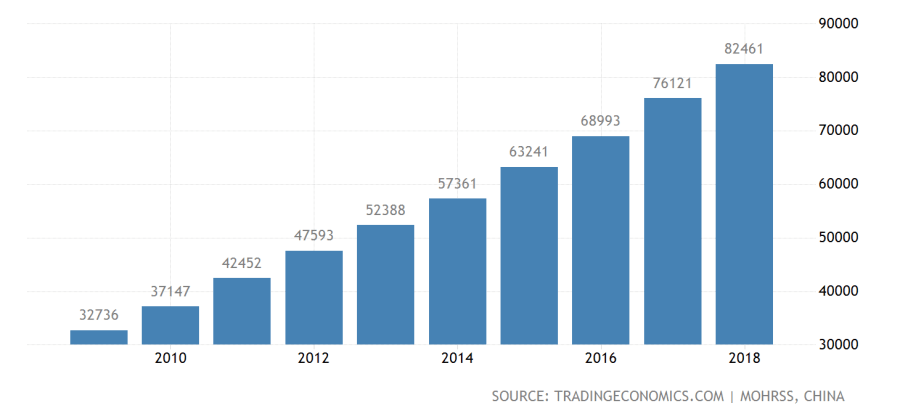

The reason for this is that manufacturing in China has, over the years, become progressively more expensive. This graph, courtesy of Trading Economics illustrates this over the course of the past ten years:

