Kazakh & Central Asian Consumers Adapting to Hi-Tech Finance Products

- Kaspi.kz users and revenues surge

- Positive implications for take up of New Tech by Central Asian consumers

- Central Asian e-commerce market is growing fast

- Indicative that Central Asian market is increasingly sophisticated with opportunities for growth

Kaspi, the London- listed Kazakh company that owns Kaspi Bank and its popular ‘Super App‘, reported a Q1 net income rise of 25% compared to the same period in 2020 to 78.6 trillion Tenge (US$183 million). Kaspi said that 10 million consumers now use the App at least once a month, up 61% in the past twelve months, and that 5.4 million people use it every day. The population of Kazakhstan is 18.5 million, meaning the App has achieved a density of nearly 35% of the total population using it daily since this time last year.

The success of Kaspi is significant as it illustrates the new, sophisticated commercial opportunities now arising from countries along the Belt & Road Initiative. Kazakhstan joined the BRI in 2013 and has seen improved regional interconnectivity in the eight years since, increasing trade and productivity. Kazakhstan’s GDP has risen from US$235 billion (PPP) in 2013 to US$541 billion (PPP) in 2020.

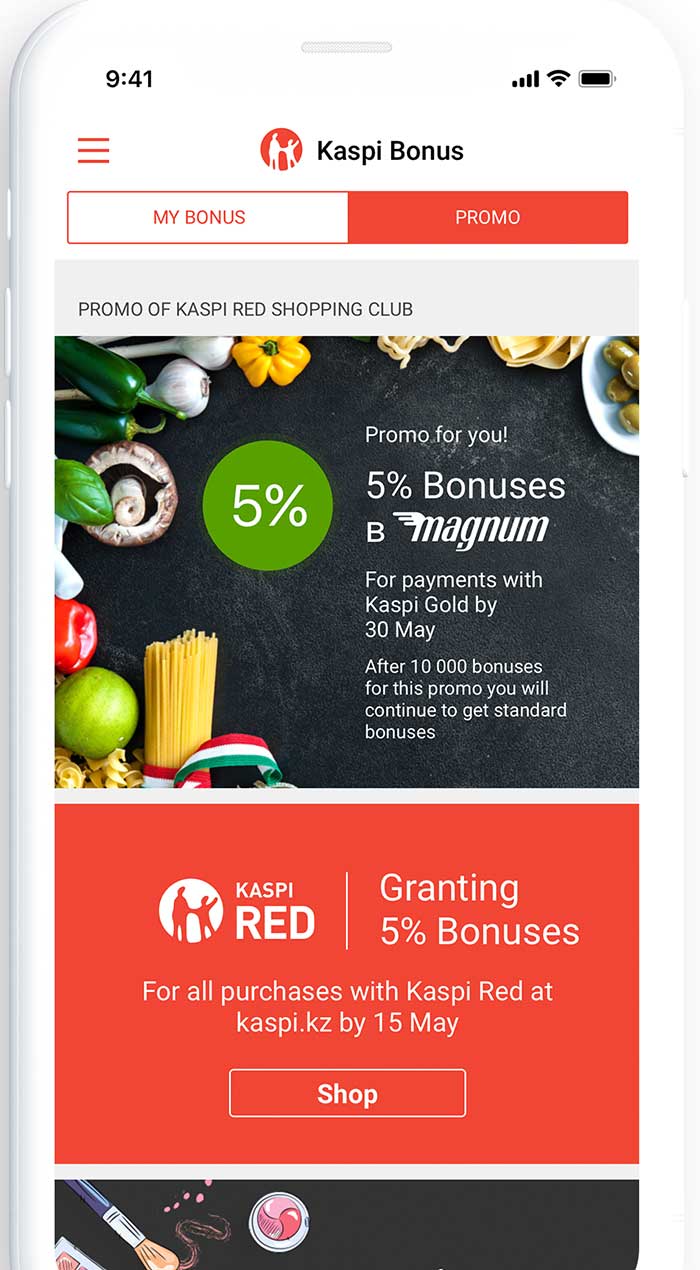

Kaspi Bank is a high-tech company that offers financial and banking services and products for retail and commercial banking. In addition to banking services, Kaspi Bank’s activities include retail financial services, electronic payments, and the organization of electronic trading platforms. The company is involved in trading with securities,

foreign currencies, and derivatives instruments, originating loans and guarantees, which is organized based on four main business segments such as marketplace, payments, e-Finance, and consumer financial services, generating maximum revenue from the consumer financial services segment. Kaspi was founded in 1991 and is based in Almaty, Kazakhstan.

Its success is indicative of the fast-moving development and acceptance of new technologies and Fintech in emerging Central Asian markets, and the adaptability of Central Asian consumers to these.

Commenting on the results, Kaspi CEO Mikhail Lomtadze said that the success of the Super App was also driving Kaspi Bank’s point-of- sale device expansion in shops, which now makes up 46% of the entire Kazakh network. “2021 has got off to a fantastic start for Kaspi” he said. “An expanded merchant base gives our consumers more reasons to transact through the Kaspi Ecosystem and ongoing strong user momentum in the first quarter of 2021 is the best illustration of this.”

Kaspi said that it now expected full year net income for 2021 to beat its original 410 billion Tenge (US$1 billion) forecast. Much of this growth has been linked to the coronavirus pandemic which has accelerated the demise of cash in societies, as consumers in Kazakhstan are using debit cards and smartphones to pay for retail products.

The Kaspi Q1 report also talked up the company’s “closed-loop propriety payments network” that has “eliminated the need for third party processors”.

“The result is that Kaspi Pay has firmly established itself as a major disruptive force, becoming the digital payments platform of choice for all types of merchants in Kazakhstan,” the Kaspi report said.

Since its IPO Kaspi shares have doubled in value, and it has built a reputation as being one of the most exciting Fintech stocks on the London Stock Exchange.

Kaspi’s major shareholders are the Russian Baring Vostok PE fund, Kazak financier Vyacheslav Kim, Georgian tech entrepreneur Mikhail Lomtadze, Kaspi’s management team, with 19% in public hands via their London IPO.

Kazakhstan is part of the Belt and Road Initiative and spin off developments by the private and h-tech sector as regional wealth is created via infrastructure build is becoming a key, subsequent opportunity issue along the BRI. That is a subject discussed by Chris Devonshire-Ellis in his new book “Identifying Opportunities Within the Belt & Road Initiative, which can be downloaded on a complimentary basis here.

Related Viewing

- The Greater Eurasian Partnership: Connecting Central & South-East Asia

- Aqtau Port, Kazakhstan’s Caspian Sea Belt and Road Window to Europe

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com