Re-Thinking Asia’s Orbits 2021

Op/Ed by Chris Devonshire-Ellis

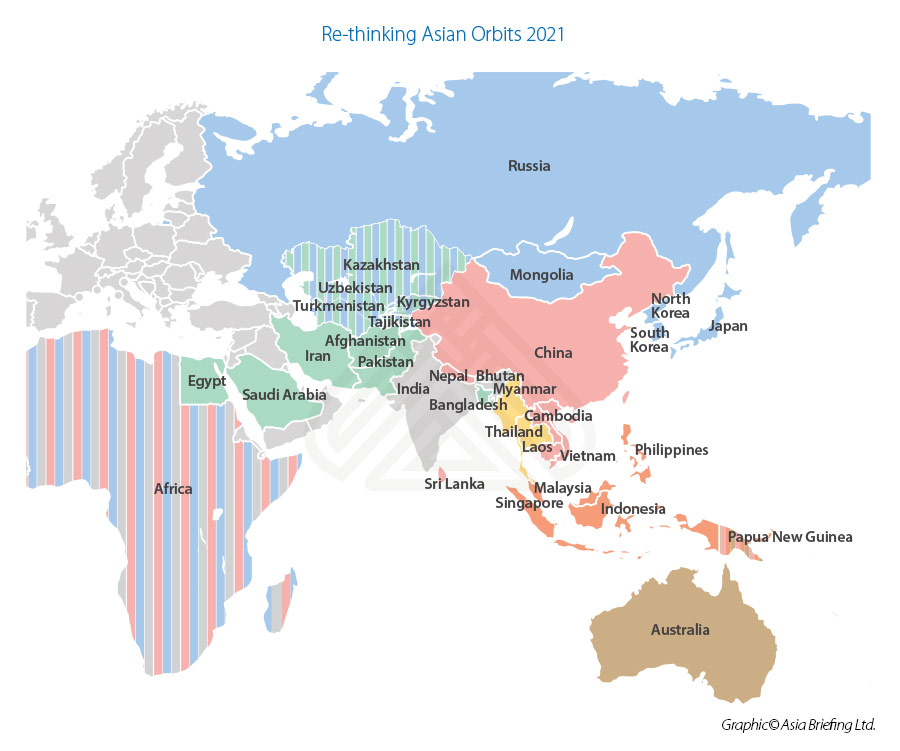

With continuing geo-political tensions between the United States and China, the development of China’s Belt & Road, an alignment between China and Russia and new regional free trade agreements and investment flows emerging, the Asian region is starting to go through numerous dynamic changes.

To illustrate my views here, I have drafted a map of Asia to explain what I mean. Please be aware this does not and is not meant to illustrate any sovereignty, specific border, or territorial changes, it is purely meant to illustrate an academic overview and provoke discussion of where Asia is now and where it is heading.

China, Vietnam, Laos, Cambodia, Nepal & Sri Lanka

China is the dominant regional power, and its influence, especially within the context of the Belt & Road Initiative and free trade by far the largest element within the Asian sphere. In this map however I have placed Vietnam, Cambodia, and Laos in ASEAN, together with Nepal and Sri Lanka as being directly within the Chian orbit. This because China’s overarching reach notwithstanding, these countries are more impacted in terms of China BRI infrastructure build, trade, and investment than any other. Infrastructure being put in place between China’s South-West and ASEAN is extensive, with rail networks shortly to connect Laos, Vietnam, and Cambodia to China for the first time. The same is true of Nepal. Sri Lanka also moves well into China’s orbit as today; about the only Indian experience one finds in the country are the ubiquitous tuk-tuk’s – whereas practically everything else is China built. India has failed to even sell coaches to Sri Lanka – the luxury buses travelling the Expressways are made by King Long on China’s Fujian Province. There is a strong case for Pakistan to have been included because of CPEC – but as I explain below, Pakistan’s Asian orbit is significantly different to that of China.

Indonesia, Malaysia, Philippines & Singapore

All these nations are part of ASEAN, however, certainly Malaysia, Singapore and Indonesia are becoming increasingly integrated. The Philippines is too but lags a little – yet its geographical position puts it within the orange orbit. Except for the Philippines, which retains some uniqueness in Asia due to its cultural differences, this massive land mass provides both large consumer bases, competitive manufacturing, and significant resources. With Singapore as a regional hub, this huge land mass – originally loosely identified by Alfred Wallace as the ‘Malay Archipelago’ is developing as a ‘bloc within a bloc’ and is both a major growth driver for Asia and within a decade, global GDP growth.

Thailand & Myanmar

Thailand has sometimes seemed an odd man out in ASEAN. Relations with Singapore are erratic as they are with Malaysia, clashes between regional cultures remaining an issue and preventing integration. However, the recent events in Myanmar, right on Thailand’s doorstep will change moves to integrate trade and infrastructure towards its massive and more culturally similar neighbor. Myanmar may not have many friends right now, but it will be Thailand who lends support, develops trade, and develops access to its resources, population, and invests – and profits from invested infrastructure.

