Can China & Russia Reposition Syria With The ‘Five Seas’ Strategy?

Planned port, canal and maritime connections would provide new infrastructure links between West and Central Asia

By Chris Devonshire-Ellis

Syrian President Bashar al-Assad has met with Chinese Foreign Minister Wang Yi in Damascus following Assad’s recent victory in Parliamentary elections, providing him with a further seven-year mandate to rule. This comes after ten years of war, partially funded by the West, in which much of the country’s infrastructure has been destroyed, and the country de-stabilized. Fighting has tended to pit foreign forces within Syria against each other: Iran, Russia, and the Lebanese Hezbollah support the Syrian government, the United States, and a coalition ”Operation Inherent Resolve” together with NATO forces (including neighboring Turkey) have been fighting the Syrian Government and ISIL.

China has not been involved militarily but is interested in Syria for its strategic positioning, as well as natural resources. Thus far, the conflict has cost (according to the United Nations) about 500,000 fatalities with about 50% of these being civilians and 10% children. The country has significant oil and gas reserves far in excess of its needs as well as minerals such as phosphates. as in Afghanistan, US and NATO troops are now in the process of withdrawing, leaving the country shattered and with the influence of China, Russia, Turkey, and Iran to try and piece the fragments back together again. It will not be easy with specially Turkey keen to retain control over parts of northern Syria it now controls under the auspices of fighting ISIL and Kurdish rebels. For this reason, many analysts believe that Syria has become such a mess any attempt at reconstruction will result in a very poor return on investment.

Aleppo City

China, however, thinks differently, is perhaps better prepared for longer term development strategies (Western democracies and financial institutions are more subject to shorter term planning influences and often fail to adequately plan ahead) and is prepared to accept Syria into the Belt and Road Initiative.

The fact that Assad has just won a seven-year term is more attractive to Beijing as it implies a degree of political certainty – a much needed commodity when major investment and infrastructure plans need to be put into place.

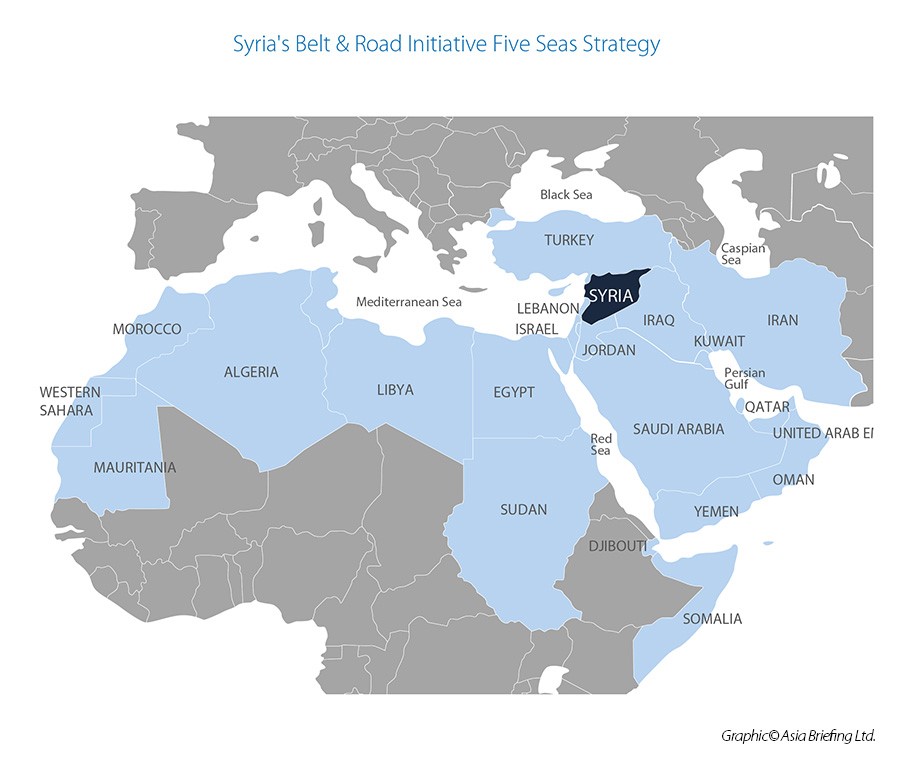

Syria’s attractiveness lies within its ‘Five Seas” capability, a plan to link the Caspian, Black, Mediterranean and Red Seas with the Persian Gulf.

