Britain’s New PM Boris Johnson Praises The Belt & Road Initiative – Could An EU Exit Mean A UK BRI Deal?

Op/Ed by Chris Devonshire-Ellis

What Are The UK’s Trade Options As Regards China, ASEAN, India & The Central Asian Belt & Road?

The new British Prime Minister, Boris Johnson, has stated that “We are very enthusiastic about the Belt & Road Initiative, very interested in what President Xi is doing.” in an interview with Hong Kong’s South China Morning Post, just 24 hours into forming a new Government to take over the EU negotiations concerning Brexit. ““We are very lucky because we have coming to the U.K. not only lots of goods manufactured in China, we have 155,000 Chinese students in the country, which is wonderful for us,” Johnson said in the interview. “They make a massive contribution to Britain and to our society.”

Johnson has pledged to take the UK out of the EU by October 31st and is keen to get the ball rolling on alternative trade deals. Should that mean a no deal with the EU, trade will be conducted with EU member states as according to WTO regulations. It also leaves Britain with options as regards forming alternative trade alliances. In fact, British businesses themselves have already been taking the initiative this year. British direct investment into China has increased 169 percent this year, with similar trends our firm is seeing occurring across the ASEAN nations and India. Even Russia, not exactly the UK’s best buddy right now, has seen foreign investment from British businesses increase by 20 percent over the past ten months.

This unofficial Brexit trend is typically indicative of the conundrum when understanding who directs investment. Is it government or the commercial sector? While government policy is always a useful pointer as to where money will flow too – especially true in centrally managed countries like China – democratic nations tend to give businesses more leeway. Worryingly, the United States, with its new tendency to withdraw from trade agreements and immediately impose sanctions, is moving away from that democratic model and becoming more authoritarian.

Business in the United States is increasingly becoming dictated to by political agendas rather than a mix of commerce and foreign policy, which is bad news for their more globally broad minded entrepreneurs, and especially so for those with independent business investments overseas. The rise of the American “State Influenced Enterprise” in all but name has begun, and they want smaller businesses out of the way.

This is one reason Donald Trump had been beating up on the previous UK Prime Minister Theresa May – it is not in the interests of either American state influenced businesses or its political agenda to have the UK operating out of the EU as a loose cannon. However, this may be exactly what is about to happen under Johnson. If so, what are immediate options for the UK in terms of alternative trade deals, free from being shackled by Brussels?

UK-China Trade Agreement

The UK has until now been part of the EU’s plans to negotiate a free trade agreement (FTA) with China, a process that has been going on since 2013. Both sides opened up talks aiming to provide investors on both sides with predictable, long-term access to the EU and Chinese markets, and to protect investors and their investments.

These talks have stalled over many issues, not least concerns over access to the Chinese market. At the present, these talks are at an impasse, with no breakthrough expected anytime soon.

A UK-China FTA would certainly be a priority for London. However, it falls behind a UK-US FTA in immediate desirability, and this could become a sticking point. The issue is because Washington DC could insist, as it has done with the new USMCA agreement between the US, Canada, and Mexico, on elements within the deal that effectively limit Canada and Mexico from reaching their own trade deals with Beijing. The issue is a clause inserted into the USMCA agreement that specifies that if any of the partners enters into a free trade deal with a “non-market” country like China, the other USMCA countries can terminate the USMCA with six months’ notice and negotiate their own bilateral agreement.

