Beijing Prioritizes ‘Polar Silk Road’ At Two Sessions Meetings

Op/Ed by Chris Devonshire-Ellis

- Proposed New Trans-Polar Route Faster Than the Northern Sea Passage

- Implications for China-Europe Trade & Shipping Vessel Designs

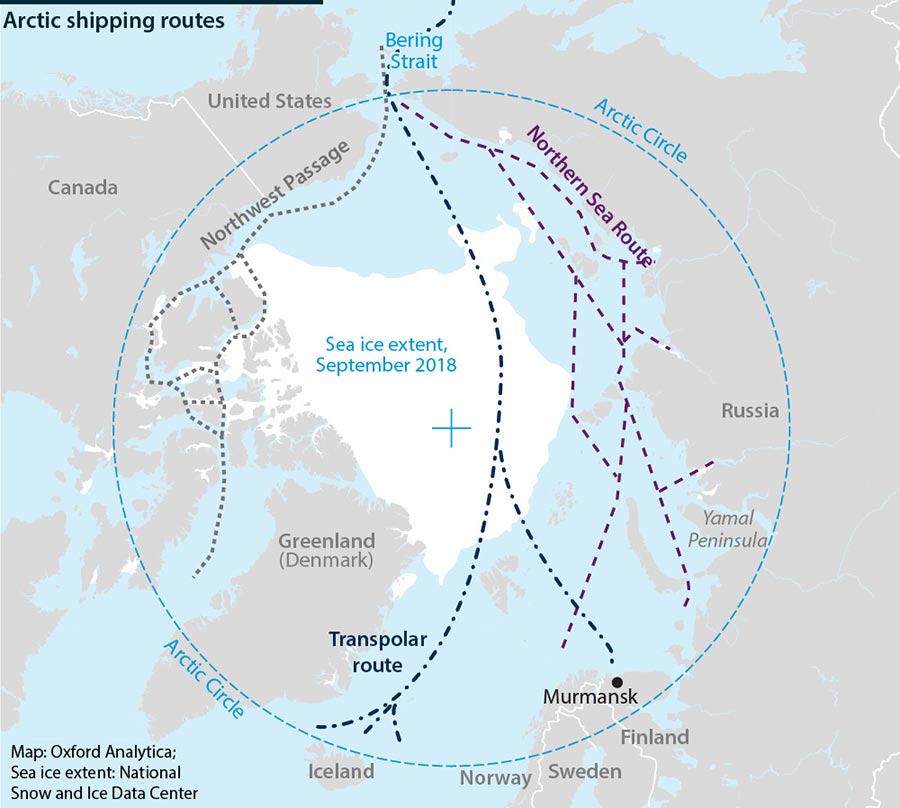

China will participate in ‘pragmatic cooperation on the Arctic’ and the building of a “Polar Silk Road,” the state-run Xinhua news agency has said, quoting the draft outline of the 14th Five-Year Plan (2021-2025) for national economic and social development and the long-range objectives to the year 2035. Both plans were submitted to China’s National People’s Congress (NPC), in Beijing last Friday. Connecting the Atlantic and Pacific oceans, the ‘Polar Silk Road’ – officially known as the Transpolar Sea Route (TSR) will cut across the center of the Arctic Ocean, passing close to the North Pole.

The Polar Silk Road is a slightly different route to the Northern Sea Passage, cutting even more time off the Northern Sea Passage, which hugs the Russian Arctic coastline. That route saves 35 days from shipping from Asia to Europe via the Malacca Straits and Suez Canal. A direct Polar route would reduce the shipping time by another 3-5 days.

There are serious practical issues to overcome, meaning China is looking at this as a longer-term project, more likely to kick in once global warming thins out the current extent of sea ice in about 30 years. At present, China is the only country studying this route. Should Arctic sea ice disappear, even just for the summer months, this would have significant implications for design, construction, and operational standards of all future Arctic marine activities. In the absence of thick multi-year ice, which can be up to five meters deep, any water that refreezes would take the form of much thinner, more navigable seasonable ice. That means nuclear icebreakers would no longer be needed. Within the next three decades, in summer, it may be possible (even if insurance companies and the Polar Code continue to mandate polar-class, ice-resistant ships) to sail in a regular vessel across the roof of the world.

