China’s Belt & Road Initiative: Where We Are Now And What Is Arriving In 2020

Op/Ed By Chris Devonshire-Ellis

Administrative, Legal, Tax & Free Trade Infrastructure Developments Point To Increasing Foreign Participation

China has been making steady progress along the BRI and will continue to do so in 2020. This has not just been limited to infrastructure projects; much documentation and regulatory agreements have been put in place too. A look at the article Free Trade Agreements along China’s Belt and Road Initiative explains the tax benefits and where they are, while the essay Free Trade Zones along China’s Belt and Road Initiative: The Eurasian Land Bridge shows how these are being put into operational practice.

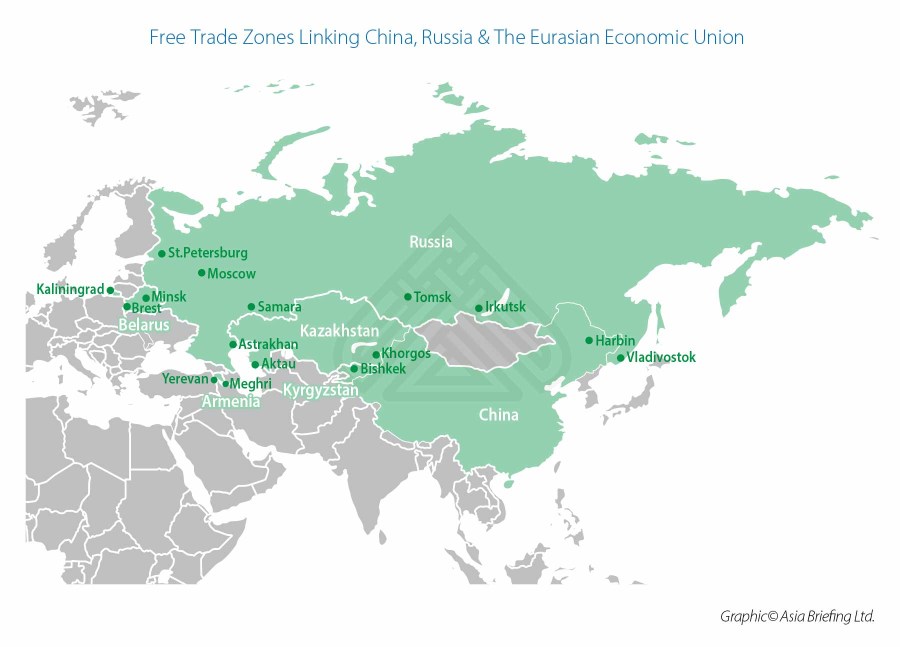

In terms of linking China to the West, and providing free trade and export processing facilities, the map below indicates how the Eurasian Land Bridge is developing is currently taking shape in cooperation with Kazakhstan, Kyrgyzstan, Russia, Armenia and Belarus all developing processing facilities across Eurasia. These countries are all part of the Eurasian Economic Union, which stretches between the borders of China to the borders of the European Union.

This has been further enhanced by developments China has made on its own territory. Beijing announced that six new Free Trade Zones would be established in Provinces with land and/or sea port borders, while a further 24 e-commerce zones are to be established, again covering China’s border areas. Clearly, China is developing internal trade hubs to facilitate import, export, and the processing of trade goods.

Also underway are negotiations between China and Moscow concerning the applicable tariff reductions to be included in the Free Trade Agreement Beijing has already signed off with the Eurasian Economic Union. The EAEU, which as mentioned above includes Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia, has also signed free trade agreements Singapore, Serbia, Iran and Vietnam and is currently negotiating the same with India, Indonesia, and Thailand among others. It remains unclear when the China-EAEU FTA will include tariff reductions and eliminations, however when it does the impact will be significant. The map below gives the current state of the Eurasian Economic Union, its members, free trade partners, and negotiations in progress.

