Chinese Companies Hunting In Latin America For Belt And Road M&A

Op/Ed by Chris Devonshire-Ellis

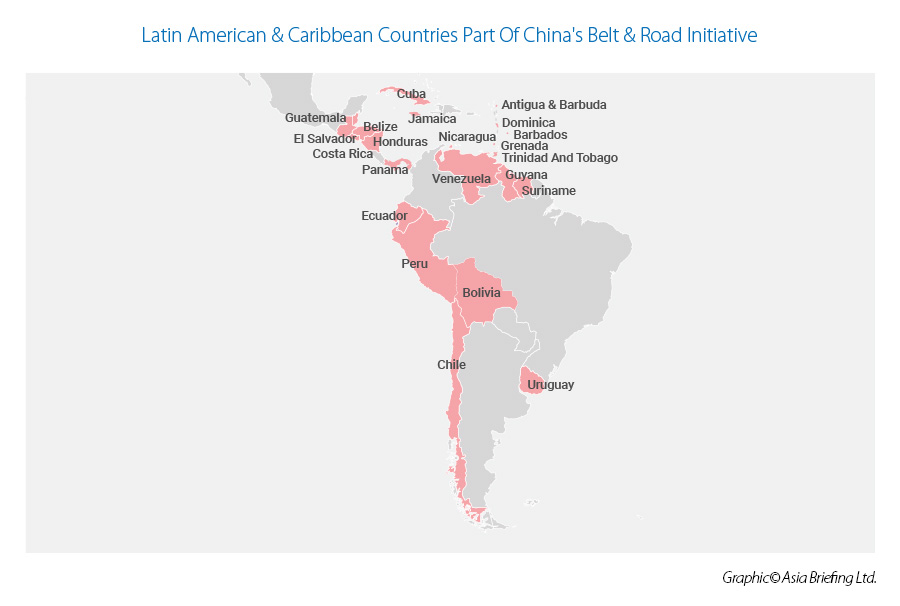

- Chinese SOEs turn Belt and Road ODI attention to Latin America

- China spent more on LatAm M&A in 2020 than in the EU and U.S. combined

- Latin America-China trade has doubled in past 5 years

- Potential is increasing for a future China-Mercosur FTA

With China changing its modus operandi as concerns ODI, Latin America is emerging as a region where increasing numbers of M&A are being achieved. This year, transactions in Latin America totaled US$7.7 billion, more than Europe and North America combined.

Chinese companies have met with increased scrutiny concerning M&A in the U.S. and EU this year as Covid-19 has created vulnerabilities in some strategic industries, creating national security concerns. China has instead turned its focus to Latin America, where years of political and social uncertainty have prompted other foreign companies, and especially those from the United States, to leave.

In terms of South America, the Chinese influence has not been as pronounced as elsewhere, mainly as it is farther away, and the U.S. political influence is far greater. However, while China’s funding of projects and acquisitions within South America has occurred later than in Asia, many are now starting to receive attention and investment.

Last month, China’s State Grid Corp agreed to buy control of a power network company in Chile. The deal, which valued the target at US$5.2 billion, including debt, was 2020’s largest Chinese outbound acquisition. State Grid also completed its purchase of Sempra Energy assets in Chile earlier this year.

In Mexico, China’s State Power Investment Corp bought the country’s largest independent renewable energy company, Zuma Energia. Another China SOE energy giant, China Three Gorges Corp acquired Sempra’s businesses in Peru for close to US$3.6 billion.

China’s ODI strategy as concerns the Belt & Road Initiative has been changing. While much of the BRI the past seven years has been about infrastructure build, that estimated US$4 trillion of project investment is now coming to a natural conclusion: China has now invested in most of the infrastructure development it needs in terms of developing supply chains and is now seeing these projects reach completion. Instead, Chinese investors are now looking for returns on investment and looking at acquisitions to develop shareholder value.

Many of these are in areas where China has considerable experience, having previously invested in much needed infrastructure in its own country. It is telling that the Latin American M&A are energy plays – China itself has invested huge amounts of money in upgrading its own facilities on a massive scale: it is a huge country with a mass energy consuming population. China’s SOE’s in this industry are experienced in the challenges faced and are investing capital and know-how into sizable Latin American firms that require large amounts of capital expenditure to bring them up to date and create efficiencies. They will then take seats on the board, sit back and enjoy the dividends.

Chinese companies see M&A as just the beginning of a much bigger picture. The real end game is to invest in these assets and boost value for all stakeholders in the long term.

Latin America of course retains close ties with Europe, and it is interesting to note that the top destinations for China M&A in the EU in 2020 were Spain and Portugal, both Latin American languages and both ex-regional colonial powers. China’s Three Gorges bought thirteen solar parks owned by Spain’s X-Elio Energy in August, this year.

