Finland and Baltics Gear Up Rail and Arctic Infrastructure Projects to Connect With China, Russia, and EU OBOR Trade

With both China and Russia gearing up for overseas rail and Arctic shipping potential to Europe, positive moves to accept and accommodate improved rail links are being taken in the Baltics. Russia has recently signaled its desire to extend and redevelop passenger rail services from St. Petersburg to Berlin in a route that sees cross-border travel through Latvia, Lithuania, the Western Russian enclave of Kaliningrad, and through Poland.

Estonia, to the north-east, has also been discussing improvements with Russia concerning both road and rail connectivity, with the Deputy Minister of Transport of the Russian Federation Sergey Aristov stating in April that Estonia and Russia have reached an agreement regarding the re-establishing of their cooperation in transportation. Aristov was reported as saying the discussions were “very positive.” Estonia was represented by Ahti Kuningas, deputy secretary general for transport at the Ministry of Economic Affairs and Communications, Priit Rohumaa, chairman of the supervisory board of Estonian Railways, and the Estonian Ambassador to Russia Arti Hilpus. According to Ambassador Hilpas, discussions revolved around the potential for high speed links and Russian/Estonian highway collaborations.

These developments are partially geared to accentuate the increasing amount of Chinese freight trains arriving in Europe via Kazakhstan and Russia, and to allow both Chinese and Russia trade access too and obtain supplies from the Baltics. At present, much of the rail traffic enters the EU into Poland via Belarus, further south, leaving the Baltics and Nordic nations out of the loop. Chinese-European freight is seeing a 100 percent increase this year, compared to 2016, with 1,000 freight trains expected to make the journey during 2017. Such growth rates are only expected to continue. Coming Europe’s way are Chinese electronics, going the other – are valuable and perishable European consumables.

Getting the Baltics configured into this trade, both from the mutual access perspective as well as services provision, is also inspiring some serious infrastructure developments. Both Estonia and Finland are discussing the possibility of connecting to each other via a 90 km, Helsinki-Tallinn undersea tunnel. A one-way journey would take just 30 minutes, as opposed to an effective 3 hour (including airport time) trip to take the 60 minute Turboprop, and the 2 hours by ferry.

Helsinki and Tallinn jointly represent an economic area populated by 1.5 million people, and there is active inter-city movement of people for work and leisure as well as freight traffic. Last year, Tallinn processed 10 million port visitors, with Helsinki reporting 11.5 million marine passengers passing through. Traffic between the two port cities in particular saw major growth last year and tens of thousands embark on work-related trips between the two cities weekly. The EU-funded studies, which are being undertaken by a consortium of interested businesses, are expected to produce initial feasibility results later in the year. These are to include cost-benefit analyses and impact assessments for both the rail and marine options, how the undersea tunnel can be technically implemented, and price tag determinants for construction, maintenance, and rail traffic. It will also sketch out the project’s main features, including location of routes, stations, and rolling stock depots.

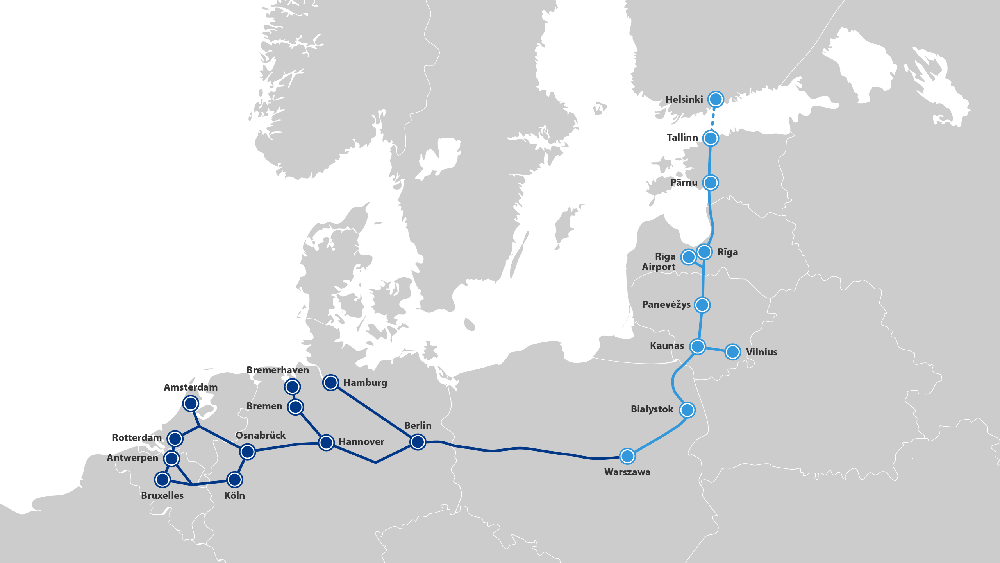

These are part of Rail Baltica, a greenfield rail transport infrastructure project intended to integrate the Baltic States in the European rail network. The project includes five European Union countries – Poland, Lithuania, Latvia, Estonia, and Finland. It will connect Helsinki, Tallinn, Pärnu, Riga, Panevežys, Kaunas, Vilnius, and Warsaw, and is expected to be completed by 2026.

