The Belt and Road: Five Opportunities for Foreign Investors

There has been much written about China’s Belt and Road Initiative, both in terms of its geopolitical issues as well as the unprecedented amount of commentary, both positive and negative in terms of what it means. I don’t think I’ve witnessed such a partisan response to what amounts to a policy and investment program. What is clear is that the Chinese have been very astute in getting their SOE’s and related businesses to clean up on Belt and Road infrastructure projects on a global basis. What is less clear is how foreign businesses can participate.

The Hong Kong Trade Development Council have been at the forefront of such thinking, and have gone to the extent of launching their own, informative Belt and Road Portal. Hong Kong has positioned itself wisely as a service center for mainland Chinese companies looking to expand overseas, and provides a substantial platform to allow them to do so – everything from raising capital to logistics. What isn’t quite so well defined in Hong Kong is how foreign, non-Chinese companies can become involved. In fact, recently, there have been issues in the territory about how hard it is now becoming for small-medium businesses to even operate in the territory, and especially as regards banking facilities. These are being withdrawn from SME’s at an increasing rate, even though the process to incorporate a Hong Kong company as a foreign investor remains simple. However, arranging banking facilities in Hong Kong is another issue and can be dealt with by Dezan Shira & Associates Hong Kong office.

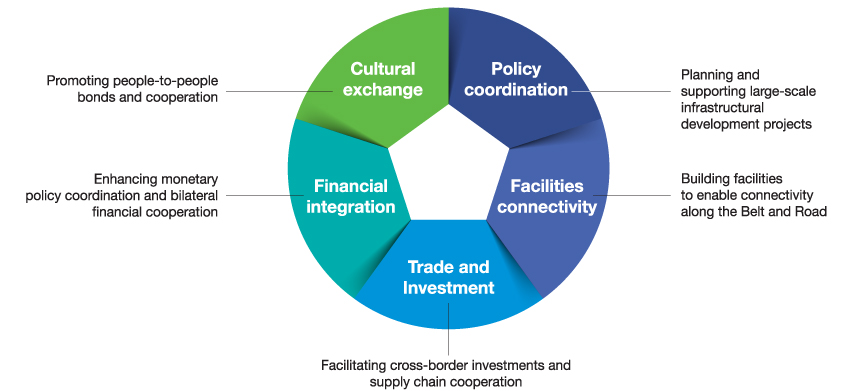

In fact, there are five key areas in which foreign companies can participate in China’s Belt and Road Initiative, and use Hong Kong (or other locations) to do so. These principally revolve around support and opportunity services. We can examine them as follows.

Cultural exchange

The HKTDC have identified 71 countries, including China as being targets for the Belt and Road Initiative, although not all of them, such as India, have actually signed up to the program. Many of these are small nations, yet with very specific cultural identities. Religion and language are key soft elements to understand and to get across, while many sensitivities exist across the region. Services provided can take the shape of everything from translations, local market intelligence, and promoting people-to-people bonds and co-operation. Each of these 71 nations engage with China in different ways, however, and that engagement is only going to increase. Foreign nationals from any of the countries concerned should be assessing what talents and skills they have and how they can bring those to create opportunities for China’s needs along the Belt and Road. It can also be fun – I financed a Silk Road inspired haute couture fashion collection in Estonia last week, and it generated rave reviews. That in its own right is morphing into business opportunities in the sourcing of garments and textiles and selling high-end fashion. It’s not a Belt and Road project per se, but it does show that with a bit of imagination, individuals from the 71 nations mentioned and beyond, all have a chance of engaging with the Belt and Road through cultural awareness and fulfilling the soft needs.

Financial integration

This is very much something Hong Kong can and does provide, and does it well. But there are other financial centers and countries, such as Singapore, which also provide regional hubs. I mentioned the 71 participating nations, and each of these also have their own financial platforms and infrastructure. Matching those to Chinese requirements is a task for locally aware individuals and financial research businesses. Shanghai, meanwhile, has set out its stall to become a “Belt and Road Investment and Financing Centre” while China has recently approved the issuing of the first Belt and Road Project Bonds, allowing the Chinese company Hongshi to issue bonds to finance a cement plant in Laos. That bond raised just under US$50 million and was placed on the Shanghai Stock Exchange. Others are sure to follow. Getting such financing in place, however, requires a great deal of due diligence and local research, in this case concerning the project viability in Laos. Meanwhile, Beijing and London have been coordinating over the establishment of a Belt and Road Development Fund, and again, others of this type can be expected to follow. Localized individuals in any of the 71 countries mentioned may be able to sell their services to bankers and the money men responsible. Research is going to be a key service here, especially as many of the Belt and Road countries are not open or well known. Local knowledge to assess risk is going to be a valuable commodity along the Belt and Road routes.

Policy coordination

China has been very astute when it comes to matching its Belt and Road dreams to other nations’ own development plans. Beijing has been very open and receptive to this joint coordination. Money always follows government policy, and again studying the development policy of any of the 71 countries involved and matching that to China’s Belt and Road ambitions is a smart move. Where are the overlaps? Because wherever they are, there will be money and there will be opportunity. China is looking to coordinate the BRI with Kuwait’s national development program as an example, and has been looking at other bilateral and multilateral cooperation too. Among the largest projects are the longer term plans to link the Belt and Road with the Russian-led Eurasian Economic Union to create a “Greater Eurasian Partnership”.

