The Most Influential Countries Across The Asian Belt And Road Initiative 2020

By Chris Devonshire-Ellis

A study just published by Australia’s Lowy Institute, titled the Asia Power Index 2020, has ranked 26 nations and territories in terms of influencing Asia. While the Lowy Institute report includes the United States, Japan, Australia, South Korea, New Zealand and India, we have extrapolated their data to illustrate the position of influence purely among countries that have signed up to China’s Belt & Road Initiative. Doing so effectively removes the US financial and military influences and shows a picture of who is coping with changing China dynamics among the Belt & Road nations – being under immediate China’s influence rather than that of the West. The Lowy Institute measured their analysis of ‘influence’ based on the following main factors: economic relations, defense spending, internal stability, information flows and projected future resources.

What is noticeable is that all Belt & Road Asian economies have fared poorly this year in terms of influential dynamics, with the exception of China, which has remained static, and Vietnam, which has improved. This is linked to the increase of FDI this year into China, which we noted back in September and the recovery and growth of its domestic market. As we stated two weeks ago, China’s imports from along the Belt & Road have outperformed its exports. In terms of Vietnam, we have already shown its FDI increased this year. I touched on the importance of what these mean when planning for 2020 business activities in the article Corporate Budget Planning For 2021. For us, the Lowy Institute report in this regard comes as little surprise; our practice services foreign investors into Asia with regional intelligence, legal and financial overviews and we see what they do.

What the Lowy Institute have uncovered however is the surprising depth of unexpected regional influence wielded elsewhere. Russia is the largest influential Asian regional power after China – people forget that 77% of Russia’s landmass is in Asia. The country has a significant border with China and is a major investor in numerous Asian nations. Moves such as bringing Singapore and Vietnam into Free Trade Agreements with the Eurasian Economic Union herald an increasing stance for Russian involvement in Asia. These countries are not alone; Cambodia, Indonesia, and Thailand are all negotiating similar Russian deals. Meanwhile, Russian bilateral trade with China has begun to pick up again. Both parties are looking to increase that by doubling existing trade to US$200 billion. Covid-19 may slow the pace of that down somewhat, however the fundamentals remain. That compares with the current bilateral average of US-China trade, which is running at about US$470 billion this year, yet is decreasing while the Russia bilateral trade curve is upwards. It remains to be seen when US-China and Russia-China bilateral trade figures reach parity, however there is a distinct possibility this could happen – especially when one considers the implication of proposed tariffs being introduced to the China-EAEU Free Trade Agreement. As and when that happens, it becomes conceivable given the current political and trade climate that China will eventually trade more with Russia than with the United States. It is feasible.

Asian 2020 Influencers In The Belt & Road Initiative

Mongolia meanwhile sits in the middle, and it too has become influential amongst Asian and Belt & Road nations because of this. Also gaining traction is Singapore, a de facto Asian regional financial hub and increasingly so for the development of ASEAN – which makes up most of the other featured nations, and for the Belt & Road Initiative itself. While all Asian influential economies have suffered this year (with the other exception of Thailand, which has remained static) the basic fundamentals suggest they will recover.