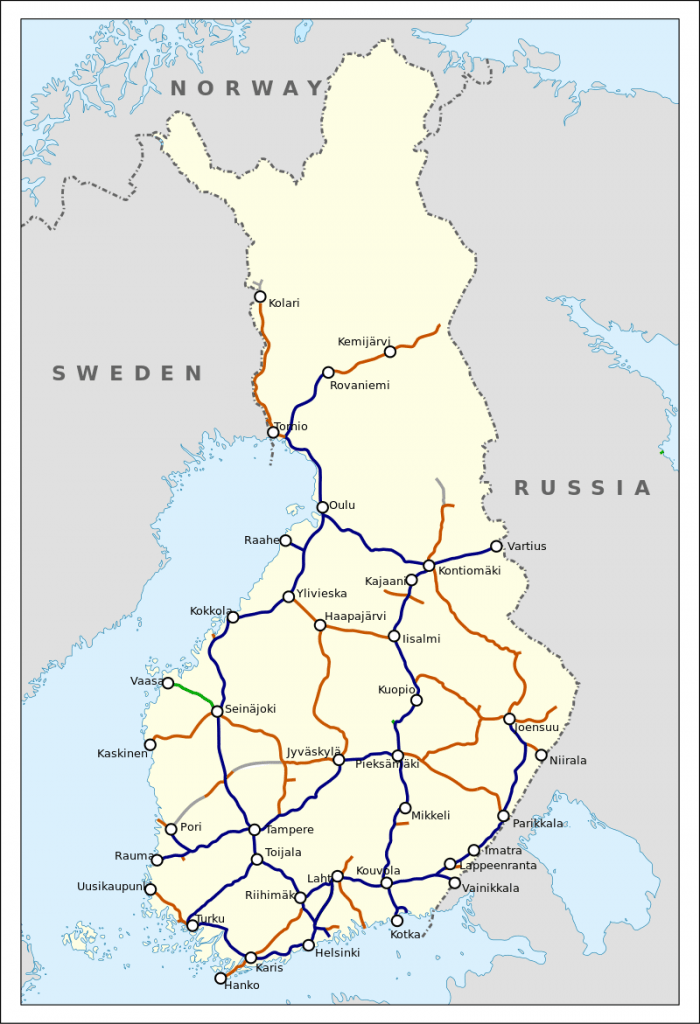

Russia is not part of this grouping, as it is not an EU nation. Nonetheless, bilateral discussions between Russian Railways and the same group of nations have been and continue to take place. An example is the Kouvola Rail Forum taking place in Finland this September. The program specifically deals with the Eurasian Land Bridge, China rail, and Finnish-Russian rail connectivity, which has been upgraded in recent years to almost wholly electrified routes.

The Taiwanese electronics business MIPRO recently won a €22.3m contract awarded by the Finnish Transport Agency (Liikennevirasto) for the renewal of signalling systems at Niirala, Kotolahti-Mussalo, and Vainkkala marshalling yards in eastern Finland, which connect directly with Russia and the Russian Railway and highway network, although these require some development on both sides. However, both Finland and Russia recognize this, and are taking steps to integrate technological systems such as the introduction of RFID remote identifier systems. These in particular, offer potential benefits along the entire supply chain – from customers and operators to handlers and border authorities, benefiting China, Russia, and EU customers and smoothing over the entire supply chain.

