China’s Moves Into Europe As Belt & Road Initiative Migrates West

Op/Ed by Chris Devonshire-Ellis

China’s Belt & Road Has Now Moved Further West Than Genghis Khan’s Armies

“Scratch a Russian and you’ll find a Tartar” runs a well known (if somewhat untrue) European saying of two centuries ago, an unkind reference to the fact that the armies of Genghis Khan reached what are now the gates of Moscow and had conquered all lands to the east – what is today much of contemporary Russia. In fact, the Mongol armies reached as far West as the eastern Mediterranean and the Carpathian Mountains, before turning back and returning to Mongolia. That Mongolian invasion has long-standing repercussions, and especially in Eastern Europe where 1 in 7 men have been identified as carrying the so-called “Genghis Khan gene” a DNA marker, 800 years old that points to a mixed heritage somewhere down the ancestral line.

Today, its another nation that Mongolia also conquered – China – that is taking the same steps West, although this time with trade and development. There are three main component parts to this from China’s perspective, and one multilateral one. They are as follows:

China’s Belt & Road Initiative & Europe

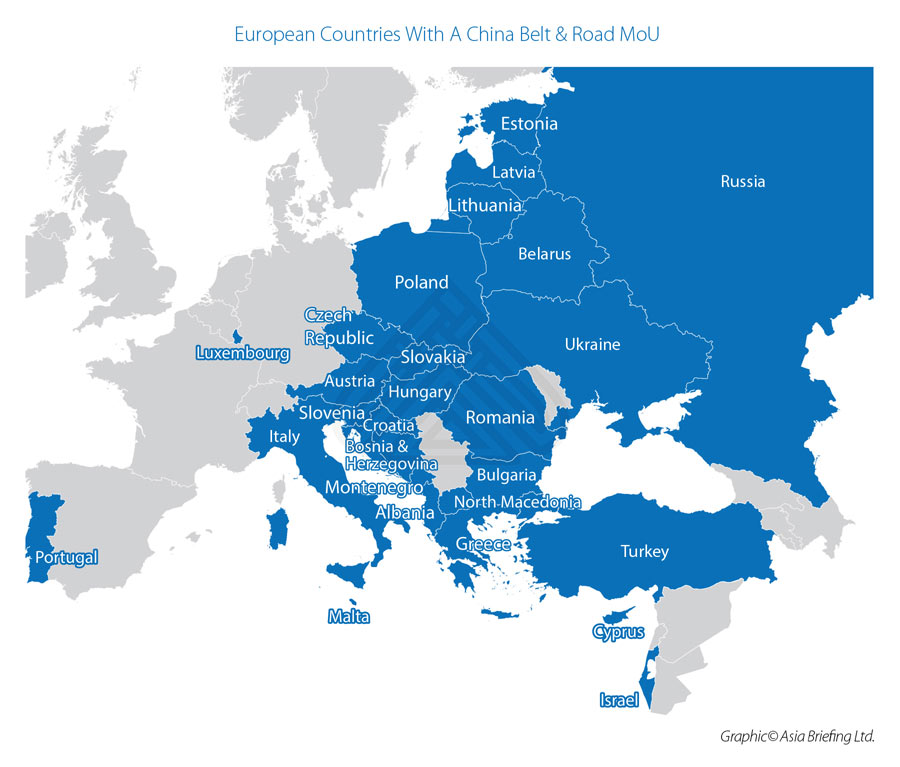

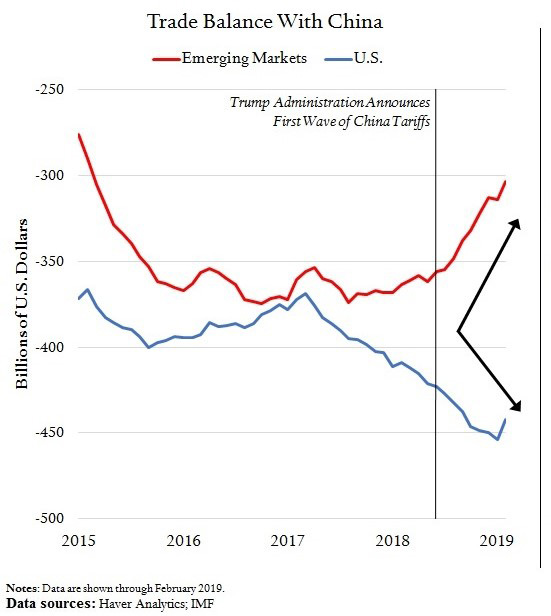

Although the China Belt & Road MoU signed off between China and European companies don’t typically amount to a huge deal on paper, they do contain promises to “assist” bilateral development. The map above shows the European based nations that have signed off a China Belt & Road MoU. This takes effect in two ways, firstly via trade concessions, and this has been especially apparent during the US-China trade war – China has stepped up its purchases of goods from Belt & Road nations in preference to previously buying from United States suppliers. The graph below shows this widening gap in preference of Belt & Road signatories, where the gap between US purchases and Emerging markets has become quite apparent.