The reference to ‘pragmatic cooperation’ is Beijing’s signaling that it wishes to discuss this development with members of the Arctic Council. That body includes the Arctic nations of Canada, United States, Denmark, lceland, Norway, Sweden, Finland and Russia. Several other countries participate as ‘near-Arctic’ states, including China.

While gains may be made with faster shipping times, there are other issues to resolve. Shipowners also consider risks and costs, and polar shipping is a more dangerous and expensive operation due to the advanced types of ships required, insurance costs, and icebreaker escort fees. Most shipping these days also follows the pendulum model, with vessels stopping at ports between their origin and destination to make deliveries. This logistics chain requires markets, of which there are obviously none in the middle of the Arctic Ocean and why, for now, the Northern Sea passage will remain the better choice.

That is already well underway, with Russian President Vladimir Putin and China’s Xi Jinping agreeing to build an “Ice Silk Road” following their bilateral meetings in Moscow in 2017. That referenced the development of the Northern Sea Passage and the opening of a route across northern Russia and the Arctic ocean as global warming gradually makes an impact.

The announcement comes shortly after China formally included the Arctic Sea as part of its Belt & Road Initiative. China’s National Development and Research Commission and State Oceanic Administration said in a document published on June 20 that year that a “blue economic passage” is “envisioned leading up to Europe via the Arctic Ocean”.

Titled ‘Vision for Maritime Cooperation under the Belt and Road Initiative’, the plan sets out priorities for the building of the 21st Century Maritime Silk Road, the second leg of the Belt & Road Initiative. It sets out plans for China to build three ocean-based “blue economic passages”: The China-Indian Ocean-Africa-Mediterranean Sea passage, which will run westward via the South China Sea to the Indian Ocean and onto Africa and Europe, while the China-Oceania-South Pacific passage will run southward via the South China Sea into the Pacific Ocean to access the Western coast of the Americas as well as Japan and Korea. “Another blue economic passage is also envisioned leading up to Europe via the Arctic Ocean,” the document stated, without giving details about the route. This weeks ‘Two Sessions’ meeting have now clarified that and placed the subject back on the agenda.

Russia has already developed a series of port facilities, over many years, along this route, stretching from the northwest at Kandalaksha near the border with Finland, Severomorsk, a closed city and home to Russia’s Northern Fleet, Murmansk, the Port of Arkhangelsk, Vitino, Naryan-Mar, Belomorsk, Dikson, and Dudinka on the Yenesei River Gulf, Igarka, Tiksi, and Pevek, the northernmost town in both Russia and Asia. From Pevek, the Russian land mass heads south, through the Bering Straits and wraps around northern China until reaching Vladivostok.

Of these, several are relatively small, and support local fishing industries, but Murmansk, Arkhangelsk, and Vladivostok are significant players. The Northern Passage also holds the attention of China, keen to use it to both gain access to Russian oil and gas fields throughout Siberia and believed to exist within the Arctic Ocean itself, and to gain trade access to both Russia, and Northern Europe.

Russia’s Arctic boundary is 24,140 km long and its closest point to the North Pole is Cape Fligely, on Rudolf Island, 911 km from the Pole. There is, however, potential for conflict with the US over the Northern Passage, as Russia claims this as within its territory – a statement contested by the US, which considers it an international route despite it not ever having been viable. It also remains to be seen what actions the US could take along Russia’s own Arctic coastline.

