China’s Overseas Free Trade Zones & Industrial Parks

China tax incentives are being exported across Eurasia and Africa

Op/Ed by Chris Devonshire-Ellis

A little-noticed aspect of China’s Belt and Road Initiative has been the trend of Chinese companies to export their own Free Trade and Special Economic Zones in order to stimulate production overseas.

China’s development of the various types of Free Trade Zones it has within its own borders developed in the late 1980’s, then really took off in the 1990’s as the Government saw them as a route to attract foreign investment and capitalize on the low cost worker dividend that China had at that time. Both China’s Central and Regional governments were deployed to work out State-level and Provincial-level tax concessions. This ranged from eliminating VAT and customs duties on products imported into these zones, (although not mainland China per se) as well as reductions in profits and other taxes realized by companies operating in these areas. They were a massive hit – with foreign investors piling into the country to take advantage.

In China, these are still valid, although perhaps not at quite the same level of incentives as they were back then – Beijing has gradually leveled the playing field between foreign companies, who could take advantage of such zones – and domestic Chinese companies (who couldn’t).

Gradually, such zones also began to move, under Government legislation, to the Chinese private sector. Many Free Trade and other Development Zones in China are now part-Government owned and have local Chinese business partners as well. The local partner does all the donkey work while the Government just sits back and collects the revenues. Some work better than others – Tianjin’s TEDA for example is a very professionally run operation.

That experience has lead to China actively promoting the concept overseas. With Chinese SOEs and private businesses looking at developing markets externally from China, it makes sense for China to have joined forces with its overseas diplomatic missions and plug the benefits of establishing Economic Zones or Industrial Parks elsewhere. “Provide us with tax incentives and low cost rent, and we’ll bring in our export manufacturers” they say. “You get the local employment, skills transfer and tax income where there was previously none.”

It’s been a productive exercise. In the list below we can see the volume of current Chinese Industrial Parks, Free Trade and Export Processing Zones that Chinese companies, often partnering with Chinese and local Governments, have established across Eurasia and Africa to date:

Not all of these are as yet fully operational, and some have experienced teething problems. Also, not all the countries concerned are fully convinced by China relocating production facilities, and occasional local issues have emerged with political pushback from local business leaders resentful at the fact that Chinese, but not their own companies are eligible for incentives. It’s a familiar problem for the Chinese, who faced the same criticisms concerning Foreign versus Chinese companies back in the 1990’s and 2000’s. However, what is apparent is that overall, China has been making great efforts to secure advantageous trading conditions for its businesses overseas, and that while not all such projects will succeed – the majority of them will assuming local Government support is strong enough to resist criticism.

A stand-out example of Chinese investment into such zones is what is happening at the Great Stone Industrial Park in Belarus. Preparations have been going on for a number of years, with numerous interlocking parts coming into play.

Belarus has a nearby border with Lithuania and Poland, both European Union members, and is a member of the Eurasian Economic Union, which also includes Armenia, Kazakhstan, Kyrgyzstan and Russia. That means it essentially straddles the economic space between the EU and China. Guess who is currently negotiating reductions and elimination of various tariffs with the Eurasian Economic Union? China.

This means that once this is in place, the Great Stone Industrial Park is likely to see an upsurge in Chinese manufacturers locating production facilities in Belarus to manufacture products for Eastern Europe, and the Caucasus. The Belarus Government also sees the potential. With the Great Stone Park just a few kilometres from Minsk airport, the Government is putting in a second runway to cope with expected demand for additional cargo flights. Great Stone is also close to the Belarus Rail network, which itself is already well connected with nearby borders into the EU and Russia. It is this combination of recognizing location, proximity to existing or developing infrastructure, the emergence and pre-armed knowledge of upcoming tax reductions and free trade deals that is driving Chinese investment into these areas.