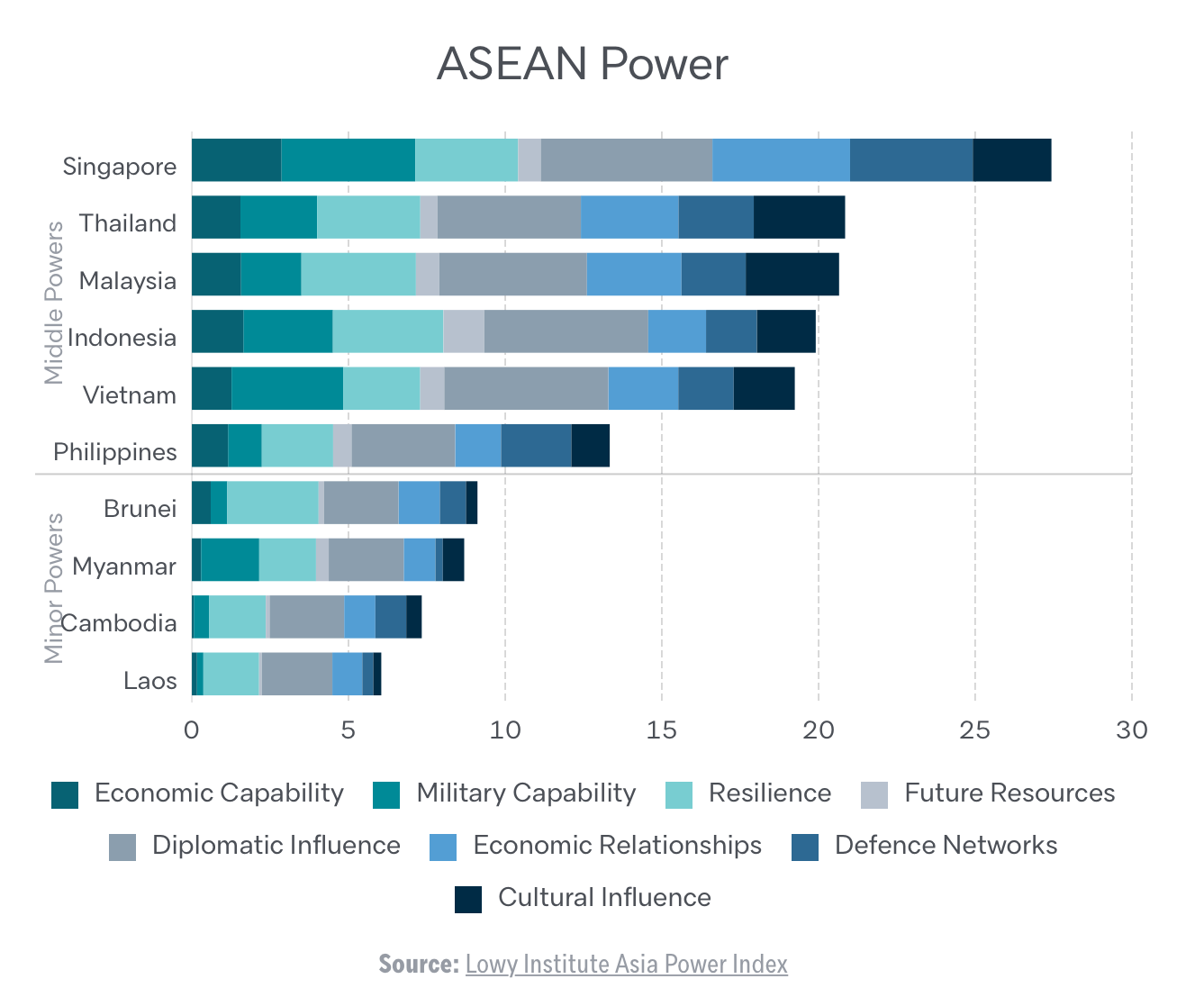

Of the ASEAN countries, the Lowy Institute says that although they hold differing levels of influence in the Indo-Pacific, the foundations of their power share some common characteristics.

Southeast Asian countries derive more of their power from diplomatic influence than anything else, suggesting that active participation in ASEAN and teaming up in other multilateral forums, including the United Nations, has paid dividends. Economic relationships mean more for their power than their own domestic economic capabilities, according with their relatively small economic size. But perhaps surprisingly for these fast-growing developing economies, perceptions of their future resources don’t mean much for their power today.

The similarities between Thailand, Malaysia, Indonesia and Vietnam are also striking. Despite extremely varied political systems, populations and economic structures, these countries project highly similar levels of power derived from virtually identical bases.

