Will The Middle Corridor Evolve To Reshape Eurasian Connectivity Between China and the European Union?

Repositioning Eurasian trade routes is proving a complex exercise

By Emil Avdaliani, with additional commentary by Chris Devonshire-Ellis

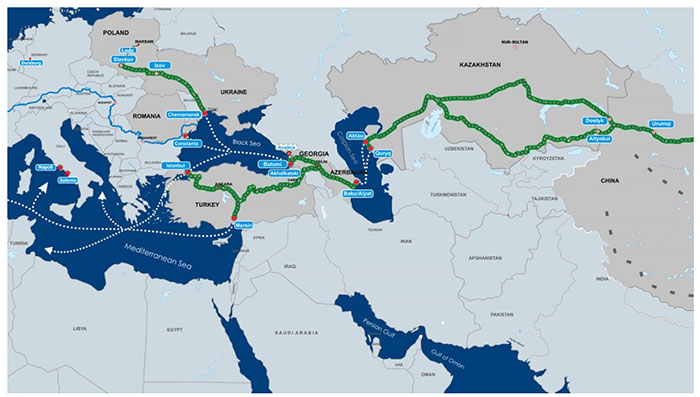

The Russia-Ukraine conflict is continuing to reshape Eurasian connectivity. As the traditional Russian route, which served as a major corridor for decades between the EU and China is facing problems, favorable alternative conditions for trade routes are emerging. These include the Middle Corridor, which spans from Turkiye to Central Asia and China through Georgia and Azerbaijan in the South Caucasus. Geographically, this is the shortest route between the Western China and the European Union.

It is rare for so many countries of different sizes, geographic locations, economic weight, and overall geopolitical importance align on advancing a geo-economic project. With the Middle Corridor, smaller countries are especially interested. In March 2022, Georgia, Azerbaijan, Turkiye and Kazakhstan produced a quadrilateral statement on the need to develop the Trans-Caspian International Transport Corridor. The following month, Maersk, a Danish shipping corporation, started a new train service along the Middle Corridor in response to the changing geopolitical situation in Eurasia having previously abandoned its access to Russian ports in the face of European political pressures. Nurminen Logistics, a Finnish company, started running a container train from China to Central Europe through the trans-Caspian route on May 10 last year, a service that has proven highly popular since.

Redesigning the Eurasian Route Map

The redesign of the Eurasian routes was quickly adopted. In May, just 10 weeks after the Ukraine conflict began, a Georgian Railway team met in Ankara with counterparts from Turkiye, Azerbaijan, and Kazakhstan to discuss the Middle Corridor of the Trans-Caspian International Transport Route project. On May 25, Georgia’s state railway company said that it was working with businesses from Azerbaijan and Kazakhstan to develop a new shipping route employing feeder vessels between Georgia’s Poti and Romania’s Constanta ports. This followed a joint declaration by Azerbaijan, Georgia, Kazakhstan, and Turkiye in late March last year on improving the region’s transportation potential. Moreover, Georgian and Azerbaijani leaders paid visits to Central Asian states in an effort to streamline connectivity through the corridor.

Beyond smaller states, larger states are likewise interested in the expansion of the Middle Corridor. Turkiye is a good example. Even before the war in Ukraine, Turkiye had actively been promoting the Middle Corridor and helped initiate a series of “block train” travels. In February 2021, the first of these block trains reached Turkiye from China, after twenty days of transit. Similar train routes soon followed and have proven both their technological and overland routing advantages.

This follows Ankara’s outreach to Central Asia as a result of Azerbaijan’s victory in the conflict over Nagorno-Karabakh with Armenia in 2020. Turkiye sees Azerbaijan as a base to extend its influence further east. Though Ankara’s potential is limited by the fact that China and Russia are stronger militarily and economically in Central Asia and there is also the Iranian element, which, like Russia, fears any non-regional presence in the Caspian region, what matters most in this situation is that the Central Asian governments aim to diversify their international and economic connections. To balance Russia and Chinese influence, both Kazakhstan and Uzbekistan see Central Asia as being as geopolitically integrated as possible – the development which would give them much greater space for maneuver and explains why these two countries in particular have been supportive of the Middle Corridor idea. They are bringing smaller nations such as Tajikistan and Turkmenistan along with them.

