China’s Maritime Arctic Silk Road on Ice

Russian President Vladimir Putin and his Chinese counterpart, Xi Jinping have agreed to build an “Ice Silk Road” following their bilateral meetings in Moscow last week. This references the development of the Northern Sea Passage and the opening up of a route across northern Russia and the Arctic ocean as global warming gradually makes an impact.

Russian President Vladimir Putin and his Chinese counterpart, Xi Jinping have agreed to build an “Ice Silk Road” following their bilateral meetings in Moscow last week. This references the development of the Northern Sea Passage and the opening up of a route across northern Russia and the Arctic ocean as global warming gradually makes an impact.

The announcement comes shortly after China formally included the Arctic Sea as part of its Belt & Road Initiative. China’s National Development and Research Commission and State Oceanic Administration said in a document published on June 20 that a “blue economic passage” is “envisioned leading up to Europe via the Arctic Ocean”.

Titled ‘Vision for Maritime Cooperation under the Belt and Road Initiative’, the plan sets out priorities for the building of the 21st Century Maritime Silk Road, the second leg of the One Belt One Road scheme. It sets out plans for China to build three ocean-based “blue economic passages”: the China-Indian Ocean-Africa-Mediterranean Sea passage, which will run westward via the South China Sea to the Indian Ocean and onto Africa and Europe, while the China-Oceania-South Pacific passage will run southward via the South China Sea into the Pacific Ocean to access the Western coast of the Americas as well as Japan and Korea. “Another blue economic passage is also envisioned leading up to Europe via the Arctic Ocean,” the document states, without giving details about the route.

![]() Related: China’s Arctic Ambitions Grow With Arkhangelsk Port Development

Related: China’s Arctic Ambitions Grow With Arkhangelsk Port Development

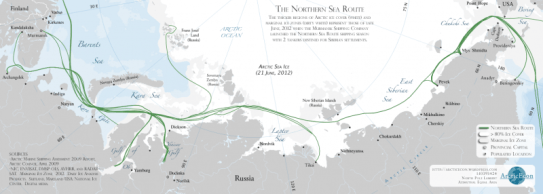

However, Russia has already developed a series of port facilities, over many years, along this route, stretching from the northwest at Kandalaksha near the border with Finland, Severomorsk, a closed city and home to Russia’s Northern Fleet, Murmansk, the Port of Arkhangelsk, Vitino, Naryan-Mar, Belomorsk, Dikson, and Dudinka on the Yenesei River Gulf, Igarka, Tiksi, and Pevek, the northernmost town in both Russia and Asia. From Pevek, the Russian land mass heads south, through the Bering Straits and wraps around northern China until reaching Vladivostok.

Of these, several are relatively small, and support local fishing industries, but Murmansk, Arkhangelsk, and Vladivostok are significant players. The Northern Passage also holds the attention of China, keen to use it to both gain access to Russian oil and gas fields throughout Siberia and believed to exist within the Arctic Ocean itself, and to gain trade access to both Russia, and Northern Europe.

Russia’s Arctic boundary is 24,140 km long and its closest point to the North Pole is Cape Fligely, on Rudolf Island, 911 km from the Pole. There is, however, potential for conflict with the US over the Northern Passage, as Russia claims this as within its territory – a statement contested by the US, which considers it an international route despite it not ever having been viable. It also remains to be seen what actions the US could take along Russia’s own Arctic coastline.

Arctic security, potential shipping routes, and energy resources are all areas of interest for Moscow and Beijing. Gas and oil reserves would be a valuable political tool for Russia in the European energy market, with an estimated billion barrels of oil in the Trebs and Titov deposits alone. Russia is also working towards developing its oil and natural gas reserves, of which 70 percent are within its continental shelf. We can examine the principal Ports as follows:

Arkhangelsk

Arkhangelsk Port sends and receives lumber, pulp, coal, machinery, metals, industrial, and consumer goods, and is the operating base of the Northern Company, facilitating the maritime transport of the White, Barents, and Kara seas, the Northern Passage and overseas lines. There are regular passenger liners from Arkhangelsk to Murmansk, Dikson, Onega, Mezen, Kandalaksha, and Novaya Zemlya.

