Venezuela Proposes New Regional LatAm / Caribbean Economic Bloc Tied To China And Russia

Venezuela’s Corpus Christi dance: a different type of Dragon

Nicolas Maduro, the Venezuelan President, has proposed establishing a new international bloc involving Latin American and Caribbean countries that would have close ties to Russia and China. Venezuela is also under strict US sanctions due to political disputes with the United States. The country possesses the world’s largest proven oil reserves estimated at some 300 billion barrels.

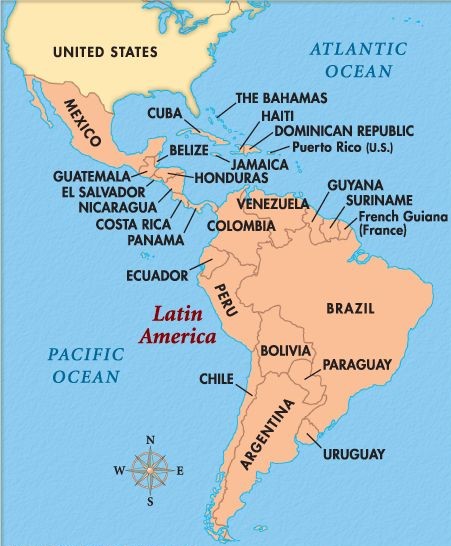

Making his annual new year speech to Venezuela’s Parliament on Friday, (January 13) Maduro said that he had spoken with the presidents of Brazil, Colombia, and Argentina about forming a new regional organization. According to Maduro, the time has come “to unite efforts and paths in Latin America and the Caribbean to advance in the formation of a powerful bloc of political forces, of economic power that speaks to the world.”

The Venezuelan president went on to say that the bloc would create “new poles of power,” and would be allied to Russia and China, the leaders of which Maduro referred to as “elder brothers.”

Such an alliance would comprise “that community of shared destiny that our elder brother President Xi Jinping talks about,” or “that multipolar and multicentric world that our elder brother, President Vladimir Putin, talks about,” Maduro added. “For this world to arrive, a united and advanced Latin American and Caribbean bloc is needed,” he stressed.

President Putin has repeatedly criticized the concept of a “unipolar world” dominated by the United States. In September, he claimed that attempts to achieve such a configuration “have taken an absolutely ugly form.” Meanwhile, Beijing has also said that China and Russia are “promoting together the multipolar world and do not recognize unipolar hegemony.”

Under former President Donald Trump, the US denounced Venezuela’s 2018 election, which Maduro won to secure a second term, as “illegitimate.” Washington unleashed a “maximum pressure” campaign to oust him by imposing harsh significant sanctions on Caracas, which included an oil embargo, and has refused to recognise Maduro as President.

The US subsequently offered support to Venezuelan opposition leader Juan Guaido, recognizing him as Venezuela’s “interim president” in 2019. In the aftermath of the move, Maduro’s government broke off diplomatic relations with Washington. Since then, Washington has made attempts to remove Maduro from power, which has included organised funding a series of violent street protests and a coup attempt. However, in late December 2022, opposition lawmakers in Venezuela voted to dissolve the ‘interim government’ led by Guaido that took its cue from Washington and have instead opted for a unified Venezuelan political strategy in the ‘national interest’.

It is uncertain how a new bloc would be created and how it would be managed. Latin America already has the Mercosur Trade Bloc, which includes Argentina, Brazil, Paraguay, and Uruguay. Venezuela is a full member but has been suspended since 1 December 2016. Mercosur also has trade arrangements with most LatAm nations, however it has been damaged by currency problems, particularly in relation to be compared to the US dollar, which has risen in value significantly against all Mercosur currencies over the past five years. US investors in Mercosur have also become somewhat greedy, and are generally considered as not leaving enough on the table in the region for the local economies.

A bloc aligned with China and Russia – both of whom are active in the LatAm and Caribbean region, is perceived by Venezuela at least as being beneficial. Both have relatively stable economies – despite sanctions – and have been prepared to trade in non-US dollar currencies; even agreeing to currency swaps to help pressurized currencies ride out the current economic winds. China’s provided of a US$7.2 billion currency swap with Argentina earlier this month is an example.

Both China and Russia have economies that are somewhat aligned to LatAm in terms of trade, Russia is an energy powerhouse both in oil, gas and nuclear technologies and is already assisting countries such as Brazil upgrade its own energy output capacity. Russia also has a significant fertilizer export industry – and is developing this. Russian exports of fertilizer rose 70% in value on 2022, a match as the LatAm economies are predominantly agriculturally based.

China meanwhile can assist with industry development in terms of auto manufacturing, IT and other manufacturing and import-export industries. That could in time mean the end of US dominance in these sectors in Latin America as Chinese goods, co-produced in the region, are likely to be more competitive than US brands.

LatAm exports to China have also been on the rise: Chinese trade with Latin America grew from just US$12 billion in 2000 to more than US$430 billion in 2021, driven by demand for a range of products, with China importing mainly soybeans, copper, petroleum, oil, and other raw materials that the country needs to drive its industrial development. In return, the LatAm region mostly imports higher-value-added manufactured products, a trade some experts say has undercut local US funded industries with cheaper Chinese goods. Beijing has free trade agreements in place with Chile, Costa Rica, and Peru, and twenty Latin American countries have so far signed on to China’s Belt and Road Initiative (BRI). Ecuador already has a Free Trade Agreement with China and is negotiating another with the Russian supported Eurasian Economic Union. Meanwhile, Argentina and Nicaragua have made official enquiries about joining the BRICS grouping. In the Caribbean, Cuba is of course a major Russian trade partner. The Cuban President, Miguel Díaz-Canel, visited Moscow and Beijing at the end of 2022. With the EU reluctant to sanction sales of products to the Russian market, Russian importers have been actively involved in replacing European products in dairy and wine from the LatAm nations – all of which possess an extensive colonial European heritage and manufacture similar products.

To build and develop such trade ties will require a huge amount of effort. Much will need to be worked on to justify the existence of a new regional trade bloc, and questions remain about why Mercosur cannot be repositioned to fulfil this role. Nonetheless, the concept can be expected to be warmly welcomed in both Moscow and Beijing and would be a significant chunk of the movement away from a US based ‘unipolar’ global order towards a multilateral world order supported by China and Russia. A flurry of diplomatic activity between China, Russia, the Caribbean and Latin American countries can be expected to occur deep into 2023 as organizational and feasibility plans are being worked out.

Related Reading