Turkiye’s Multilateral Trade with Central Asia: Current Situation and Future Prospects

Overall growth with the proposed Turancez FTA a potentially significant major trade corridor boost

By Farzad Ramezani Bonesh with additional commentary by Chris Devonshire-Ellis

Introduction

With the collapse of the Soviet Union, the Turkish recognition of the independence of the newly created republics of Kazakhstan, Turkmenistan, Uzbekistan, Kyrgyzstan, and Tajikistan in 1991 was the first step in Turkiye’s diplomatic, economic and political relations with Central Asia.

Ankara, due to its linguistic and to some extent Turkic historical commonality with the majority of the Central Asian republics, immediately recognized the independence of these countries and played an active role in the region by establishing bilateral relations with them.

Turkiye today is one of the 20 largest economies in the world, has developed as an important player in the region and has a significant level of economic development, and economic capacities for cooperation and engagement with Central Asia.

A key factor of the recent economic approaches of Turkiye’s foreign policy is to have close relations and grow trade, develop exports, attract foreign investment and foreign contractors, establish free trade agreements, create a positive image, and strengthen economic diplomacy with the Central Asian region.

Energy

Central Asia’s energy sector and the natural hydrocarbon reserves of Kazakhstan, Turkmenistan, and Uzbekistan are more economically important than other sectors and are of interest to Ankara. In terms of natural gas reserves, Turkmenistan ranks fourth in the world, while Kazakhstan and Uzbekistan also have significant reserves – in terms of oil, Kazakhstan ranks 11th globally.

Turkiye also participates in the exploration and exploitation of energy resources; and pursues a serious presence in the creation and construction of energy export lines, the transfer and crossing of energy lines in the medium and long term, and the diversification of energy sources and ensuring energy security within and from Central Asia.

To be positioned as an energy transit hub, Ankara expects to receive gas from the region and Turkmenistan through the Trans-Anatolian Natural Gas Pipeline (TANAP).

Meanwhile, the agreement between Azerbaijan and Turkmenistan on the joint development of the Dostluk gas field under the Caspian Sea and the joint development of the Kepez/Serdar field is a step in tripartite cooperation in the exploration, development, and implementation of the Trans-Caspian pipeline in line with the interests of Ankara.

In addition, Ankara is looking to increase the delivery of Kazakh oil through the Baku-Tbilisi-Ceyhan (BTC) pipeline.

Turkiye, along with the establishment of the Turkish Cooperation and Coordination Agency (TIKA) is promoting economic cooperation, implementing construction projects, investing in various fields, and has implemented numerous projects in sectors such as transportation, communication, construction, mining, oil, and Gas, and building schools and universities in Central Asia. The establishment of TIKA largely solved the deficiencies in technical infrastructure and projects and its offices were opened in the region in the post Soviet era.

Attracting FDI

Turkiye also aims to increase and diversify the area of cooperation through mechanisms such as high-level mutual visits, joint economic commissions, trade councils, and high-level strategic cooperation. Turkiye’s relations with Uzbekistan, Kazakhstan, and Kyrgyzstan are at the level of strategic partnerships, while its relations with Turkmenistan and Tajikistan are developing.

One of the dimensions of Turkiye’s economic diplomacy is attracting foreign direct investment and encouraging the Turkish private sector investment abroad. Turkiye with its state and non-state sector facilities in the region has provided investment grounds by allocating monetary and financial credits to these countries.

Turkiye’s investment in Central Asia currently stands at over US$85 billion, and includes several large projects such as the redevelopment of the Turkmenbashi Caspian Seaport. Almost 4,000 Turkish companies operate in Central Asia. As can be seen, China’s Belt & Road Initiative blueprint has launched additional infrastructure projects, with Turkiye one of the countries spreading the connectivity concept.

Transport

Ankara has also diversified transportation and alternative routes. Turkiye’s attention to the development of the Middle Corridor in Central Asia, agreements with Azerbaijan, China, Georgia, and Kazakhstan to improve the connection of this corridor in December 2020, while cargo train freight volumes from Turkiye to China through this corridor have increased.

From this perspective, the middle corridor passes through Georgia, Azerbaijan, and the Caspian Sea, enhances China’s Belt & Road Initiative routes and reduces travel time.

In addition, the Lapis Lazuli Corridor connects Afghanistan, Turkmenistan, Baku, Georgia, and Turkiye, while the launch of the Baku-Tbilisi-Kars (BTK) railway to Kars city in eastern Turkiye is another step in the expansion of Turkiye’s trade cooperation with Central Asia.

Multilateral Trade

Another approach for the development of Turkiye’s economic cooperation in the Central Asian region is the multilateral trade councils.