The Port itself has three cargo areas, a container terminal, and a passenger shipping company terminal. The total wharfage is 3.3 km, with berthing suitable for vessels with a draft of 9.2 m and a length of 175–200 m. It also has 292,000 m² of warehousing facilities and a 2000 m² Bonded Warehouse facility. It can handle 5,762 TEUs at the same time, including up to 200 reefer containers and 2,200 containers with dangerous goods. Bandwidth container terminal 75,000 TEUs per annum.

Murmansk

Murmansk port ranks fourth in Russia in terms of processed goods, and is the second largest in the northwest of Russia, after St. Petersburg. Murmansk is one of the largest ice-free ports in Russia, has 13 berths, and is equipped with modern handling facilities: 52 gantry cranes with the capacity up to 40 tn, one ship loader for handling of apatite concentrate with the capacity more than 1000 th tn/hour, 113 units of fork trucks with the capacity from 1.5 to 32 tonnes. The entire city is classified as a Free Trade Zone, and it is Murmansk that is expected to develop as a major hub for the Northern Passage. Current cargo turnover is about 16 million tons, with this set to double by 2025.

Vladivostok

Vladivostok is very close to Russia’s border with both China and North Korea, and is Russia’s main Port opening onto the Pacific Ocean. It is also linked directly to Moscow via the Trans-Siberian railway. It is a Free Port, with tax incentives for investors (instead of CIT at the usual 20 percent, the Vladivostok CIT rate is 5 percent for the first 5 years, then 12 percent during the next 5 years), and has been heavily invested in by China’s Fesco. It is increasingly becoming a center for auto production and also contains several casinos; the Port has all the expected services in place and has a 200,000 TEU capacity per annum.

![]() Related: Advancing Russian Free Trade With China, Asia & The Pacific

Related: Advancing Russian Free Trade With China, Asia & The Pacific

In summary, Russia’s Northwest Arctic coastline could be operational for regular shipping by 2025. The Russian Regional Governor for Arkhangelsk Oblast Igor Orlov has stated that Russia’s northwest Arctic coastline will be operational and handling regular shipping by this time, while Chinese investment is already going into Arkhangelsk and Murmansk to further develop the existing facilities. Both are expected to be among the world’s top 50 ports in terms of overall capacity, and both are equally capable of handling 30 million tons per annum. The involvement of the Chinese is especially interesting as the Chinese are currently negotiating a Free Trade Agreement with the Eurasian Economic Union (EAEU). Should this happen, bilateral trade between China and Russia, as well as with the other members of the EAEU will massively increase. If so, then the capabilities of the Russian Sea Ports from northwestern Europe to the Russian Far East will see a dynamic shift in how Eurasian shipping is serviced and handled. Europe especially is being targeted by both China and Russia as markets for goods and supplies, with the much vaunted overland rail routes increasingly operational. An FTA between China and the EAEU would effectively bring China’s manufacturing capabilities right up to the EU’s borders in both overland and maritime routes.

Impact On the European Union’s Baltic Rim

Shipping, warehousing, and logistics companies in both Europe and Asia will need to start thinking about developing a strategy for the Northern Passage – that 2025 operational goal is only seven years away. This has special implications for EU member countries such as Finland, Latvia, and Estonia as they are reachable by both land and maritime routes. Such nations need to be positioning themselves accordingly, in order to service the Chinese demand – Estonia, for example, already handles 5 percent of China’s Postal Services due to the tie-up between the two countries as part of their Post 11 JV, which offers logistics solutions for e-commerce between China and Europe, and especially within the 16+1 framework between China and Eastern European nations. Having China and Russia collaborating on both rail and maritime links to China only means that more opportunities in services provisions will arise. The Baltic Rim nations need to be investing in the infrastructure to support this now, or face losing this one time opportunity to other EU competitors such as Germany and Sweden. Eurasian Trade is flowing to Eastern Europe – with the Arctic Maritime Route becoming increasingly viable.

About Us

Silk Road Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Eurasia, including ASEAN, China, India, Indonesia, Russia & Vietnam. For editorial matters please contact us here and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates provide business intelligence, due diligence, legal, tax and advisory services throughout the Asian and Eurasian region. We maintain offices throughout China, South-East Asia, India and Russia. For assistance with OBOR issues or investments into any of the featured countries, please contact us at silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

Silk Road and OBOR Business Intelligence

Dezan Shira & Associates´ Silk Road and OBOR investment brochure offers an introduction to the region and an overview of the services provided by the firm. It is Dezan Shira´s mission to guide investors through the Silk Road´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.