According to the UN, rebuilding Syria will cost some US$400 billion. China, as well as Russia are eying the potential. Syria’s participation in the BRI would create a new corridor through the Middle East connecting Iran to Syria via Iraq, and would be beneficial to all states in the region. Despite historic conflicts between Iran and Iraq, Beijing and Moscow have been able to build a bridge between them. Iraq has agreed to develop cross border rail with Iran at the border crossing between the two countries at the Basra/Shalamchek corridor at which itself leads onto Iran’s southern ports on the Persian Gulf and connects with the International North-South Transportation Corridor (INSTC). That multi-modal route feeds east to ports on India’s West coast, north through to the Caspian Sea and onto Azerbaijan and Russia, with a north-east spur leading to Afghanistan.

We can examine how Syria’s Five Seas Strategy provides the country with unique interconnected energy and trade hub potential as follows:

Caspian- Black Sea-Mediterranean Corridor

The Caspian Sea is home to Ports servicing Central Asia and the countries of Kazakhstan, Uzbekistan (via Kazakhstan), Turkmenistan, Afghanistan (via Uzbekistan or Turkmenistan), Iran, Azerbaijan (with rail through to Georgia and Turkey) and Russia. It is directly linked to the INSTC.

The Manych Ship Canal is an existing canal between the Black Sea, the Sea of Azov and the Caspian Sea. Proposals are being considered to turn it into a larger form known as the Eurasia Canal. This would be a multipurpose water-resources system and a limb of international transport. A proposed design would deepen the canal to 6.5m and widen it to 80m. This would afford a traffic capacity of more than 75 million tons of cargo per year, while vessels could have a freight-carrying capacity of up to 10,000 tons. Deployment has begun: Dubai-based P&O Logistics, which owns some 400 cargo ships, announced the opening of a new cargo container shipping route between Istanbul and Central Asia using the Black Sea and the Manych Ship Canal via the Caspian to Kazakhstan and Turkmenistan.

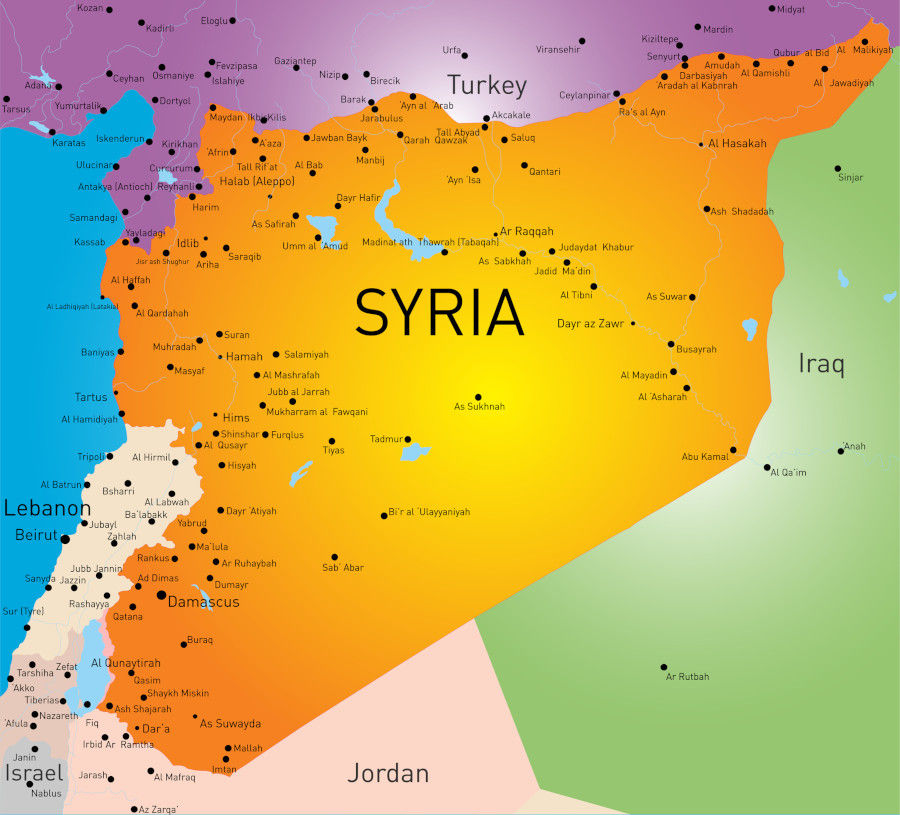

The Eurasian Canal would link through to the existing Bosphorus Straits while the planned Istanbul Canal would also link the Black Sea with the Sea of Marmara, which empties out into the Mediterranean. This would provide routes through to the major Syrian Mediterranean Ports of Lattakia and Tripoli giving Central Asia access to Syrian oil and gas and Syria access to Central Asian markets. Redeveloping the Eurasian Canal from the existing Manych (Volga-Don) Canal could cost as much as US$18 billion. However, doing so would cut the distance by ship between the two seas from more than 1,000 kilometers to 680–850 kilometers and, reduce the transit time, meaning such an expenditure would have an acceptable RoI.

