Understanding China’s Free Trade Agreements Along The OBOR Routes

The elimination of tariffs and taxes is always a boom for exporters, and is something that China has taken advantage of very effectively over the past two decades. When China first began its journey towards becoming the massive manufacturing giant it is today, it attracted foreign manufacturers, from which the Chinese could learn, by eliminating or cutting profits tax rates for up to five years worth of profitable operations. This represented something of a boom time for foreign businesses in China, and arguably kick-started the entire Chinese economic growth. China has also been very busy in agreeing Double Tax Treaties, which often contain clauses and reductions in taxes beneficial to the respective parties trade. China has also been active when it comes to participating in Free Trade Agreements; it has significant and wide ranging deals with the likes of ASEAN, Australia, Singapore, South Korea, and New Zealand among others and is actively engaged in negotiating several more. These are important because they can and do direct and massively influence bilateral, and in some cases multilateral trade patterns. Taken overall, FTA impact upon and are the structural support for all global trade.

The elimination of tariffs and taxes is always a boom for exporters, and is something that China has taken advantage of very effectively over the past two decades. When China first began its journey towards becoming the massive manufacturing giant it is today, it attracted foreign manufacturers, from which the Chinese could learn, by eliminating or cutting profits tax rates for up to five years worth of profitable operations. This represented something of a boom time for foreign businesses in China, and arguably kick-started the entire Chinese economic growth. China has also been very busy in agreeing Double Tax Treaties, which often contain clauses and reductions in taxes beneficial to the respective parties trade. China has also been active when it comes to participating in Free Trade Agreements; it has significant and wide ranging deals with the likes of ASEAN, Australia, Singapore, South Korea, and New Zealand among others and is actively engaged in negotiating several more. These are important because they can and do direct and massively influence bilateral, and in some cases multilateral trade patterns. Taken overall, FTA impact upon and are the structural support for all global trade.

Consequently, the issue of Free Trade along the OBOR routes is a matter of keen interest. In fact, some agreements that impact this are already in position. Others are pending. This is an overview of how things stand at this moment in time.

The China-ASEAN Free Trade Agreement

This agreement has been in force since 2010 and was expanded in 2015 to incorporate an extension into the economies of Cambodia, Laos, Myanmar and Vietnam, who had asked for more time to adjust. This agreement covers both goods and services provided by the above nations as well as China, Brunei, Indonesia, Malaysia, Philippines, Singapore and Thailand and essentially eliminates tariffs on some 95% of all traded goods and services. This covers much of the OBOR Maritime Routes.

China, Hong Kong Macau Closer Economic Partnership Agreements

Although Hong Kong and Macau are part of China, they have different customs and tax regimes. To cater for this, and also recognize the status of Hong Kong and Macau, these CEPA agreements have been entered into between them and China, which in certain cases provides investment incentives, especially in service areas, that only companies registered in Hong Kong and Macau can benefit from. These include tax reductions as well as preferential market access to otherwise restricted investment areas in mainland China.

The China-Pakistan Free Trade Agreement

This came into effect in 2009, and has formed the backbone of Chinese investment into Pakistan. A direct result of this has been the Chinese development of Pakistan’s Gwadar Port, as well as the “China-Pakistan Economic Corridor” which ultimately aims to link China rail from Kashgar in its south-western Xinjiang Province through to Pakistan’s rail networks at Islamabad. This route will allow Chinese goods to exit via the Arabian sea. To date much of the investment has been from the Chinese side.

The China-Gulf Co-Operation Council Free Trade Agreement

This deal, between China, and the GCC member states of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates, is still under negotiation. It includes details of goods and services, however given the nature of the GCC economies is largely focused on energy. However, tourism and services are expected to be a large part of this, especially as the United Arab Emirates includes Dubai, a popular destination for Chinese tourists and businesses wishing to reach out into Arabia. The ninth round of discussions were concluded recently in Riyadh, and it is understood that most major points have been agreed.

The China-Sri Lanka Free Trade Agreement

This agreement is still under negotiation, although China has been investing in Sri Lankan Ports and road infrastructure for some time now. The country is also a preferred destination for increasing numbers of Chinese tourists. There has been some resistance to this proposed FTA in Sri Lanka, notwithstanding recent scandals involving Chinese investment in the main Colombo Port. Sri Lanka is coveted by both China and India as a base for transshipment, as well as potential for Naval operations. In truth the Sri Lankans are probably content to play one off against the other. The fifth round of talks was held in Colombo in January 2017.

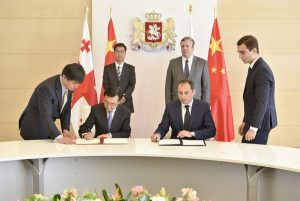

The China-Georgia Free Trade Agreement

This agreement, which gives China access to the Caucasus markets and through to the Black Sea, has been “substantially concluded” as at the end of 2016. The agreement will mean that “Chinese enterprises and consumers will have greater access to high quality products like wine and fruits from Georgia, while Georgians will benefit from cheaper China-made industrial products” according to Chinese Commerce Minster Gao Hucheng. Chinese buyers have already been to Tbilisi looking at purchasing products. However, a word of warning – the prices offered have been relayed to me as being so low that there is very little profitability in China trade for Georgian farmers and producers. It remains to be seen what impact this has on the Georgian economy – other countries such as Armenia, Azerbaijan and Turkey will be studying this closely.

