China’s African Belt & Road Initiative – It’s Not What You Think It Is

It’s Far More Complicated Than That

Op/Ed by Chris Devonshire-Ellis

China’s moves into Africa are in fact a great case study into how the Belt & Road Initiative actually works. While most of the media commentary has been on the infrastructure, there is rather a lot more at play. In this article, I will demonstrate how China is putting in hard – and soft – infrastructure to boost its supply chains and trade.

The Belt & Road Initiative Is Not What You Think It Is: Ports

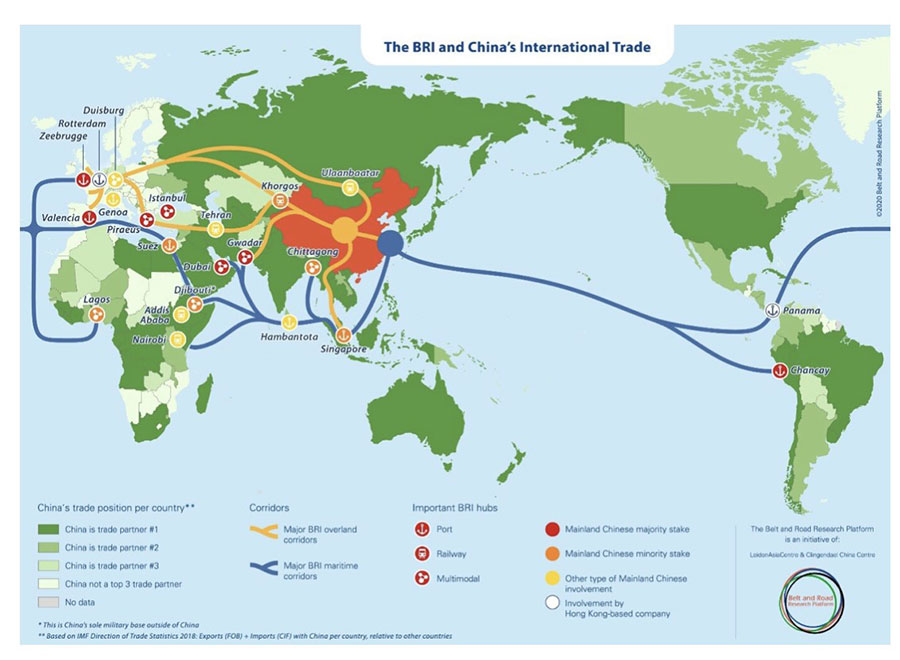

Concerning Africa, last month the Netherlands-based Belt and Road Research Platform produced a ‘novel’ new map which, they say illustrates the BRI into China’s international trade patterns. Look at Africa.