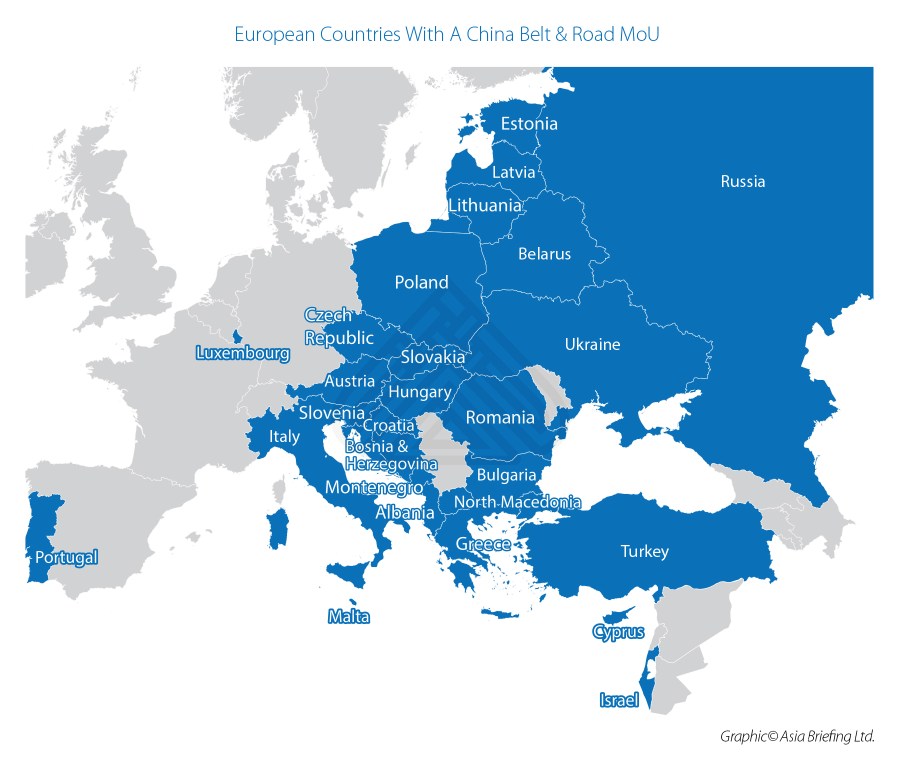

In terms of new countries and territories signing up to the BRI, over 150 countries and territories have done so far, meaning a slow down in this pace of commitment will naturally occur. Some of the smaller island nations and especially those aligned with Taiwan may well sign off, while South America remains Belt & Road light. Some additional African nations may also join. In Europe, the recent decision not to extend membership to Albania and North Macedonia may have a knock on effect in the Balkans, who in not wishing to align with Moscow and the Eurasian Economic Union is likely to spur a less controversial move to the BRI instead. I would be surprised if the UK, in the wake of Brexit committed, however other European nations such as Denmark, Finland, Norway and Sweden may in time consider. This is especially relevant if China intends to make serious investment commitments to developing the Arctic and the Northern Sea Passage. It will need these nations onside to help develop the infrastructure to develop the potential within the EU. We can look at the existing state of play of Europe in the map below which features the current European nations with a China Belt & Road MoU.

At present, much of the infrastructure work along the BRI has been undertaken by Chinese SOEs, but the percentage of foreign participation is growing. China’s new Foreign Investment Law, which kicked in on January 1st, also opens up the Belt and Road to foreign investors. We discussed how China’s new foreign investment law would impact upon the Belt and Road Initiative here and how foreign companies may now participate in Chinese procurement contracts. We also discussed the issues when getting involved in China Belt and Road Project Contracts here. China’s Belt and Road Initiative isn’t going to go away anytime soon and increasing numbers of foreign businesses will begin to get involved. 2020 promises to be a year when some maturity comes into how the Belt and Road Initiative is viewed, managed, and becomes less exclusive – to the benefit of foreign investors.

Related Reading

- Typical China Loan Deals To Belt & Road Countries Revealed

- Russia Tax Preferences To Spur US$243 Billion Investments & Tax Free Zones For Russian Arctic Development

- Russia’s Free Trade & Special Economic Zones

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm provides strategic analysis, legal, tax and operational advisory services across Eurasia and has done since 1992. We maintain 28 offices throughout the region and assist foreign governments and MNC’s develop regional strategies in addition to foreign investment advice for investors throughout Asia. Please contact us at asia@dezshira.com or visit us at www.dezshira.com