Policy also includes trade and tax, as well as the movement of people. Examining China’s bilateral trade agreements and free trade agreements to examine where the trade opportunities lie is something that needs to be carried out. (Dezan Shira & Associates has such a team in place). Of the trade deals in the offing, China is negotiating with the Russian led Eurasian Economic Union over a Free Trade Agreement that will see bilateral trade between the two countries and the EAEU’s Central Asian members expand exponentially. India is also in negotiations with Moscow over a similar deal while a large number of other nations are also contemplating such agreements, as are Singapore and Indonesia. Vietnam already has an FTA with the EAEU, and this has seen Viet-Russian trade rise from nowhere to US$10 billion in just two years. Clearly these agreements are going to change the global supply chain and create new trade opportunities. Knowing where these are is a key element to future business success. Following policy matters, and this intelligence has value.

Facilities and connectivity

This is where the Belt and Road Initiative gets hi-tech. New technologies such as 5G and blockchain are going to shape the way that trade is conducted and how logistics behaves. As I explained last week, the Belt and Road is ushering in new technologies and there are tremendous opportunities to get involved. IT and imagination are key here, and help explain why countries with vision, such as tiny Estonia, have already been positioning themselves as logistics suppliers to China, essentially acting as a routing hub for Chinese products to access the EU. IKEA, for example, uses Tallinn as a port to consolidate shipments of their Chinese manufactured furniture en route to Europe.

Not everyone is up to speed as concerns the connectivity issues along the Belt and Road, and there remains a lot to be done – meaning there are opportunities. Some of the connectivity issues are big ticket items, such as the joint China-France Eutelsat Silk Road Satellite, which will significantly improve communications along the entire Eurasian landmass. Others, though, just require vision, and technical skills. Connectivity is a key growth area in the Belt and Road routes, and individuals and companies with local and global IT expertise can expect to be in demand.

Trade and investment

The entire Belt and Road Initiative has trade at its heart, and the opportunities are immense. While many have focused on China’s ability to develop infrastructure to help sell its products overseas, the flip side of the coin is that China’s Communist Party must also work hard to keep the nation happy. That means enabling Chinese nationals to purchase products from overseas. China has already indicated its options by entering into negotiations with the EAEU as I mentioned above, and it is still stimulating domestic demand via tax cuts. Good news for foreign exporters to China is that China has just reduced VAT in the manufacturing, transportation, construction, telecommunications, and agricultural sectors.

Accessing Chinese consumers has long been the holy grail of China focused businesses, and new trade routes are opening up to develop this. I highlighted the fastest growing China-Belt Road Trade Corridors in 2018, and this has been underlined by newly released trade statistics that illustrate that China-Belt Road countries’ trade increased 14.8 percent to US$1.1 trillion last year. The Belt and Road trade trend is not just up, it’s positively bullish.

China has some one billion consumers with online access and they want to buy. The national goal is to get all 1.3 billion Chinese with access to online shopping by 2020, and to provide them with 48 hour delivery services. Getting products to them is part of the concept of the Belt and Road, and the infrastructure is being put in place – from hardware such as roads and rail and ports to software such as translations skills, tax advisory, and IT developments in 5G and blockchain.

It also means that nearly everyone on the planet, for the first time, has the ability to sell to China. Working out where the opportunities are is one issue, but the software of doing so online is already in place, as explained in our new and complimentary issue of China Briefing Magazine: “Cross Border E-Commerce in China”. (It is a free download.)

These five areas show what is needed, and where the opportunities are for participating in China’s Belt and Road Initiative. The beauty of the concept is that you don’t have to be in China to be involved. Instead, individuals and businesses with localized knowledge in their country of origin are already at an advantage. All it takes is imagination and vision, and an understanding of what China wants. Key to the Belt and Road Initiative are market intelligence and knowledge. Marry those with the trade potential and there is no reason why anyone should not be able to take those first few steps along the new Silk Road – and take advantage of the opportunity.

About Us

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates. The practice assists foreign investors throughout Asia and maintains 28 offices across China, Hong Kong, Singapore, Malaysia, Thailand, Indonesia, Vietnam, India and Russia. We also have partnerships with another 225 firms throughout the world. For assistance with China’s Belt & Road Initiative, or for matters involving selling to or doing business in China, please email the firm at china@dezshira.com, or visit our practice at www.dezshira.com

Related Reading:

Related Reading:

China’s New Economic Silk Road

This unique and currently only available study into the proposed Silk Road Economic Belt examines the institutional, financial and infrastructure projects that are currently underway and in the planning stage across the entire region. Covering over 60 countries, this book explores the regional reforms, potential problems, opportunities and longer term impact that the Silk Road will have upon Asia, Africa, the Middle East, Europe and the United States.

Cross Border e-Commerce in China

While cross border e-commerce (CBEC) is an attractive channel for foreign businesses to sell to China, misunderstandings over how CBEC in China works frequently end in costly disappointments and retreats from the market. In this issue of China Briefing magazine, we offer foreign investors a practical guide to selling to China through CBEC. We begin by introducing the market landscape, before diving in to the sector’s legal and regulatory framework. We then compare the advantages and disadvantages of different CBEC business models. Finally, we consider how to protect intellectual property in China when selling online.

Silk Road and OBOR Business Intelligence

Dezan Shira & Associates´ Silk Road and OBOR investment brochure offers an introduction to the region and an overview of the services provided by the firm. It is Dezan Shira´s mission to guide investors through the Silk Road´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.

Dezan Shira & Associates’ Service Brochure

Dezan Shira & Associates´ brochure offers a comprehensive overview of the services provided by the firm. With its team of lawyers, tax experts, auditors and consultants, it is Dezan Shira´s mission to guide investors through Asia´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.