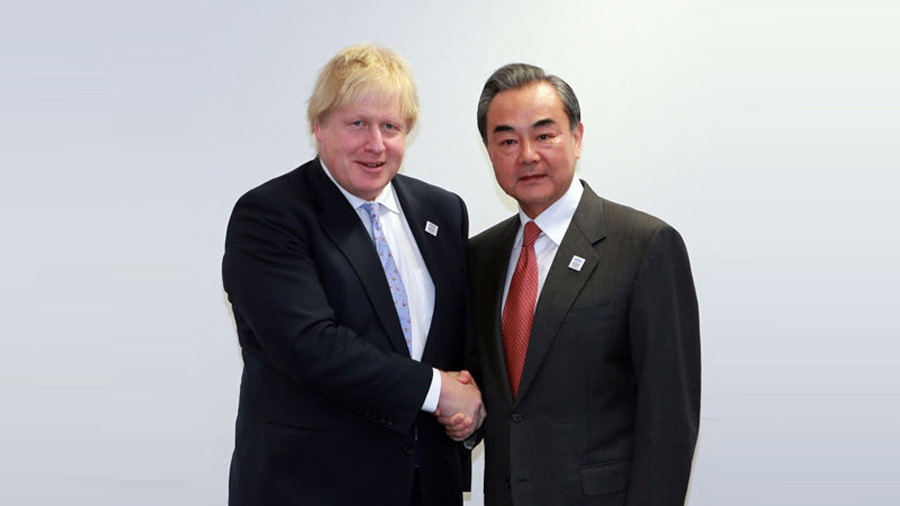

This clause, Article 32.10 in the USMCA deal, has created controversy in Canada. But it has helped US President Donald Trump isolate China by preventing China from pursuing agreements with Canada or Mexico that serve as a back-door to ship products into the US. Although Ottawa has claimed the clause will not prevent Canada seeking a trade deal with China, opponents of the agreement state that Washington DC wants to control how countries trade with China, a situation Beijing has called “an infringement of sovereignty.” With the UK actively seeking a trade deal with the US as its first priority, much of how a future UK-US trade deal is designed will impact on whether London is prepared to stand up for itself and insist on the UK’s right to negotiate trade agreements with whoever it wishes. A UK-China free trade deal will or will not happen as a result of what can be agreed between London and Washington DC. If it does, then China is likely to be prepared to offer the UK better terms than it would the EU. Johnson is already well known to China, having received the Olympic flame at the end of the Beijing 2008 tournament in his capacity as Mayor of London, and more recently with his trade counterpart, Chinese Foreign Minister Wang Yi (the two pictured, above) when Johnson served as UK Foreign Secretary. Those connections, dating back a decade now, are likely to stand him in good stead.

UK Signs Up To China’s Belt & Road

Italy has, so has Switzerland. With the Belt & Road Initiative actually very much in British recent history as concerns its previous incarnation in the Great Game, Johnson and his cabinet have the balls to sign off on China’s BRI MoU. Its actually not such a big deal in terms of content, as I described here and it would seriously throw a cat amongst the pigeons in Brussels, who are currently advising member EU states not to sign off such deals. Johnson would likely relish that, while China would welcome British recognition with open arms. A closed door deal over Hong Kong’s current situation and the state of concern there might produce a compromise allowing London to help calm the territory down with Beijing being seen to take the lead in ditching the controversial repatriation bill, paying more attention to mainland Chinese failing to integrate properly into the territory, with a BRI MoU as a reward.

Dezan Shira & Associates 28 Year Relationship With The UK

But it’s not just China that Boris Johnson will have his eye on. Better trade relations with countries long in Britain’s trade sphere could also start to come back into focus.

UK-India Trade Agreement

Certain elements in India would get political mileage from London being seen as asking for a trade deal from their old political masters, but patriotic breast thumping aside, history has bound these two nations together for centuries. Despite occasional anti-colonial rhetoric, the two nations are genuinely fond of each other, and have shared interests, not least in cricket and a love of spicy food. Curry is now the national dish in the UK. Although a deal would be difficult – India is a huge country with a massive population, and would need to be pragmatic over issues such as visas, there is a lot the two countries could achieve together. An India deal would also help British businesses hedge against China.

UK-ASEAN Trade Agreement

ASEAN would be a natural fit for UK trade, with London having historic colonial era relations with Malaysia, Singapore, Myanmar, Brunei, and the Philippines. Laos, Vietnam, and Cambodia have a similar history with Paris, and the region is especially familiar with European style business practice and investments. A UK deal would be especially welcome in services, as the ASEAN region is still somewhat diversified when it comes to currency management and distribution.

UK-Eurasian Economic Union Trade Agreement

While the current political arguments remain fresh, such a deal is not on the cards. However, the Eurasian Economic Union (EAEU) is strategically placed between China and the EU, and has been expanding its influence globally. While at present much of the EAEU agreements are fairly soft, a rapprochement between London and Moscow could see a provisional deal being made. Moscow is in need of respite – especially in its services sector – and there is a lot of pent up demand in a Russia coping with EU sanctions. China already has a non-preferential FTA with the EAEU, and the UK has a great deal of interests in Central Asia. It will require a strong political will and the re-energizing of ties between London, Moscow, and Beijing to make it happen, with a timescale of possibly a decade to pull it off. But if it did occur, British businesses could cash in.

The Brexit Trade Off: Reactivating the British Commonwealth

There are other options too for the UK, not least being the re-emergence of the Commonwealth, and its re-positioning as a trade organisation. I wrote about the potential here. With a population of 2.2 billion, a GDP of US$14.6 trillion, and an annual growth rate of 7.1 percent, the Commonwealth remains an under-utilized British asset with tremendous resources in Africa.

The above, not unrealistic scenarios show that the UK has the potential, post-Brexit, to develop into a serious Silk Road player, with business opportunities available through existing, well-established links, to Central Asia, South-East Asia and Africa. Rather than have anti-Belt and Road mechanisms and alternative, US-backed funds and schemes to inhibit the rise of China, it could yet be the role of the British to counter-balance China on a global basis. A post-Brexit Britain under the new Prime Minister Boris Johnson and his cabinet, determined to deliver an EU departure, while looking at viable alternative trade sources could deliver that scenario.

This article has been updated and adapted from the piece titled “Could A Post-Brexit Britain Emerge As A Silk Road Player?” published on16th November 2018.

About Us

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates and a noted Belt & Road academic. The firm assist foreign investors, including British businesses, invest into China and Asia and have done since 1992. The practice has 12 China offices, as well as offices in Hong Kong, India, Singapore, Indonesia, Vietnam and representation in the Philippines, Thailand, Malaysia and Russia. Please contact the practice at silkroad@dezshira.com or visit us at www.dezshira.com