The African Continental Free Trade Agreement Starts From 1st January 2021.

This Is What It Means For Foreign Investors & Global Manufacturers.

Op/Ed by Chris Devonshire-Ellis

- New African free trade deal unites a US$3.4 trillion market and eliminates tariffs on 90% of all goods

- AfCFTA with China’s Belt And Road Initiative promise huge manufacturing potential

- Chinese and Russian investors already well advanced into the African market

- Free Trade Zones and Industrial Parks opening all over the African continent

- Plenty of opportunities for foreign investors to invest for low cost manufacturing

The 54 member signatory nations of the African Continental Free Trade Agreement (AfCFTA) agreed last week to commence trading under the terms of the AfCFTA rules from 1st January 2021 – little more than 3 weeks away. The AfCFTA free trade area is the world’s largest in terms of the number of participating countries since the formation of the World Trade Organization. All African countries have signed up to the deal with the exception of Eritrea, due partially to conflicts with neighboring Ethiopia, however this is expected to be resolved next year.

The agreement initially requires members to remove tariffs from 90% of goods, allowing free access to commodities, goods, and services across the continent.

The general objectives of AfCFTA are to:

- Create a single market, deepening the economic integration of the continent;

- Establish a liberalized market through multiple rounds of negotiations;

- Aid the movement of capital and people, facilitating investment;

- Move towards the establishment of a future continental customs union;

- Achieve sustainable and inclusive socio-economic development, gender equality and structural transformations within member states;

- Enhance competitiveness of member states within Africa and in the global market;

- Encourage industrial development through diversification and regional value chain development, agricultural development and food security;

- Resolve challenges of multiple and overlapping memberships.

The economic impact will be profound. AfCFTA connects 1.3 billion people across 55 countries with a combined GDP valued at US$3.4 trillion. As noted, it will reduce tariffs among member countries and cover policy areas, such as trade facilitation and services, as well as regulatory measures, such as sanitary standards and technical barriers to trade. It will complement existing subregional economic communities and trade agreements by offering a continent-wide regulatory framework and by regulating policy areas, including investment and intellectual property rights protection that have not been covered in most subregional agreements.

According to the World Bank, analysis shows that full implementation of AfCFTA could boost pan-African income by 7 percent, or nearly US$450 billion. The agreement would also significantly expand African trade, and especially intraregional trade in manufacturing. In addition, it would increase employment opportunities and wages for unskilled workers and assist getting women into the workforce.

African Sourcing & Product Development

Eliminating intra-African, cross-border tariffs on 90% of all African traded goods means that sourcing and manufacturing on a pan-African scale is now feasible. That is going to have a significant impact on manufacturing businesses not just in Africa, but also for businesses in Asia, the Middle East and to some extent Europe, as operational overheads are far lower. An issue will be the productivity gap as African workers will require training and the ability to acquire new skill sets. This will need to be handled with some care, Africa is a huge continent and to give an idea of diversity, it is prudent to note that the AfCFTA deal itself is legally binding with versions in Arabic, English, French, Portuguese, Spanish and Swahili.

Where To Locate In Africa?

Investors will now be able to establish factories and source on a pan-African basis, consolidate component parts and create a single unified product. Where that should be is dependent upon a number of issues:

Origin of the Investing Company

This is pertinent as it directly impacts on other Bilateral and Double Tax Treaties that may be in place between different countries. This includes not just African countries but also overseas. Mauritius for example has a highly successful DTA with India that reduces profits taxes for Indian businesses receiving dividends from a Mauritian parent company. The nature of DTA and other trade agreements between your businesses country of domicile and the African nations concerned should be ascertained.

Free Trade Zones

This is an area of trade development that will rapidly expand in Africa, and especially on coastal regions. FTZ allow the importation of goods duty free, where they can be mixed with African sourced products and subsequently either resold onto the African domestic market, (in which case the imported component parts will attract VAT) or re-exported elsewhere (VAT and applicable duties will still apply when they reach their designated destination). Essentially this is a question for Head Office accountants, being a product competitive toss-up between lower wages in Africa and the amounts of VAT and applicable duties in the target market.

That worked for China back in the early 1990’s, when a combination of low Chinese wages at the time and a low tax base and incentives were one of the main pillars that allowed the country to grow into the economic giant it is today.

Most Free Trade Zones also allow tax incentives and holidays; some are industry specific to allow industry clusters to develop with related businesses all operating in one zone to assist each other. That model was originally developed by Taiwanese businessmen in the footwear industry, where leather manufacturers, rubber sole producers, zip and fastener makers and other related footwear manufacturers all came together to supply each other with the related products in factories in a specific Footwear Free Trade Zone in Dongguan, South China. Similar arrangements are sure to spring up in Africa.

