How Foreign Businesses Can Prosper from China’s Belt and Road Initiative: Exploit the Infrastructure

An as yet unanswered question posed by many foreign commercial attaches to China and the international business community at large has been how their related businesses can be included in China’s Belt and Road Initiative and be part of that. China, for it’s part, has usually thrust a copy of the Belt and Road MoU at them and told them to get on with it. (A redacted copy of a typical bilateral Belt and Road MoU can be found here) As reading the download will illustrate, it provides no real clues as to participation other than the usual sloganeering and political-speak. There is no explanation of how a bilateral MoU can assist with foreign participation.

More recently, a report issued by the German GTAI foreign trade and investment marketing agency and the Association of German Chambers of Commerce and Industry concluded that around 80 percent of BRI infrastructure projects funded by Chinese state banks had gone to Chinese companies.

That should not really be any surprise. The role of the Chinese government in trade is to support and fund its own businesses, not foreign. In fact, foreign companies can become involved in the BRI infrastructure development, but typically only if they possess a JV with a Chinese company. Typically, these are state-owned enterprises, and the arrangement is usually worked out on a G2G basis. In some cases, the Chinese will actually specify they will only partner with other state-owned enterprises. In the case of Maritime Belt Road infrastructure projects being conducted in Indonesia for example, Chinese loans have been made but under certain conditions – the money must filter down to Indonesia’s state-owned companies, to better fit with Chinese participating SOE’s, and 30 percent of the loans should be denominated in RMB to better underpin the internationalization of that currency.

It helps keep details of the arrangement more opaque and allows a similar mind-set to run through the whole project. Understandably, such conditions do not fit well with Western mindsets. It is this trajectory that has led to the EU Ambassadors to China sign off a recent statement criticizing the Belt and Road Initiative.

However, the reality is that China is not going to change its approach. They will build the infrastructure, sometimes with local assistance, but always involving a Chinese SOE. That is the deal. So how can foreign businesses participate?

The answer, apart from the few MNCs that can lobby their governments to partner with Chinese SOEs on projects, is that foreign investors interested in the Belt and Road must learn to exploit the infrastructure, and not necessarily participate in it. By this, I mean studying the impact of infrastructure developments, be they roads, bridges, ports, airports, rail, and so on, and measure the trade impact of these. An example is Sri Lanka’s Hambantota airport. It has been criticized already as a white elephant, and is massively underused. But as I explained here, that has been due to local political rivalries delaying its use, and not the underlying development benefits the airport will bring. In fact, the new airport, situated on the southeast coast of Sri Lanka, shaves off 30-40 minutes flying time from flights arriving from Asia (the existing airport in Colombo is on the Western coast), and cuts an astonishing 3-5 hours drive time to reach the excellent beaches and safaris that the southeast coast has to offer.

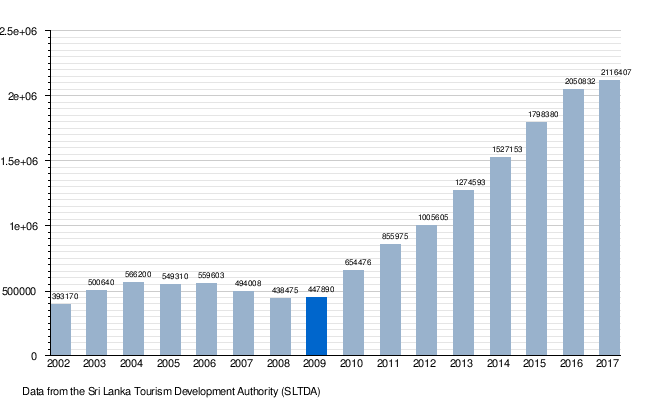

Although Sri Lankan companies were not really involved in the infrastructure development of the airport, the entire regional economy is going through a boom. The airport will eventually open, and foreign investors are already entering the local market to prepare themselves. This includes Shangri-La Hotels, who have just put in a luxury spa and golf resort in Hambantota itself – the largest single luxury development on the island as well as Canadian developer Pura, and their new eco resort at Trincomalee. The Marriott have just opened an exclusively Chinese tourists hotel at Weligama while Starwood are also looking at investing in more properties, including Pasikuda on the east coast, which the Hambantota airport will service. These are just a few. There are many others, not least the smaller investors putting in boutique hotels and spas. The local construction industry, civil engineers, architects, interior designers, and everyone from speed boat manufacturers to the textiles industry, dive masters, and chefs and everything one can imagine is related to the tourism industry is having a field day in Sri Lanka. In short, forget about who built the airport. Look at the tourism and supporting industries that go along with having such a facility. In fact, Sri Lanka’s tourism figures are already going through the roof as the country starts to position itself as the new Bali. I have first hand knowledge of this, I maintain a winter house there and own a small boutique hotel in the area. The current boom in Eastern Sri Lanka is down to Chinese infrastructure investment – both the Southern Expressway and the new Hambantota Airport. Without the Chinese BRI investment, the entire sector would still remain much as it was – moribund.