Arctic security, potential shipping routes, and energy resources are all areas of interest for Moscow and Beijing. Gas and oil reserves would be a valuable political tool for Russia in the European energy market, with an estimated billion barrels of oil in the Trebs and Titov deposits alone. Russia is also working towards developing its oil and natural gas reserves, of which 70 percent are within its continental shelf. We can examine the principal Ports as follows:

Arkhangelsk

Arkhangelsk Port sends and receives lumber, pulp, coal, machinery, metals, industrial, and consumer goods, and is the operating base of the Northern Company, facilitating the maritime transport of the White, Barents, and Kara seas, the Northern Passage, and overseas lines. There are regular passenger liners from Arkhangelsk to Murmansk, Dikson, Onega, Mezen, Kandalaksha, and Novaya Zemlya.

The Port itself has three cargo areas, a container terminal, a passenger shipping company terminal and a marina. The total wharfage is 3.3 km, with berthing suitable for vessels with a draft of 9.2 m and a length of 175–200 m. It also has 292,000 m² of warehousing facilities and a 2000 m² Bonded Warehouse facility. It can handle 5,762 TEUs at the same time, including up to 200 reefer containers and 2,200 containers with dangerous goods. Bandwidth container terminal 75,000 TEUs per annum. Recent Chinese investments are repositioning Arkhangelsk as a deep-water port.

Murmansk

Murmansk port ranks fourth in Russia in terms of processed goods, and is the second largest in the northwest of Russia, after St. Petersburg. Murmansk is one of the largest ice-free ports in Russia, has 13 berths, and is equipped with modern handling facilities: 52 gantry cranes with the capacity up to 40 tn, one ship loader for handling of apatite concentrate with the capacity more than 1000 th tn/hour, 113 units of fork trucks with the capacity from 1.5 to 32 tonnes. The entire city is classified as a Free Trade Zone, and it is Murmansk that is expected to develop as a major hub for the Northern Passage. Current cargo turnover is about 16 million tons, with this set to double by 2025. Murmansk was designated as the capital city for the Russian Arctic last year.

Vladivostok

Vladivostok is very close to Russia’s border with both China and North Korea and is Russia’s main Port opening onto the Pacific Ocean. It is also linked directly to Moscow via the Trans-Siberian railway. It is a Free Port, with tax incentives for investors (instead of CIT at the usual 20 percent, the Vladivostok CIT rate is 5 percent for the first 5 years, then 12 percent during the next 5 years), and has been heavily invested in by China’s Fesco. It is increasingly becoming a center for auto production and also contains several casinos; the Port has all the expected services in place and has a 200,000 TEU capacity per annum.

Russia’s Northwestern Sea Passage Arctic coastline is now partially operational with traffic expected to quadruple by 2024.

Chinese investment is already going into Arkhangelsk and Murmansk to further develop the existing facilities. Both are expected to be among the world’s top 50 ports in terms of overall capacity, and both are equally capable of handling 30 million tons per annum. The involvement of the Chinese is especially interesting as the Chinese are currently negotiating tariff reductions as part of the Free Trade Agreement with the Eurasian Economic Union (EAEU). Should this happen, bilateral trade between China and Russia, as well as with the other members of the EAEU will massively increase. If so, then the capabilities of the Russian Sea Ports from northwestern Europe to the Russian Far East will see a dynamic shift in how Eurasian shipping is serviced and handled. Europe especially is being targeted by both China and Russia as markets for goods and supplies, with the much-vaunted overland rail routes increasingly operational. An FTA between China and the EAEU would effectively bring China’s manufacturing capabilities right up to the EU’s borders in both overland and maritime routes.

These developments coincide with Russia’s declaration of the entire Russian Arctic as a Free Trade Area. Further future development of the ‘Polar Silk Road’ will speed up efficiencies even more. Planning infrastructure ahead 30 years from now is also an impressive symbol from Beijing taking a longer-term view of global supply chains. This will impact, for example, on the shipbuilding industry in China and in its own way, usher in new Arctic capable technologies that can be used in other applications.

Related Reading

- The Arctic Link: Connecting Norway, Sweden, and Russia to China Trade

- Russian Arctic Economic Zone Attracts Investors In Logistics, Transport, Tourism & Fishing Industries

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com