Foreign Investment Into China Increases By US$90 Billion In 2020 YTD

Op/Ed by Chris Devonshire-Ellis

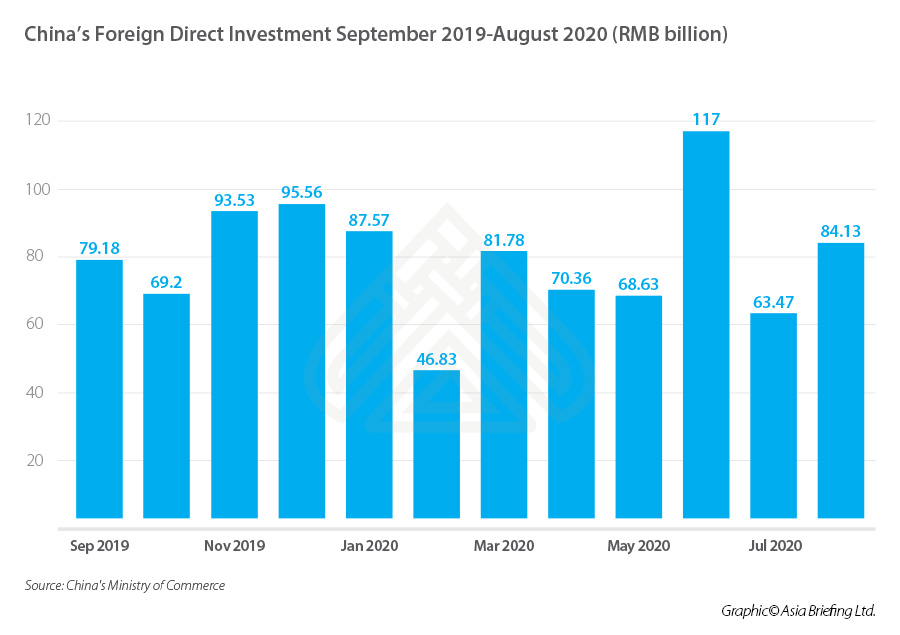

China’s economy has proved resilient during the year and has seen an 18.7% increase in August’s foreign direct investment, up by U$12.3 billion over 2019. China’s Ministry of Commerce has stated that for the year as a whole, foreign direct investment (FDI) into China has already exceeded that of 2019, jumping 2.6% to 619.78 billion yuan (US$90.69 billion) between January and August this year.

China’s Commerce Ministry data illustrates that investors have been pouring their money into the country for five months in a row in search of a diversification of opportunities, as most of the world remains engulfed in the Covid-19 pandemic.

China’s Foreign Direct Investment: September 2019-August 2020

FDI into China does follow annual seasonal trends, with investment dropping off historically in the early part of each year due to Christmas and Chinese New Year holidays, and also during the summer months for the same holiday reasons. That hasn’t occurred this year, with a steady build up month by month following the disasterous start to the year when the country went into lockdown and borders were closed.

Investments in the high-tech service sector showed the greatest growth at 28.2% in the first eight months of 2020, while the service industry came in second with a 12.1% spike compared to the previous year. Seeing the growth in these sectors, Beijing has already announced the implementation of mechanisms that will boost investors’ interest in China in general by easing cross border financial flows, as well as by partially deregulating foreign investment in the country’s telecommunications sector.

The news of the booming foreign direct investment in China comes as the country’s recently-held International Fair for Investment & Trade and the Belt and Road Investment Congress boasted a massive 800 billion yuan (US$117 billion) worth of agreements struck between Chinese and foreign companies. Beijing has been broadening its economic ties with the rest of the world, receiving for example 73.6% more in FDI from the Netherlands and 17.2% more from the UK, amid an ongoing confrontation with the US.

In terms of the Belt & Road Initiative, many of the 2,500 infrastructure projects Chinese SOE’s have conducted around the world are now coming to fruition and creating further investment opportunities for their stakeholders and incoming investors alike. These include projects such as the Colombo Port City in Sri Lanka, which seeing real estate and related assets increase in value as the build out nears completion, giving opportunities to foreign investors to buy into such projects in both real estate and investment into the required service industries that such projects need.

‘Investing in China’ will in coming years take on a phase where the investment may not necessarily be made on Chinese sovereign territory, but in projects run and operated by Chinese SOE’s in other countries. Interested parties should be looking at where the commercially accessible investments made by China’s SOE’s are, and conduct research into viability and opportunities.

Related Reading

- China’s Belt and Road Initiative – It’s about the Trade Opportunity, Stupid

- China’s Belt & Road Initiative Changes Focus As Smaller Investments With Minority Equity Stakes Take Preference

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com