Xinjiang – Central Asia’s Wealthy, Prepared, & Influential Trade & Investment Partner

Op/Ed by Chris Devonshire-Ellis

Central Asian investment trade and development capital is already being raised via Urumqi MNC, Shanghai IPOs

While the immediate future of Afghanistan still lies in the balance and will apparently take a while to settle down, Central Asia elsewhere is rebuilding and reestablishing trade and commercial ties. What can be expected to happen is that Russia and the Shanghai Cooperation Organisation (which includes China) will, via its own Security Council keep the regional peace and oversee and coordinate infrastructure connectivity.

An example of this are the Russian-Uzbekistan railway corridors that will ultimately link up with Chinese funded rail to Uzbekistan’s Ferghana region and connect with this.

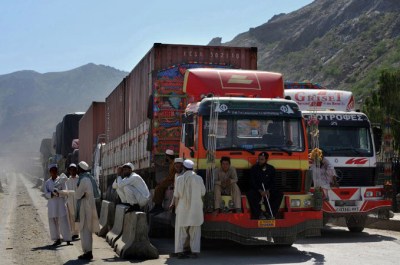

China, for its part will extend its Belt and Road Initiative into Afghanistan, mainly via the existing CEPA infrastructure build from Pakistan, although other China-Afghanistan routes will also be developed as I explained in these articles about Kyrgyzstan, Tajikistan, and Uzbekistan.

All these countries provide third party routes that already link China to Afghanistan. I have observed, along with the lovely Eunice Yoon the large lorry haulage depot in Urumqi with trucks laden with produce and signs, rather like bus destinations, stating ‘Kabul’, ‘Tashkent’ and ‘Dushanbe’ written on top of the driver’s cabin as we filmed a program for CNN about China’s ‘New Silk Road’ (now the Belt & Road Initiative) about ten years ago.

The center of all this trade and commerce though will be Xinjiang Province, and specifically the regional capital, Urumqi. It is Central Asia’s wealthiest, and second largest city. We can compare it with other major regional hubs as follows:

| City | Population (millions) | GDP per capita (US$, PPP) |

|---|---|---|

| Almaty | 2.0 | 8,500 |

| Ashgabat | 1.0 | 7,100 |

| Bishkek | 1.0 | 2,300 |

| Dushanbe | 0.8 | 2,400 |

| Islamabad | 1.0 | 1,500 |

| Kabul | 4.6 | 2,070 |

| Kashgar | 0.7 | 5,028 |

| Tashkent | 2.6 | 4,500 |

| Urumqi | 3.5 | 13,721 |

In addition to Urumqi, Xinjiang’s three other major cities of Hami, Karamay and Turpan all have higher GDP per capita than any of the other Central Asian regional cities. Xinjiang’s wealth, and certainly that in Urumqi, will be key to financing trade and soft power.

Urumqi Demographics

Urumqi’s strength is often forgotten amongst Western media hype. It is one of the top 500 cities worldwide in scientific output (Nature Index rankings). Xinjiang University is a first-class academic institution, specializing in science and engineering with specific leading technologies in developing resilient agriculture in arid ecologies.

The city also has sizeable ethnic diversity, including the dominant Han Chinese, in addition to ethnic Uyghurs, Kazakhs, Mongols, Russians, Kyrgyz, Uzbek, Tartar, and Tibetan minorities. Western media often misrepresents Xinjiang as a Uyghur dominated society, but this has never been true. In 1908, the Uyghur population in Urumqi was estimated by explorer Aurel Stein to be about 25% of the total. Since then, the Uyghur population in Urumqi has grown from 1908’s 12,500 to 388,000 today and has grown by 20% since 2000. That make up is also reflected at the University, where Central Asian culture is an Undergraduate subject.

The 2004 Western Development Project

Urumqi is also the focal point for China’s “Western Development Project” (the Go West campaign) which entered into the National People’s Congress plans in 2004. That is still in effect and regularly updated (for example the latest additions provided for the development of ECommerce Economic Zones). Broadly however the 2004 Western Development plans called for “the development of infrastructure (transport, communications, hydropower, energy), ecological protection (reforestation), and improved education. (We preempted that development by two years, a 2002 archived issue of a now 20-year-old China Briefing Magazine ‘Opening Up The West’ can be seen here and a 2003 title, ‘Way Out West’ here. Times have changed!)

The Western Development Project has manifested itself over the years to include massive economic spending in Western China, and especially Xinjiang, including over 100 significant development projects and a regional spend estimated at over US$100 billion. It can be argued that the genesis of China’s entire Belt and Road Initiative was from Beijing’s experience in developing Xinjiang and observing the results. It is no coincidence that Xi Jinping announced the original “One Belt One Road” policy in neighboring Kazakhstan in 2013 – nine years after the initial “Go West” project began.

Horgos Port on Xinjiang’s border with Kazakhstan meanwhile has become the regions largest inland port, mirrored only by the similarily named Khorgos Port just across in Kazakhstan – which itself would not exist in its current form where it not for China’s trade with Central Asia, Russia and Europe. Horgos sent over 3,600 freight trains through to Europe during the first seven months of 2021, a year-on-year increase of 44%.

Urumqi has subsequently become industrialized and has moved from primarily an agriculture-based economy to manufacturing, especially heavy-duty machinery and vehicles, power transmission equipment, fertilizers, BioPharm, and new energy. Anyone who has travelled from Urumqi to Turpan will be familiar with the sight of thousands of wind turbines and solar panels lined across the Taklimakan Desert. It is again no coincidence that these are the exact products that Afghanistan will need during its reconstruction and that Central Asia is already utilizing.