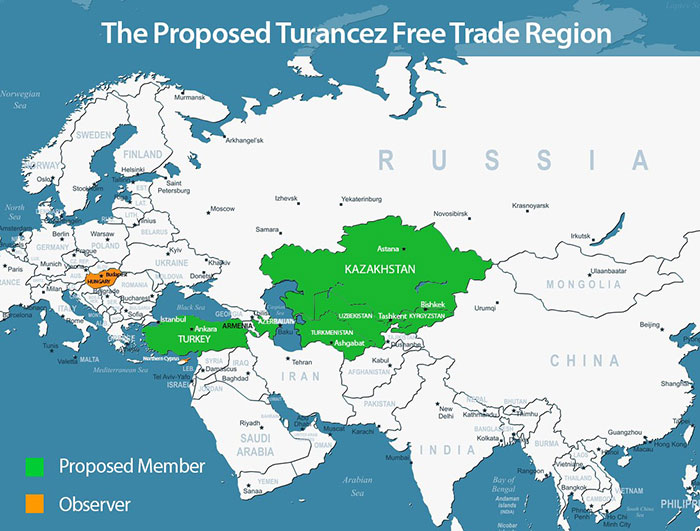

At the last Organization of Turkic States (OTS) summit in November 2022 in Samarkand, the expansion of economic relations between Turkiye and the region included positive discussions concerning the proposed TURANCEZ free trade bloc. Devised under the OTS, this would bring together Turkiye along with Kazakhstan, Kyrgyzstan, Uzbekistan, Turkmenistan, Azerbaijan, and as observers, Hungary, part of the EU, along with Northern Cyprus.

Turkish exports would surge if TURANCEZ becomes a reality, especially—and rather counterintuitively—as the Turkish lira has been steadily declining in value. Having a weaker currency is linked to the possibility of higher exports in traditional economics. This could be an unexpected upside to the Turkish lira’s woeful performance in recent years.

Other proposals also include the establishment of a Turkic Common Market, and the establishment of a regional Turkic Development & Investment Bank. If these happen, this will increase the economic convergence of Central Asia with Turkiye.

Other connectivity infrastructure is also on the rise. The launch of the regional Turkic TV station TRT Avaz has been influential, with programs televised in Azeri, Bosnian, Turkmen, Kazakh, Kyrgyz, and Uzbek with Turkish-language subtitles. TRT Azat includes Turkic documentaries, talk shows, culture and music programs as well as region-specific films and soap operas. Audiences also have the opportunity to learn Turkish through tutorials.

With 200,000 Central Asian nationals in Turkiye, and about 40,000 Turkish citizens in the region, tourism, and the associated infrastructure from airlines to hotels are important in expanding the volume of Turkic exchanges. There are opportunities in this sector.

Turkiye has an overall positive trade balance with Central Asia, with a negative trade balance only with Kazakhstan. According to Turkish customs, Turkish foreign trade turnover with Central Asian countries reached about US$12.33 billion in 2022. We examine the trade by individual country as follows:

Kazakhstan

Turkiye has invested about US$20 billion in oil fields, communications, hotel and banking, production of agricultural products, food, steel, textiles, and so on and is in the first rank in terms of the number of foreign companies operating in the country.

Recently and mutually established Joint Venture capital companies as well as 100% Turkish investments in Kazakhstan, and the investment of Kazakh companies in the fields of oil and tourism in Turkiye have all increased. In Kazakhstan, Turkish construction projects have so far amounted to US$21 billion. Bilateral trade between Kazakhstan and Turkiye was US4.1 billion in 2021, with the prospect of developing this to US$10 billion by 2030 according to goals set by both sides. In 2022, Kazakhstan became Turkiye’s main trade partner among Central Asian countries.

In 2022, the trade volume between Ankara and Astana increased to US$5.5 billion. About 2/3 of bilateral trade is in Kazakhstan’s favour, mainly due to energy supplies.

Turkiye’s imported products from Kazakhstan are mostly oil, in addition to iron, steel, copper, grain, and mineral fuels, while and most of Turkiye’s exports are from the food industry products, iron, mechanical and electrical devices, textile, clothing, ceramics, and glass industry products.

Uzbekistan

Uzbekistan’s open economic policy has had a positive effect on economic and trade cooperation with Turkiye, with more than 30 protocols and agreements in economic, trade, technological, tourism, and health fields, an expansion of bilateral trade to US5 billion by 2030 has been targeted.

The two countries cooperate in the automotive, textile and clothing industries, oil and gas transmission, and telecommunications. In 2022, the total bilateral trade turnover reached about US$3.6 billion, with Turkish exports slightly higher than imports from Uzbekistan.

