Bangladesh, Sri Lanka & Pakistan As A South Asia Triumvirate

By Chris Devonshire-Ellis and Pathik Hasan

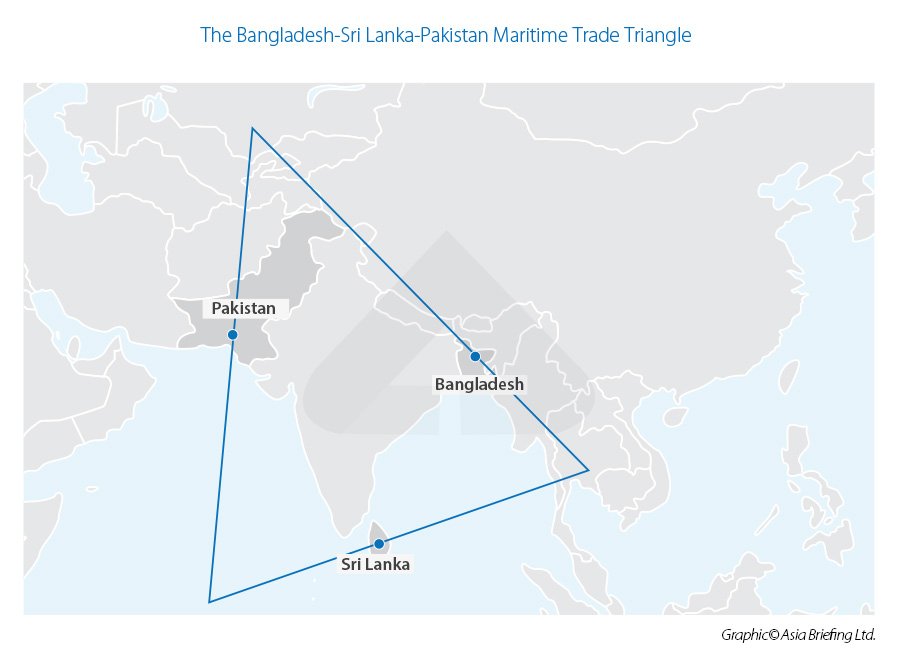

These three maritime nations offer new connectivity routes throughout Eurasia

Pakistan, Bangladesh and Sri Lanka are all near neighbours in South Asia, orbiting around the influence of India. All four share common ties both in terms of their history with the United Kingdom and through more recent ties through membership of the SAARC trade bloc.

Sri Lanka differs in that it is an island economy and has been utilizing this in terms of developing and redeveloping its maritime facilities in international trade and commerce. Long known, even to the ancient Greeks as a maritime hub in South Asia, its redevelopment, with Chinese financial assistance through the Belt and Road Initiative of its West coast Colombo Port is poised to hasten a reset in regional maritime trade capabilities. To the East, its Hambantota Port, Airport and Free Trade Zone are beginning to attract clients looking at servicing East Asia and towards ASEAN, China, and ultimately the CPTPP. Sri Lanka, which previously looked West to India, the Gulf and East Africa, now has a dual face looking East. With its Northern Port of Jaffna to be renovated and developed later in the decade, Sri Lanka will ultimately end up with Ports serving the Bay of Bengal to the North with onward passage possible into Central Asia.

Bangladesh also joined the Belt and Road Initiative in 2017 and its location in the Bay of Bengal gives a strategic position in Southeast and South Asia. It shares borders with ASEAN and India, has free trade agreements with numerous ASEAN nations, China, India, Pakistan, and Sri Lanka and is utilizing these geographic and trade advantages.

At present, Pakistan is the only South Asian country showing its full-scale strategic significance to the region at this moment. Its foreign policy has shifted towards geo-economic from geo-strategy. The China-Pakistan Economic Corridor (CPEC) and Gwadar Port have added huge extra regional value in this regard in terms of infrastructure and capacity, with the significance of this still poorly understood. However what CPEC does is connect China’s Western Xinjiang Province to the Arabian Gulf in addition to giving access to Central Asia. Some connectivity still needs to be completed, but this will happen in the next two years. Should the Afghanistan situation settle down it will further boost Pakistan’s infrastructure use.

It is pertinent to understand that Bangladesh, Pakistan, and Sri Lanka are all active participants in China’s Belt & Road Initiative. Sri Lanka’s Hambantota and Colombo Ports are considered as epicentres of China’s BRI in South Asia. Sri Lankan ports can be used a regional maritime hub between South Asia, Southeast Asia, Central Asia, the Middle East, and East Africa. That in turn gives two additional important connectivity routes: via the International North-South Transportation Corridor (INSTC) from Pakistan’s Gwadar or Iran’s Chabahar Port through to Central Asia, the Caucasus, Turkey, the Eastern EU and Russia. Then of course the Suez Canal route through to the Mediterranean.

