Central America’s Belt And Road Initiative: How US Investors Can Take Advantage

How U.S. SMEs And Corporate Investors Can Exploit Chinese Built Infrastructure In Costa Rica, El Salvador, Mexico & Panama

Op/Ed by Chris Devonshire-Ellis

China’s Belt & Road Initiative officially kicked off in 2013, some seven years ago, under the initial title of ‘One Belt One Road’. That was later dropped as it became apparent that the scale of demand for projects would be rather more than single Eurasian and Maritime routes. While there has been some controversy over China’s financing and exporting of its construction SOEs to build these projects, closer examination of the so-called ‘debt trap’ issue by US Universities such as John Hopkins and William & Mary have revealed this not to be the case; their studies failing to produce any evidence of debt trap problems created by Chinese loans. It is however encouraging that such finance is being monitored and it will help keep Beijing straight.

In terms of Central America, the Chinese influence is not as pronounced as it otherwise would be as Belize, Guatemala, Honduras, and Nicaragua all recognize Taiwan. This precludes any investment by Beijing or China’s infrastructure building SOE’s.

However, while China’s funding of projects within Central America has been rather more low key than in Asia, many are now in the final stages of completion.

These include roads, rail and ports within the sphere of influence of the United States, either because they are taking place in countries next to (such as Mexico, included in this article for geographical perspective) or close to the US southern borders or because they are within America’s geo-political sphere and relatively nearby. For example, a flight from Miami to Costa Rica is less than 3 hours.

While Washington has not been especially welcoming of Chinese funded infrastructure build close to its borders, the fact remains that these projects, now coming to fruition offer American investors the ability to get involved by exploiting that same infrastructure. This includes property investments, transportation, waste and water management, power, and especially catering for human needs such as restaurants, catering, computer services, tourism and business services and so on.

We can examine some of the Belt & Road Initiative projects that are about to reach maturity in Central America as examples:

Mexico: Veracruz Port

Mexico is not a member of China’s Belt & Road Initiative, but it is involved with Chinese investors and SOE’s engaging and financing a variety of projects. One of these is Veracruz Port, officially known as Heroica Veracruz, a major port city and municipality on the Gulf of Mexico. It is located along the coast in the central part of the state, 90 km southeast of the state capital Xalapa along Federal Highway 140. It is connected by freight rail to Mexico City and has an international airport with flights to Houston. Veracruz is the gateway for Mexico’s Auto Industry, which is concentrated in the center of the country, in the states around Mexico City and is equipped specifically for shipping automobiles. Located on the south-central coast, Veracruz is closer to car manufacturers and has better access to both import and export markets in the U.S., Europe, Central and South America than other Mexican ports.

Much-needed container capacity is being built in a US$1.5 billion upgrade, which includes as the first phase a 1.2 million TEU, US$450 million container terminal built and operated by Hong Kong’s Hutchison Ports, in conjunction with China Harbour Engineering Company Ltd. (CHEC) and built by CCCC Third Harbor Engineering Co., Ltd., both subsidiaries of China Communications Construction Company Limited (CCCC). The project is expected to evolve into the second largest port in the country when it is completely constructed. The upgrade includes enlarging the storage yard of the container wharf to 400,000 sqm, a heavy container zone, a refrigerated container zone and structural layers consisting of a PV zone, empty container areas and a housing project, as well as water and electricity programs.

The United States is the destination of 73% of Mexican imports and the source of 53% of its imports, figures that will increase given the Veracruz port upgrade. It is also significant that China is now the third largest destination for Mexican export sales. In addition to the aforementioned items, Mexico is also now the main Latin American supplier of auto parts and motor vehicles to the Chinese market. Mexico’s imports from China are typically intermediate or capital goods, which are used or repurposed for re-export, mainly to the United States. Mexico is China’s main largest commercial partner in Latin America. With the recently begun presidency of Andres Manuel Lopez Obrador, it is expected that business opportunities between Mexico and China will continue to grow. This is because the Lopez Obrador administration is acutely aware of its overexposure to the U.S. economy and its business cycles. Now it is trying to hedge its bets. Recent figures show that total annual Mexican exports to the United States are valued at US$372.4 billion, while its exports to China account for only US$6.7 billion. These figures demonstrate that business opportunities between Mexico and China have much room to improve. In the meantime, numerous opportunities across multiple business sectors will emerge as a result of the Veracruz improvements, with all the business, import-export trade and services that Veracruz will require.

El Salvador: Sports & Tourism

El Salvador has only recently formed diplomatic relations with China, and at present significant infrastructure investment plans, understood to include Port, Road and Rail facilities are still being discussed. However, China is constructing a large sports stadium, multi-story library and water treatment plant in the country.

China’s main focus on El Salvador is currently in tourism and is assisting with the upgrading and development of coastal tourist sites, including building streets, parks and a water systems along Surf City, and restaurants and shops on the Puerto de la Libertad pier.

Surf City takes in the coastal locations of Ahuachapán, Sonsonate, La Libertad, La Paz, San Miguel, Usulután and La Unión, and is a flagship scheme for the country’s President Nayib Bukele. It was the site of the ISA World SUP and Paddleboarding Championships last year.

The country is also being promoted as a ‘preferred’ destinations for Chinese holidaymakers. Opportunities therefore exist in property development, hotels, resorts, and the general tourism industries, especially water sports, as well as niche SME areas such as providing facilities for Chinese nationals.