Free Trade Zones

Urumqi has also prepared itself in motivating both Chinese and foreign investors by developing Special Economic Zones such as the Urumqi High-Tech Industrial Development Zone and the Urumqi Economic and Technical Development Zone. These offer tax breaks for investors and possess bonded zones – products can be imported duty free, combined with Chinese components and reexported without incurring tariff charges or VAT. An ECommerce Zone was established in Aksu City in Xinjiang in May this year, mainly servicing Kazakh and some Mongolian outlets; it is almost guaranteed that as consumer sophistication improves in Afghanistan and the other Central Asian countries, additional ECommerce Zones will appear in Urumqi and Kashgar. An explanation of how these zones work – foreign investors may participate – can be found here. Online retail sales of rural products in Xinjiang rose 29% last year.

Xinjiang also has a preferential foreign trade and investment policy that gives concessions to foreign investors in industries that are not permitted elsewhere in China. The current Xinjiang and Western China Encouraged Industries Catalogue can be found here.

Xinjiang Foreign Trade

While the West has decried investment into Xinjiang for largely misrepresented reasons concerning treatment of parts of the Uyghur population (an issue I discussed here) it should be noted that other Muslim countries are major investors in Xinjiang. There are differing perceptions with the West jumping to conclusions that are misleading. In fact, Xinjiang’s main foreign investment and trade partners are Kazakhstan, Kyrgyzstan and Tajikistan, all Muslim countries. Trade has been booming; figures released August 26, 2021 by Xinjiang customs show that during the period January-July this year, Xinjiang’s exports rose 33%, while imports increased 14%.

Western Sanctions

The market is increasingly being left to regional players – with the United States, European Union, Canada, and the UK imposing sanctions earlier this year on certain Chinese officials, and construction companies in Xinjiang. That means that while Western investment into Xinjiang will be labeled as problematic on their part, alternative FDI and fund-raising mechanisms will replace these sources. This bloc is also part of NATO whose military forces just exited Afghanistan, making trade with them even less likely. However, this makes little difference, the cultural aspects of trade between the West and Central Asia are so diverse that very few can succeed – this is an area where an understanding of Islam, and a working knowledge of Mandarin, Russian and Arabic are all required. Very few Westerners have such skills.

Xinjiang Foreign Direct Investment

In fact, FDI into Xinjiang has been growing, and reached US$33 billion in 2019. To put that into context, Afghanistan’s total GDP that year was just US$19 billion – even after the United States had invested US$2.6 trillion into the country. The differences in policy between Chinese investment on infrastructure and the US investment into military could not be starker, and neither could be the end results: increased trade, versus a ruined economy and political chaos. It is a lesson China has been observing for some time.

Primary investors into Xinjiang include the previously mentioned neighboring countries of Kazakhstan, Kyrgyzstan, and Tajikistan, but also includes Russia, Uzbekistan, Pakistan, India, Mongolia, and a small amount of Afghani investments. These are likely to increase, both in FDI and trade. This is because Kazakhstan, Kyrgyzstan and Russia are all members of the Eurasian Economic Union, while Uzbekistan is mulling the possibility of joining. That is significant because China signed a Free Trade Agreement with the EAEU in September 2018. At present, it is non-preferential, meaning no tariff reduction mechanisms have been agreed. However, this is the subject of current negotiations, and when effected will significantly boost Xinjiang’s trade with these countries. It is also pertinent to note that both India and Pakistan are also currently negotiating FTA with the EAEU.

Afghanistan is not yet in this picture – its economy is far too fragile for it to be bound to any such agreement at this time. However, this is a moot point – the country has existing preferential tariff agreements in place that are designed to motivate Afghani exports. This will be encouraged by China as a pillar of their desire to develop regional peace via trade.

Xinjiang IPOs

There are other developments that are happening. As part of the 2004 ‘Go West’ campaign, cities in China’s wealthier eastern seaboard, such as Shanghai, were instructed to develop and invest in manufacturing in Western China. There was some moaning about that at the time, but results are now coming to fruition – both for Xinjiang and its Shanghai investors. In June this year, Xinjiang Daqo, a regional solar energy producer, became the first Xinjiang company to list on the Shanghai Stock Exchanges STAR market. It just missed being a Unicorn by raising the equivalent of US$938 million. Its stock value tripled after its debut. Money can be made from investing in Xinjiang’s infrastructure and energy businesses and especially when one considers its regional focus and the development opportunities right on its doorstep.

Other major Xinjiang companies involved in the type of infrastructure required to develop Afghanistan and the Central Asian region include Goldwind, (Wind Turbines), TBEA (Power Transformers), Pacific Construction (Infrastructure, named by Fortune in its global 100 largest business with revenues of US$87 billion in 2018) Ba Yi (Steel Manufacturing) Xin Xin (Nickel Mining) and Chalkis http://www.chalkistomato.com/ (Agricultural Processing). There are many other examples. The synergies between these businesses and regional requirements to develop Central Asia is again, no accident.

Prospects

While the situation in Afghanistan unfolds, its prospects will become clearer. But what is apparent is that China has been preparing for nearly twenty years. Xinjiang’s own regional development has seen it develop, pre-Belt & Road, into being a BRI role model in its own right. Xinjiang Province has developed industries that can be used specifically to redevelop Central Asia and Afghanistan. The regional capital, Urumqi, is poised to become a Central Asian key player. Foreign investors should be taking note.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com