Belt and Road Initiative Ushering in New Trade, Logistics, Blockchain, and 5G Technologies

China’s Belt and Road Initiative is having a huge impact on the development of blockchain, VR, and other digital services in the need to upgrade facilities and maximize profitability and delivery times for goods traversing Eurasia.

China’s Belt and Road Initiative is having a huge impact on the development of blockchain, VR, and other digital services in the need to upgrade facilities and maximize profitability and delivery times for goods traversing Eurasia.

There are two sides to the China phenomena, one the oft mentioned exporting of Chinese goods to Europe and other parts of Asia, and the lesser discussed absolute need for the Communist Party to deliver to Chinese nationals. That supply chain – giving mainland Chinese the goods they want – is a critical component of China’s development and an issue the CPC must get right – even with Xi Jinping having cemented his position as leader, an unhappy Chinese population remains a serious concern within a one-party state. Getting products to China is essentially a more serious political issue for China than boosting its exports, an issue and opportunity not often recognized outside of China’s own borders.

Accomplishing a “win-win” situation, however, in terms of bringing imported goods into China, and exporting its own manufacturing and services, requires a massive Eurasian systems upgrade. Part of the tremendous potential of the Belt and Road Initiative is achieving just that. While at the current juncture it is the hardware that is being noticed – everything from the building of ports in Sri Lanka, railways in Kenya, and bridges with Russia, it is the hi-tech solutions that will really drive the efficiencies ahead and get products to consumers as effectively and inexpensively as possible. It is extremely good news for Europe and beyond that China’s Communist Party absolutely must arrange to service their own population – and is investing heavily to do so. But what are these new technologies, and how will they be used?

It’s all about efficiency and cost. To do that, in a trade space that includes at present un-integrated systems operating between China, Russia, and the Eurasian Economic Union (which includes Kazakhstan) and the European Union, standardization first needs to be agreed upon. This includes solving issues such as the differing gauge rail widths that exist along the routes. China is doing that by developing track changing trains that will do away with the need to use different locomotives and trucks along different parts of the routes. At present, having to stop and physically change bogies is time consuming and expensive. That hassle will eventually disappear. Also, between China, the EAEU and EU, rail containers are not standardized. That again is being dealt with as China is in discussions with the countries involved to obtain rail container standardization. Then comes the fun part. New technologies, such as blockchain and 5G are being developed. With the hardware in place, there should, in future, be no reason why a train should not remain intact and travel non-stop between China and the EU. However, at present there are differing customs areas involved, again principally between China, the EAEU, and the EU, and these require the inspection of containers as well as the payment of customs duties. My firm, Dezan Shira & Associates is in discussion with Microsoft over developing a blockchain based system that will allow clients the ability to complete a declaration form at one end of the route, with transit and payment software in place to allow the relevant customs unions concerned to digitally verify what is in the container, and to automatically process and pay any duties on them – without having to actually stop the train. As blockchain technologies are secure and cannot be hacked without this being noticed, everyone gets paid on time without the need for physical inspection. That facility alone can cut 3-4 days off the travel time as well as cut out corruption.

In fact, both China and Russia have been very keen on developing such technologies. In many instances, both countries are some way ahead of various EU nations in their development of the digital economy, a subject I touched upon in the article “Winners & Losers In The EU’s Digital Connectivity With China & The OBORsphere” With China possessing one billion consumers able to access the digital economy, and the state government putting into plans to deliver to 95 percent of China within 24 hours by 2020, the opportunities for getting produce both into and out of China and the Belt and Road regions as a whole are immense. The digital revolution is impacting on the essential deliverables of the BRI routes – getting products delivered, on time, safely, and securely. This includes not just e-commerce, but also e-customs and e-government. Supporting services will all be managed by online platforms.

5G networks are expected to bring about a veritable revolution in business processes owing to the brand new technological opportunities that come along with them. The industrial Internet of Things, smart cities, self-driving cars, telemedicine, and other promising development areas will get a fresh start following the 5G standardization, which will be trialed in countries such as Russia as early as at this summer’s World Cup Soccer Finals, and rolled out as a service by 2020 – just two years from now.

Both China and Russia are making giant steps to transform their economies and gear up for their entire markets being dominated by the digital evolution. Both nations also recognize the urgent need to synchronize systems, develop compatible standards, and allow use of such technologies to speed up trans-shipment, logistics, warehousing, and end delivery systems to consumers.