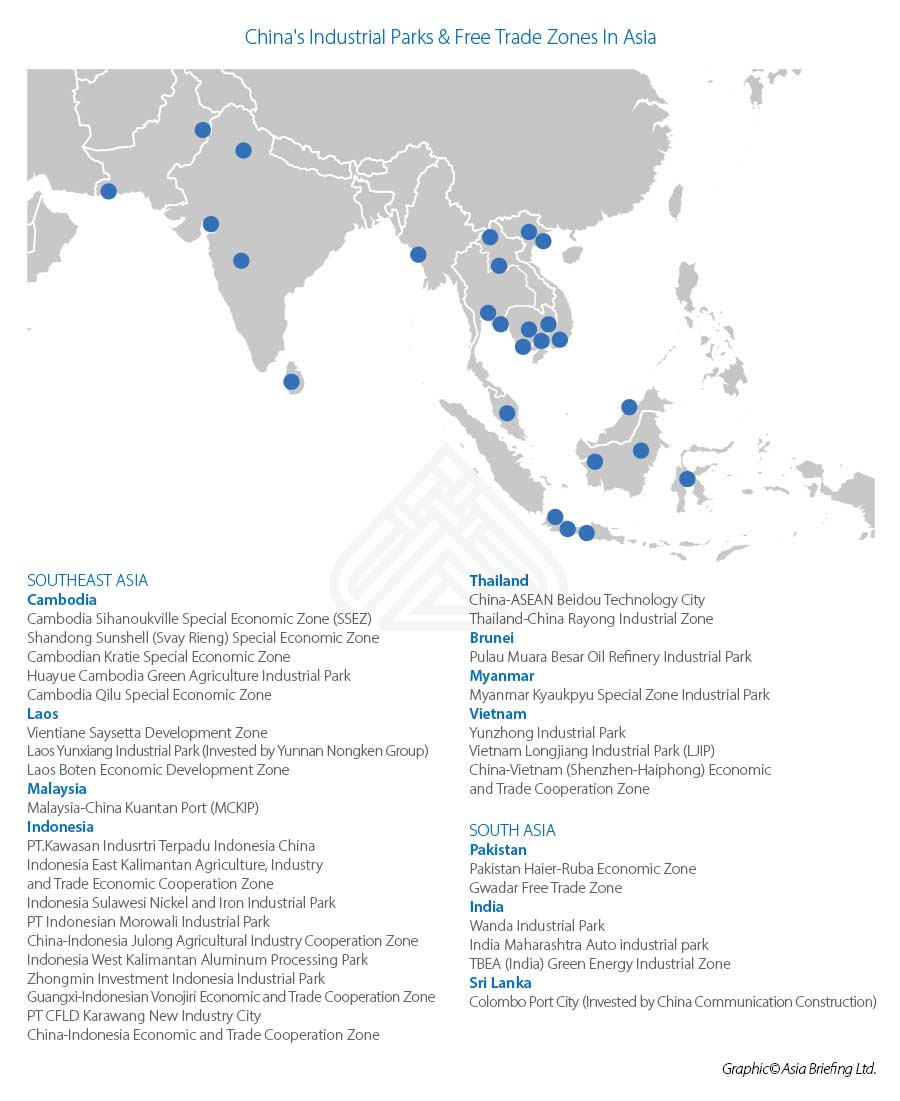

While much is made of China’s project financing and infrastructure build along many of the nations it has signed Belt & Road MoU with, a lesser known aspect is the Chinese need to use emerging economies to provide cheaper labor resources than China itself can now provide. To this end, China has quietly been establishing Chinese owned, or Chinese joint-ventured Industrial Parks and Economic Zones across the Belt & Road Initiative. I outlined these in the article China’s Overseas Free Trade Zones & Industrial Parks Many of these Parks have been established for strategic reasons, being sited close to necessary infrastructure such as road and rail networks, ports, airports and nearby border regions. These include Parks in Europe, Russia and the Middle East where wages are close or higher than those attainable in China. However, a large number of these Parks are also in the emerging economies of South East Asia and Africa, where wage dynamics are considerably lower than in China. It is noticeable that the majority of the Parks that China has established are also within these two regions.

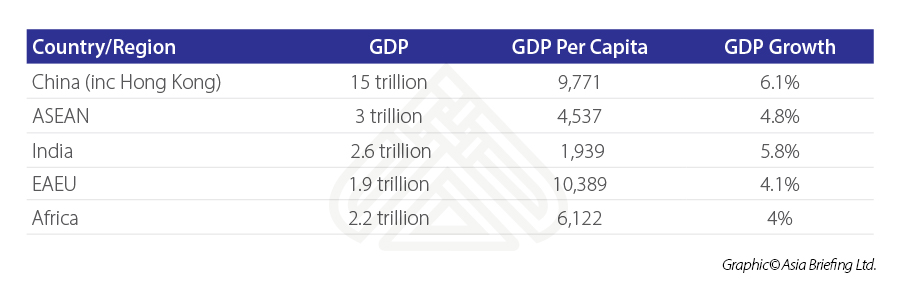

We can examine the wage differentials between regions as follows:

Of note here is India, which also has a wage dynamic competitive to China, yet is being underutilized. In fact, India should right now be inheriting the “Workshop of the World” title that China has held for the past 30 years – it has a worker-age dividend in millions of young, semi-skilled workers entering the market at low-cost. Jobs should be relocating from China to India. But they are not.

Why India Is Excluded From Asia’s Low Cost Wage Demographic

The reason for this is continuing Indian insularity and some prejudice against China. Indian businesses and their owners are a powerful political body in India and they do not want Chinese factories to compete with them in India. There are also border disputes, which could be solved but which India perhaps places too much emphasis on at the expense of trade development. As a result, India has refused to endorse China’s Belt & Road Initiative, has extremely low bilateral trade volumes with China (we don’t hear much about “Chindia” these days) and has just pulled out of the pan-Asian Regional Comprehensive Economic Partnership (RCEP) deal with the rest of Asia – mainly because it meant India would have to endorse some Free Trade aspects with China. India will probably arrange a Free Trade Deal with the Eurasian Economic Union – but this still underlines the point that India is not prepared to compete with China on its own turf, and will resist any attempts to get them to do so. Personally, I think this is a huge mistake, as India will inevitably miss out on the new Global Supply Chains that China, and to some extent Russia are in the process of developing in their need to lessen trade dependence with the United States. Consequently, China has been investing in developing Industrial Parks, Economic, and Free Trade Zones to service Chinese manufacturers elsewhere. Of note are the developments across the South-East Asian region, and he ASEAN bloc, in addition to Africa. As can be seen in the Wage Differential graphic above, both these regions currently possess low cost labor resources.

China’s Industrial Parks & Economic Zones In Asia

As can be seen these are wide spread. Essentially what happens is that Chinese SOE’s will approach the regional Government with plans to establish a manufacturing zone, typically as mentioned close to relevant infrastructure or supplies. If not already in place, (such as the China-ASEAN Free Trade Agreement) preferential tax policies will be negotiated, often including duty elimination on imported products into such zones, the ability to claim back local VAT on locally sourced products, and often tax breaks on profitability in addition to exemptions or lower than normal social security payments to workers and so on, in addition to cheap rent or land taxes. In this way China is actually duplicating the concepts it introduced to foreign investors in China back in the early 1990’s – which triggered huge amounts of FDI flowing into China at that time and laid the foundation for continuing reforms and the development of China we know today.