Sri Lanka and Pakistan – together with Iran – therefore have an opportunity to increase their maritime capabilities and work together in maritime trade, investment, science and technology, and culture through enhancing these connectivity opportunities. Sri Lanka has an FTA with Pakistan and is negotiating one at present with China. It also has an FTA with Singapore. However, given the developing maritime connectivity Sri Lanka would also gain by entering discussions with Iran (Central Asia access), Russia (Eurasian Economic Union access), Mauritius (access to the African Continental Free Trade Agreement) and consider how it could leverage itself into the CPTPP countries in East Asia and AsiaPac as a longer-term aim.

The Pakistan connectivity is certainly growing. Pakistani Prime Minister Imran Khan visited Sri Lanka in February this year, interestingly hosted also by Russian businessmen. During his visit to Sri Lanka, Khan focused on Pakistan’s connectivity with Sri Lanka, its existing use of Karachi Port and the additional Central Asian options that Gwadar provides.

Pakistan’s Muslim community are well positioned to provide Islamic packaging for these markets, which Sri Lanka as a Buddhist nation is less able to provide.

There are motivations for both to do so – Pakistan and to some extent Iran are conduits for opening new trade corridors for Sri Lankan made products, an increasing share of which will be from Chinese invested JV’s and Sino-Lankan ventures. China will want market access to Central Asia and that means via CPEC – or the INSTC.

During the visit of Sri Lanka, Khan commented that Pakistan is allocating land to Uzbekistan for warehousing and export services, and that the same facility can also be provided to Sri Lanka. Uzbekistan is a rapidly developing Central Asia nation and although landlocked, can access other regional markets that open these up for Sri Lankan made products. Uzbekistan is surrounded by five countries: Kazakhstan to the north, Kyrgyzstan to the north-east, Tajikistan to the southeast, Afghanistan to the south, and Turkmenistan to the southwest. Collectively the Central Asian nations have a GDP (PPP) of US$1 trillion, a projected post-covid growth rate of about 5-6% and a population of some 73 million. Its average GDP (PPP) per capita is four times higher than Sri Lanka meaning the region is a wealthy market for Sri Lanka to target for exports.

Bangladesh can also benefit from using Pakistan’s Gwadar port for the same reasons, with a GDP per capita base seven times less than the Central Asian average.

Maritime connectivity is key. Bangladesh’s Chittagong, Payra, Mangla ports can be connected with Pakistan’s Gwadar ports including Karachi, Port Qasim and Keti Bandar via Sri Lanka’s Colombo and Hambantota Ports to create a trilateral access and distribution hub.

Sri Lankan traditional tea, apparel, rice, and agricultural industries, together with up-coming machinery and industrial manufacturing industries such as auto tyres can be mixed with Bangladeshi apparel, medicines, fruits, and vegetables along with its upcoming IT services and electronic sectors.

Bangladesh and Sri Lanka both import goods such as cotton from Pakistan, Central Asian States, Western and Central China and even Russia. Pushing this existing trade however requires a holistic trilateral effort. If Sri Lanka and Bangladesh can make better use of CPEC, they can take part in the development process in Afghanistan with Pakistan, China, Russia, and Iran. The South Asian SAARC trade bloc may also be revived through these activities.

Intra-regional and international tourism can also become a platform for services growth. Religious tourism is a growing sector, with Bangladesh, Pakistan and to some extent Sri Lanka more tolerant than neighbouring India, where religious differences are currently being politically exploited in favour of the Hindu mainstream.

However, Pakistan has many historical Buddhist sites such as the ancient civilizations of Gandhara and Takhsila. These would be of interest to Sri Lankans. Sri Lanka meanwhile has historical places important in Muslim culture such as Adam’s Peak and the ancient Dewatagaha Mosque.

As regional states, Sri Lanka and Bangladesh should be examining a revival of connections with Pakistan. The Belt and Road Initiative has and is being built to promote such interconnectivity. South and Southeast Asian Governments and businesses should be examining how best to exploit it.

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates and is based in Sri Lanka. The practice assists foreign investors throughout Asia and has 28 offices across China, ASEAN, and India with partner firms in Bangladesh, Pakistan, and Sri Lanka. Please see www.dezshira.com

Pathik Hasan is a Dhaka based NGO worker, and freelance writer commenting on current affairs and international politics. He can be contacted at pathikhasan1141@gmail.com

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com