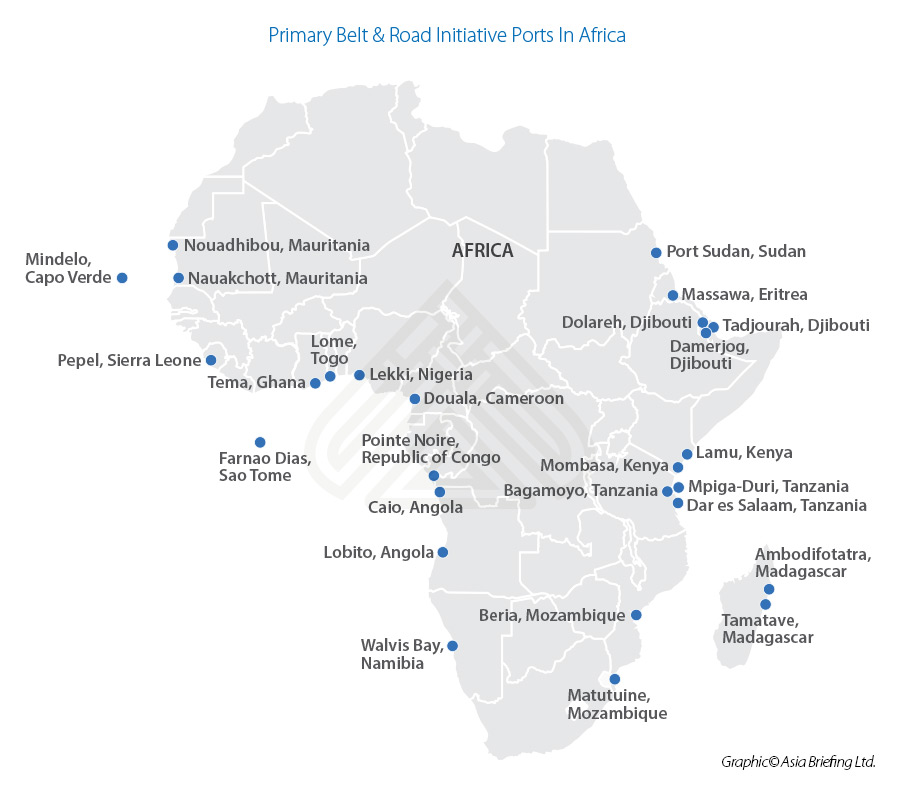

I am sure the good folk over at the Research Platform are well meaning, however their view of the BRI is far too simplistic. In fact, China has invested in 74 African Ports, either as developers or operators, or both. In this map, we illustrate 28 of the larger ones. Seven have deep water capabilities.

What can be ascertained is that from the Ports mentioned above, China is developing an entire coastal infrastructure around Africa to service shipping supply chains. But to do that, you need to connect ports with inland supplies, and that takes additional hard infrastructure.

The Belt & Road Initiative Is Not What You Think It Is: Hard Infrastructure

As of April last year, China had invested in BRI projects in 42 different African countries (from a total of 54). Time and space constraints prevent us from listing them all, however a report of some of the larger ones were featured in our article Eight African Belt & Road Initiative Projects Foreign Investors Should Be Aware Of. We followed that up with a summary of Chinese Foreign Minister Wen Jiabao’s 5 nation tour of Africa in early January.

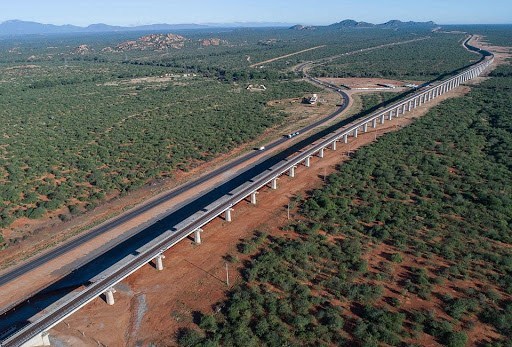

The Nairobi-Mombasa Railway

As we can see, China is building Ports, road, rail, and other hard infrastructure to gain access to essential supplies. But to do that efficiently, you need localized processing facilities and ideally, special economic zones.

The Belt & Road Initiative Is Not What You Think It Is: Special Economic Zones

China didn’t invent the Special Economic Zone but is has made the most use of the facility. SEZ’s come in differing formats, but all follow similar patterns, foreign investment is allowed into a country, with goods, typically component parts, able to enter zones duty free. These can then be married with locally sourced products, and either re-exported, therefore negating VAT or other charges, or can be sold onto the local markets, at which point import duty and VAT apply. In this way, foreign investors can access inexpensive labor, other components, avoid immediate duty and other taxes, and either use the facility as a manufacturing and export base or, over time, develop production to fit the local market too.

Chinese companies have, over the years, established, after negotiations with national and regional Governments over tax concessions, multiple SEZ or similar zones throughout Africa. However, SEZ only deal with import duty and VAT. What about services?

The Belt & Road Initiative Is Not What You Think: Double Tax Treaties

Double Tax Treaties offer mutual protection from being taxed twice in cross-border trade, and unlike Free Trade Agreements, which deal with goods and products, often contain low tax provisions for services industries, and local profit minimizing tactics such as the ability to charge royalties (at a lower rate) to your own subsidiary as a buffer against corporate income tax rates (which are higher). Such techniques can save to 15% of profitable income.

China is not yet an especially service oriented economy, but it is becoming more so. We can expect to see more Chinese DTA agreements with African nations come into effect as Chinese companies start to provide more service-related industries such as architects, medical, educational, and other professional experts. But what about Free Trade?

