The African Continental Free Trade Agreement And Its Impact On China

Op/Ed by Chris Devonshire-Ellis

China’s moves into Africa should not really come as any great surprise – the Chinese African diaspora has long been energetic and far reaching, mostly involved in trade. Many of them have African roots dating back centuries, with artifacts still cropping up on the East African coast from Chinese Admiral Zheng He’s voyages in the mid 1400’s.

With a resource-hungry China on a global search to secure supplies, and well as improve infrastructure to obtain political influence and secure trade routes, the African adventures China has been having are starting now to impact upon supply chains, and moving beyond the sales of low end goods to relatively poor consumers.

China’s positioning when it decides to get involved in continental trade though isn’t just a matter of turning up with a treasure map and a dictionary translating “win-win” into Swahili. Beijing, and the Chinese in general, are far more careful planners than the West often gives them credit for, and engage in developing new markets on several different levels. Africa is no exception, and Beijing’s attention to the continent has become far more sophisticated and deliberate in recent years.

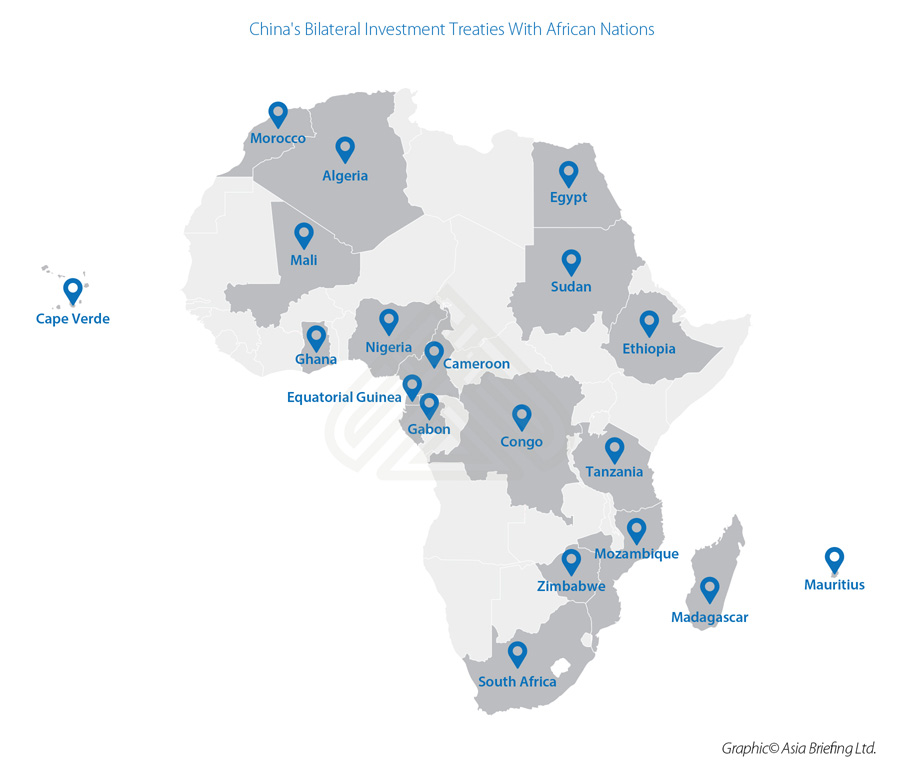

An example of this is the introduction of the many Bilateral Investment Treaties (BIT) that China began introducing to African nations back in the mid 1990’s. Bilateral Investment Treaties are a tax and duty driven agreement that provide a useful mechanism for understanding the legal, tax and dispute resolution mechanisms for investors into the country. As such, BITs are a useful starting point to clarify legal and tax treatments under bilaterally agreed conditions and should be understood as a bilateral document of first resort when understanding the investment environment, and protection mechanisms that China offers its many trading partners. These tend to be of particular importance for understanding the rights of companies investing from or into emerging markets. I wrote about their use in some detail back in 2013 here

BIT have been important for China’s trade relationship with Africa as these introduced a system of codifying exactly what was meant, this providing an initial trade platform. This is particularly important in emerging markets overseas where local cultural and trade practices may differ. BIT provide a basic platform of mutual understanding. African countries that signed off BIT with China – and effected them (not all came into force) include:

More recently, as China grew to understand greater specifics about doing business with African nations and where specific opportunities and needs were, BIT have been upgraded into more product and services specific bilateral agreements: Double Tax Treaties (DTA). Despite the name, these seek to reduce the prospect of a company involved in trade in and with China being taxed both in its home country and in China. They also seek to reduce tariffs on certain products and services, and provide for a tax loophole in the provision of withholding taxes – which can be used to mitigate against a higher profits tax.