However, I have noticed another impact on Belt & Road Initiative signatories – creeping censorship. This has been apparent recently in the EU member state Estonia, which has a Belt & Road MoU with China. Dezan Shira & Associates has an office in Hong Kong and I have been concerned about the recent protests there. Yet when clicking on You Tube and other video links showing demonstrations, the streaming had been cut. Other videos (such as music) worked fine. Did calls between the Chinese Ambassador and the Estonian Government seek to delete such media? If so, then there is a case for the Belt & Road MoU to perhaps been seen as a leverage tool to pressure Governments to show what China wants and censor negative news. That is a concern, and some answers need to be forthcoming from EU members about such behaviour. Or perhaps it was a “technical glitch”?

The Cooperation Between China And Central & Eastern European Countries

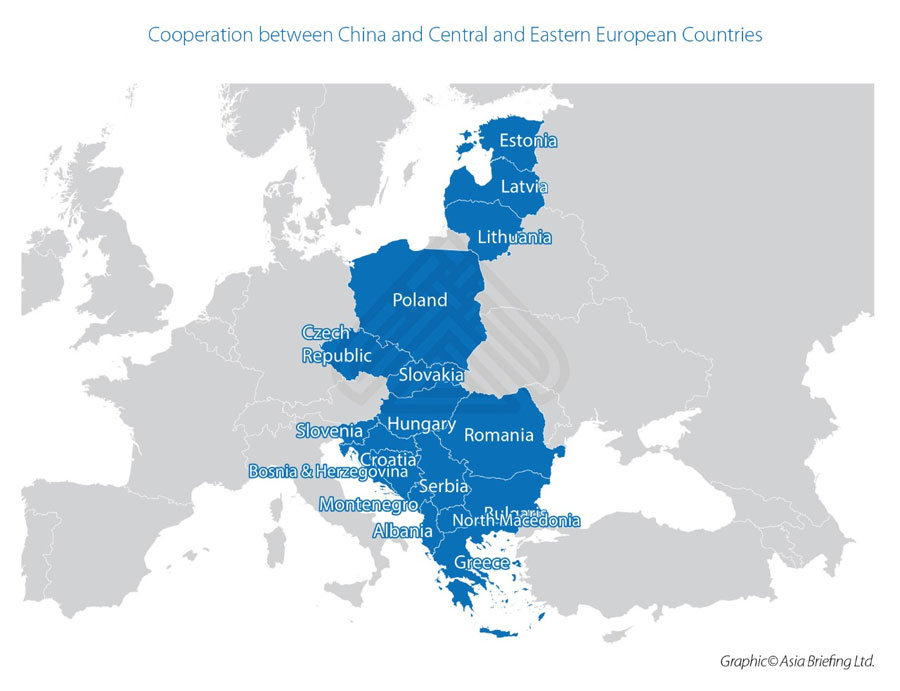

The Cooperation Between China And Central & Eastern European Countries (CEEC, also referred to as the 17+1) is a working group between China and seventeen European nations. This includes EU member states Bulgaria, Croatia, Czech Republic, Estonia, Greece, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia & Slovenia, all of which have Belt & Road MoU with China. Additional members include Albania, Bosnia & Herzegovina, Montenegro, North Macedonia & Serbia. Collectively, this creates a discussion forum with interests from the Baltic to the Black and Mediterranean seas.

