How Foreign Investors Can Benefit From The Belt & Road Infrastructure Build In Africa

Op/Ed by Chris Devonshire-Ellis

Pan-Africa Free Trade And Industrial Parks Herald A New Era For Africa Manufacturing Capacity

Speaking on the influential “Rethinking The Dollar” program last week, one of the final questions was about Africa – how did I feel it would compete in global supply chains and become part of China’s Belt & Road? (Readers can hear my response at 44:40 on the video link here)

As I stated in the program, Africa’s prognosis as joining the Belt & Road Initiative is extremely positive. This is largely in part due to a concerted, and co-ordinated effort, principally by China, but also involving Russia, to get productivity into the African continent. This has taken the form of negotiating bilateral Double Tax Treaties with a host of African nations, encouraging a Pan-African Continental Free Trade Agreement amongst African countries themselves, in addition to investing in and establishing Industrial Parks and Free Trade Zones throughout the African continent itself. That, coupled with low cost African wages, when added to infrastructure build and increasing productivity, will see Africa emerge as a Global Workshop of the World within the next decade.

Africa Preferred Over India Manufacturing

It is significant as these moves also indicate that India is missing out on inheriting that same mantle. Over the past two decades, inexpensive Chinese labor boosted the Chinese economy as the country opened up its markets, provided plenty of trade zones, and developed an export based economy. Now, as wages are increasing, part of that economic boom is being eroded and replaced with a move higher up the value chain and into services. India was supposed to be moving into that Workshop of the World status, as its own worker age demographic has reached the same level as that of China in the 1990’s – plenty of them, available at competitive rates – but has largely failed – the country has political concerns about what its business leaders view as potentially ultra competitive cheap Chinese products swamping the local market if they open their domestic market up to foreign trade, and as a result have just pulled out of the much anticipated, pan-Asia Regional Comprehensive Economic Partnership (RCEP).

Although it will take time to improve African productivity, the die is already cast for global manufacturers, lead by the Chinese and Russians, to bypass India as a global manufacturing base and instead relocate low cost manufacturing in Africa instead.

With a resource-hungry China on a global search to secure supplies, and well as improve infrastructure to obtain political influence and secure trade routes, the African adventures China has been having are starting now to impact upon supply chains, and are now moving way beyond the previous Chinese trend of pushing sales of low end goods to relatively poor African consumers in local markets.

China’s positioning when it decides to get involved in continental trade though isn’t just a matter of turning up with a treasure map and a dictionary translating “win-win” into Swahili. Beijing, and the Chinese in general, are far more careful planners than the West often gives them credit for, and engage in developing new markets on several different levels. Africa is no exception, and Beijing’s attention to the continent has become far more sophisticated and deliberate in recent years.