In return, the local and state government can provide employment, generate taxable income from that, and over time, on duties, VAT and profits taxes as pertinent to each specific agreement.

Chinese investors in such Zones are able to source product from across the region (such as the ASEAN bloc, or South Asia’s SAFTA) according to the respective rules of origin and tariffs, have the option of combining those with Chinese-made and imported components, and then either selling them onto the domestic market concerned, or re-exporting them back to China or other markets. China has also created a similar network in Africa:

China’s Industrial Parks & Free Trade Zones In Africa

The situation in Africa is similar to that in Asia, except that a different set of Free Trade Agreements apply. To this end, China was highly influential in having the African Continental Free Trade Agreement (AfCFTA) come into force, which is reducing to zero, over a phased in timescale, 90% of tariffs on all goods traded between African nations over the next five years. That is a great incentive if you are a foreign business wishing to source from across Africa and consolidate those products at one factory or processing location elsewhere in Africa. The same structure applies; duty elimination on imported products into such zones, the ability to claim back local VAT on locally sourced products, and often tax breaks on profitability, low social security payments and cheap rent and land taxes.

The end result is that China’s Overseas Industrial Parks and Zones in Asia and Africa can both source products either not available or more expensive in China, mix those if required with Chinese made components, and resell back to China (or other markets) at competitive prices. The model isn’t fully operational yet, and especially in Africa, where infrastructure needs to be put in place and workers educated over required skill sets. However these investments are taking place today, and these facilities are already coming online.

Russia Is Also Developing Free Trade And Special Economic Zones In Africa & Asia

Russia is a far smaller player than China in terms of influencing global trade flows – with the exception of energy resources where it is arguably the most influential player. However, like China, it has a need for some of its manufacturers to develop new export markets in the wake of sanctions, and like China, it too has been investing in Economic Zones to service Russian businesses in Africa and Asia. These include Egypt, where a large facility is being built at Port Said and negotiations are underway for a similar investment in Morocco, while the Russian Foreign Minister has recently declared interest for Russian zones to be established in Mozambique and Namibia.

In terms of Asia, the Indian government has been keen to secure Russian investments in Economic Zones in India, while elsewhere in Asia, Russia’s approach is rather different to China.

Russia is part of the Eurasian Economic Union (EAEU), a Free Trade Bloc that also includes Armenia, Belarus, Kazakhstan and Kyrgyzstan. As a geographical land mass, that sits between China and the European Union. Russia has successfully negotiated Free Trade Agreements in Asia with both Vietnam and Singapore, with Russian trucks set to be manufactured in Da Nang under this agreement. Meanwhile, numerous other Asian and African countries are currently in discussions with Moscow over following suit. We can examine the current situation as regards Free Trade between the EAEU, Africa and Asia as follows. It appears likely given what is happening in Africa and Russia that Russia will also establish such zones elsewhere in Asia over coming years.

These developments, and especially the extent of the Chinese network, mean that China will be able to satisfy its domestic demand, even as its own economy grows and Chinese consumer wealth increases, with competitively produced products made by Chinese manufacturers in Africa and South-East and South Asia.

It also means that the same African and Asian based Chinese manufacturers will be able to both access the regional African and Asian markets concerned, both via the low wage demographics these possess but also via the terms of negotiated free trade agreements with ASEAN and elsewhere. It will not be very long, for example, that “Made in Africa” products will start turning up in Europe.

It also means that China, and to some extent Russia are putting their influence on the way the Global Supply Chain is being developed. That has implications for future trade flows. The “Workshops of the World” over the next 10-20 years are shifting to Asia, and to Africa. Global manufacturers should be aware of the trends and how they can also take advantage.

Related Reading

- China’s Free Trade Agreements Along The Belt & Road Initiative

- China’s Free Trade Agreements Along The Belt & Road Initiative

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm provides strategic analysis, legal, tax and operational advisory services across Eurasia and has done since 1992. We maintain 28 offices throughout the region and assist foreign governments and MNC’s develop regional strategies in addition to foreign investment advice for investors throughout Asia. Please contact us at asia@dezshira.com or visit us at www.dezshira.com