Alternatives To Russian Transit

Increasingly, Central Asian politicians see the corridor to be a viable option to the Russian route. At least, this is the impression that Turkish President Recep Tayyip Erdogan and Kazakh President Kassym-Jomart Tokayev gave during their summit in Ankara in May last year. The joint statement had one interesting passage on connectivity: “The Parties agreed to enhance cooperation in transport and logistics, commending the growth of cargo transit via the Baku-Tbilisi-Kars railroad and the East – West Middle Corridor. Noting fixed complex rates for the transportation of wagons and containers on Transcaspian direction of the Middle Corridor, we emphasize its importance for cargo transit via new Baku-Tbilisi-Kars network and stress the importance of strengthening coordination between the relevant institutions for the effective and sustainable use of the Middle Corridor.”

Changes are already seen on the ground where the logistics companies increasingly opt for the Kazakh-Caspian route instead of traditional Russian transit via the Baltic states or via Belarus to Poland. In the period up to December 2022, these routes attracted a meagre 5% of the EU-China throughput, with traffic slumping by some 40%. But in response, by June 2022, the shipping volume in the Kuryk and Aktau ports in Kazakhstan had doubled and was expected to reach 3.2 million tonnes.

This has meant a decline in shipping and logistics in North-Eastern Europe, with operators and their related supply chains in Finland, Sweden, Denmark, Latvia, Lithuania, Estonia, Poland and northern Germany all suffering. That business has now moved south to Bulgaria and Romania in the EU, while also boosting the Caspian Sea ports.

Seeing the growing transit potential, but also fearing Russian moves to dominate Kazakh supply chains, the Kazakh president instructed the state-owned oil and gas company KazMunaiGaz to work on finding new export routes for Kazakhstan’s oil. This statement came a day after Russia stopped the operation of the the Caspian Pipeline Consortium (CPC) which handles the export of Kazakh oil. Though Moscow later reversed the decision, a new reality is opening up in front of Kazakhstan – the need to diversify export routes.

Regional Geostrategic Complexities

Another indication of the Middle Corridor’s increased relevance amid the war in Ukraine is the stated progress on the long-stalled China-Kyrgyzstan-Uzbekistan railway project. Kyrgyzstan has always been a weak point in the project as the country lacks finances of the magnitude required to build this, while mountaineous geography complicates the implementation, and somewhat nationalistic sentiments against China are delaying its implementation. Russia, unwilling to see transit shifting to the new corridor, is alleged to have silently obstructed the project.

However, with the major reconfiguration of trade routes across Eurasia, prospects for the railway seem increasingly promising. In June 2022, China’s National Development and Reform Commision stated that work on the railway will commence in the near future. The Kyrgyz president also greenlit the project through securing Russia’s consent. Obstacles to the project will remain significant, but the prospects nevertheless seem more promising than at any time since the initiative was first announced nearly twenty years ago.

The railway, if implemented, will help better connect Central Asia not only with the South Caucasus, but also with Iran, which is seeing significant growth in trade with Uzbekistan. Since the Ukraine conflict broke out, Iran has been trying to gain advantage from changing connectivity in Eurasia. The potential nuclear deal is seen to allow Iran to serve as a potential transit for Chinese goods to Turkey and further the EU; while for India, Iran is an interconnector in the International North-South Transport Corridor. Tehran is also aiming at building a route to Armenia, then Georgia’s Black Sea ports.

Beijing’s Middle Corridor Interests

China is especially interested in the re-invigorated Middle Corridor. For Beijing, trade route alternatives are essential. As was the case with the ancient silk roads trade corridors rarely remain static. They constantly adjust to emerging opportunities and to evade potential geopolitical dangers. Nor is China’s massive Belt and Road Initiative (BRI) as static as many have portrayed it. It evolves and adjusts to varying circumstances and though the South Caucasus has not featured high in the BRI documents published by Beijing, the region is responsive to Chinese interests amid a new emerging geopolitical reality. Chinese EV auto investors for example are already extant in Georgia.

Critical infrastructure is already there. The Baku-Tbilisi-Kars railway was unveiled back in late 2017, while the improving web of region-wide roads from the Caspian to the Black Sea serve as a good starting point for China-EU trade relations through the South Caucasus. Azerbaijan and Georgia have joined the BRI and enjoy close trade relations with China. The national infrastructure development strategies of Azerbaijan and Georgia, both aligned with BRI cooperation and projects emphasize the role China and its initiatives are playing.