Chinese investors are now experienced in global M&A and have changed their focus, no longer purchasing assets that make no strategic sense at high multiples. It is true the Chinese have purchased a few Pups. However, the focus is now to building a Chinese footprint in various global markets, now including Latin America, and focusing on sustainable cash flow and dividend producing investments in key industries such as energy and infrastructure.

This will be further developed in soft infrastructure developments. China is looking at increasing trade ties, and this means developing diplomatic channels in the region. Only Chile, Costa Rica, and Peru have Free Trade Agreements with China, while Panama is negotiating, but Beijing has its eyes on a Free Trade Deal with the entire Latin American Mercosur bloc.

China-Mercosur Free Trade Potential

Brazil is the dominant member of the Mercosur Customs Union, which has as its current main members, Argentina, Brazil, Paraguay, and Uruguay. Mercosur operations involve free intra-zone trade and a common trade policy between member countries. It is the world’s fourth largest trading bloc after EU, NAFTA, and ASEAN, with an annual GDP of about US$5 trillion.

Mercosur is home to more than 250 million people and accounts for three quarters of total economic activity in Latin America. It also includes Venezuela, but the country has been suspended from Mercosur since early 2016 for not complying with agreed tariff changes.

Associate members include the rest of Latin America, namely Bolivia, Chile, Ecuador, Guyana, Peru, and Suriname, along with Mexico and New Zealand as observer nations. Of these, China has double tax agreements with Brazil, Chile, Cuba, Ecuador, México, and Venezuela.

Mercosur Associate members do share some of the free trade benefits, although in several cases these are still awaiting legislative approval.

On enhancing Mercosur, however, Uruguay’s Finance Minister has previously indicated an openness to other FTA, saying that “each Mercosur country should have a multiplicity of memberships. Mercosur must have joint international policies, an agreement on moderate protection from third parties and above all must have agreements with other trade blocs.”

For China, however, although individual trade between Mercosur nations and China are increasing, very few have signed off on China’s Belt and Road Initiative – with Uruguay being the only major Mercosur nation to have done so, signing off on an MoU in August 2018 in Montevideo.

China is Uruguay’s most important trading partner, purchasing 27 percent of Uruguayan exports. Uruguay wants to deepen that relationship by increasing cooperation in several other areas, in addition to trade, while offering attractive conditions for Chinese investors, particularly in infrastructure.

Uruguayan Foreign Minister Rodolfo Nin Novoa, identified the following as key investment projects: Uruguay’s Central Railroad, a new fishing port, and rural electrification in the country’s north, and “expressed the hope” that Uruguay can serve as an “entry point” for China into the region, and “help promote closer ties between China and Mercosur.”

The fact that thus far, only Uruguay within the Mercosur bloc has signed off on China’s Belt and Road MoU showcases that there is still a lot to be done to “sell” the Belt and Road to Latin American governments. Argentina, Brazil, and Paraguay, not to mention the associate members, will also be watching closely as there are various issues. For example, China could become quite stretched with its resources in terms of providing finance and loans to governments in search of infrastructure funds, and has prioritized regions, such as Southeast and Central Asia and Africa, which are closer to home, although it seems this is now changing. There are also diplomatic issues between these countries and the United States to consider with Brazil especially being friendly with Washington and unwilling to damage those ties.

Discussions are taking place between China and the Mercosur nations over upgrading trade relationships to free trade status. However, to date China has not appeared to be in much of a hurry, preferring to want to arrange this on a “step by step” basis according to comments made by China’s Foreign Minister Wang Yi when meeting with the Uruguayan Foreign Minister Nin Ninova at the beginning of 2018.

Here, China’s “step by step” approach is probably an allusion to “one at a time” rather than a full China-Mercosur FTA. However, as we have seen the Mercosur bloc is significant, being the world’s fourth largest with a population of 260 million and accounting for 75 percent of South America’s GDP. China’s trade with Mercosur totaled about US$107 billion in 2018. The behavior of Chinese SOE’s in Latin America in 2020 however may indicate that Beijing is now more interested in the past in securing an FTA, already stating an intention to double bilateral trade with Latin America to US$500 billion by 2025 and to increase total investment into the region to US$250 billion. I would tend to read that as indicating an FTA is back on the agenda, and as governments look to kick start their economies after Covid, this could now happen sooner rather than later.

To some extent, a Mercosur-China FTA deal then rides on the following points:

- An ability to link into China’s Belt and Road Initiative and expand Mercosur’s export range;

- Brazil’s political relations with Washington as opposed to Beijing; and

- The likelihood of additional free trade potential with other EAEU prospective FTA.

These are quantifiable points, although partially dependent upon the political landscape such as with Brazil’s relationship with the United States. Others points revolve around trade issues, such as China agreeing to tariff reductions, which will become more apparent over time.