India, Bhutan

India’s problem has been its insularity and unwillingness to open its domestic markets. An overly strong business element within the countries political make up has spurned attempts to have India become a larger player within Asia as vested interests run scared of allowing foreign investment and trade to adequately compete domestically. The country has missed the opportunity to inherit the ‘workshop of the world’ mantle from China, which is passing now to other parts of Asia and over time, to Africa. As a result, India’s orbit has diminished considerably, with the country failing to properly engage in regional trade and infrastructure development. India’s decision to pull out of the Asian Regional Comprehensive Partnership Agreement is symptomatic of an economy in decline and unwilling and unable to see beyond their own borders.

Pakistan, Afghanistan, Bangladesh, Iran, Saudi Arabia, Egypt

In contrast, a newly emerging Pakistan is now starting to turn the corner – mainly in thanks to China’s financial support and infrastructure build. Much of that has been a deliberate policy to calm Pakistan down – the country has a border with China and Beijing has not wanted to be the recipient of radical Islam. Instead, the scenario has been focused on developing peace through trade – but CPEC and numerous other projects have had to be build first, including what will be the first Trans-Afghan Railway linking Central Asia to the Persian Gulf via Gwadar. As a result of the CPEC infrastructure build and the development of a more progressive tax and investment system, Pakistan is now starting to become a conduit for other business investments and trade. Again, there is a cultural issue here, with Muslim sensitivities best placed to invest. Investments from Bahrain, Dubai, Saudi Arabia, and Egypt among others are all seeing Pakistan in a new, dynamic light.

Russia, Japan, North & South Korea & Mongolia

North-East Asia is also developing as a bloc, albeit one with disparate cultures and influence. Japan and South Korea are major investors across Asia, however there is much to be done to unite them more closely together and especially with the Russian Far East. Russia though holds the key to two major and important routes to trade – the Northern Sea Passage and the Trans-Eurasian Rail. These provide far improved access for markets to Europe, and vice-versa. Investments and joint-projects between Russia, Japan and South Korea are well underway, with Mongolia, sandwiched between Russia and China, yet leaning well towards Japan and Korea as benefactors as a periphery player – yet one that is also rich in mineral commodities, and sunshine – Mongolia has huge amounts of excess energy it can export to its regional neighbors just at the time eco solutions are being incentivized.

Central Asia: Kazakhstan, Kyrgyzstan, Turkmenistan, Uzbekistan, Uzbekistan, Tajikistan

The Central Asian region has various factors including China as a player; however, the main sources of orbit are jointly Russia, and to some extent Pakistan and its orbit, which will become increasingly influential. Central Asia’s main hinderance to growth has been its landlocked nature preventing it reaching out into larger markets and economies. That is now changing, with routes to seaports being developed east from Kazakhstan though China and access to ASEAN, and directly south from Uzbekistan through Afghanistan to the Gulf and markets to the Middle East. Russian pragmatism, Chinese investment and Islamic capital are the driving forces in the region.

Africa

Africa is being rapidly re-purposed as a coming global manufacturing hub and massive consumer market. By the end of this century, businesspeople will be suggesting that the 2000’s were the ‘African Century’. A new, continental Free Trade Agreement is now in place that reduces to zero tariffs on 95% of all African products, while China alone has been involved in financing over 70 Ports around the coastline. Both Chinese and Russian investors have been setting up Free Trade Zones, making significant infrastructure investments, and manufacturing operations, while the ever-cost effective Indian diaspora will always be involved in trade. Africa will develop its own, self-sufficient orbit in time, redevelop ties with Europe, and be master of its own destiny. But for now, its immediate future lies more with Asian trade and investment.

Australia

Australia’s orbit, despite its positioning itself as part of Asia, has never really lived up to that promise. Instead, it remains very much moored to the United States. It is undergoing serious diplomatic, trade and political differences within Asia and these are impacting its position. Consequently, I see it in a somewhat isolated position at present. Australia’s main issue is its small population – 25 million. That is only slightly larger than the population of Sri Lanka. The Australian consumer market is Western, not Asian oriented and apart from its mineral wealth in reality it is a US play, not Asian

Papua New Guinea

This huge, yet undeveloped region is currently being courted by a combination of Australia, Indonesia, and China. All are heavily involved with eyes on what is in the ground, and its early-stage politics are not for the faint hearted. It will probably end up in the Orange Orbit but with Chinese investment.

The above comments and analysis are designed to be discussed and debated, not as a guide to future geo-politics. The discussion is open, and please feel free to share elsewhere.

Related Reading

- Beijing Prioritizes ‘Polar Silk Road’ At Two Sessions Meetings

- China Prioritizes Sichuan-Tibet Rail and Western Land-Maritime Corridor At Two Sessions Meeting

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com