Mongolia. Between China & Russia, But Where Do Its Trade Trends Point To?

Op/Ed by Chris Devonshire-Ellis

Mongolia is a landlocked, huge country lying between China and Russia. About the size of Western Europe, it has a population of about 3 million, of whom about 50% are subsistence, nomadic herders and farmers. The terrain includes oceans of grass steppes, high altitude mountains, forests, and a large chunk of the Gobi Desert. Temperatures can range from 35 in the summer to -50 in the winter, meaning it is a country for the hardy. Its not hard to see why it gave birth to conquerors such as Chinghis Khan, still revered here and even today remembered in brand new Mongolian rock videos.

The country possesses significant, and much coveted reserves of coal, gold, and many other precious metals and earths, as well as producing fine wools, mainly from cashmere, camel and yak. It also has a developing gourmet meat industry – the land here is fragile but relatively unpolluted, with herds of cattle and other animals essentially organically farmed. It has more recently been strongly linked to the economy of China, which bought large amounts of coking coal from the country to feed the Chinese massive steel foundries. At the beginning of the global slowdown and an over-capacity of steel, Mongolia’s economy tumbled.

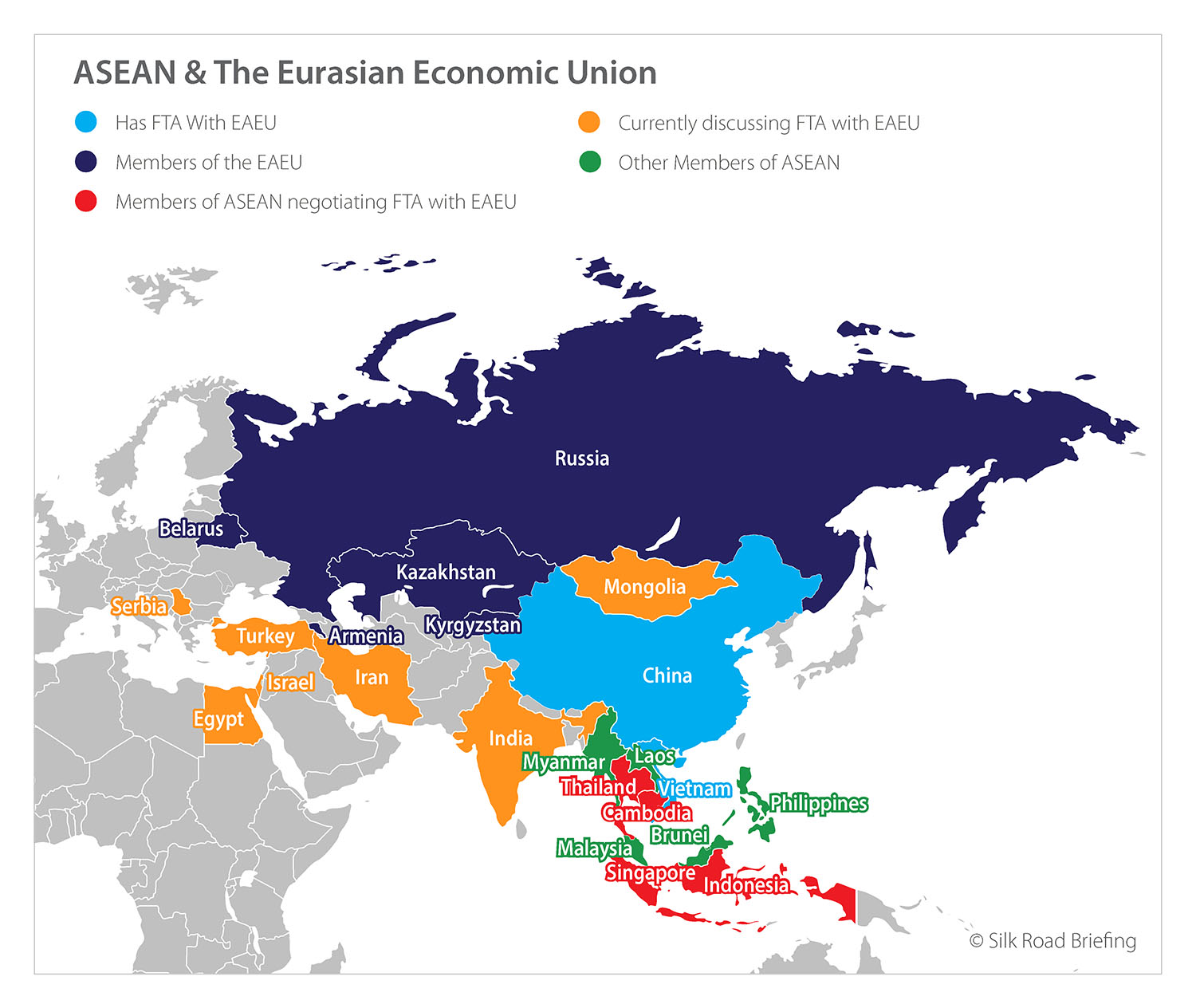

However, more recent fluctuations of history are again bringing the Mongolian economy into the spotlight. China and Russia, both with differing, yet related problems emanating from the United States, are both subject to American sanctions; the Russians essentially financial and the Chinese with tariffs. The emergence of the Eurasian Economic Union (EAEU), which has Russia as the lead nation, but also includes Belarus, Armenia, Kyrgyzstan and Kazakhstan, fills a huge land mass stretching from the borders of the European Union to the Western borders of China. China has signed off a Free Trade Agreement with the EAEU but has not yet agreed any product tariffs on which to encourage trade. Iran, Serbia and Vietnam all have FTA with the EAEU and so soon will Singapore, with a deal apparently to be signed off next month. Mongolia sits in the middle of all this, but as yet has no deal on the table.

