The United States Answer To China’s BRI In Africa : Finance ISIS In Mozambique As An Alternative To Russian LNG

ISIS Mozambique. The US is giving these soldiers money to ‘settle’ them down.

Op/Ed by Chris Devonshire-Ellis

The US EXIM bank has jumped back into global financial circles by making its first multi-billion direct loan. This 86 year old organization was dormant during 2012-2016 after the US Senate failed to renew its charter in 2012, however the Trump administration reconstituted the board quorum in May 2019, with the mandate to fulfil Trump’s Prosper Africa Initiative.

That is an economic effort launched in 2018 to increase two-way trade and investment between the United States and Africa. In an interview earlier this year, The President & Chairman of USA EXIM publicly stated that Africa and Sub-Saharan Africa are an absolute priority (surprising in light of Trump’s prior comments on African countries as being ‘shitholes’).

China’s African Engagement

U.S. – Africa trade has dipped in recent years, while China is now Africa’s biggest trade partner.

The total value of Chinese investments and construction in Africa is closing in on US$2 trillion since 2005, according to the American Enterprise Institute (AEI) China Global Investment Tracker.

Washington’s top diplomat in Africa, Tibor Nagy, has sought to address the issue and restore influence in a part of the world where the U.S. and Europe have not faced genuine competition for political or economic influence in recent decades. China’s influence however has been increasing, with the country partially responsible for brokering the African Continental Free Trade Agreement and engaging in a flurry of Double Tax Treaties and promoting its Belt & Road Initiative across the African continent. We explored this in the article China’s African Moves Through The Belt & Road, Double Tax Treaties And AfCFTA

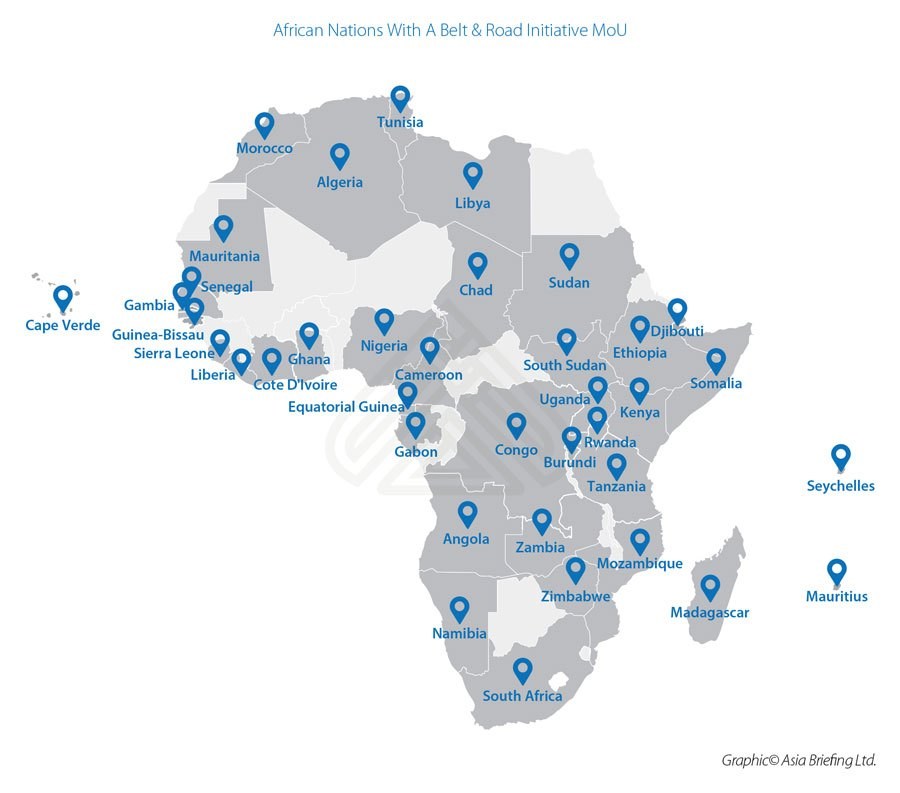

The extent of China’s influence can be seen in the map below:

