BRICS 2019 Summit Declaration : Free Trade Agreement On The Horizon?

Op/Ed by Chris Devonshire-Ellis

BRICS To Open Up To Free Trade Via The EAEU?

The BRICS grouping of nations – Brazil, Russia, India, China, and South Africa, have been holding their Ministerial summit in Brazil this week as they look at developing the groups connectivity. The BRICS countries are expected to produce 50% of global GDP output by 2030. However – the BRICS group of nations is not a common Free Trade market.

A declaration of intent has followed the summit, at which the BRICS nations have said they “Find it necessary to coordinate actions at a global level to reach maximum economic growth.”

“We support the conclusion of the BRICS Trade Ministers that bold, coordinated international action is required to increase economic growth and sustainability. Increased trade can help with global growth, but the demand deficit in the global economy requires additional sources of growth, which could include infrastructure investment, including in digital infrastructure, skills development, particularly for young people, sustainable investment, investment in local basic services, and outward investment to areas of high potential growth, including on the African continent.”

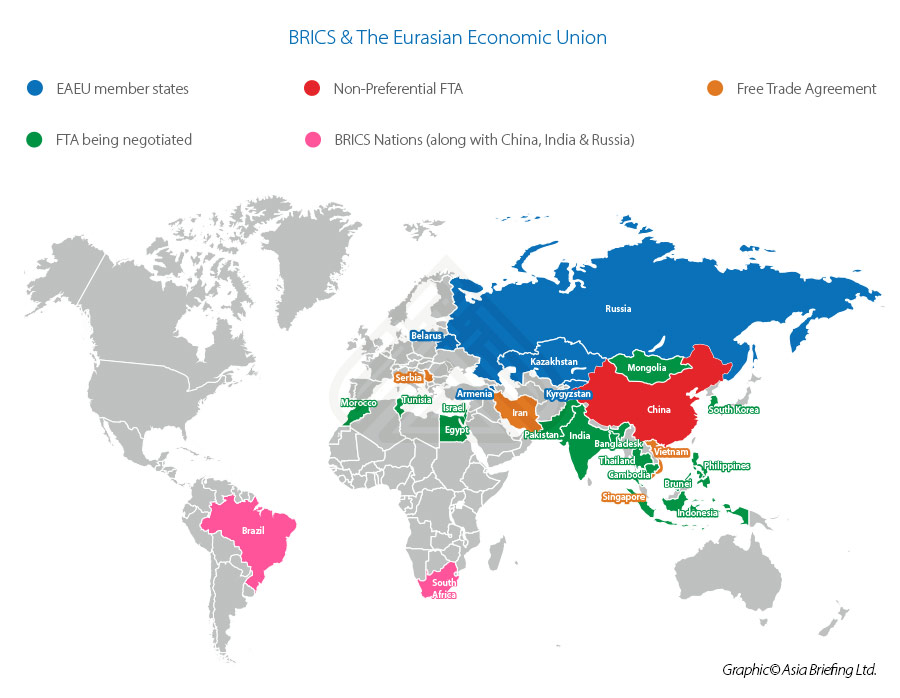

Although the declaration doesn’t state how these broad objectives will be achieved, it is conceivable that a Free Trade Agreement could be reached, either between the nations concerned, or perhaps to make it more attractive to each of them, to fold such a deal into the existing Eurasian Economic Union (EAEU). The EAEU is a Moscow derived initiative that includes Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia, sitting on territory that extend from the borders of the European Union to the borders of China. It has a population of 390 million and a GDP of US$1.9 trillion. Intra-EAEU trade has been growing at 30% per annum. The EAEU is a Free Trade bloc, a structure that China has not developed as part of its own free trade agenda. Although the proposed pan-Asian RCEP deal is being viewed in some quarters as being Chinese-led, that is inaccurate – it was first proposed by ASEAN, and has been widely supported by Japan. China in terms of Free Trade has instead concentrated on bilateral FTA and has additionally launched the Belt & Road Initiative – although that is not a Free Trade area – and neither is BRICS. The BRICS need to enter into some sort of FTA will become more pressing now the member states have agreed on the need to “increase economic growth”.

We can examine each of the BRICS member states and their current situation as regards Free Trade as follows:

BRAZIL

Brazil is a member of the Mercusor Free Trade market, which also includes Argentina, Paraguay and Uruguay. Mercusor operates as a customs union, in which there is free intra-zone trade and a common trade policy between member countries. It is the world’s fourth largest trading bloc after EU, NAFTA, and ASEAN. Mercosur is home to more than 250 million people and accounts for almost three-fourths of total economic activity in South America. Otherwise, Brazil has not been especially active in signing off global free trade, and it doesn’t have agreements with any of the other BRICS nations, although through Mercusor it does have an Preferential Trade Agreement with India and the Southern African Customs Union.