The Middle Corridor also has strong potential for expansion. Turkiye and Armenia are getting closer to the opening of their long-closed border, with the first major steps already made. Moreover, bilateral trade between the two countries has been encouraged, and the overall sentiment in Ankara and Yerevan is positive; creating favorable conditions for rapprochement. Despite the fact that Armenia and Azerbaijan failed to reach a comprehensive peace agreement in their Nagorno-Karabakh dispute, and constantly exchange accusations, there are reasons to believe that the situation will stabilize and both sides will reach a settlement under both Russian, Chinese and to some extent Turkish pressure to do so.

Yet Challenges Remain and Commitment Uncertain

Yet the Middle Corridor remains a fragile construct where geography constitutes a major obstacle. The route is a multi-modal corridor consisting of sea, rail and road routes, making logistics more complex. China always preferred sending goods via the Russian route simply because it involved a fewer number of national actors, and a more or less stable and predictable geopolitical situation. While that has changed, in Central Asia and especially the South Caucasus the situation is different and could yet deteriorate. While Armenia on one hand and Azerbaijan and Turkey on the other are closer to peace than ever, and Georgia-Russia relations seem stable, it remains to be seen how the Ukraine issues spills over into the Caucasus. Weapons smuggling from Ukraine into the region is rife, and could later spark conflict in the Caucasus itself, creating a southern military conflict front for Russia to deal with. Meanwhile, should Russia be victorious or win concessions, it is unlikely to be patient about seeing a competing trade corridor circumventing it from the south. Although Russia is likely to continue to be curtailed by the West upholding existing sanctions – even after a peace agreement.

There is also a lack of necessary infrastructure in the Caspian Sea and the Black Sea where the need to have a deep sea-port has now attained a bigger significance. The long-stalled Anaklia deep-sea port in Georgia has not yet been built, though it was recently announced that the Georgian government will pursue its construction. Middle Eastern investors have apparently filled the financial investment gap. But even if implementation of the project proceeds it would likely take years to complete – a critical period for establishing itself as a reliable transit route.

Other problems along the Middle corridor include a lack of effective inter-governmental dialogue. To have tangible progress requires the large external actors be interested in the corridor. The EU seems interested. Brussels looks at the South Caucasus as an energy source and a bridge to the Central Asian region. Brussels signed a massive gas deal with Azerbaijan and laid out the plan for an underwater green energy cable connecting the region with the EU. The involvement of external powers is crucial, and this leads us to the most intriguing question: what is China’s stand on the Middle Corridor?

So far China has shown little economic interest in the South Caucasus. From Beijing’s perspective, the region remains not only under Russia’s geopolitical orbit, but also under Russia’s huge economic influence, which continues to grow. China’s involvement might also not be so welcome in the Kremlin. However, as other cases (such as in Central Asia) show, China can move against Russian interests when and where it is critically important for Beijing.

Yet China is also weakly represented in Azerbaijan’s economy. The latter is firmly within the Turkiye and Russian economic area, which limits the space for Beijing. Moreover, with Ukraine conflict showing no immediate sign of abating, China’s presence in the Black Sea region is also undergoing significant changes. In a rare case of China being caught off-guard, Chinese involvement and investment in the region has not been sufficient and was not given sufficient priority, with Beijing failing to get the rights to build the Anaklia port and facing resistance from the West in its attempt to gain vital infrastructure in Ukraine.

Perhaps this explains China’s reticent attitude toward the corridor. Chinese officials as well as analysts have been appeared ambivalent in neither supporting nor resisting the idea. It is possible we are in the midst of an evolution of Chinese thinking as Beijing waits to establish what the fall-out from Ukraine will be, and how China is perceived in the West. The recent blanket Western rejection of China’s ’12 point peace plan’ for Ukraine may yet prove pivotal in shaping China’s attitude towards Western trade and engagement.

As was the case with the ancient Silk Road routes, trade corridors nowadays are also adjusting to new geopolitical realities. Perhaps Beijing is watching what Central Asian and South Caucasus states could be doing to upgrade their infrastructure, a sign of their own commitment to change before Beijing invests more heavily. Nevertheless, despite Chinese reticence, the wider geopolitical picture is critical for our understanding of where the Middle Corridor development process might be heading.

Emil Avdaliani is a Eurasian strategic analyst. He can be contacted at emilavdaliani@yahoo.com. Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates and may be reached at asia@dezshira.com

Related Reading