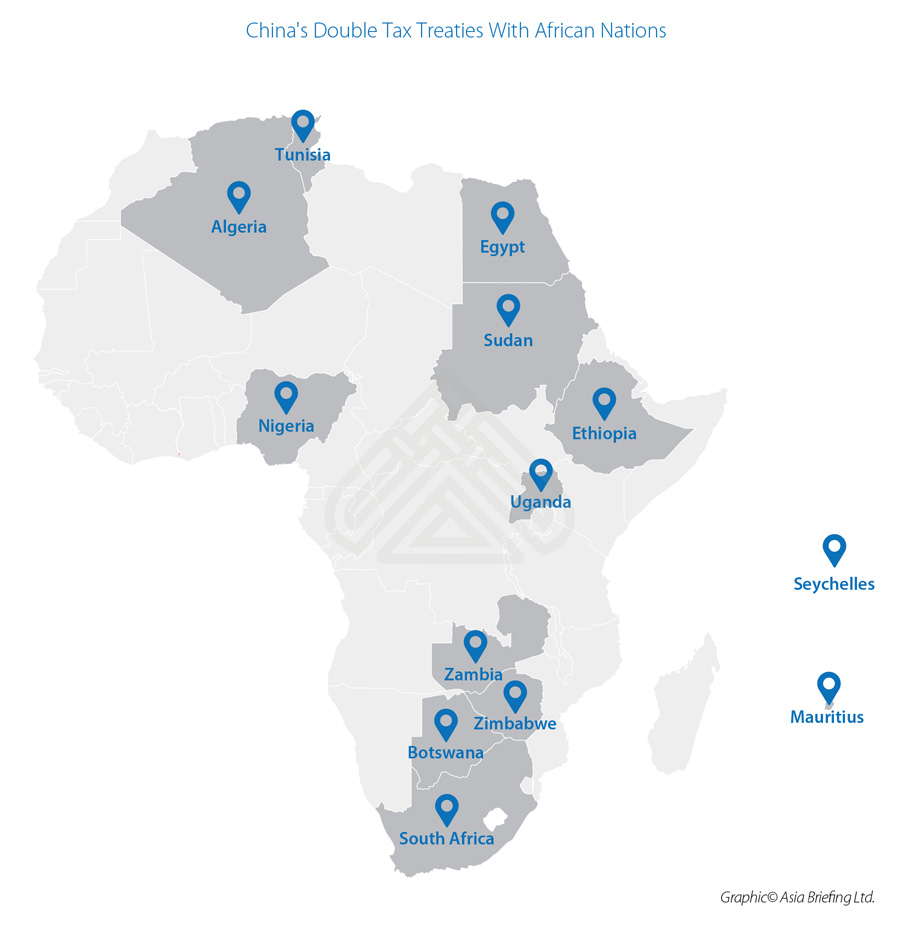

China-Africa Double Tax Agreements

More recently, as China grew to understand greater specifics about doing business with African nations and where specific opportunities and needs are, China has been introducing to specific well targeted African producing nations the concept of Double Tax Treaties (DTA). Despite the name, these seek to reduce the prospect of a company involved in trade in and with China being taxed both in its home country and in China. They also, crucially, seek to reduce tariffs on certain products and services, and provide for a tax loophole in the provision of withholding taxes – which can be used to mitigate against a higher profits tax.

DTA are therefore of extreme importance to African businesses with a large market in China – Cameroonian coffee traders for example. China has recently been making a lot of efforts to negotiate DTA with a number of African countries, and these now include:

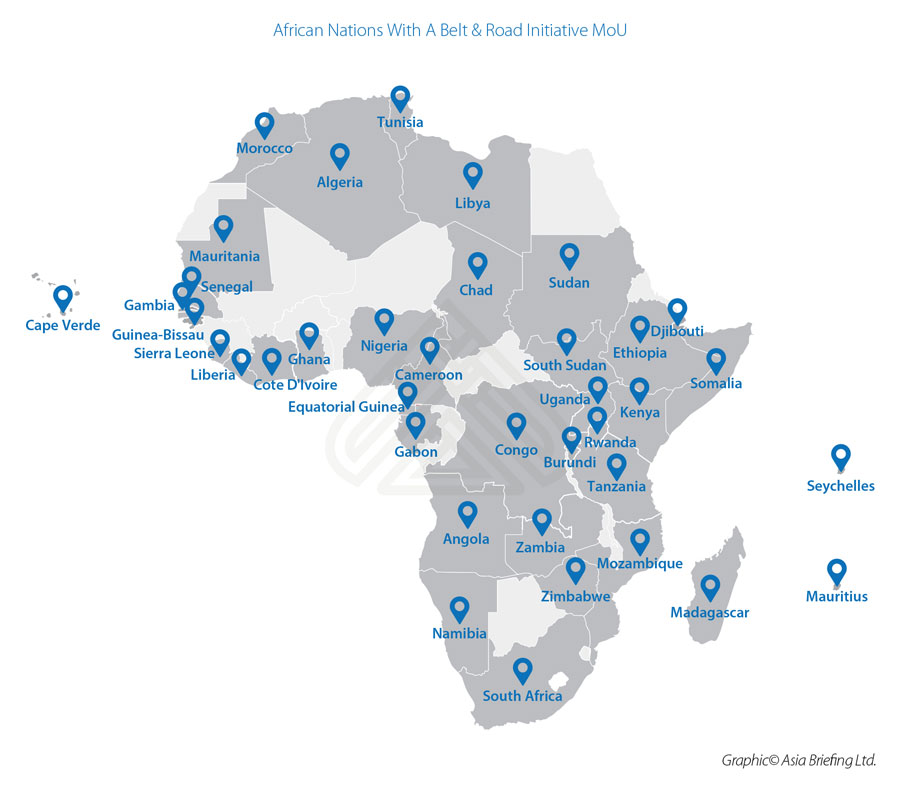

China – Africa Belt And Road MoU

Then there are the Belt & Road MoU that China has been introducing. These promise bilateral cooperation and can be project specific. African nations that have signed off Belt & Road MoU with China include:

China’s Overseas Industrial Parks In Africa

China has also been busy in developing a network of Industrial Parks and Free Trade Zones across Africa. These are in different stages of operations, however a quick glance gives us an idea of what has been going on:

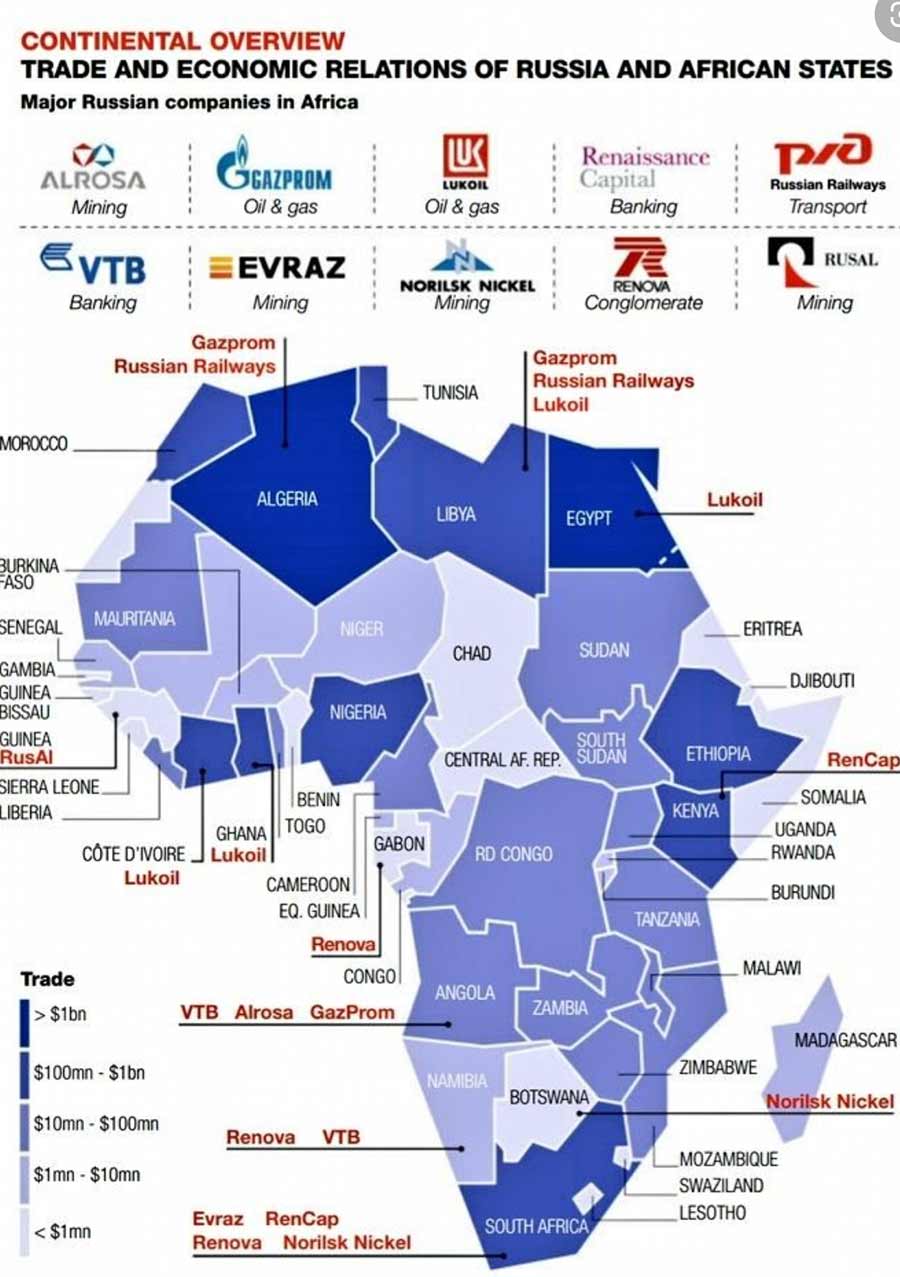

The Russians In Africa

China isn’t the only country following this path. Russia too has been investing as its own domestic MNCs seek both lower cost manufacturing alternatives, better climatic conditions more amenable to sustainable manufacturing processes (much of Russia experiences very low winter temperatures, affecting cost and productivity) and, in the wake of sanctions, more export opportunities in new markets. Russia has also signed off a large number of DTA with African countries, including Algeria, Botswana, Egypt, Mali, Morocco, Namibia, and South Africa. There is a Russian Development Zone currently being developed in Port Said, where exports are expected to reach just under US$4 billion in coming years, mainly in the auto and related sectors. Russia is also looking at establishing similar zones for Russian investors in Mozambique and Namibia. Russia is a principal partner in the Eurasian Economic Union (EAEU), which also includes Armenia, Belarus, Kazakhstan and Kyrgyzstan, and has free trade agreements of it own with Iran, Serbia, Singapore, Vietnam – and China. The EAEU and the African Union are currently negotiating agreements for the development of Africa-Russia agricultural trade. On top of all that, Russia and Africa are developing an Online Trade Platform with the capacity to handle US$5 billion of bilateral trade online. The result? Russia-Africa trade has been growing at 17% the past couple of years, is now at US$20 billion, and these growth rates can be expected to continue. In comparison, British trade with Africa is roughly about US$15 billion per annum, and has been declining, despite the benefit of having colonial-era expertise there. France, another colonial Africa power, has Africa trade of about US$44 billion. Russia has its eyes on being a serious player now in the African continent.

We can look at some examples of Russian investment into Africa in the graphic below:

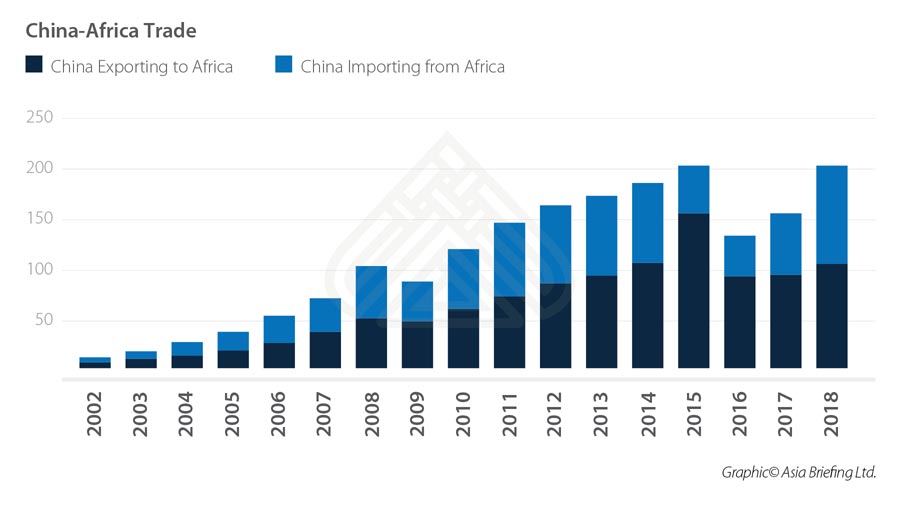

Africa-China Trade Increases

But its not just Russia who is having all the fun. As we have discussed, as China’s diplomatic efforts in African free trade evolves, so has other infrastructure such as the Industrial Zones – largely built by Chinese Private investors. This has had an impact on China-Africa trade. While the region is fairly volatile, and subject to currency swings and regional disputes, China is now Africa’s largest trading partner. In 2018, bilateral trade reached US$200 billion, with an upward trend. The graphic below, courtesy of the China Africa Research Initiative based on data from the Chinese Ministry of Customs, includes North Africa and demonstrates this well:

What is interesting about the statistics is that the trade flows are relatively mutual – Africa is selling to China only slightly less than China is selling to Africa. In 2017, the largest exporter to China was Angola, followed by South Africa and the Republic of Congo. In the reverse direction, South Africa was the largest purchaser of Chinese goods, followed by Nigeria and Egypt. As can be seen, China has been introducing diplomatic and tax incentives to encourage African businesses to trade with China – which remains a market that wants to consume. African products are welcome in China and there is huge growth market potential.

The AfCFTA Impact On Chinese & Asian Manufacturing Flows

This has further been underpinned by China’s involvement in structuring the African Continental Free Trade Area (AfCFTA) which came into effect a few months ago, and which eliminated intra-Africa duties paid when African goods were traded across the Continent. We covered the implications of AfCFTA previously in the China Briefing article China Set To Cash In On New African Free Trade Agreement, but what it effectively means is that the costs of sourcing different products or component parts from different African countries is much reduced – great news if you are setting up a factory in a Free Trade Zone in Africa and are adding pan-African sourced products to perhaps duty-free imported component parts from your own country in order to produce a complete end product – just as many foreign investors currently do in China.

