China’s 2023 Trade and Investment with Kazakhstan: Development Trends

By Emil Avdaliani

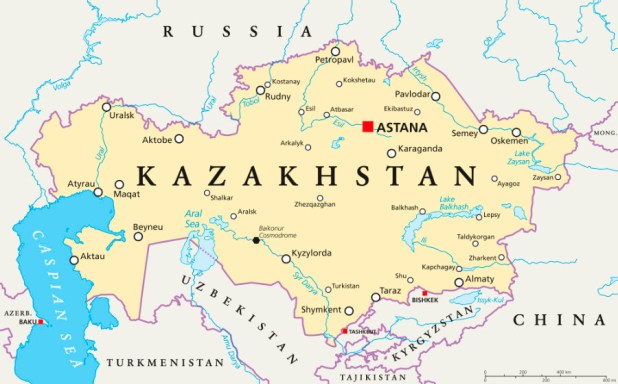

For many years China has been one of the largest trading partners of Kazakhstan. Kazakhstan, in turn, is China’s largest trading partner among five Central Asian states. For example, in 2021 total import and export of goods between China and Kazakhstan reached US$25.25 billion, being 17.6% higher than the previous year.

China’s exports to Kazakhstan reached US$13.98 billion, showing significant growth of 19.5% while China’s imports from Kazakhstan reached US$11.27 billion, an increase of some 15.3%. Bilateral trade between Kazakhstan and China in 2022 grew by 23.6% and reached a staggering US$$31.2 billion. If the current positive dynamic persists, the two sides could reach the stated goal of US$35 billion worth of bilateral trade well before the 2030 target year.

Kazakhstan exports to China

This positive trade dynamic is mainly due to Kazakhstan’s growing supplies to China of agricultural products (133.7% growth), oil (US$4.1 billion), gas (US$1.2 billion), copper ores and concentrates (US$2.04 billion), uranium and nuclear fuel (US$817 million), other ores (iron, zinc, precious metals at just over US$1 billion in trade.

It is worth noting, however, that the supplies of Kazakh gas to China declined from 13 billion cubic meters to 5.5 billion cubic meters over the past two years. Kazakhstan annually produces up to 55 billion cubic meters, one third of which, according to expert estimates, is injected into the reservoir to support the current flow rate of oil wells. The rest goes to domestic consumption due to the growing gasification of Kazakhstan’s energy consumption. The country has the world’s 12th largest oil reserves and 15th largest gas reserves. These are helping to power, along with Russia, Chinese production capabilities.

Chinese exports to Kazakhstan

In turn, Chinese imports consisted of appliances, household appliances and equipment worth US$6.1 billion; and fabrics, textiles and footwear at US$1.5 billion. Moreover, Kazakhstan imported from China over 3.5 million car tires, 12,500 passenger cars, almost 3,000 tractors, 2,800 thousand trucks and over a thousand units of specialised vehicles. Also exported were over 200,000 motorcycles and mopeds, as well as almost half a million bicycles.

Chinese Investments

China is actively investing in Kazakhstan and in 2005-2019 was Kazakhstan’s fourth biggest investor after the Netherlands, the United States, and Switzerland. The gross inflow of direct investment from China to Kazakhstan in 2020-2022 amounted to US$960 million, US$1.85 billion and US$996 million, respectively. Interestingly, half of all Chinese investment in 2022 came in the fourth quarter.

Since 2005, Chinese investment in Kazakhstan’s economy has amounted US$44.5 billion. This volume includes investments in the capital of companies, the acquisition of real estate or the acquisition of debt instruments, both in cash and in other forms. If purely investment into joint ventures in extraction, especially oil and gas and manufacturing is counted, the total gross inflow of FDI from China, excluding Hong Kong, amounted to US$18.9 billion between 2005 and 2019, being 6% of total investment into Kazakhstan.

In 2019, agreements were signed on 55 Chinese investment projects in heavy industry, energy, agriculture, and the financial sector of Kazakhstan involving some US$27.6 billion. One of the key aspects of Kazakh-Chinese cooperation has been the construction of new transport and logistics corridors, and related infrastructure. This includes two railway border crossings, a cross-border cooperation center, five oil and gas pipelines, in addition to several dry ports and one seaport in Lianyungang on China’s east coast that specifically services the Kazakh and Central Asian market from the economic powerhouse of Shanghai, and the huge production factories in Jiangsu and Zhejiang Provinces.

Growing transit volumes

By the end of 2022, more than 12,000 trains for the year – an average of 33 daily – had passed through the Alashankou and Khorgos border crossings in the direction of both China and Central Asia. Looking ahead, by the end of 2023 the rail transit volume is expected to have reached 24.5 million tons of cargo or 1.1 million DFO (20-foot containers); by 2025, the goal is to increase this volume to 30 million tons.