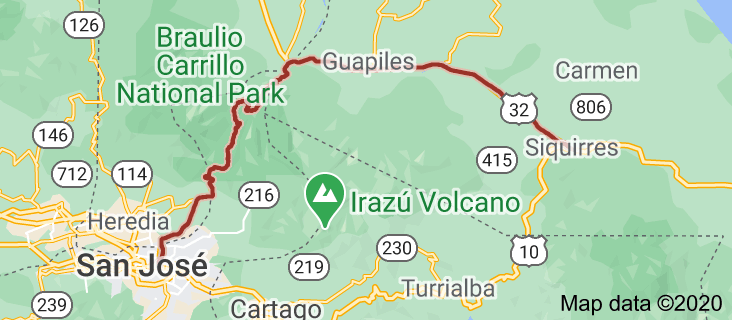

Costa Rica: Route 32

Costa Rica’s National Primary Route 32, (Ruta Nacional Primaria 32) is a National Road Route running across the countries San Jose, Heredia and Limon provinces. It connects the Central Valley and Greater Metropolitan Area to Costa Rica’s Caribbean coast. The China Harbour Engineering Company (CHEC), is undertaking upgrades and widening works, in a project costing US$465 million.

Once the work is complete, it will improve transport to and from the port of Limon on Costa Rica’s coast. This will help boost traffic capacity to and from the port as well as aiding Costa Rica’s economically important tourism sector. There have been delays with compulsory land acquisitions meeting resistance. It was due to be completed in March 2021, a more realistic date may push that back until 2023. However, the route carries some 80% of all Costa Rican exports, as well as 90% of regional imports, entering and exiting the country at Limon Port, which is also a tourist destination with access to the Caribbean. With the additional development and expansion of the container terminal at Moin (Limon) multilateral trade to and from Costa Rica will significantly increase, along with the tourism industry. Numerous opportunities therefore exist in multiple industry sectors once this route is completed.

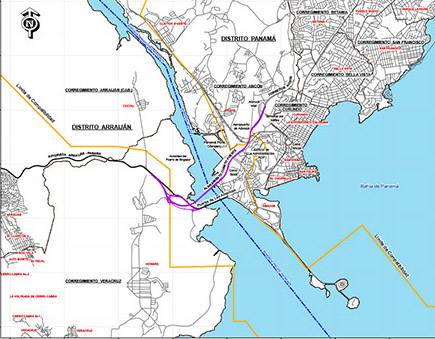

Panama: Panama Canal Fourth Bridge

The Panama Canal is operated by CK Hutchison Holdings, a Hong Kong listed company controlled by Li Ka-Shing, a billionaire who holds joint British, Canadian and Chinese nationality. The company, together with the Panama Canal Authority, a state owned business who own the canal, has been developing and upgrading the canal facilities in line with the development of modern shipping and technologies, and put out to tender requests for a fourth bridge to be constructed over the canal. That resulted in 2018, Panama becoming the first Latin American country to sign a BRI contract by approving the construction of a fourth, US$1.42 billion bridge over the canal. Funded by China, the work is being done by Chinese state-owned companies.

Featuring two dramatic towers with multiple cable planes, the signature crossing will consist of 1,010 meters of cable-stayed main bridge, a 510-meter-long by 51-meter-wide main span across the canal, and 1,500 meters of approaches. The center span will provide a 75-meter free vertical and 350-meter-wide clearance over the navigational channel to accommodate vessels for the future Fourth Set of Locks of the Panama Canal.

The 4th Bridge over the Panama Canal will be constructed on the north side of the existing Bridge of the Americas. The multimodal crossing will carry six lanes of vehicular traffic (three lanes in each direction), two-way rail lanes to be linked with Panama’s future Metro Line 3, and a bicycle/pedestrian path.

The West Tower will feature a high-end restaurant below the superstructure and an observation deck at the top of the tower. The bridge will have a 100-year design life, and will connect west Panama with Panama City allowing users to travel from the Tocumen area to the region west of the canal without having to go through Panama City. It is expected to be used by 70,000 vehicles a day and will benefit 1.7 million people.

There have been construction delays due to design difficulties related to the regions’ seismic issues, however completion is currently scheduled for 2024. Opportunities in real estate demand, build and investment will provide a local boom, along with all the other human services that will be required as people move into what is a relatively undeveloped area.

Exploiting The Infrastructure

These are just a handful of the Belt & Road projects that China has invested in Central America that are about to come to fruition. As the Chinese SOE contractors pack up their equipment and go off in search of new projects, their influence is restricted mainly to small equity holdings, while management of these facilities reverts to either shared, in the form of Port management, or local control.

All, however, offer opportunities for both small and large investors to service the human needs of the people that will now be flocking to use them — and this is where the real benefit to US investors lies in such BRI projects. We will be continuing to bring readers up to date with these developments, and also provide business intelligence and market research facilities to clients. Please click here to obtain a complimentary subscription and here to talk to us about how to get involved and exploit the assets now coming onstream.

Related Reading

- The European Belt & Road: Railways, Roads & Ports That EU Investors Should Be Examining For Post-Completion Investment Opportunities

- Five Belt & Road Projects in ASEAN that SME Investors Should be Looking at for Opportunities

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com