The AfCFTA deal – to be phased in over a five year period among some members – reduces to zero about 90% of all intra-African traded goods, thereby essentially demolishing cross-border trade barriers. That, coupled with the developing DTA network that China has built up in Africa over the past decade is set to provide a huge boost to Africa-China trade, with some estimates suggesting it will rise by 50% in the next 12 months. That will spur further infrastructure development and increase China’s role in Africa exponentially.

It will also impact upon South-East Asia – not far away across the Indian Ocean, which washes up against the East African coast. This is because the low end manufacturing that China pushed out to South-East Asia is starting to be pushed out again – both due to intensive labor issues and increasing operating costs. The implementation of AfCFTA is expected to see millions of African workers currently engaged in agriculture shift into manufacturing. About 50% of the African workforce is currently engaged in agriculture, yet it only produces a small amount of GDP. Shifting that worker pool into manufacturing has a significant impact on productivity. This is turn will mean that production facilities that were in China ten years ago and are now in South-East Asia will eventually relocate again to Africa, and especially the East and Southern African nations of Kenya, Tanzania, Madagascar, Mozambique and South Africa. Spill-over will occur in Uganda, Zambia and Zimbabwe.

This ability to produce a finished article in a factory in Africa – taking advantage of lower African production costs – means there are capabilities developing across the African continent that mean such products can then either be resold back onto the domestic African market; exported back to your home country, or exported to other overseas markets. It won’t be long before “Made in Africa” vehicles and computers are turning up in China, Asia, and even Europe.

Belt And Road – Africa Project Funding

China has also recently invested US$1 billion in a Belt & Road Africa Fund, while the BRICS grouping also invests under its New Development Bank, which includes China and South Africa as equal equity partners, and includes infrastructure projects in South Africa. China’s Silk Road Gold Fund is also looking at African gold deposits and of course China is a regular financier and investor in a variety of bilateral infrastructure development projects with a large number of African countries.

As usual, at Dezan Shira & Associates, we have been speaking from experience, rather than just creating articles from armchairs elsewhere as is increasingly common among some of our competitors. In terms of Africa, I have recently been involved in assisting Chinese/Foreign JV partners look at the possibilities of Auto Component Parts manufacturing in Africa, with an existing and successful China-based JV using a Singapore invested Holding Company to invest into Kenya. Our firm meanwhile are also members of the Leading Edge Alliance, which similar to a multi-lateral FTA allows us to take advantage of local experience on the ground with other Partner firms. This we do in Africa, where we have partners in Algeria, Angola, Egypt, Ethiopia, Kenya, Libya, Morocco, Nigeria, Rwanda, Senegal, South Africa, Sudan, Tanzania, Tunisia, Uganda and Zimbabwe. In time, our firm will be establishing our own presence on the ground, with Egypt, Kenya and South Africa probably being the favorites at this stage.

These developments in Africa mean there will be a coming impact on Foreign Investors in China, Russia and elsewhere, as manufacturers that are a vital component part of any Chinese investment (such as JV’s) may find themselves being asked to additionally invest in Africa. Africa still needs investment and it will need a large amount of skill sets to be introduced into its productivity. Foreign Executives across China and Asia can expect to start to hear of plans to examine the Africa market potential, and it is time now to start putting that on the radar. Our firm can assist with feasibility studies, strategic planning advisory and cost/productivity analysis.

This article has been significantly updated from the piece China’s African Moves Through The Belt & Road, Double Tax Treaties And AfCFTA published on 29th May 2019.

This article was updated on November 22, 2020.

Related Reading

- China-Africa Trade to Benefit from Growing Economic Cooperation

- A Digital Free Trade Agreement for Africa’s Silk Road

- BRICS Nations Will Account For 50% Of Global Economy By 2030

About Us

Dezan Shira & Associates provide foreign investment strategic, legal and tax advisory services to foreign investors throughout Asia and have done since 1992. We are one of the largest privately owned practices in the region, and have 26 offices throughout China, ASEAN, and India. We also have Partner firms in Russia and across Africa. Please contact us at info@dezshira.com or visit us at www.dezshira.com