The China-Eurasian Economic Union Free Trade Agreement

This agreement, still under negotiation, will effectively bring, if signed, the Free Trade of Chinese goods right up to the borders of the European Union. The EAEU is a trade bloc, rather like ASEAN, but comprising of Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia. If the EAEU were a country, it would be the fourth largest global economy, with a GDP in excess of USD4 Trillion. China is keen to get a deal done as these countries, and especially Kazakhstan, Russia and Belarus, offer China uninterrupted transportation of goods from China right up to the borders of the European Union at Brest, in Belarus, where Poland, and rail and road infrastructure leads directly to Germany. This would be a significant trade deal and would change the course of EU supply chains.

This article

The Eurasian Economic Union. About To Bring China To The EU’s Borders explains in greater detail.

The China-Regional Comprehensive Economic Partnership Agreement

This agreement has been touted by some as China’s answer to the TPP. It is between the ten member states of ASEAN (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam) and the six countries with which ASEAN has existing free trade agreements (Australia, China, India, Japan, New Zealand, and South Korea). As such, it is a purely Asian deal. The main prize here for China would be to draw India and Japan into an FTA through the RCEP, which would give Chinese manufacturers access to two huge, dynamic, and powerful markets. China does not have full-blown free trade status with either, though it does with all other RCEP states via other multilateral agreements.

But getting Japan and India on board will not be easy. Japan has ongoing political tensions with China, particularly related to territorial disputes. Many Japanese businesses are wary of China, and keen to keep innovative manufacturing technologies – such as advanced robotics – out of China’s reach.

India, meanwhile, may slowly be beginning the process of taking over China’s mantle as workshop of the world. India will be wary of large quantities of cheap Chinese products entering their huge domestic market while Indian manufacturers are still in the process of upgrading and improving their own capabilities (the iPhone is about to start production in India). Cheap Chinese imports flooding the market would be politically disastrous and interfere with India’s transition to a global manufacturing hub.

China, to be fair, probably agrees. A short-term gain in India is not want the Chinese want. Indeed, China will need Indian manufacturing capacity just to keep its own domestic consumers supplied with inexpensive consumer goods.

The RCEP has also not been without its critics. It has gained some notoriety over what have been called “the worst provisions ever drafted on copyright protection”. While the negotiations continue – the 15th round was recently held in Tianjin – the RCEP and China will need to provide major concessions to India and Japan to get anywhere fast. At present, these discussions look like they will be an ongoing saga for some time to come.

Summary

Of all the agreements and potential agreements above the ones having the most impact and greatest potential are the existing China-ASEAN FTA and the proposed China-EAEU FTA. These effectively cover the Maritime and Overland OBOR routes. Arguably missing are proposed Chinese FTA with Iran and Turkey, although China needs to be diplomatically careful here. Nonetheless it will not surprise me if discussions begin to at least evaluate the possibility. As can be seen, China is a great believer in Free Trade – which is hardly surprising as it has such a large manufacturing capacity. However it can be a double edged sword. Complaints from Georgian producers about the real value of Chinese purchasing ring true. But whatever the results, the inescapable movement of China towards the West, using Free Trade Agreements as a tool, will mean a great deal of strategic thought needs to be put into the implications for European manufacturers whose product is already manufactured in Asia. The lower operational costs enjoyed by manufacturers in China and the region will obliterate inefficient European manufacturers. What to do about that is a question of keeping essential technologies at home, to add value, and outsource the basic component part production elsewhere. The Chinese are coming, If you can’t beat them – join them. Setting up production facilities in China or any of the above locations mentioned as part of the OBOR Free Trade routes may be the only way to survive.

About Us

Silk Road Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Eurasia, including ASEAN, China, India, Indonesia, Russia & Vietnam. For editorial matters please contact us here and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates provide business intelligence, due diligence, legal, tax and advisory services throughout the Asian and Eurasian region. We maintain offices throughout China, South-East Asia, India and Russia. For assistance with OBOR issues or investments into any of the featured countries, please contact us at silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Silk Road and OBOR Business Intelligence

Dezan Shira & Associates´ Silk Road and OBOR investment brochure offers an introduction to the region and an overview of the services provided by the firm. It is Dezan Shira´s mission to guide investors through the Silk Road´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.

DSA 2017 Doing Business In China

Doing Business in China 2017 is designed to introduce the fundamentals of investing in China. Compiled by the professionals at Dezan Shira & Associates in January 2017, this comprehensive guide is ideal not only for businesses looking to enter the Chinese market, but also for companies who already have a presence here and want to keep up-to-date with the most recent and relevant policy changes.

Using China’s Free Trade & Double Tax Agreements

In this issue of China Briefing, we examine the role of Free Trade Agreements and the various regional blocs that China is either a member of or considering becoming so, as well as how these can be of significance to your China business. We also examine the role of Double Tax Treaties, provide a list of active agreements, and explain how to obtain the tax minimization benefits on offer.