Iran has a lease on part of Lattakia Port and has a preferential trade agreement with Syria, while Russia has a base at the nearby Tartus Port. Russia established a trade office in Damascus late last year.

Russia is also looking at signing off a long, 20 year cooperation agreement with Iran, while China agreed a 25 year deal last year.

Lattakia Port

Lattakia has the potential to become the Eastern Mediterranean’s largest port facility, and can later be expected to develop free trade and special economic zone facilities. It would not be surprising if Chinese investment and port operational knowledge would be directed into Lattakia as part of a BRI network linking through to Central Asia and providing Mediterranean use. Today, petroleum products such as bitumen and asphalt are exported via the port, as well as grain, cotton, vegetable oil and tobacco.

Lattakia also provides access to the Red Sea via the Suez Canal, and Russia free trade facilities at nearby Port Said. This has additional significance as Egypt is close to finalising a Free Trade Agreement with the Eurasian Economic Union (EAEU) of which Russia is by far the largest market. With Egypt a member of the African Continental Free Trade Agreement (AfCFTA) this also permits Russian access to pan-African markets. Russia is also buulding a Red Sea-Mediterranean Sea high speed railway for the Egyptian Government.

From there, vessels can access the Persian Gulf – under protection of a further Russian facility at Port Sudan. Goods can then be shipped onto Iran, completing the circular Five Seas route with INSTC connections through again to the Caspian Sea at Chabahar Port. From there, it is a short maritime journey to Pakistan, India and ultimately to China. This route also provides significant potential for Syrian access to markets in North Africa and the Middle East. China is shortly to finalize a long-negotiated free trade agreement with the Gulf Cooperation Council (GCC) which includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

This then provides a circular route utilizing both the INSTC and Suez Canals – useful given recent problems with the Suez – connects West Asia with Central Asia and positions Syria’s Lattakia Port as an important gateway to this. Lattakia can also act as a West and Central Asia gateway through to North Africa as well as markets in Europe.

Upcoming Agreements

Syria officially joining the Belt and Road Initiative is looking highly likely. I strongly suspect that Chinese investment will also start to appear in Lattakia Port and connecting road and rail infrastructure, both to Tripoli, Damascus and Syria’s oil and gas reserves. This will provide both China and Russia with infrastructure investment projects that can be paid for against proven reserves.

At some point in time these will be underpinned by more significant agreements. Syria already has Double Tax Agreements with China, India, Iran, Jordan, Pakistan, Russia, and Saudi Arabia amongst others. These are useful to mitigate against profits taxes and specially within the services industry – which Syria will be requiring a great deal of.

Syria also has Free Trade Agreements with Iran and Turkey, while it can be expected that negotiations to link Syria to the Eurasian Economic Union – including partners Armenia, Kazakhstan, and Russia with immediate trade interest along the Five Seas routes will shortly commence. An FTA with China may be more problematic but could materialize given energy resources once these are better defined in terms of deliverables. Syria has also applied for observer status within the regional Shanghai Cooperation Organisation which would further envelop it in an additional layer of much-needed security.

Summary

While a great deal needs to be done to get Syria back on its feet, the upshot of the ten-year war calling for regime change is that Syria is now firmly under the influence of the Eastern, rather than Western powers. Infrastructure can be expected to exchange Syrian resources in exchange for construction; it looks increasingly likely that both China and Russia, with possible contributions from Iran and Turkey will concentrate on energy revenue providing infrastructure first, to develop cash flow and finance. This will certainly include developments at Lattakia Port. While the Eurasian and Istanbul Canal projects are separate issues, and will not be determined by Syria, the country – and its supporting and regional partners will certainly benefit. Syrian energy as a support to Turkmenistan’s huge gas fields will also help stabilize Central Asia and especially ‘given the withdrawal of US and NATO troops from Afghanistan, and in doing so provides, via the INSTC and the Five Seas Strategy a first sign of willingness to link the Eastern Mediterranean with Central Asia. With Syria being 87% Muslim, and with a highly educated population of some 18 million, there are markets for it to culturally access if Bashir can regroup, reunite the country, and get its citizens back to work. It will be interesting for investors to see how these plans develop.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com