The Belt & Road Initiative Is Not What You Think It Is: African Free Trade

A continental African issue that has, until recently hindered some of these ‘initiatives’ (now you know why it’s called the Belt & Road Initiative) has been the independent development, amongst the 54 different African nations, of their respective tax systems. In many ways, this has hindered Africa’s development as a unified continent, with the taxing of imports and exports between them interfering with regional trade flows and making the sourcing of different component parts both time-consuming, and expensive. That has not fitted in with China’s agenda and ambitions to source from Africa. Consequently, huge amounts of coordinated Chinese diplomatic efforts went into getting all African countries on board to agree Free Trade between them. That manifested itself in the African Continental Free Trade Agreement (AfCFTA), which came into force from January 1 this year. Only Eritrea has not signed the deal.

The agreement initially requires members to remove tariffs from 90% of goods, allowing free access to commodities, goods, and services across the continent. The general objectives of AfCFTA are to:

- Create a single market, deepening the economic integration of the continent;

- Establish a liberalized market through multiple rounds of negotiations;

- Aid the movement of capital and people, facilitating investment;

- Move towards the establishment of a future continental customs union;

- Achieve sustainable and inclusive socio-economic development, gender equality and structural transformations within member states;

- Enhance competitiveness of member states within Africa and in the global market;

- Encourage industrial development through diversification and regional value chain development, agricultural development and food security;

- Resolve challenges of multiple and overlapping memberships.

The economic impact will be profound. AfCFTA connects 1.3 billion people across 55 countries with a combined GDP valued at US$3.4 trillion. But money like that requires financial services.

The Belt & Road Initiative Is Not What You Think It Is: Offshore Finance

All this African investment and trade requires offshore financing and structuring to optimize the best ways of moving money around in the most effective manner. Mauritius has long been an offshore financial centre – in fact Dezan Shira & Associates produced the first translations of Mauritian company law and articles of association into Chinese. Mauritius is well known as an offshore financial centre servicing lndian companies, via the Mauritius-lndia Double Tax Treaty. China already has a DTA with Mauritius, however, has gone one better by signing off a Free Trade Agreement too. The FTA gives Mauritius duty-free access to about 8,547 products, representing 96 percent of Chinese tariff lines, and covers more than 40 service sectors, including financial services, telecommunications, ICT, professional services, construction, and health.

Where Mauritius will really benefit is to become a base for Chinese exports to Africa, not in terms of goods because the manufacturing base is too narrow but in services. This is where the strategic part of China’s Belt & Road Initiative makes itself clear; it is no coincidence that the African Continental Free Trade Agreement has also come into effect in the same period as the China-Mauritius FTA.

Mauritius’ future then is to perform a similar function as it does for India, an offshore gateway to and from Africa, and to some extent how Hong Kong services China. That in turn provides foreign and local investors in Mauritius with opportunities to service the Africa-China trade – including professional services, lawyers, accountants, translators, and import-export agents.

The Belt & Road Initiative Is Not What You Think It Is: Summary

As can be seen, China’s Belt & Road Initiatives in Africa are not restricted to just a few ports, or purely to infrastructure. The entire African continent has been the focus of much coordinated thought and combined activity by the Chinese. Nothing has been left to chance that is not out of their control. Africa therefore is an excellent case study of how the Belt & Road Initiative really operates – as a multi-layered, multi-component structure all working towards the same end goal. Whether or not one believes China is doing this purely for its own purposes or not is a bit of a moot point, and of course China has its own interests at heart. However, the legacy of the BRI will undoubtedly be a boom in regional trade, the development of new, emerging economies and the establishing of new global markets and commerce. It is the same situation elsewhere – across Central Asia, Russia, Latin America, the Middle East, and Southeast Asia: infrastructure, ports, roads, rail, special economic zones, double tax, and free trade agreements. The Belt & Road Initiative is a global, diplomatic coordinated dance on an unprecedented scale.

The great news is that although China has dreamed up the scheme and built large parts of it – like the ancient Roman roads across Europe, and indeed parts of North Africa, they can be used by everyone – if you are open to the opportunities.

Related Reading

- Eight African Belt And Road Initiative Projects That Global Investors Should Be Aware Of

- How Foreign Investors Can Benefit From The Belt & Road Infrastructure Build In Africa

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com