In terms of Double Tax Agreements (DTA), Brazil has signed off deals with China, India and South Africa, but not yet with Russia or any of the EAEU nations. Brazil has not signed off an agreement with China’s Belt & Road Initiative.

Russia

As mentioned, Russia is a founding member state of the Eurasian Economic Union, which also has FTA with Iran, Singapore, Serbia & Vietnam. Numerous other nations are currently negotiating FTA with the EAEU, (see map below) including China, who have signed off on a deal but have yet to agree tariffs on specified products. That can be expected to change by 2021. Russia also has FTA with the Commonwealth of Independent States (CIS) which also includes, in addition to the EAEU members, Moldova and Tajikistan. Russia has numerous Double Tax Treaties in place, including with BRICS members China, (and Hong Kong), India and South Africa. Russia has signed off on China’s Belt & Road Initiative.

India

India has a patchy record with Free Trade Agreements, and has recently opted out of the RCEP deal, in decisions made we explained here and alternative options we discussed here. Otherwise, India has FTA with the ASEAN group of countries (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand & Vietnam), as well as the South Asia Free Trade Area (SAFTA) grouping which includes Afghanistan, Bangladesh, Bhutan, Maldives, Nepal, Pakistan and Sri Lanka. We have discussed these previously here India also has FTA with Japan and South Korea.

In terms of DTA, India has 88 DTA in force, including agreements with all of the BRICS nations, as well as EAEU members Armenia, Belarus, Kazakhstan and Kyrgyzstan, however it has not signed off on China’s Belt & Road Initiative.

China

China has sixteen FTA with its trade and investment partners, and is negotiating or implementing an additional eight. China’s FTA partners are ASEAN, Singapore, Pakistan, New Zealand, Chile, Peru, Costa Rica, Iceland, Switzerland, Maldives, Georgia, Hong Kong, Macao, and Taiwan. China has also recently signed FTAs with Korea and Australia, both of which include investment details. In terms of DTA, China has numerous agreements in place, including with BRICS members India, Russia and South Africa, as wlel as with members of the EAEU. It often also offers preferential trade terms to countries along its Belt & Road Initiative.

South Africa

South Africa is a member of the African Continental Free Trade Agreement (AfCFTA) which reduces, over the coming five year period, intra-border taxes on 90% of all products traded within Africa to zero. It is also a member of the South African Customs Union (SACU) which also provides free trade between its member states including Botswana, Lesotho, Namibia and eSwatini, and the Southern African Development Community (SADC) which also includes free trade among the SACU members in addition to Madagascar, Mauritius, Mozambique, Tanzania, Zambia and Zimbabwe. It also has partial FTA with Mercusor via the SACU and the European Union. South Africa has also been active in signing numerous DTA, including all other BRICS members in addition to EAEU member state Belarus. South Africa is a signatory to China’s Belt & Road.

Clearly, more alignment needs to be carried out between the BRICS member states in terms of bilateral agreements, several of which still need to be cleared up if the blocs ambitions to increase trade among them are to be realized. Such agreements most notably not yet in place include free trade agreements between Brazil, China, India and Russia; as well as China with India and South Africa.

However, the introduction of Free Trade between BRICS members and the Eurasian Economic Union remains an interesting one. The EAEU has already stated it is prepared to sign off agreements with non-Eurasian countries, and at present Morocco, Egypt, along with Mozambique and Namibia (border countries with fellow BRICS member South Africa) are on the agenda. Russia has been developing Free Trade Zones in Africa and Asia and China has been doing the same – I wrote about this in the article How Foreign Investors Can Benefit From China’s Belt & Road Initiative In Africa Despite the current partial lack of free trade connectivity, it is apparent that moves are also being taken to deal with this. That makes the prospect of a BRICS alignment with the EAEU more likely. If so, such a Free Trade area could potentially look like this:

Given that China has also been making inroads not just into Africa but also South America and especially Brazil, who products China has been importing in far higher quantities due to the current US-China Trade War. That statistic alone suggests that China will be turning to Brazil far more as a trade partner – and that means free trade deals with be on the agenda.

China is also looking to Africa to supply it with goods and products, while Russia again is looking to outsource production to other emerging markets as well as gain access to markets it has lost through sanctions imposed by the United States and EU. With US trade with South America being increasingly politicized and polarized, it may well prove that the EAEU provides an existing bloc that may well suit all parties.

Related Reading

- Eurasian Economic Union Examining Free Trade Potential of South America

- China’s Overseas Free Trade Zones & Industrial Parks

- Russian Trade Turnover With African Countries Up 17% To US$20 Billion

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm provides strategic analysis, legal, tax and operational advisory services across Eurasia and has done since 1992. We maintain 28 offices throughout the region and assist foreign governments and MNC’s develop regional strategies in addition to foreign investment advice for investors throughout Asia. Please contact us at asia@dezshira.com or visit us at www.dezshira.com