Chinese Contractors Winning Bid for EU Funded Peljesac Bridge in Croatia Raises Eyebrows

A Chinese consortium led by China Road and Bridge Corporation (CRBC) has won the bidding for a contract to build a bridge in Croatia, an EU member state. The awarding of the contract has led to further allegations concerning Chinese state funding amounting to subsidies and a lack of transparency over the bidding process. The same anti-China arguments were unveiled during China’s building of a railway between Belgrade and Budapest, which also raised concerns about Chinese bidding on projects affecting the EU, although in that case the project was Chinese funded.

A Chinese consortium led by China Road and Bridge Corporation (CRBC) has won the bidding for a contract to build a bridge in Croatia, an EU member state. The awarding of the contract has led to further allegations concerning Chinese state funding amounting to subsidies and a lack of transparency over the bidding process. The same anti-China arguments were unveiled during China’s building of a railway between Belgrade and Budapest, which also raised concerns about Chinese bidding on projects affecting the EU, although in that case the project was Chinese funded.

The allegations come as the European Union (EU) and potential accession countries prepare for next week’s summit in Sofia. The EU-Western Balkans Summit takes place on May 17 and is hosted by the Bulgarian Presidency of the Council of the EU. It will bring together the heads of state or government of the member states of the European Union, and their counterparts from the Western Balkans region.

The theme of the summit will be “Connectivity” – in terms of transport, energy, digital infrastructure, education, and other aspects. High on the agenda will be plans for improved road and rail links across the region, which is a sector where the EU is trying to discourage involvement from China, in favor of EU-led projects.

Sure to be a hot topic is the Chinese bridge contract, which was awarded by the Croatian government in January for a bid of 2.08 billion kuna (€283 million) to construct the first phase of the Peljesac Bridge and access roads. Competing rivals Strabag of Austria and a Turkish-Italian consortium comprising Astaldi and IC Ictas of Turkey, however, then lodged an appeal to the EU State Commission for Control of Public Procurement Procedure. They alleged that the low winning bid from CRBC was backed by Chinese state aid, saying that according to EU law, the Commission had an obligation to question unusually low prices. That argument was effectively based on the fact that the CBRC is a state owned company, and therefore must enjoy Chinese government privileges that assist with its competitiveness.

In fact, CBRC are part of a Fortune 500 company and have a strong record in building bridges throughout Asia, in particular. Their parent company, the China Communications Construction Company’s annual report (2016) can be viewed here. The company is listed in Hong Kong, is audited by Ernst & Young, and declared profits of just under €400 million for the financial year.

The State Commission rejected the filing, and Strabag then lodged a complaint to the Administrative Court in Zagreb, asking for a provisional measure to stop construction. The government decided to press ahead with the official signing of the contract between Croatian roads operator Hrvatske Ceste and CRBC on April 23. The same week, the court in Zagreb rejected the request from Strabag.

In an interview with Chinese media after the signing ceremony, Croatian Prime Minister Andrej Plenkovic stressed that the bidding had gone through a transparent process in accordance with public procurement procedures of Croatian and EU standards. Also present was Oleg Butkovic, Croatian minister for maritime affairs, transport, and infrastructure, who told Chinese media that the construction of the Peljesac Bridge was a high priority project for Croatia and should be completed within three years.

Speaking at the signing ceremony, Chinese ambassador Hu Zhaoming said the bridge was the largest-ever cooperation project between China and Croatia, and it had opened a new chapter of the China-Croatia relationship. Ambassador Hu had already told Chinese media in March that the appeals against the winning Chinese consortium were groundless.