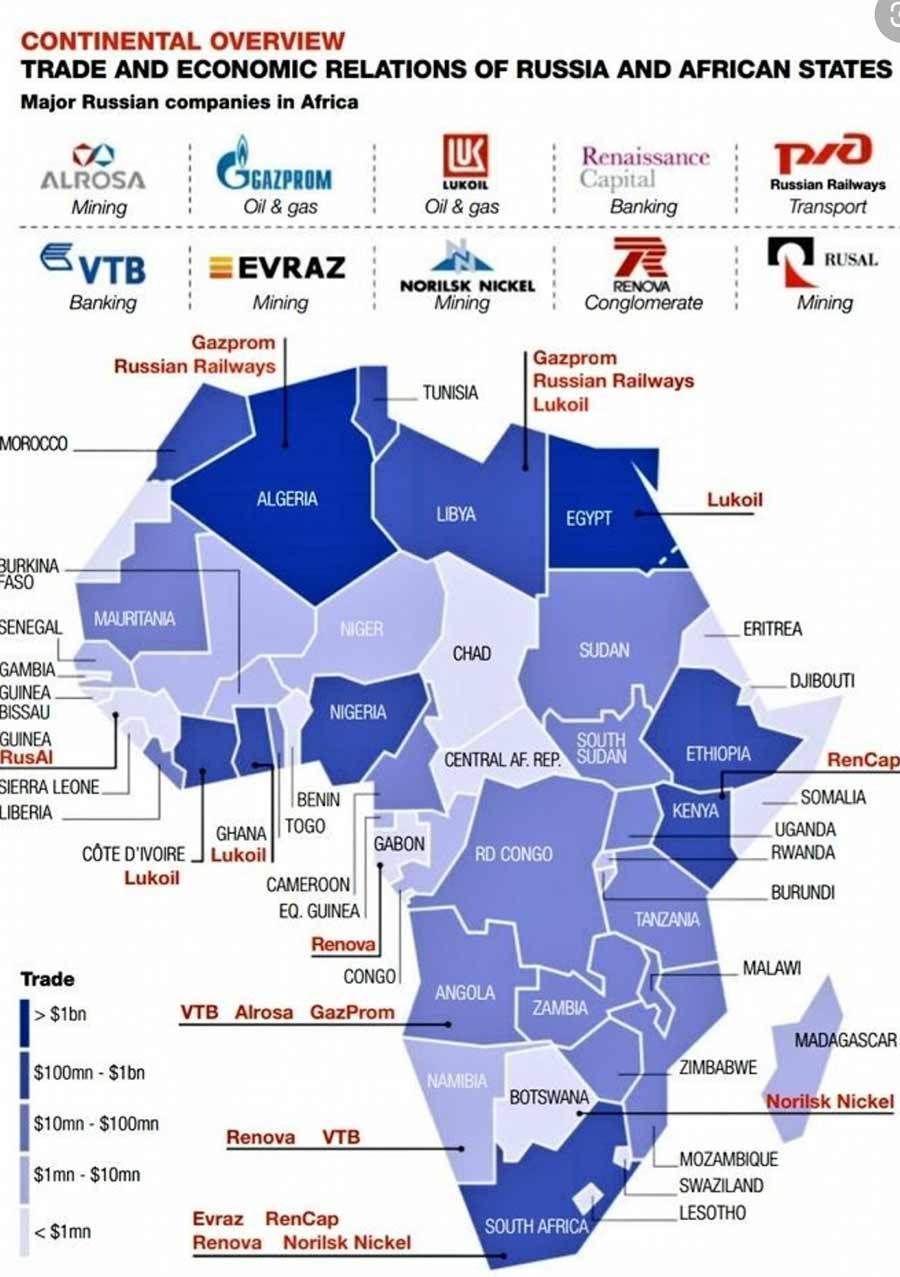

China & Russia In Africa

As part of the Belt And Road Initiative, and wary of United States sanctions and trade wars, both China and Russia have been quick off the mark when it comes to Africa. China was a primary driver in getting the AfCFTA deal over the line, and both countries have been both looking at developing new markets while searching for lower cost labour. India, which should have inherited China’s “Workshop of the World” status and has a young, inexpensive workforce of about 400 million, has missed the boat somewhat due to the overly protective nature of its corporate manufacturers towards its own domestic market, a situation that outwardly manifested itself when it pulled out of the RCEP free trade deal.

China and Russia in contrast have been busy establishing Free Trade Zones of their own in Africa and making significant inroads into the continent in advance of the AfCFTA deal. Both are of course members of the BRICS grouping which also includes South Africa, the largest African economy and one which represents African issues at the BRICS summits.