Russia In Africa

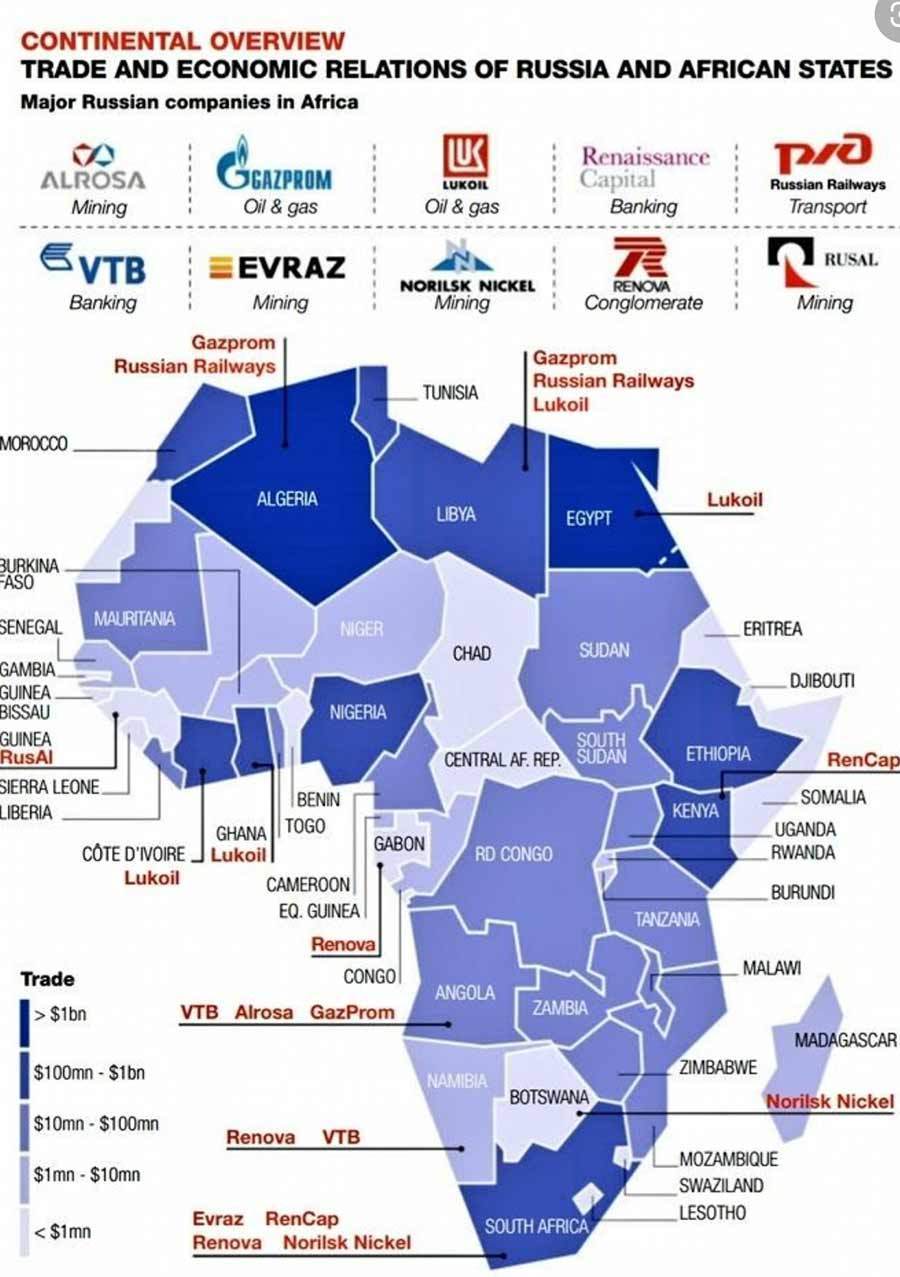

But China is not the only major nation that has been upgrading its investments and influence in Africa. Russia, looking for new market opportunities in the wake of Western sanctions, has been actively increasing activities in Africa. Russian/African trade grew by 17% last year, and like China, the Russians have been developing Free Trade Zones in Africa and has plans to do so in Mozambique. The country is setting up a US$5 billion Russia-Africa Online Trading platform, has signed off Agricultural deals with the African Union Commission and is a major investor in the Port Said Free Trade Zone, close to the Suez Canal. An overview of Russian involvement in Africa can be seen in the article Russia-Africa Continental Investment Opportunities & Potential Explained while an overview of Russian corporate investment into Africa can be seen here:

The United States Reaction To China & Russia In Africa

The United States reaction to this, together with that of its allies, has been perplexing, and especially as concerns US activities in Mozambique, a member of China’s BRI. The countries well-publicized financial problems and the so-called “Tuna Bond Default” displayed exactly the sort of behavior that China has oft been accused of: saddling third world countries with sovereign debt.