The CEEC is treated with some suspicion from Brussels, who in turn has sometimes been heavy-handed in dealing with Chinese investments into EU nations. This has resulted in a notorious decision to hold up progress on a wholly Chinese-funded high speed rail link between Budapest (Hungary, an EU member state) and Belgrade (Serbia, a non-EU member state). The project delay was in part due to Brussels insistence the project conformed to EU standards and protocols, meaning an awarded tender had to be scrapped and re-held. When it was, a Chinese consortium won the project anyway. The resulting perceived interference and imposition on the arrangements from Brussels on what is a project that promises huge trade benefits between the two nations has seen Serbia, long a prospective EU member, sign off a Free Trade deal with the Eurasian Economic Union instead, while Hungary has also developed anti-Brussels views and has been sanctioned by Brussels – moves that have met with some resistance from other EU member states. In part, the evolution of the CEEC is in response to the EU’s perceived lack of interest in integrating Eastern Europe, while at the same time creating obstacles to its development. The result is these countries beginning an alignment with China.

China & Free Trade Agreements

China has been negotiating an FTA with the European Union since 2013, and it has yet to be concluded. Brussels has missed a trick, one can imagine the impact on EU exports now China is embroiled in a trade war with the United States. Brussels tends to view a China FTA as meaning a vast inflow of cheap Chinese goods coming into the Eurozone and putting EU manufacturers out of business. Very little research appears to have been done on the legitimate evolution of EU manufacturing towards a higher, more intellectual base, superior EU food standards and business processes that should have or be migrated to China anyway. With the EU having placed sanctions upon Russia, about to lose the UK as a market, and unable to agree a deal with Beijing, the pressures on Brussels to pander to Washington over trade will only increase.

The Eurasian Economic Union

The Eurasian Economic Union (EAEU) sits between the EU and China, and has borders with Estonia, Finland, Latvia, Lithuania and Poland. It includes the countries of Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia. China is a Free Trade signatory to the EAEU, although this hasn’t yet been enacted in product terms, these negotiations are underway. As and when that happens, Chinese goods will be able to travel, duty free, across Eurasia to the borders of the EU. The EAEU also has FTA with Vietnam and Serbia, and it looks like this:

The implications are clear. It is to Eurasia that Europe should be looking, and in many cases is actively doing so – countries do not sign off Belt & Road MoU or join the CEEC without extensive consultation. Brussels meanwhile prefers to keep China and the East at bay, a sentiment I discussed in the article Here There Be Dragons This means that Brussels is out of step with the economic and trade reality of what is going on right on its borders. Visiting Belarus last week, the Chinese are building a second runway at Minsk international airport to facilitate more cargo. The Chinese funded Great Stone Industrial Park is nearby and is being filled with Chinese manufacturers looking in part at the European market – Geely are soon to be operational there. Cities such as Brest are improving their rail and warehousing capacities.

But on the EU side progress is limited. This is a problem for EU based businesses, with an eye on exporting to new markets. China’s middle class is expected to reach 400 million with income levels at @US$34,000 per annum – a similar base to Italy. This report from McKinsey also shows that the “Generation 2” of China is also adapting to Western styles and tastes. They want to buy. The question for Brussels, and for the EU in general, is does it want to sell?

It appears to be a struggle between the EU serving the United States, or embracing Eurasia. However developments such as the Belt & Road MoU and the membership of the CEEC appear to dictate which way the wind is blowing. Business, not mandarins in Brussels will ultimately decide the issue, as the likes of hardliners Merkel, Tusk and Junkers sail off into retirement. We are unlikely to see their type again, and that may well prove to be the moment that nudges the EU towards a more realistic geophysical, eastern looking future.

Related Reading

- Britain’s New PM Boris Johnson Praises The Belt & Road Initiative – Could An EU Exit Mean A UK BRI Deal?

- “Great Eurasian Partnership” Back On Track As Putin And Xi Commit

- How Chinese Contractors are Winning EU Infrastructure Projects

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. The firm provides business intelligence, legal advisory, tax advisory and on-going legal, financial and business operational support to investors throughout China, India, ASEAN and Russia, and has 28 offices throughout the region. We also provide advice for Belt & Road project facilitation. To contact us please email silkroad@dezshira.com or visit us at www.dezshira.com