China In Africa

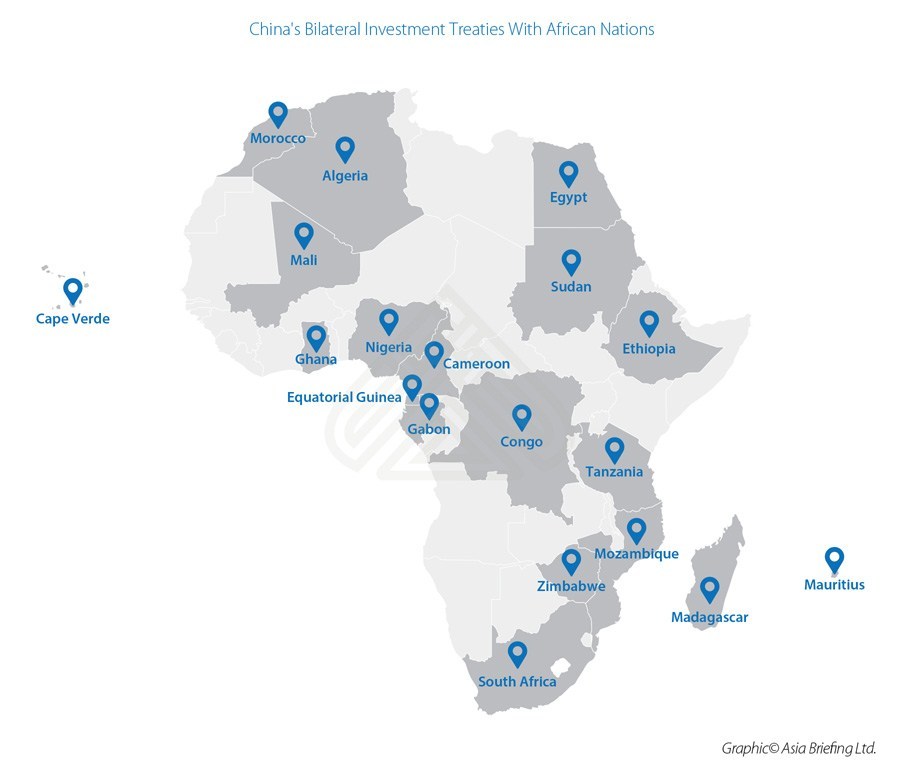

I previously discussed the impact of AfCFTA on China in the article The African Continental Free Trade Agreement And Its Impact On China. This highlighted the tax advantages for Chinese based companies in Africa – which may be useful for foreign investors with a China-registered factory in for example Shanghai or elsewhere – their WFOE or JV is a China domiciled business and can take advantage of the various Bilateral Trade Agreements and Double Tax Treaties China has with African nations.

Bilateral Trade Agreements are useful in the services industry in particular as these often contain specific details for the tax treatment of these, in addition to the tax treaties of individuals. They differ from each other according to bilaterally agreed specifics. Our Asiapedia search engine is a good place to look for documentation related to these, while the map below explains the current treaties in force.

Double Tax Treaties exist to nullify the chances of being taxed twice in bilateral trade, and also contain provisions concerning tax reducing clauses such as withholding tax. These can often be used (with professional advise) as tax reduction mechanisms as withholding taxes are generally lower than applicable profits taxes, and are especially useful when claiming payments for royalties such as trademark and patent use from one jurisdiction to another.

In addition to these existing bilateral trade deals, China has also set up a US$1 billion Africa Fund to support bilateral trade between African businesses and China, while I discussed China’s potential dealing with the Southern African Customs Union here. What is interesting about China’s trade relationship with Africa is that, as I explained in that piece, is that the trade flows are relatively mutual – Africa is selling to China only slightly less than how much China is selling to Africa. In 2017, the largest exporter to China was Angola, followed by South Africa and the Republic of Congo. In the reverse direction, South Africa was the largest purchaser of Chinese goods, followed by Nigeria and Egypt. As can be seen, China has been introducing diplomatic and tax incentives to encourage African businesses to trade with China – which remains a market that wants to consume. That has resulted in the Chinese developing a series of Industrial Parks across the Continent.