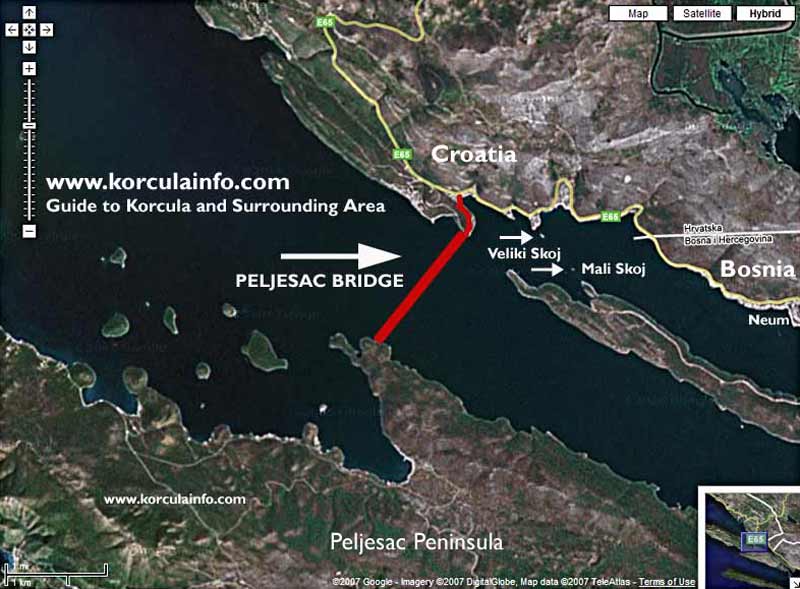

The bridge will mainly be financed with EU funds, which makes the fact that a Chinese contractor won the bidding even more sensitive. In June 2017, the EU Commission announced that it was allocating 357 million euros (US$424 million) of Cohesion Policy funds to build the bridge that will connect the southernmost part of the country and Dubrovnik to the rest of mainland Croatia. The EU contribution will cover 85 percent of the cost. The bridge itself will be 55 meters high and 2.4 kilometers long, with four lanes. EU funding also covers the supporting infrastructure, such as the construction of access roads, including tunnels, bridges, and viaducts, the building of an eight-kilometer bypass near the town of Ston, and upgrading works on the existing road.

The bridge will give Croatia a continuous land link. The Neum corridor, a strip of the Adriatic Sea coastline, which is a part of Bosnia and Herzegovina, is currently the only land-based route between Dubrovnik and the rest of Croatian mainland, meaning that a lengthy detour through Bosnia is necessary. Croatia joined the EU in January 2013 and is still its newest member. It is also a member of the Cooperation between China and Central and Eastern European Countries. This group is made up of both EU and non-EU countries and is generally viewed with suspicion by the EU.

An additional group of six countries are hoping to join the EU, including Serbia, Montenegro, in addition to longer-term ambitions for Albania, Bosnia and Herzegovina, Kosovo, and Macedonia. The EU is consequently stepping up infrastructure spending on road and rail across the region, in order to improve connectivity. But some countries are skeptical that in reality they will ever actually be allowed to join the EU and continue to remain receptive to Chinese involvement in infrastructure projects.

Bidding procedures on major infrastructure projects is a controversial topic in Brussels at the moment. Last year, it expressed concern about the high-speed rail link from Belgrade to Budapest, which features a Chinese contractor, as well as financing from China. Serbia is free to make any bilateral arrangements that it likes, since it is outside of the EU. But Brussels made it clear to Hungary that EU procurement rules for large infrastructure projects must be followed.

Chris Devonshire-Ellis of Dezan Shira & Associates comments: “The EU likes to feel it can exert sovereign pressure on countries that are not already EU members. It also has an unhealthy pre-occupation over who gets to build infrastructure. As always, these conflicts are about money. While it remains important that tender processes are transparent and fair, the EU must also face up to the fact that operational costs and taxes are hgher in the EU than in China, and the construction industry also tends to be heavily unionized, which adds to costs and can make projects non-competitive. There is also a viewpoint that EU money should be spent on EU contractors. However, not enough thought is being put into maximizing the benefits of infrastructure build. If more thought and effort was put into the exploitation opportunities of having these projects built rather than arguing who will build them, we may see a more productive use of EU resources and longer-term potential for its businesses. To paraphrase Deng Xiao Ping, no one really cares who builds the bridges in Europe. As long as they are good bridges, they can be maximized for their use potential. And that is where the long-term development opportunities are – using the infrastructure to develop new industries, not the one-off construction project itself.”

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. The firm provides business intelligence, investment advisory, due diligence, tax advisory, corporate establishment and structuring, accounting, payroll and related professional services throughout Asia and has business experience dealing with both Mongolia and North Korea. To contact us please email silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

![]() China Targets, Funds, and Incentivizes Eastern Europe as Bilateral Trade Potential Intensifies

China Targets, Funds, and Incentivizes Eastern Europe as Bilateral Trade Potential Intensifies

![]() How Foreign Businesses Can Prosper from China’s Belt and Road Initiative: Exploit the Infrastructure

How Foreign Businesses Can Prosper from China’s Belt and Road Initiative: Exploit the Infrastructure

Dezan Shira & Associates and the European Union

In 2017 our firm Dezan Shira & Associates turned 25 years old in Asia. We are an independent professional services firm, and one of the primary brands in this field in the region. We provide foreign investors throughout the world with advisory services concerning their investments into Asia, including pre-investment due diligence and financial planning, legal establishment, IP protection, as well as financial management such as accounting, bookkeeping, payroll, HR administration, and treasury.