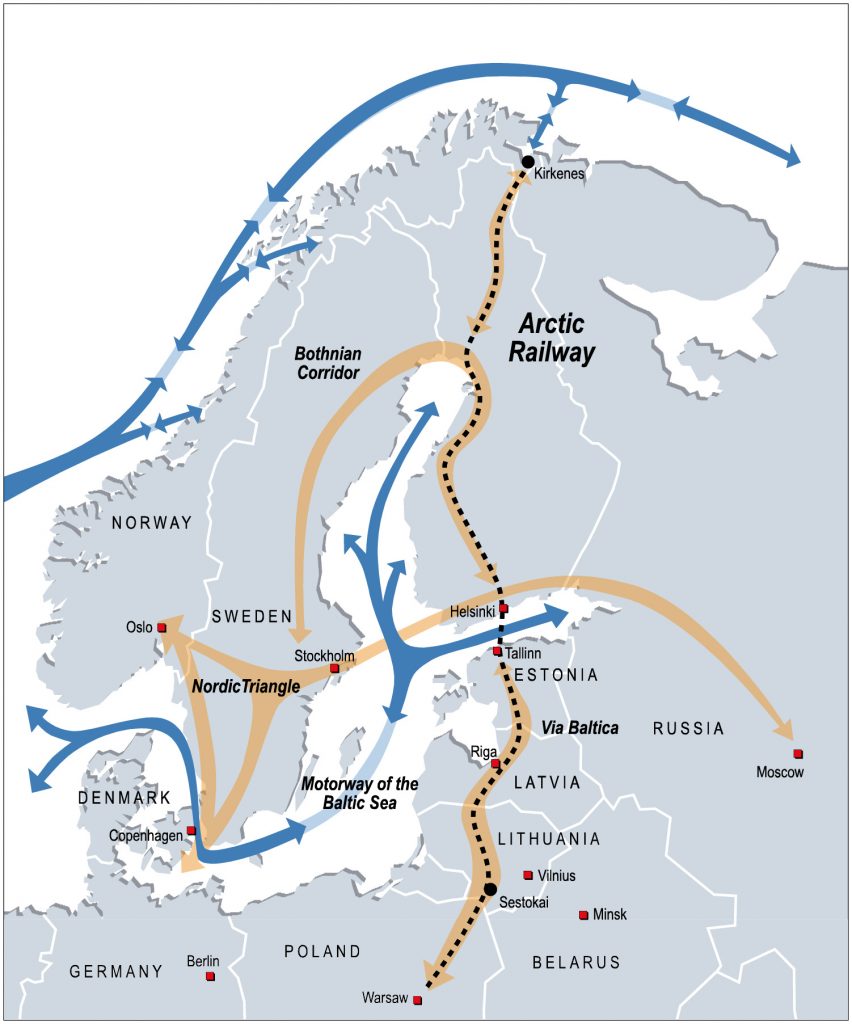

Finland has also been discussing the potential for a US$3.4 billion “Arctic Corridor” that would connect Northern Europe with Russia, China, and Arctic Ocean deep-water ports. The idea is being pitched by a group of Finnish academics and business leaders, and would connect the city of Rovaniemi in northern Finland with the Norwegian port of Kirkenes on the Barents Sea. Ships could move goods from China as well as oil and gas from Arctic fields in Russia westward along the Northern Sea Route to Kirkenes. Cargo would be offloaded to the railway and sent southward through rail connections to Scandinavia, Helsinki, the Baltic states, and the rest of Europe. The Chinese routes for this are explained in the article “China’s Maritime Arctic Silk Road On Ice”

“The Arctic Corridor project sees OBOR as very important as it provides an alternative to connect Asia with the Arctic and Europe.” said Timo Lohi, a spokesman for the Arctic Corridor project. Lohi also notes that Kirkenes in Norway is the closest Western port to Asia. Kirkenes Port is also ice-free, allowing the use of larger vessels and saving on ice-breaking costs.

These developments, tucked away into North-Eastern Europe, seem a long way from China when viewed on traditional flat maps. However, this is the top of the world, and distances are actually shorter than they appear. A direct flight from Helsinki to Beijing for example takes just 6 hours.

It should be remembered that Finland is a major gateway into Russia and also offers mutual access to China for electronics, as well as high quality Finnish goods to China. The same applies to the Baltic nations of Estonia, Latvia, and Lithuania, with Estonia especially having tied itself to developing China trade services as well as being a viable rail and sea port. While much of this depends upon the acceptance of Russia, and Russian Rail operators in the Baltics, a politically tricky subject at present, should military and security concerns be put to rest, the Baltics region can become a major player in future Chinese and Russian regional trade. Regional manufacturers should be looking at adjusting quality consumer products to Chinese tastes, and especially the sustainable, yet exotic (such as Nordic meats and fish) in addition to high quality clothing and other consumables. The services industries and development funds in particular, in everything related to transportation, warehousing, logistics, and related IT within the region should be keeping an eye on these possibilities. The EU’s next major capital city as concerns OBOR and influence may well be Helsinki.

About Us

Chris Devonshire-Ellis is the Founding Partner and Chairman of Dezan Shira & Associates. He is based in Europe. The firm provides European businesses and governments with strategic, legal, tax and operational advisory services to SMEs and MNCs investing throughout Asia and has 28 offices across China, India and the ASEAN nations as well as St. Petersburg and Moscow. Please contact the firm at asia@dezshira.com or visit the practice at www.dezshira.com

Related Reading:

Related Reading:

Silk Road and OBOR Business Intelligence

Dezan Shira & Associates´ Silk Road and OBOR investment brochure offers an introduction to the region and an overview of the services provided by the firm. It is Dezan Shira´s mission to guide investors through the Silk Road´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.

Assisting Foreign Investors into Russia

Dezan Shira & Associates´ Russian investment brochure offers an overview of the services provided by the firm – both foreign investment into Russia and Russian investment into Asia. It is Dezan Shira´s mission to guide investors through Russia´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.

China’s New Economic Silk Road

This unique and currently only available study into the proposed Silk Road Economic Belt examines the institutional, financial and infrastructure projects that are currently underway and in the planning stage across the entire region. Covering over 60 countries, this book explores the regional reforms, potential problems, opportunities and longer term impact that the Silk Road will have upon Asia, Africa, the Middle East, Europe and the United States.