Russia In Africa

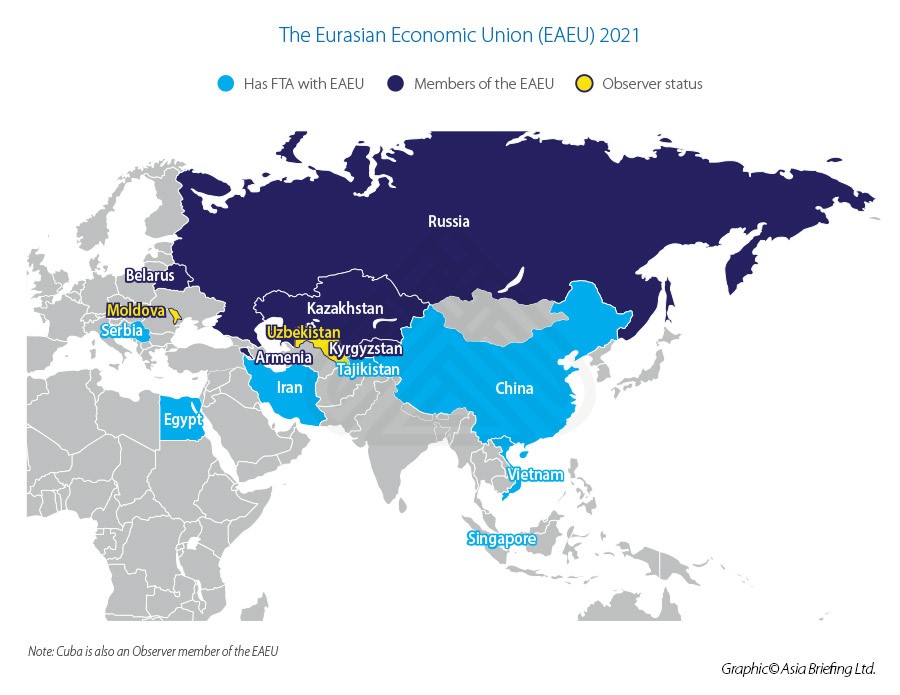

Russia has been equally active. It has set up a Free Trade Zone in Port Said, near to the Suez Canal, with Russian automotive and other related and component parts being manufactured there. Russia, via the Eurasian Economic Union (EAEU), also has a Free Trade Agreement with Egypt that facilitates this trade. Egyptian exporters should be looking at the EAEU markets – 180 million people to sell to in Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia, while Russian businesses now have an excellent opportunity to use Port Said to access the AfCFTA markets.

The EAEU has already signed off an Agricultural deal with the African Union Commission while I explained the developing ties between Russia, the EAEU and the Southern African Customs Union in this article here. Moscow has also set up a US$5 billion online trading platform to encourage trade between African and Russian businesses.

That is having an impact – in 2019, Russia-African trade grew by 17% and that trend is expected to get back on track after Covid, with Moscow pursuing an active policy, like China, of making Double Tax Treaties with an increasing number of African countries. These now include Algeria, Botswana, Egypt, Mali, Morocco, Namibia & South Africa. The latter is a member of the BRICS grouping along with Russia, China, India and Brazil, and is a 20% shareholder along with Russia of the BRICS New Development Bank. The result is clear to see in this snapshot of Russian investments into Africa.

Africa and the Belt & Road Initiative

While many African nations are looking to China to invest, the Belt & Road Initiative and involvement with AfCFTA will manifest itself more through bilateral infrastructure agreements, some of the more notable we examined in the article Eight African Belt And Road Initiative Projects Foreign Investors Should Be Aware Of. Those, and future BRI projects in Africa are not a result of AfCFTA, although AfCFTA will be a partially determining point in where some projects will be built, and especially as concerns trade. That means developing Ports, Roads and Rail, all of which I discuss in the article linked to above. Africa as a continent needs rather more than supply chains, and some BRI projects and Chinese bilateral assistance can be expected to arrive in the form of medical and other health related projects. Those are a bilateral, not pan-regional matter.

AfCFTA itself as a trade agreement, coupled with the DTA and bilateral agreements I have illustrated, is not in itself an infrastructure facilitator. But it does open the way, with adequate productivity gap patience, to allow African manufactured goods to be exported around the world. It also, via the use of Free Trade Zones (such as Russia’s FTZ in Port Said) allow foreign manufacturers access to a large and relatively cost-effective workforce – once those training and educational gaps can be bridged. AfCFTA will significantly alter global supply chains, although it will be a work in progress, and there will be disputes and conflicts and hiccups along the way. But one aspect is for sure – the AfCFTA deal will impact on all of us, and change the very nature of the products – some new – that will restructure global purchasing operations, and shift where manufacturing investments are made.

A comprehensive, 163 page World Bank report, “The African Continental Free Trade Area: Economic and Distributional Effects” can be downloaded free of charge here.

Related Reading

- A Digital Free Trade Agreement for Africa’s Silk Road

- Africa Needs China’s Belt & Road Initiative To Assist With Growth & Trade Potential

- China Set to Cash in on New African Free Trade Agreement

About Us

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates. The practice advises foreign investors throughout Asia and has 28 regional offices. It is a member of the Leading Edge Alliance of global professional firms with partnerships with additional practices throughout Africa, including Egypt, Kenya, Nigeria and South Africa. Please contact us at info@dezshira.com for assistance or visit us at www.dezshira.com