The Belt & Road’s Business Secret: Cashflow Opportunities Come After Infrastructure Development

Op/Ed by Chris Devonshire-Ellis

Many years ago I attended a private audience with then Chinese Premier Zhu Rongji. He and the Chinese President, Jiang Zemin, had been largely responsible for forging an exciting atmosphere of can-do achievement in China, both in terms of opening up the country to foreign investment, as well as embarking on a massive national plan of dynamic infrastructure build and redevelopment of what was at the time, a fairly backward nation.

I travelled a great deal across China in those days, with our firm, Dezan Shira & Associates willing to take on international clients anywhere within the country. I wanted us to “stick client flags” in every single major city and province in China, a goal that was completed by about 2008. But it was something that Zhu said about the development of China that was going on at the time that pricked up my ears. When it came to the infrastructure projects that every major city and province in China was going through then, he had a simple justification for it “If we build the roads and bridges, business opportunities will come.”

I never forgot that, and although there have been a few white elephants along the way when certain local governments got carried away and built airports no-one really needed (Zhuhai, anyone? Or Manzhouli with its population of 250,000 and an annual airport passenger capacity of 5 million?) Zhu’s premise has largely become true.And so it is with the Belt & Road Initiative. This is purely a continuation of China doing what it does very well – develop infrastructure. I spotted this and wrote about this from the perspective of where China’s overseas investments were heading back in 2013 in the article “China – The Great Infrastructure Developer” That article predates the Belt & Road Initiative, and was written when many US and EU business leaders were asking when China would be investing in the United States and Europe. I said that wouldn’t happen, and that while Chinese foreign investment was growing, it wouldn’t be heading where people thought it would. Its easy to claim that in hindsight, but I effectively predicted the Belt & Road was on the way, even though it hadn’t been titled yet. Now though, the Belt & Road has become a cornerstone of Chinese policy and one of the largest global development initiatives ever seen.

But as I wrote in the article “China’s Belt & Road – The Most Internationally Divisive Campaign Of The Past 25 Years” the reaction to it has been far from passive. There have been accusations of Empire building, Chinese Colonialism, Debt Traps, Military Buildups and massive corruption. But as I found out after an ex-boss in my pre-China days in Hong Kong told me “Chris, don’t go to China. Its communist, dirty, and they’ll rip you off” – all of which was true, the same can and is said of the Belt & Road Initiative. But crucially, none of it to a terminal state. And so it is with the Belt & Road Initiative. Not all of the projects will work, some will be white elephants, and there will be corruption and sometimes it will go wrong. But that doesn’t mean it is a bad idea or will run out of steam either.I also recall Zhu Rongji getting angry with Chinese construction bosses after a new dam they had built in a town in Sichuan failed, causing numerous deaths and a devastated landscape. “What did you build it out of?” He demanded to know “Tofu?”. Not everything China does with its Belt & Road Initiative will be totally excellent. There will be shoddy works and problems along the way. But the point is that the vast majority of it will be fine, and that China will generally do a good job on the infrastructure build wherever it is. Meanwhile, what a lot of a anti-BRI brigade have missed when criticizing the Belt & Road Initiative and its projects is what happens afterwards. They criticize the build, but fail to look any further beyond that.

One project that is often touted as an example of Chinese debt trap development and white elephant building is the Hambantota Port in Sri Lanka. There are negative reviews of this from the New York Times the Center For Strategic Studies and Quartz among many others. I wrote a response to these pieces in the article “China’s Belt & Road Initiative Is Being Blamed For Sri Lanka’s Hambantota Port Problems. But The Real Story Is Rather Different”. Unlike the “Special Report” status the latter publications gave their stories, I had an even better one – I live there for part of the year and relatively close to the Port itself (Hambantota is a 90 minute drive along a Chinese expressway from my home near Galle on the South Coast).

While the Hambantota Sea Port itself may well be a bit of a White Elephant at present, it remains true that Sri Lanka needs a South-Eastern airport alternative to Colombo – and this was built as part of the Hambantota project. It too, is currently in mothballs while the Sri Lankan Government work out what to do with it – however this remains a local political issue and isn’t anything really to do with China. And despite these two current Hambantota failures – a vastly under-utilized Port and Airport – there have been distinct positive spin offs. The infrastructure development that went with those developments includes the little mentioned Southern Expressway. That has been picked up by local and other foreign investors and utilized primarily for the extra-curricular development of the Sri Lanka tourism industry. That isn’t a Belt & Road Initiative direct story – but it is a Belt & Road Initiative influenced success. It is also one that had an immediate impact:

Foreign Tourists Visiting Southern Sri Lanka

2012: Before the Southern Expressway was opened: 540,000

2013: Immediately after the Southern Expressway was opened: 1,200,000

2018: Subsequent growth to: 2,300,000

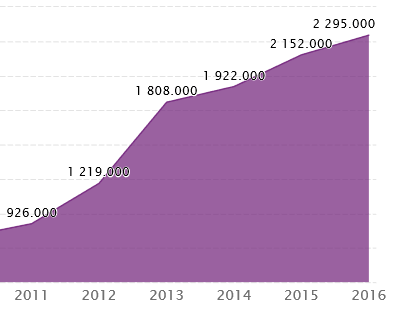

In terms of spend, this chart from CEIC shows the expenditure of tourists visiting Sri Lanka.