Uzbekistan is one of the main destinations for Turkish products in Central Asia, with Turkiye outstripping demand from China in 2022. Turkish exports vary from food and textile products to industrial goods and machinery. Turkiye imports products such as copper, zinc, cotton, and cotton products from Uzbekistan.

Turkmenistan

Turkiye ranks high in Turkmenistan’s foreign trade and with the participation of Turkish companies. Ankara, with more than 800 projects has a leading role in the construction industry of Turkmenistan.

Among the products imported by Turkiye from Turkmenistan are fuel and mineral oils, candles, cotton, plastic, and raw leather, while most of the exports are machines and devices, and household appliances. In 2022, bilateral trade exceeded US$2 billion for the first time, with a 21.9% increase over the previous year. Trade is very much in Turkiye’s favour with about 90% of the volume being Turkish exports. That can be expected to change over time as much of Turkiye’s exports are related to the energy pipelines that will later bring Turkmen gas to Turkiye.

Kyrgyzstan

Wholly Turkish owned and Kyrgyz-Turkish JVs are active in food and beverage production, construction materials, textiles, clothing, leather products, furniture, banking, and services, with bilateral trade almost doubling between 2019 and 2021. That has now reached slightly under US$1 billion, with Turkish exports accounting for about 80% of the total trade volumes.

Tajikistan

Since 2019, 53 new Turkish-Tajik JV’s have become active in Tajikistan. Turkiye is assisting Tajikistan in the creation of free trade economic zones, construction of hydroelectric power stations, joint investment in agriculture-related sectors, development infrastructure, and tourism, amongst other smaller sectors.

Bilateral trade between Kyrgyzstan and Turkiye in 2022 reached about US$543 million dollars with Turkish exports accounting for about 2/3 of the total.

Challenges and Prospects

Trade integration problems in customs, smuggling, transportation bottlenecks, inconsistent tax laws, financial transfers and services, residence and work, and foreign ownership issues still exist in making life difficult at times in mutual trade and investment development.

These include problems such as foreign capital laws, and a lack of infrastructure and insurance systems in the Central Asian republics.

In the Central Asian market, Russia and China are the most important competitors and business partners of the region. Apart from the periodical political instability of the region, Turkey does not have a common border with the region – relying partially in Iran as both a bridge, and a rival. This means geopolitical factors occasionally override commercial interests, although the development of the INSTC should bring Ankara and Tehran closer together.

In addition, periodic economic problems, such as Turkmenistan completely shuttering its borders during covid have negatively affected bilateral trade and suspended projects.

Trade along the Middle Corridor also faces several challenges, such as underdeveloped infrastructure and delays, while alternative routes that have not yet been fully integrated. In addition, the prediction of the expansion of trade relations between Turkiye and Central Asia is overshadowed by China and Russia. Economic integration within the OTS is also a concern for regional players including Tehran, Beijing, and Moscow.

Turkiye also lacks sufficient financial and technological resources for the region, and despite Ankara’s interest, Turkish economic influence in Central Asia is still somewhat limited when compared to the economic might and influence of Russia and China. However, Turkiye’s approach and turn towards Central Asia with a new geo-economic view, the development of new markets, provision of energy resources, and attraction of foreign investment have been more considered in recent years. Ankara is finding a way to insert itself into the Moscow-Tehran-Beijing triad.

Last year, Turkiye had a positive trade balance with Central Asia, while the growth of the countries economic presence in the region has helped Ankara to become a leading business partner.

Despite Western sanctions on Iran, Turkiye has gained part of the Iranian market in Central Asia and has diversified its transportation routes. Meanwhile, opportunities such as anti-Russian sanctions and the desire of regional countries for commercial diversification have also boosted the potential for the growth of Turkish business in the region. Cooperation with Russian companies in Central Asia and the joining of forces between them is also providing both consolidation and growth.

However, Ankara’s trade with Central Asia is still about 2% of the country’s total trade – meaning a lot of hard work needs to be done – but at the same time there is significant development capacity.

There are numerous opportunities for cooperation between Turkiye and regional players within Central Asia and the OTC, in addition to cooperation with the Middle East, Russia and China. The multilateral potential has not yet been sufficiently filled.

It can be expected that the trade and investment of Turkiye and Central Asia will experience medium growth in the next two-three years – foreign investors should keep an eye on any progress concerning the Turancez trade agreement to establish at which juncture these trade routes become opportunity rich.

Dezan Shira & Associates advises MNCs and foreign government trade organisations into the Middle East and Central Asian regions. For evaluation assistance in these markets, please contact silkroad@dezshira.com for additional research capabilities.

Related Reading