DTA are therefore of extreme importance to African businesses with a large market in China – Cameroonian coffee traders for example. China has recently been making a lot of efforts to negotiate DTA with a number of African countries, and these now include:

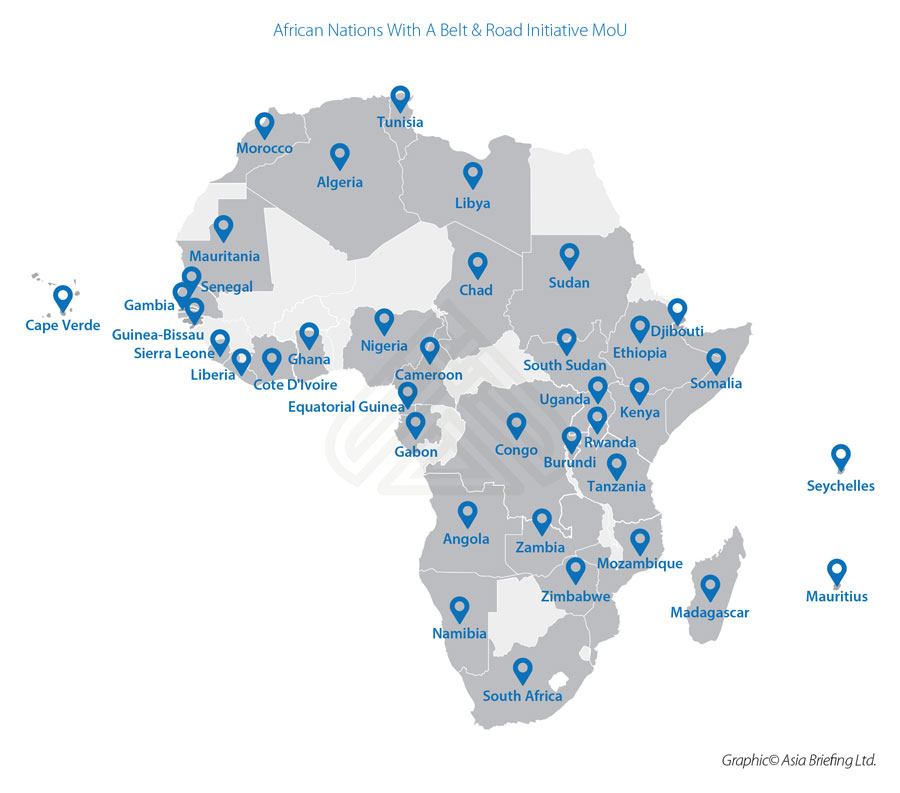

Then there are the Belt & Road MoU that China has been introducing. These promise bilateral cooperation and can be project specific. African nations that have signed off Belt & Road MoU with China include