The US Prosper Africa Funding Program & Mozambique LNG

Mozambique however does have assets in the form of LNG reserves. As Henry Tillman, of China Investment Research points out in the latest issue of their BRI Pulse – the China Investment Research monthly update, 2018 World Bank/IMF meetings seemed to attract investor attention to Mozambique’s two major LNG discoveries (Block 1 and Block 4). In 2019, Andarko Petroleum (USA), was acquired by Occidental Petroleum (USA). As part of the transaction, Andarko, the owner of the more desirable Block 1 assets, located in the Cabo Delgado Province, sold these assets to Total (France), which in turn created a consortium; Total (26.5%), Mitsui (Japan – 20%), ENH (Mozambique – 15%), Bharat Petroleum (India – 10%), PTT (Thailand – 8.5%) and Oil India (10%).

Most of the LNG developed from this operation was contracted to be purchased by Japan, India and Thailand – which represented nearly 50% of the consortium shareholders. After previously attempted closings, in July 2020, Total announced that it had secured financing commitments of US$14.9 billion, led by loans from USA EXIM (US$4.7 billion), JBIC (Japan – US$3 billion), Thai Eximbank (US$150 million) and ADB (US$400 million) as well as loan guarantees from NEXI (Italy – US$2 billion), UKEF (UK – US$1 billion), SACE (Italy – US$950 million) ECIC (India – US$850 million) and Altradius (Netherlands – US$604 million). Twenty-one banks were involved in the facility.

At the time of the closing, the US EXIM bank claimed that its US$4.7 billion loan will support exports of US goods and services for the supply of American equipment that will be used for the production of LNG, add 16,700 new jobs over 9 states from 68 U.S. suppliers before any follow-on sales to lead to additional jobs growth over a 5 year construction period. While many of the world’s press have lauded the Trump Administration for its success in leading this consortium of its allies, producing new jobs for USA (and other countries) and for assisting future Mozambique GDP growth, there are large risks associated with this project. These include security risks related to growing insurgency and deaths committed by ISIS in Cabo Delgado.

On 29th September, it was reported that the United States, in a phone call between U.S. Assistant Secretary for African Affairs Tibor Nagy and Zimbabwe Foreign Minister requested Zimbabwe’s assistance in settling ISIS in the region, which is likely to be the recipient of up to US$60 billion of investment, led by the USA and implicitly supported by its allies. There appear to be double standards at play here: the United States has long imposed targeted measures on the Government of Zimbabwe, including financial and visa sanctions against selected individuals, a ban on transfers of defense items and services, and a suspension of non-humanitarian government-to-government assistance. However, the US military has requested that Zimbabwe send its troops into Cabo to deal with a worsening situation.

The Cabo Delgado ISIS Insurgency : Fund The Guns To Keep Them Quiet?

The Mozambique Province of Cabo Delgado Province covers some 82,625 km² and has a population of 2,320,261, and has been the focal point of an Insurgency fought mainly between Islamist militants attempting to establish an Islamic state in the region, and Mozambican security forces. Fighting commenced in late 2017 and has escalated over the past year, with multiple cases of atrocities committed and civilians being both killed and large numbers – estimates of over 300,000 – displaced. As a result, this years crops are failing and famine is predicted in some areas. ISIS soldiers have also recently taken several offshore islands, having occupied the strategic port town of Mocimboa da Praia, which was used for cargo deliveries for the development of the LNG project. Last month ISIS seized control of the islands of Mecungo and Vamisse, and have begun threatening regional maritime traffic. This is exactly where the LNG blocks are located.

Zimbabwe – called in by the United States to provide troops – is however under US arms sanctions, meaning the US Government could be in breach of its own sanctions laws. Meanwhile, the concept of ‘settling ISIS’ – giving them money to cease fighting – has not been properly explained. Instead, it appears ill-thought out at the very best, coming straight out of the US NRA narrative that giving people more guns helps preserve peace.

One has to remember that the Taliban were funded by the United States in opposition to Russian (then Soviet) attempts to put down Islamic fundamentalism in Afghanistan. Funding rebels and terrorists didn’t work then, and lead ultimately to the rise of characters such as Osama Bin Laden. No-one needs reminding of the legacy he inflicted upon the United States.

There are additional human rights and moral concerns that employees of UK companies (many of which have avoided investing in or even sending staff to Pakistan because of possible violence) and employees from the 68 USA based companies involved and whether they will want to operate on a project in the region. After all, Mozambique’s Foreign Minister has requested international military assistance to defeat ISIS in the exact area the project financing is being sent. There are also problems with legitimate reporting on the issue: last year, Mozambican authorities unlawfully detained journalist Amade Abubacar, who had reported on the insurgency. He was subsequently tortured, and only released on bail after 107 days in detention.

Mozambique’s Financial Viability As A Sound Investment

While the backdoor assistance to ISIS via investing in LNG blocks in Mozambique is one issue, another is the substantial economic risks regarding Mozambique, one of the world’s poorest countries, which had a 113% debt/equity ratio in 2019 (up from 54% in 2013) and is expected to have negative GDP this year.

