BRICS New Development Bank on Course to Lend US$40 Billion in Green Infrastructure Projects

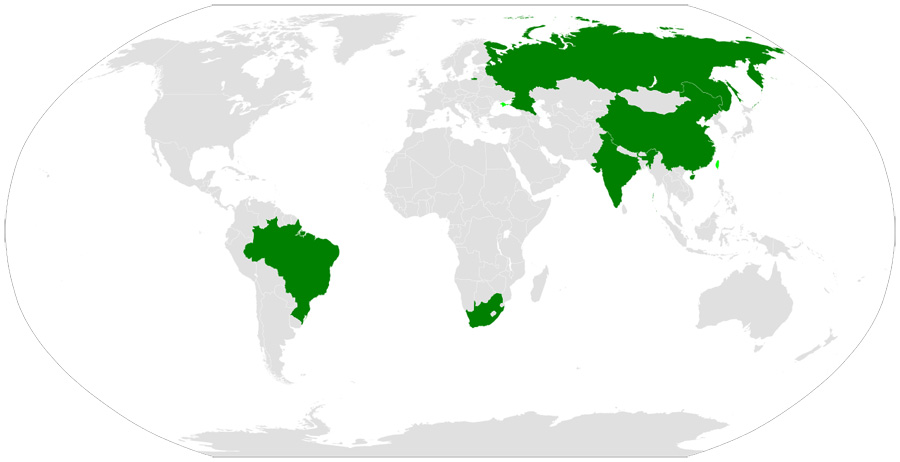

The BRICS New Development Bank (NDB), owned by Brazil, Russia, India, China, and South Africa, will issue bonds in South Africa and commercial paper in US dollars in the first half of this year, according to the bank’s president, K.V. Kamath.

“Most of the work is done and it’s basically finalizing the launch,” Kamath told China’s Xinhua news agency. “The new bonds in South Africa will be denominated in the local currency (Rand) and will be placed at the Johannesburg Stock Exchange.”

The NDB was established in 2014 and formally opened for business a year later. The bank’s current capital base is US$100 billion and it says all members of the United Nations can join it. However, BRICS nations must retain 55 percent of the voting power. The NDB and to some extent the BRICS grouping is a precursor to China’s AIIB and the Belt & Road Initiative, which has tended to overshadow the BRICS group. The bank is headquartered in Shanghai, with a regional office in Johannesburg.

The NDB had already approved 30 projects with a combined contract value amounting to US$8 billion and will approve another 20 to 25 projects involving loans of between US$7.5 and US$8 billion this year, Kamath said. “By the end of 2021, we will do about 100 projects and the total loan amount could be US$35 to US$40 billion,” he added.

The NDB had already approved 30 projects with a combined contract value amounting to US$8 billion and will approve another 20 to 25 projects involving loans of between US$7.5 and US$8 billion this year, Kamath said. “By the end of 2021, we will do about 100 projects and the total loan amount could be US$35 to US$40 billion,” he added.

According to the NDB, thus far, nine projects were approved by NDB in China, with loans totaling US$2.8 billion. The bank also plans to endorse a further 10 projects in the country this year. Loans have also been granted to over NDB shareholders, including India, Russia, Brazil and South Africa. The bank tends to service projects with a green element about them, including anti-pollution infrastructure measures such as water treatment plants, and solar and wind power technologies. In September last year, the NDB approved three infrastructure and sustainable development projects in India and Russia with loans of US$825 million.

Last week, the BRICS bank successfully placed 3 billion yuan-denominated bonds (about US$448 million) on the China Interbank Bond Market. The bonds were more than three times oversubscribed with more than 20 orders from financial institutions from both China and abroad. The bank said it aims to continue issuing financial products denominated in the local currencies of its member nations – China, Russia, Brazil, India, and South Africa.

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. Chris Devonshire-Ellis is the practice Chairman. The firm has 26 years of China operations with offices throughout China, Asia and Europe. Please refer to our Belt & Road desk or visit our website at www.dezshira.com for further information.

Related Reading:

Related Reading:

![]() The BRICS New Development Bank: India’s Power Play?

The BRICS New Development Bank: India’s Power Play?

![]() More Self Reliance than US Reliance Promoted as BRICS 2018 Summit also Calls for Expansion

More Self Reliance than US Reliance Promoted as BRICS 2018 Summit also Calls for Expansion