So the question remains, in which direction is Mongolia pointing?

Mongolia’s Double Tax Agreements

One clever way to assess which way a countries trade fortunes are going is to examine any recent Double Tax Agreements (DTA) it has signed. DTA are the essential tariff wheels upon which free trade is based, as they both identify specific products and services to be traded between two countries and identify the tariffs to be charged. They also provide for profits tax reducing mechanisms, by allowing the substitution of withholding tax charges (typically 10%) instead of the more onerous profits tax (typically 20%). Mechanisms as how this works are discussed here (complimentary download).

Mongolia has DTA with numerous countries, but significantly, China, Russia, Belarus, Kazakhstan and Kyrgyzstan. The latter four make up all of the EAEU members bar Armenia. When an Armenia DTA is signed off, Mongolia will have them in place with all EAEU member states. Mongolia also has DTA with both Singapore and Vietnam – FTA signatories with the EAEU.

Mongolia – Transition To An EAEU FTA

I have heard conflicting news concerning a Mongolian deal to sign off an FTA with the EAEU. Russian President Putin, who was in Mongolia two weeks ago, seemed to suggest a more long term approach with the gradual relaxation of trade tariffs would occur. The Mongolian President, Battulga Khaltmaa, speaking at the Far Eastern Economic Forum last week suggested his country would be signing off a deal. So who is correct? I suspect both, but that President Putin’s version is probably more accurate: Mongolia has a relatively fragile economy and it makes no sense to disrupt it by the country suddenly opening up to Russia and other EAEU members in free trade. Consequently I suspect it will happen over time, with tariffs on certain products being reduced or eliminated, then when absorbed, ushering in another tranche until the entire FTA deal is done. My estimation of a timeframe? 2-3 years from now.

Mongolian Bilateral Trade – Moving Ahead

I produce the current Mongolian trade stats in full below, courtesy of Bulgan Munkhtsetseg of the Doing Business In Asia Alliance in Ulaan Baatar, which is supported by Dezan Shira & Associates. But in summary, Mongolia’s export volumes with major Asian trading partners China, Japan, Russia, and South Korea are all up by considerable percentages and especially with China. On the import side, its a similar story, yet in a lesser percentage, indicating that Mongolian trade is currently going through a welcome rebalancing as well as increasing. In total, Mongolian trade is rising about 6-7% per annum. This is a healthy figure.

Chris Devonshire-Ellis (Centre Right) with the Doing Business In Asia Alliance In Ulaan Baatar yesterday

Chris Devonshire-Ellis (Centre Right) with the Doing Business In Asia Alliance In Ulaan Baatar yesterday

But there are other upward trends creeping in, most notably trade with other countries. This is also a good sign, with Singapore leading the way for ASEAN, together with Cambodia, Philippines, Thailand and Vietnam. Concerning the EAEU, trade volumes with Armenia and Belarus have just begun, while trade with Kazakhstan, long a Mongolia trade partner and Kyrgyzstan are lively, if in need of a push. The full results, including the commodities traded, can be downloaded below:

DOWNLOAD: Mongolian Trade in Numbers

These statistics, which come from the Mongolian Statistical Information Service illustrate how Mongolia is diversifying its trade economy away from purely China and Russia, and towards the Eurasian Economic Union and ASEAN. That does not indicate any strategic pull back from Mongolia’s neighbours, but it does represent an increasing engagement with Asia. The point to note is that while the Mongolian economy is already going well, upcoming developments, such as China agreeing products in its EAEU FTA, and Mongolia coming into tariff compliance with the EAEU, will only enhance its trade potential outlook. Diversification is the key here, and Mongolia is wise to hitch part of its trade development plans not just to China, Russia and the EAEU, but to ASEAN and emerging markets as well. As they grow and develop, so will Mongolia, which has already been the focus of several false dawns in the past. But on current reading, Mongolia seems to be developing as both a value add transit hub between China and the EAEU, with trade corridors now reaching down into South-East Asia as well.

Related Reading

- China To Establish Heilongjiang Free Trade Zone Near Border With Russia

- Russia To Upgrade Mongolian Rail Links Between Russia And China, Joint Investment Fund Set Up

- Manzhouli-Russia Trade Heats Up

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm assists foreign investors and advises Governments throughout Asia in facilitating trade and investment into the region, and maintains 28 offices throughout China, India, ASEAN and Russia. We also provide Belt & Road advisory and intelligence services. Please email us at silkroad@dezshira.com for enquiries or visit us at www.dezshira.com