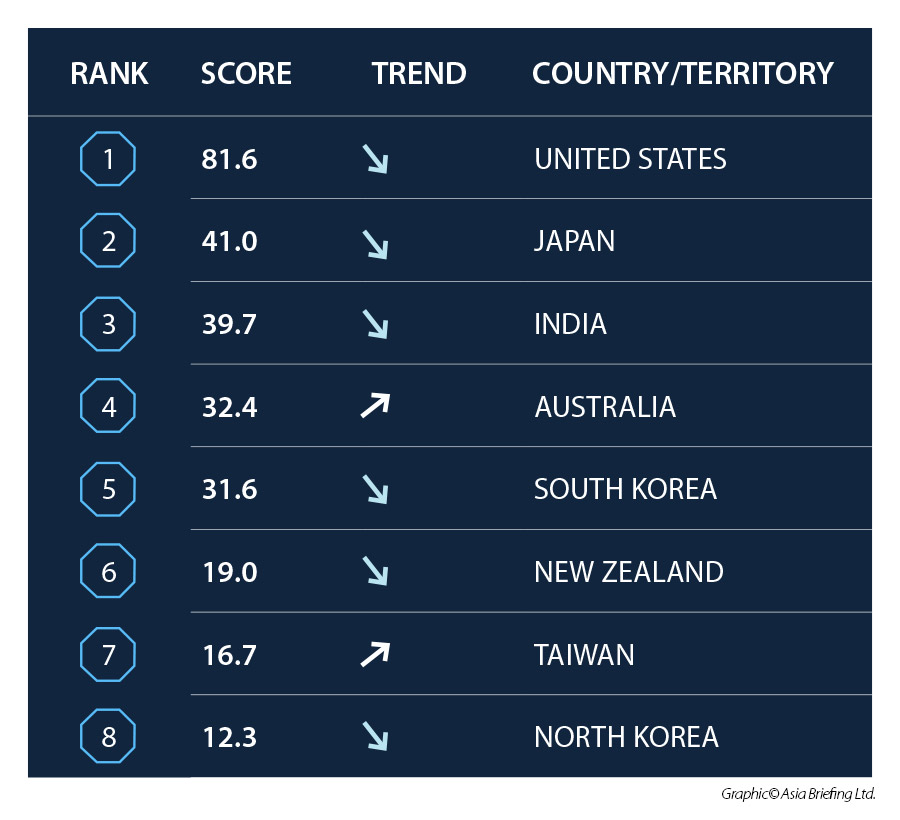

Unlike the Lowy Institute, we divided the Asian influencers into BRI members and non BRI countries. For the countries that are strong Asian influencers but not part of the BRI we separated them out as follows:

Non-BRI Asian Influencers

Much of the media attention concerning the Lowy report centered on the decline of the United States influence in Asia, followed by Japan and India. Yet as the report’s authors note, “While Japan is a mature and waning advanced economy, India is a young and emerging market. India’s cultural influence comes from strong media influence and migrant drawing power in South Asia, alongside a large diaspora regionally, whereas Japan commands significant popularity with travellers and netizens online more broadly. The different approaches the two states take with power is also clear. Japan’s strengths come from its relationships with others, most prominently in the diplomatic sphere, but also in the defence and economic realms. On the other hand, India remains more internally focused, with stronger military capabilities and resilience. Its expected economic size and favourable demographics in the future also serve to bolster its power.”

India therefore should not be discounted in future growth and development in Asia, and as we noted a couple of months ago, is a de facto Belt & Road hub in its own right without being an official partner.

While the Lowy Institute report is interesting, we believe that they’ve missed the signal that it is the China-Russia-India dynamic rather than the US-China one that is where the more interesting and challenging future trade and related dynamics are set to emerge.

Related Reading

- Mongolia. Between China & Russia, But Where Do Its Trade Trends Point To?

- Vladivostok & Russian Far East To Be Developed As Significant North-East Asian Resource & Trade Hub

- India and Russia To Connect Supply Chains Via Iran’s INSTC

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com