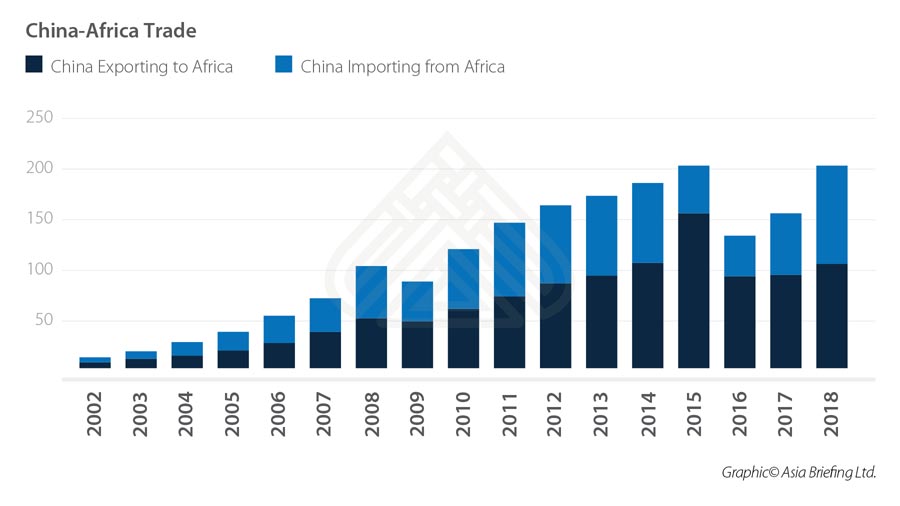

Thus we can see how China’s diplomatic and trade spread evolves. It has had an impact on China-Africa trade. While the region is fairly volatile, and subject to currency swings and regional disputes, China is now Africa’s largest trading partner. In 2018, bilateral trade reached US$200 billion, with an upward trend. The graphic below, courtesy of the China Africa Research Initiative includes North Africa and demonstrates this well:

The figures above were obtained from the Chinese Ministry of Customs. What is interesting is that the trade flows are relatively mutual, Africa is selling to China only slightly less than China is selling to Africa. In 2017, the largest exporter to China was Angola, followed by South Africa and the Republic of Congo. In the reverse direction, South Africa was the largest purchaser of Chinese goods, followed by Nigeria and Egypt. As can be seen, China has been introducing diplomatic and tax incentives to encourage African businesses to trade with China – which remains a market that wants to consume. African products are welcome in China and there is huge growth market potential.

This has further been underpinned by China’s involvement in structuring the African Continental Free Trade Area (AfCFTA) which comes into effect at the end of this month – just two days away. We covered the implications of AfCFTA earlier this week in the China Briefing article China Set To Cash In On New African Free Trade Agreement

The AfCFTA deal reduces tariffs – to be phased in over a five year period among some members – to zero on about 90% of all intra-African traded goods, thereby essentially demolishing cross-border trade barriers. That, coupled with the still-developing DTA network that China has built up in Africa over the past decade is set to provide a huge boost to Africa-China trade, with some estimates suggesting it will rise by 50% in the next 12 months. That will spur further infrastructure development and increase China’s role in Africa exponentially. It will also impact upon South-East Asia – not far away across the Indian Ocean, which washes up against the East African coast. This is because the low end manufacturing that China pushed out to South-East Asia is starting to be pushed out again – both due to intensive labor issues and increasing operating costs. The implementation of AfCFTA is expected to see millions of African workers currently engaged in agriculture shift into manufacturing. About 50% of the African workforce is currently engaged in agriculture, yet it only produces a small amount of GDP. Shifting that worker pool into manufacturing has a significant impact on productivity. This is turn will mean that production facilities that were in China ten years ago and are now in South-East Asia will eventually relocate again to Africa, and especially the East and Southern African nations of Kenya, Tanzania, Madagascar, Mozambique and South Africa. Spill-over will occur in Uganda, Zambia and Zimbabwe.

In future articles we will drill down and examine the China-Africa picture on the ground, including infrastructure projects, loans China has made into Africa, and developing trade trends. To subscribe to Silk Road Briefing and receive regular updates, click here

This article was updated on November 22, 2020.

About Us

Silk Road Briefing is published by Dezan Shira & Associates. The firm assists foreign companies in China and Asia and has a portfolio of African clients. For assistance with trading and setting up business in China or elsewhere in Asia, please contact us at africa@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

![]() A Digital Free Trade Agreement for Africa’s Silk Road

A Digital Free Trade Agreement for Africa’s Silk Road

![]() China-Africa Trade to Benefit from Growing Economic Cooperation

China-Africa Trade to Benefit from Growing Economic Cooperation

![]() China’s Silk Road Gold Fund – The African and South American Gold Deposits (Part 3 of a 5 Part Series)

China’s Silk Road Gold Fund – The African and South American Gold Deposits (Part 3 of a 5 Part Series)