China To Invest US$300 Million In Sri Lanka Based Export-Oriented Tyre Factory

Op/Ed by Chris Devonshire-Ellis

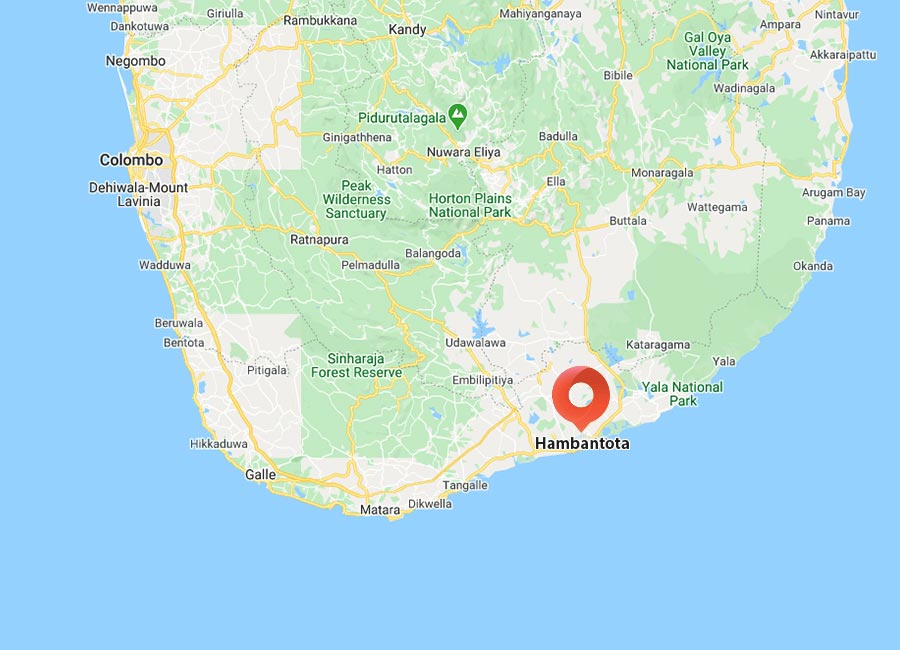

Sri Lanka announced the first large-scale Chinese investment in manufacturing in the country last week, a US$300-million tyre factory near the Hambantota deep water port on the south-East Coast.

Sri Lanka’s cabinet approved the setting up of the tyre plant under legislation that allows generous tax concessions, provided that the investing party, Shandong Haohua Tire Company exports at least 80 per cent of its Sri Lanka production.

The tax support provided also applies to Sri Lanka’s domestic industry development and gives a 10-year tax holiday on investments above US$10 million, and are designed to help Sri Lanka to expand and opportunities for new partnership to expand export activity. They are not dissimilar to the types of incentives China itself used to offer foreign investors in its free trade zones in the mid 1990’s.

Proposals to establish new investment zones in addition to the existing Hambantota FTZ will also assist the rubber manufacturing sector, which has clearly identified the need for such facilities to expand investments of current manufacturers and it would be an impetus to drive FDI in the rubber manufacturing sector. This is exactly what has occurred.

The Haohua factory will employ 2,000 workers is to be sited in the Hambantota Port industrial zone. The land is provided to Shandong Haohua Tire Co. Ltd by Hambantota International Port Group (HIPG), a unit of China’s CM Ports, which runs the port and its adjacent industrial zone. The factory will start operations in three years and in the first phase nine million tyres, enough to fill 45,000 containers will be exported.

Hambantota itself as a Port development has suffered from much media criticism, mainly due to two political factors:

- The original development build cost overstretched Sri Lanka’s budget at the time, and was renegotiated at terms that provided China with a lease for 99 years and a payment to Sri Lanka of US$1.1 billion. That lead to accusations of China developing ‘debt traps’ as part of its Belt & Road Initiative development strategy, accusations that have since been debunked.

- The Port has not been fully operational, and has endured delays, partially due to unforeseen geological construction difficulties, and also due to problems in Sri Lanka, both political and terrorism related. These have been overcome, however there remain connectivity issues. This includes the Hambantota airport, which is actually ready to use but has had to be mothballed during Covid. It is strategically positioned for servicing air traffic from Asia. The airport and port are still not connected to Sri Lanka’s national rail network, creating further bottlenecks, however this link is expected to be completed in 2023. I live fairly close to the area, work appears to be progressing on schedule.

Sri Lanka itself will be the focal point for sourcing all the necessary rubber. That empowers the native rubber farmer, generates new job opportunities while the country will benefit from exposure to Chinese technology. Sri Lanka has also been importing lower grade rubber for some time to add value for re-export, as the country seeks to become a centre of solid tyre manufacture. But China’s Haohua Tires is not the only investor in this sector in the country.

Sri Lanka’s Rigid Tyre Corporation (Pvt) Ltd said it will start producing passenger car radials with a US$100 million first phase of a US$250 million project that started build in January this year.

Besides rejuvenating the Sri Lankan export sector which has suffered due to varying problems over the past few years, these projects will also serve to revive the local rubber industry. Sri Lanka needs to move away from a largely agrarian base and towards some manufacturing to develop its economy.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com