The China-CELAC Forum

China has also been active in the pursuit of diplomatic ties, and has formed the China-CELAC Forum, which brings China and the Community of Latin America and Caribbean States (LAC) together under a formal banner. The Latin American members of this include Argentina, Belize, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Paraguay, and Venezuela.

The China-CELAC Forum serves as a platform for dialogue and agenda-setting between international and regional leaders. It has become a Chinese priority as China pushes for deeper influence within the region and is considered by some to reduce the significant influence of the U.S. on the politics and economics of Latin America.

China is LAC’s second largest source of imports, and the third largest market for LAC exports. China has recognized this in the second Chinese Policy Paper on LAC (2016), a cooperation trade network and investment review that leans towards the identification of energy and resources with new targets including the now Belt and Road construction, agriculture, manufacturing, and scientific and technological innovation. This fits in with countries such as Bolivia, Chile, and Peru, as their economic profiles are built on national mineral wealth leading their domestic and foreign policies.

China-Latin America Bilateral Trade 2020

The value of trade between Latin America and China has been increasing. Exports from Latin America to China increased from a monthly average of US$11.5 million in 2014, reaching an all time high of US$26.9 million this February. The total export value in 2020 from Latin America to China will amount to about US$205 million, having effectively doubled over the past five years. Covid in 2020 has also suppressed exports. China’s exports to Latin America in 2020 will reach about US$137 million. With markets the size of China and Mercosur, there is plenty of room for mutual trade development.

Other China-Latin America Belt & Road Projects

Of the Latin American countries that have signed off on China’s Belt and Road, Bolivia and Peru are being linked on the ground via improved rail connections, which allows mineral production from Bolivia to be exported to China through Peruvian ports. China’s Ocean Shipping (Group) Company (COSCO) appears to be facilitating this as it has purchased a 60 percent controlling stake in the Chancay terminal in the North of Lima for US$225 million. This is the first operation in Latin America for COSCO, which is already well known via its acquisition in the Greek Port of Piraeus.

China is also funding several major Argentinian infrastructure projects, including constructing two nuclear plants and US$2.5 billion spent on upgrading its main cargo rail network, while Argentina has also recently joined the Asian Infrastructure Investment Bank and expressed interest in joining the BRI, although the political situation remains complicated as I explained here.

In Chile, China is providing an underwater Fibre-Optic network linking the two countries together. It will be the first underwater fiber optic cable to directly connect Asia with Latin America and will help drive interconnectivity, trade, investment, as well as scientific and cultural exchanges between the two continents. The cable begins in the Chilean city of Valparaiso, passing New Zealand, Australia, and French Polynesia to connect with Shanghai and beyond.

Ecuador joined the Belt and Road Initiative last December, and immediately agreed to a US$900 million loan from China, a further US$69.3 million for “reconstruction”, and received US$30 million in “non-refundable assistance”.

I recently discussed several key Latin American BRI projects in the article South American Belt & Road Projects Investors Should Be Aware Of and explained where the post-build investment opportunities are.

Latin American countries, which are similar to countries in Central America in that they have been partially excluded from trade with the U.S. due to issues concerning minimum wages within the USMCA deal, may also start to turn its trade face more towards China. However, this will probably mean concessions will need to be made. China, who has already committed to providing significant financial and infrastructure resources to Africa, is chewing off two continents at the same time – a financial stretch even for Beijing’s pockets. The hot regional spots continue to be further north around the Panama canal, while at present it appears China is still evaluating where in Latin America the low hanging fruit is easiest reached. I discussed opportunities for Central American investors around China’s Belt and Road project builds there in the article Central America’s Belt & Road Initiative: How Investors Can Take Advantage.

In the longer term, given the huge network of Chinese free trade and economic zones emerging along the Belt and Road Initiative – including the Eurasian Economic Union in addition to pan Africa, South-East Asia’s ASEAN, the recent RCEP, and an upcoming agreement with the European Union closer study of China’s involvement in Latin America and the potential for another pan-continental Free Trade Agreement is warranted.

Attention to when new Free Trade Agreements with China are signed off in the next couple of years will provide the details. This will undoubtedly increase trade. China is still a growing consumer market, which is good news for Latin American manufacturers and exporters, while Chinese tourists are gaining more confidence in their international travels. Latin America may be some way off for the type and sheer scale of Belt & Road investments that have taken off elsewhere, however an increasingly protectionist United States and a resurgent China are changing global dynamics. Attention to Chinese business practices and the opportunities that exist with both Chinese investments, and China trade with Latin American businesses should not be underestimated as Chinese eyes and desire for sustainable profits and investment returns turn towards Latin America as the next pan-continental investment and trade target.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com