International Tourism Spend In Sri Lanka, US$ Billions

As can be seen, both the volume of tourists and their spend increased significantly in Sri Lanka after the Southern Expressway – part of the Hambantota Port and Airport projects – were completed. As Zhu Rongji said “If we build the roads and bridges, business opportunities will come.” The reporters covering the Hambantota Port ‘failure’ have failed themselves – in discounting the total impact of the infrastructure built at Hambantota and disregarding the spin off benefits.

In fact several financial houses and think tanks take the same position as Zhu Rongji stated and as I have observed first hand. Singapore’s DBS Bank issued a report last year titled Understanding China: BRI In Southeast Asia – Beyond Infrastructure in which they state “The Belt & Road Initiative will help to improve infrastructure conditions in SE Asia, enhance the overall investment environment and attract the general FDI inflows. An improvement in power supply and transportation networks, for instance, will reduce the production and logistics costs. This will, in turn, encourage Chinese (and other foreign) companies to invest and build manufacturing facilities. In addition, the infrastructure projects under BRI will create a value chain for services. This will involve not only project financing, but also engineering consultancy, engineering insurance, infrastructure management, legal, advisory and various other types of professional services. Investment opportunities will also arise in these areas.”

In Sri Lanka’s case the investment opportunities mentioned by DBS arose in the tourism sector, and now contributes several billions of dollars of revenue per annum in sustainable trade. That will more than offset the cost of building the two currently underused Ports at Hambantota. It might not be the greatest example of BRI infrastructure as a success story – but the message is clear.HSBC concur. In their 2019 Global Asset Management Report, titled “Belt, Road & Beyond – Understanding The BRI Opportunity” the bank states “Belt & Road countries vary; some are tiny and poor, others are well developed and economically strong. For the poorer countries in particular, the BRI is a source of much-needed development funds, and in particular funding for crucial infrastructure such as highways, bridges and port facilities. It also gives these countries access to a new and potentially rich market – China, and other new markets along the Silk Road routes. This in turn enables such countries to reduce their reliance on support from developed countries.”

Concerning Central Asia, the Norwegian backed OECD has produced a 2019 review of Chinese infrastructure projects in the region, in a PDF titled BRI In Central Asia – Overview Of Chinese Projects

Deloittes meanwhile also produced a report at the end of last year titled Embracing The BRI Ecosystem and states “BRI is a collaborative ecosystem that to date has focused on energy and infrastructure but over the next five years and beyond will evolve to concentrate on manufacturing, trade, internet, tourism and other aspects.”

In all these cases, the message is the same. As Zhu Rongji said, “Built the infrastructure and business opportunities will arrive.” In other words, development along the Belt & Road Initiative is all about creating – and taking advantage of – the sustainable cash-flow business opportunities that the infrastructure build provides. That requires logical thinking and the application of entrepreneurial instincts. Business students and academics should be looking at the opportunities for business development, the infrastructure build provides, not purely concentrating on the projects themselves, no matter how large, impressive or even implausible they may initially be described, and especially in Western media.

Evaluating BRI Projects For Spin Off Business Opportunities

- What is the local catchment area by population likely to be affected by the infrastructure build? Will this attract more people to the region? If so what will be their needs?

- What are the local industries? How could they be impacted by the local infrastructure build?

- Does the project provide interconnectivity? If so where too? Will these areas change? How? What industries could use this new trade corridor?

- Will demand for utilities and supplies increase as a result of the project and subsequent spin offs? If so, which ones?

- Are there international implications? Will demand for personal skills such as languages, restaurants and so on increase?

The Belt & Road Initiative has attracted a great deal of attention from global MNC’s, lobbying to take part in some of the multi-million dollar, news headline making infrastructure projects that are and will continue to be announced. In reality, a great deal of these will be taken up by Chinese contractors, rather than foreign ones, although I have commented on a recent, still emerging trend for global contractors to get involved and partner with Chinese contractors. I discussed how to go about this in the article Preparing Foreign Investors For China’s Belt & Road Projects in which I talked about how foreign contractors could partner with Chinese firms and sell products and services to them as part of BRI infrastructure deals. In fact, Beijing is keen to see more foreign participation as needed expertise and technologies are required to be brought in.

That said, the real key to understanding the opportunities that China’s Belt & Road Initiative infrastructure project build brings is to look beyond the project itself, but instead how it can best be utilized. It isn’t the project itself that is the key, it is the business development and cashflow opportunities they represent that is where the real sustainable income will be made. While the Belt & Road is often talked about in billion dollar infrastructure contract terms, it is the local on-the-ground expertise and entrepreneurs who will really reap the local build advantages.

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. The firm provides business intelligence, legal advisory, tax advisory and on-going legal, financial and business operational support to investors throughout China, India, ASEAN and Russia, and has 28 offices throughout the region. We also provide advice for Belt & Road project facilitation. To contact us please email silkroad@dezshira.com or visit us at www.dezshira.com