China’s Position

Henry Tillman also comments on the Chinese involvement “It is our understanding that China was well aware of the investment opportunities within both Block 1 (above) and the less attractive Block 4 – where CNPC has been a minority investor with Exxon (the majority owner) for a number of years. Indeed, we believe that China met with Total (and others) to discuss developing such finds years prior to the US EXIM involvement.”

It is also important to note that since 2017/ 2018 China has been focused on funding the rapidly developing Russian LNG as part of the Arctic Silk Road. In 2019, three of China’s major energy firms (CNPC, Sinopec and CNOOC) were merged into a new company, PipeChina, China’s new state-owned pipeline operator. At the end of 2019, the Power of Siberia I pipeline, which is designed to pump 38 billion cubic metres of gas (bcm)/year from Russia to China became operational. In March 2020, President Putin approved the Power of Siberia II, which, when operational, is designed to pump up to 50bcm/yr, nearly double the volume in the original MoU, to China. In July 2020, PipeChina began construction of the southern portion of the Power of Siberia system.

The markedly above average summer temperatures across Siberia during both 2019 and 2020 have led to rapid ice melt along the Northern Sea Route (NSR), which was ice free by mid-July 2020, and thus saw substantially increased sea traffic over the past several months. It is very clear that Russian LNG has a substantial CIF price (Cost, Insurance and Freight) advantage as well as reduced shipping risk for China, Korea and Japan, the world’s three largest LNG importers – over Mozambique, Australia or USA LNG. Russia has also begun shipping Arctic LNG to India – another target for potential Mozambique LNG exports.

The Art Of The Deal?

As such, maybe what the USA (and its UK friends) really “won” by funding this project was to invest/lend US$6 billion of USA and UK taxpayer monies to fund to their allies to operate in an area of growing ISIS insurgency, requesting international Government military assistance, as well as to implicitly link USA allies to the larger (US$30 billion) and much more complex Block 4 project. However, it is a banking truism that it is difficult to build a profitable loan book when you are the last lender to enter a market.

The Manchester Guardian reported that UKEF’s contribution involves US$300 million loans to UK companies working on the project plus guarantees of UK bank loans of US$850 million. In September, Friends of the Earth confirmed it was seeking a judicial review of UKEF’s decision to help finance the project – to date the UKEF declined requests to make its review public.

The entire project appears to be a bizarre, conflicted structure, with the United States using the Mozambique LNG project to allow Trump to publicly score points over China and the BRI in announcing a ‘winning bid’ over highly problematic LNG blocs, while at the same time attempting to produce LNG supplies in future to counterbalance Russia’s superior fields and attempts to sell gas. Those may be laudable objectives, but the tag-along problems – funding ISIS, military intervention, the ignoring of sanctions, the highly implausible financial rewards not to mention human rights concerns make the art of this deal highly dubious in terms of both the cost, its morality and perhaps even more importantly, its future implications.

It is also noticeable that the Chinese media have remained quiet on the issue, quite possibly content to see the US dig itself into a massive black hole. One can only imagine the Western media furore and indignation were this a China-constructed Belt & Road Initiative investment. Fortunately for China, Beijing appears to understand when too much, is too much.

The questions that the United States and its allies need to address is why such an investment is being made when both China and Russia have already shown that strategic, well planned forays overseas, based on forging trade ties, putting in place trade enhancement mechanisms such as Double Tax Treaties, and building Free Trade facilities appear to be eschewed in favor of throwing money at terrorists in order to develop non-market competitive energy facilities in projects that will require long term military support to protect.

Perhaps it is a sign of the current decadence in Western politics: the importance of scoring of political points rising above planned strategies. Or it could also be a worrying trend of deals to support the arms trade; after all, according to CAAT, the UK has increased weapons sales by 300% since 2018. The United States meanwhile approved US$7.9 billion worth of arms sales in just one day in May this year and is set to reach US$49 billion in deals in 2020, albeit a slowdown against US$70 billon that was notified in 2019.

Mozambique’s annual GDP, when last measured in 2018, was a little under US$15 billion. To compare, in 2020, for every GDP dollar made in Mozambique, the US arms industry will make 3. The United States – and its allies – need to rethink their position as concerns securing energy supplies in Africa, and in terms of the perceived competition with China and Russia.

It really is coming down to Bullets versus Free Trade.

This article was written by Chris Devonshire-Ellis based upon research and comments kindly provided by China Investment Research. Please contact China Investment Research for additional comments concerning this content here.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com