Chinese companies are also involved in the key infrastructure projects in the transport sector, such as the railway line through Almaty, including connecting it to the new Bakhty border crossing in China’s Western Xinjiang Province. In addition, as part of the construction of the Trans-Caspian International Transport Route, the volume of cargo transportation along this corridor increased nearly three-fold to over 1 million tons of cargo.

There is an active construction of terminal infrastructure at the Dostyk railway station, close to the Chinese border, which is expected to expand the trans-shipment capacity to 480,000 thousand tons per year against the 160,000 tons carried in 2021.

An example of a significant joint industrial business project was the start in November 2022 of the construction of a new full-cycle multi-brand car plant in Almaty, with an area of 100,000 square meters and a total investment of US$222 million. The uniqueness of the industrial site lies in the fact that it will produce cars of three popular Chinese brands – Chery, Changan and Haval.

The significance of this planning should not just be perceived as a Kazakh play. The country is a member of the Eurasian Economic Union (EAEU), a free trade bloc that also includes Armenia, Belarus, Kyrgyzstan, and Russia. Kazakh-made, Chinese branded autos can be expected to progress to these markets in due course.

In total, 52 joint industrial projects worth more than US$21 billion are being implemented between Kazakhstan and China. These include a petrochemical complex in Atyrau, two wind farm projects in Zhanatas and Shelek; a glass plant in Kyzylorda, as well as a joint venture for the production of fuel assemblies for Chinese nuclear power plants based on the Ulba Metallurgical Plant.

Atomic energy trade

Kazakh-Chinese cooperation in atomic energy is of special attention. The first batch of fuel assemblies for nuclear power plants produced by the Ulba TVS JV (51% owned by NAC Kazatomprom, 49% by China Nuclear Energy Corporation, CGNPC) was delivered to China back in 2021. In 2022, according to the State Revenue Committee of Kazakhstan, the export of fuel assemblies to China amounted to US$51.1 million; this unit is scheduled to reach its design capacity of 200 tons per year in 2024.

In turn, the even larger China National Nuclear Corporation (CNNC) has begun construction of a full-fledged uranium trending hub in China’s Xinjiang Province, close to the border with Kazakhstan, near Alashankou. By 2026, the storage capacity of this is estimated to be 23,000 tons of uranium, comparable to the annual production of the metal by Kazakhstan, which supplies 40% of the global uranium market. That uranium will now be a manageable, tradeable commodity with profits split between the two countries.

A multi vectorial foreign policy

Kazakhstan’s growth of economic cooperation with China takes place amid racial geopolitical changes across Eurasian continent. With the Ukraine conflict likely to drag on, Kazakhstan has an opportunity to reduce its dependence on Russia. Officially allied and linked through many multilateral security and economic alliances led by Russia, for Kazakhstan there has been a lot of unease concerning the longer-term implications of the Russia-Ukraine issue, including fears that Russia could turn east. While unlikely, Kazakhstan also has China, which has available investment capital and can act as a crucial counterbalance to any external pressure from Moscow that Astana might feel.

Indeed, for Beijing, Kazakhstan is a vital artery in the Belt and Road Initiative. China’s interests in Kazakhstan were highlighted during a visit by Chinese President Xi Jinping in September 2022, who chose Astana as his first overseas destination since the Covid-19 outbreak. The Chinese leader supported Kazakhstan’s independence and committed to protect its territorial integrity.

The message was seen as a warning not only to non-regional actors, but also states with potential geopolitical ambitions over Kazakhstan and in generating Central Asian unrest in general.

Beijing’s messaging was especially timely as Kazakhstan had to deal with internal unrest in early 2022, with the Moscow-led Collective Security Treaty Organization troops being dispatched to stabilize the situation in the country.

Kazakhstan’s growing relations with China should be seen within the framework of the multi-vector foreign policy the country has been pursuing, now accelerated amid the Ukraine conflict. Astana has increased cooperation with Turkiye, and the European Union and maintains healthy ties with the United States. Relations with Russia are regarded as a necessity in Astana’s multi vectorial foreign policy and is needed, conversely, to balance China and vice versa.

As such, Kazakhstan’s multi-vector foreign policy is based on constant balancing. It requires stamina and acute understanding of the evolving geopolitical landscape in Eurasia. To be successful it also needs to be rooted in practical policies such as transit, trade and investment, all areas where Kazakhstan has skillfully managed the interests of various states and upheld its own geopolitical position as a critical country for Russia, the EU, Turkiye, India and China in their quest to expand their influences in Central Asia.

Emil Avdaliani is a Eurasian strategic analyst. He can be contacted at emilavdaliani@yahoo.com

Related Reading