Another example is China’s massive investments into such zones in Africa. These have been going on for some time now, but all with the knowledge that Africa would itself shortly agree a pan-African Free Trade Agreement (AfCFTA) that would eliminate taxes on 90% of products traded across the African continent. Such a deal is great news for businesses operating in Africa wanting to source components and products from different African countries and suppliers and combine them perhaps with components imported, duty free, into Free Trade Zones and combine them into one finished product for either re-sale back onto the African markets or for re-sale elsewhere. The AfCFTA came into effect earlier this year. I wrote about this and the moves that Beijing made to make it happen in the article China’s African Moves Through The Belt & Road, Double Tax Treaties, And AfCFTA With China having built zones such as the China-Egypt Suez Trade & Economic Cooperation Zone (coinvested in by Tianjian’s TEDA), and with China’s President Xi promising to bring over 100 textile, garment, oil equipment, motorcycle and solar energy companies to Egypt, creating more than 10,000 local jobs, it may not be long before “Made in Africa” versions of Chinese brands begin to turn up in EU markets, and certainly across Africa and the Middle East.

China has also recently announced the establishing of a further six new Free Trade Zones in its own territory – and all of them are based in its border regions with nearby access to markets in Japan, South Korea, Vietnam and Russia.

Interestingly, Russia has begun following the same policy of establishing trading zones for its own businesses overseas, and is also in the process of setting up a Special Economic Zone in Egypt’s Port Said. Russia has also been targeting Africa, and is looking at setting up additional zones in Mozambique and Namibia. Like China, Russia is also strengthening its foothold into South-East Asia. Via the Eurasian Economic Union, it has a Free Trade Agreement with Vietnam, has recently signed another with Singapore and is negotiating to do the same with Cambodia, Indonesia and Thailand.

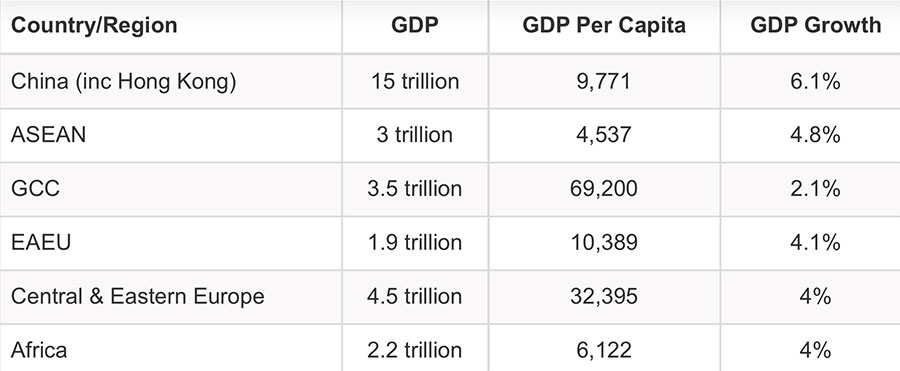

There are sound reasons why. In the graph below, we can see the per capita income in China, ASEAN, the Gulf Nations, Eurasian Economic Union, Central & Eastern Europe, and Africa. It clearly shows that both South-East Asia and Africa have and are inheriting the worker-age demographic and that these regions offer the most profitable base for establishing production facilities.

That isn’t to say that there aren’t productivity issues, because there are. But with China, and now Russia starting to invest in both infrastructure and negotiate tax-friendly Industrial Parks and Free Trade Areas for their companies overseas, the future of China and Russian owned supply chains to markets throughout Asia, Eurasia, Europe and Africa can start to be evaluated.

Related Reading

- The Emerging Markets In China’s Belt & Road Initiative

- China’s Top Twenty Belt & Road Export Partners – The Main Buyers Of Belt & Road Initiative Materials.

- Russia’s Free Trade & Special Economic Zones

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The practice advises foreign Governments and MNC’s on conducting business throughout the Belt & Road Initiative and has offices throughout the Eurasian region. For research, analysis and strategic overviews please contact us at info@dezshira.com or visit us at www.dezshira.com