Innovation, however, and especially in the first phase of securing China’s needs, is required, and to this end China and Russia have both embarked and will continue to embark on projects that combine technologies – including joint ventures with European businesses. Examples are Siemens involvement in the Moscow-Kazan high speed rail, a project that may later extend all the way to Beijing and the Chinese funded development of electric vehicles in Bulgaria and Romania – following which China announced all Volvo cars would be electric by 2019, the first major manufacturer to make such a statement. Clearly, China is looking to Europe to innovate and create and develop new technologies to support global trade as the century progresses. Sitting on the bedrock on basic Chinese needs, this is a good place to begin examining the opportunities that this can bring EU nations. However, in order to do so, connectivity needs to be in place. China, for its part, has announced it will be investing US$411 billion between 2020 and 2030 on upgrading its entire telecommunications system to 5G.

China has been making great strides in developing its digital economy, which according to a White Paper issued by the Chinese Academy of Information and Communications Technology (CAICT) and Ministry of Industry and Information Technology (MIIT), expanded at 18.9 percent in 2016, much faster than that of China’s overall economy, which grew 6.7 percent during the same period. In total, China’s digital economy accounted for 30.3 percent of China’s total gross domestic product (GDP) over the year, said the white paper. Taking its spillover effect into account, China’s digital economy contributed 69.9 percent to its GDP in 2016.

KPMG has issued a report on this stating that the growth of China’s digital economy and the emergence of many new business models as a result, has triggered a wave of new and complex issues for companies operating in practically all sectors of the Chinese economy. However, it is not all plain sailing.

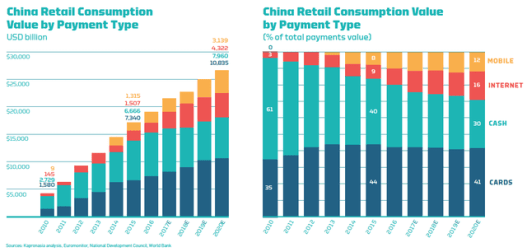

China has some difficulties with telecommunications due to mountainous terrain and a still-developing communications satellite need. Nonetheless, China’s enormous projected spend will take care of the terrain and satellite gap. As of today, about 731 million Chinese are online, with 95 per cent of them accessing the internet via their phones. This has spurred the development of arguably the most dynamic mobile ecosystem in the world. China’s digital payments market as a result has exploded to about 50 times the size of that in the US. It may take time for China to roll out 5G across the entire country; however, the primary cities, manufacturing and distribution hubs, and crucially, transportation border areas are all being prioritized. China is a leading player in digital connectivity and has the architecture and the finance to further develop this. This includes not just state planning but also China’s private sector, which has taken huge steps to get on board. Huawei, for example, have been investing what is expected to be a total of US$600 million for R&D in 5G technologies from 2013 until 2018. That dwarfs investments being made by EU businesses in the same technological field.

Businesses such as Tencent and Alibaba, with a combined market value of more than U$500 billion, as well as China’s tech companies are also forging ahead with innovation and investment on their own. Tencent, a gaming-to-messaging powerhouse, is using its popular WeChat app as a platform for an array of other services, including digital payments. Similarly, Alibaba, whose core e-commerce platform serves millions of businesses across the world, has diversified into other online markets and financial services. With 120 million Chinese tourists travelling abroad every year, Alipay is fast becoming one of the most global digital payments services. It should be noted by European governments and businesses that the new wave of Chinese tourists visiting their cities will want to be acquiring European clothes, foods, and products to take home and integrate into their daily lives in future, and they will be expecting service that can deliver produce from Europe with the minimum of delay and fuss.

Russia, meanwhile, has approved a rolling, three year plan worth US$1.6 billion per annum to upgrade its own digital network. That is equivalent to about a third of China’s total spend per head of population over the next decade, but also accounts for the fact that many of Russia’s citizens live in relatively easier to access cities than China’s, and it already possesses superior satellite technologies with craft already operational and in orbit. Moscow expects to be one of the first global cities to be 5G by 2020, a task that will rank it ahead of cities such as London and made somewhat easier due to the upgrade in communications currently taking place to prepare the nation for the upcoming FIFA World Cup finals, which is expected to feature a pilot 5G zone. By 2020, Russia plans to roll out 5G networks by 2020 in eight cities.