There are numerous other examples, scattered around Europe, Asia, Africa, and beyond. The message then is crystal clear – the way to get involved in China’s Belt and Road Initiative is to look at the opportunities it creates and then exploit them.

However, there is a disconnect between many public and private sectors in various countries in generating the intelligence needed to understand the potential of such infrastructure developments. The public sector has been concentrating its efforts at getting contracts as part of China’s infrastructure build. The private sector has grown frustrated waiting for progress. But that’s the wrong approach. The public sector needs to be examining the infrastructure projects China is building, and working out what the trade development impact will be. That intelligence then needs to be fed to the respective private sector companies. What is required is more imagination, not demands for contracts to build things.

In fact, a lot of initiatives in exploiting the new Chinese built infrastructure have come from Alibaba, the Chinese online shopping portal. Infrastructure developments have not just included airports in Sri Lanka, they have also included technology within China itself. Foreign companies have by and large been fairly lax in approaching China as an e-consumer market, when in fact, nearly 600 million Chinese have access to online shopping. As any European will know, the sight of Chinese tourists has become far more commonplace. China’s Communist Party, as a One Party State, also recognizes that it must also keep China’s population happy, and that means giving them access to European and other imported goods. Those Chinese tourists of today are tomorrow’s new consumers. The hard infrastructure is being built and will continue to be built to interconnect Europe with Asia, yet the soft infrastructure has largely been ignored by many governments. Alibaba, however, has been very busy sealing agreements with countries such as Italy, Denmark, and New Zealand among others to promote better sales of goods to Chinese consumers online. Yet, not all countries have recognized this opportunity, and even less have been especially active in educating the private sector about how to take advantage of selling to China. The EU SME Centre did produce a small booklet on the subject, yet that was based on 2013 China consumer demographics, is out of date, and in any event, China has amended its e-commerce laws for foreign participation since then. The EU itself has not kept abreast of the challenges and opportunities presented to EU SME’s by helping them sell to the Chinese consumer market – a direct by-product of the Belt and Road. Instead, they’ve issued a letter criticizing the entire initiative. As I said last week, such an attitude is myopic.

Clearly, this stance needs to change. The Belt and Road is not going to provide a windfall for global foreign MNC’s hoping to become involved in China’s infrastructure projects. Those will be mainly shared with local contractors on an as need basis. But where the big opportunities lie are in the benefits the Belt and Road infrastructure build will bring. That is where public money should be spent, in order to help the private sector understand where the opportunities lie. The exciting part about that is they provide for longer-term sustainable industry developments, are not exclusive, anyone can participate, and you don’t have to engage with the Chinese.

Infrastructure projects are big-ticket, one off items. The development of entire industries as a result remains the more attractive, sustainable option, and Belt and Road policy makers should be looking at where those opportunities are, not concentrating solely on the infrastructure projects themselves.

About Us

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates, a foreign direct investment practice assisting foreign investors throughout Asia. The firm also provides advisory and intelligence services concerning China’s Belt & Road Initiative. For more information please contact us at silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

Silk Road and OBOR Business Intelligence

Dezan Shira & Associates´ Silk Road and OBOR investment brochure offers an introduction to the region and an overview of the services provided by the firm. It is Dezan Shira´s mission to guide investors through the Silk Road´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.

Cross Border e-Commerce in China

While cross border e-commerce (CBEC) is an attractive channel for foreign businesses to sell to China, misunderstandings over how CBEC in China works frequently end in costly disappointments and retreats from the market. In this issue of China Briefing magazine, we offer foreign investors a practical guide to selling to China through CBEC. We begin by introducing the market landscape, before diving in to the sector’s legal and regulatory framework. We then compare the advantages and disadvantages of different CBEC business models. Finally, we consider how to protect intellectual property in China when selling online.

China’s New Economic Silk Road

This unique and currently only available study into the proposed Silk Road Economic Belt examines the institutional, financial and infrastructure projects that are currently underway and in the planning stage across the entire region. Covering over 60 countries, this book explores the regional reforms, potential problems, opportunities and longer term impact that the Silk Road will have upon Asia, Africa, the Middle East, Europe and the United States.