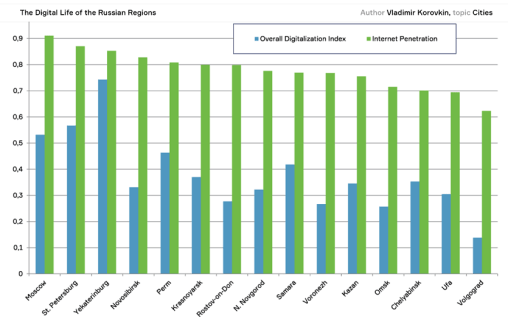

The Skolokovo School of Management recently released a report into Russia’s digital connectivity, entitled the “Russian Regional Digital Life Index“ with the aim of studying the existing levels of digital penetration on everyday life, including transport, finance, retail, education, healthcare, media, and public administration, together with the supply and demand for digital services. What was found is that Russia has already reached the second phase of connectivity – the apparatus is in place, now it is starting to yield results. This is a measure of intensity rather than breadth of usage and accordingly puts Russia ahead of China in this regard. Also of interest were the city results – Yekerterinburg ranked higher than Moscow, St.Petersburg, and Novosibirsk in overall digitization, a mark of the city’s modern and innovative culture. The results are shown below.

It should also be remembered that despite sanctions, the Russian economy itself is now growing at a faster rate than the EU’s, and there is huge pent up demand. Russia’s middle class consumer base is about 75 million, roughly 50 percent of its total population and among the highest percentage total among the BRIC nations. It should be remembered that prior to the sanctions, bilateral trade with the EU was worth some €276 billion, and had just reached a record high. Russia, at the time, was the EU’s second largest trade partner, with about 85 percent of EU exports to Russia being in manufactured goods. The vast majority of that trade has now passed to Asia. The EU sanctions upon Russia are a direct cause of the huge increase in Russia’s trade with China, which has consequently been growing at rates of 30 percent per annum, and are expected to reach US$100 billion within the next two years.

In summary, Russia still has a lot of work to do in digital connectivity – east of the Urals and across to Vladivostok, but European Russia is well prepared. It can be expected that lines such as the Trans-Siberian and other routes, will convert to 5G standard, even if the surrounding, often remote areas around such routes may not be able to. No one is buying much in deepest Siberia, with one of the lowest population densities in the world, a fact that makes Russia’s 5G ambitions easier to deliver and manage. With a mandated budget in place, Russia is set to continue its digital connectivity and take its place at the 21st century e-commerce and trade table with China. With the digital economy largely able to bypass sanctions – import-export tariffs excepted – both Russian and EU businesses will be able to find new methods of doing business with each other, and especially should pressure to permit cryptocurrencies in trade start to take effect. The current sanctions have effectively highlighted the problems in relations between the EU and Russia, but at the same time, have demonstrated a real degree of interdependence between their economies. The imposition of sanctions has instead provided an opportunity to create new cross-border value chains.

With Russia a de facto vast border region between China and the EU, having Russia up to speed will prove vital to both Chinese and the EU’s prospects of maintaining and developing trade. But there is a down side. Without Russia on board and synchronized between Asia and Europe, the entire global economy is in danger of significant trade risk. EU politicians should take note of this potential bottleneck, and begin to upgrade their own systems. The driver, it is key to understand, is not China’s need for exporting plastic toys and Christmas trees. China’s drive for new technologies is a purely selfish one – the political need for the CPC to remain in power. For that, they need to keep China’s 1.6 billion people – 95 percent of them which have access to online purchasing – happy. Blockchain technologies, 5G communications, and other new developments are spearheading a global revolution in supply and demand, and it is China who is driving the way ahead in the new technologies required to make this happen.

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. The firm provides business intelligence, investment advisory, due diligence, tax advisory, corporate establishment and structuring, accounting, payroll and related professional services throughout China, India, ASEAN, Russia and the Eurasian region, servicing both Governments and Multinational clients. To contact us please email silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

![]() IKEA Shipping China Made Furniture via Rail to Estonia for European Markets

IKEA Shipping China Made Furniture via Rail to Estonia for European Markets

![]() Where the Belt and Road Opportunities Lie – The Fastest Growing Silk Road Corridors in 2018

Where the Belt and Road Opportunities Lie – The Fastest Growing Silk Road Corridors in 2018

![]() Understanding China’s Free Trade Agreements Along The OBOR Routes

Understanding China’s Free Trade Agreements Along The OBOR Routes

Silk Road and OBOR Business Intelligence

Dezan Shira & Associates´ Silk Road and OBOR investment brochure offers an introduction to the region and an overview of the services provided by the firm. It is Dezan Shira´s mission to guide investors through the Silk Road´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.

China’s New Economic Silk Road

This unique and currently only available study into the proposed Silk Road Economic Belt examines the institutional, financial and infrastructure projects that are currently underway and in the planning stage across the entire region. Covering over 60 countries, this book explores the regional reforms, potential problems, opportunities and longer term impact that the Silk Road will have upon Asia, Africa, the Middle East, Europe and the United States.