Argentina Close To Joining China’s Belt And Road Initiative?

A major blow to the United States’ B3W credibility if Argentina goes BRI

By Chris Devonshire-Ellis

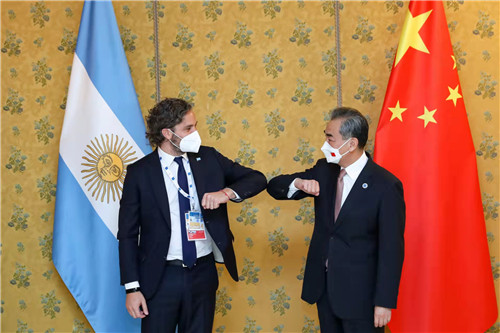

China’s Foreign Minister Wang Yi, possibly the world’s busiest diplomat of 2021, has met with Argentine Foreign Minister Santiago Cafiero in Rome following the G20 meetings.

Wang Yi’s Comments

Speaking at the discussions, which took place last Saturday (October 30) Wang said ‘China and Argentina are comprehensive strategic partners. Bilateral relations have withstood the test of the changing international landscape, and always maintained sound and steady development. Taking the opportunity of the 50th anniversary of the establishment of diplomatic ties next year, China will leverage the mechanisms such as the inter-governmental permanent committee and the strategic dialogue for economic cooperation and coordination to host the Year of China-Argentina Friendship and Cooperation and create brighter prospects in bilateral relations.’

Wang stated that ‘China appreciates Argentina’s active response to the joint building of the Belt and Road Initiative and is willing to work with Argentina to sign the Memorandum of Understanding on cooperation as soon as possible, and further synergize development strategies. Both sides need to enhance cooperation in fields such as financing, energy and mineral resources, and electric power, and expand cooperation in new areas such as aerospace, communications, Antarctica, and Blue Ocean strategies. China intends to continue to provide Argentina with vaccines and medical supplies to help the country secure an early victory over the virus. China welcomes Argentina to actively participate in the Global Development Initiative and inject new impetus into the accelerating realization of the UN 2030 Agenda for Sustainable Development.’

China’s Wang Yi with Argentine Foreign Minister Santiago Cafiero

China’s Wang Yi with Argentine Foreign Minister Santiago Cafiero

These are direct invitations to join the Belt and Road Initiative. Argentina has significant importance for China, as despite the distances, Argentina is China’s largest producer of soy and wheat to the Chinese market. It is also a primary member of the Mercosur Free Trade bloc, which also includes Brazil, Paraguay, and Uruguay with trade agreements with the vast bulk of other South American nations. It has an actual GDP value of some US$2.5 trillion and a combined population of 295 million.

Santiago Cafiero’s Comments

Cafiero said that ‘Argentina is willing to take the opportunity of the 50th anniversary of the establishment of diplomatic ties to deepen practical cooperation in fields such as economy, trade, water conservancy and finance. Argentina attaches great importance to the Belt and Road Initiative and the Global Development Initiative and stands ready to strengthen synergy with China.’

The two sides also exchanged views on deepening China-CELAC cooperation and other issues of common concern.

Summary

Getting Argentina into the BRI is a difficult issue. While it would allow its heavily indebted government to deepen trade and investment ties with China even further, it also needs to balance debt to the United States. China has been financing projects to non-BRI member states in South America, with Argentina for example the recipient of Chinese funding for number of major Argentinian infrastructure projects, including two nuclear plants and a US$2.5 billion upgrade of its main cargo rail network.

Yet making such a move is politically complicated. To solve its external debt problems, Argentina needs to strike a balance in its relations with both China and the United States, its largest creditor. The country has already sealed a deal with most of its foreign private creditors, which have agreed in principle to restructure bonds worth more than US$65 billion. But with an economy in recession and default, a thirst for investment and foreign exchange, and the need to overcome the economic consequences of the Covid-19 pandemic, Chinese capital would greatly help struggling Argentina. Then again, the United States has thrown a potential spanner in the works by placing sanctions on the China Communications Construction Company (CCCC), the largest Belt & Road foreign infrastructure contractor.

An issue in Argentina however is an uncertain political policy towards China. Bilateral relations with China intensified during the government of Cristina Fernández de Kirchner (2007-2015), but when Mauricio Macri rose to power (2015-2019) he questioned several flagship Chinese projects. Alberto Fernández, who took office in December 2019, intends to revitalize the relationship with Beijing and reactivate the controversial Chinese-backed dams in Santa Cruz province among other projects. However, his government needs to finalize its external debt problem with private bondholders, mostly US-based, and renegotiate its US$44 billion debt with the International Monetary Fund (IMF), in which Washington has a hugely influential role.

By joining the BRI, Argentina could unlock Chinese finance for vital investment in infrastructure and transport, fossil and renewable energy, mining, manufacturing, agriculture, innovation and information technology. This would enable the country to bridge infrastructure gaps and better integrate with countries such as Chile, which enjoys strong commercial corridors that connect it to foreign markets in Asia, thereby lowering logistics costs and enhancing competitiveness. This includes the Chile-China underwater optic network is potentially a game changer, as this will help drive interconnectivity, trade, investment, as well as scientific and cultural exchanges between South America and Asia, the first time this will have happened. The cable begins in the Chilean city of Valparaiso, passes New Zealand, Australia and French Polynesia and connects with Shanghai.

Should Argentina decide to join the BRI they will be at the forefront of a South American region that has seen 24% of all Latin American products now go to Asia, up from 18% in 2017. China has also stated that it expects to invest about US$250 billion in South America over the next decade.

B3W vs BRI

Here though comes the promise – not yet approved and unlikely to be fully agreed by the US Congress – of the United States ‘Build Back Better World’ (B3W) project which US President has said will be a US$3.5 trillion infrastructure expenditure plan available to the global community. While that figure is almost certain to be slashed, there remain application criteria that the US will impose on recipients. Some will involve trade and development ties. Argentina then can be expected to be a case study for examining what the application criteria for B3W will be, the terms and conditions, and whether or not the US markets are as attractive as China’s. In short, it will provide answers to two key questions: Are the BRI terms more attractive than the B3W, and does China, or the United States have the more attractive export markets?

China and Asia overall are in fact sound markets for Argentinian and other Latin American manufacturers as long as they do their homework and know the costs involved and what to expect. South America has a combined middle class population of about 50 million. China has a middle class of about 700 million, India around 350 million and the ASEAN bloc about 150 million. That means for every single South American middle class consumer, there are about 24 in emerging Asia. Which makes it a great market to be looking at.

The Mercosur bloc as a whole could also benefit, perhaps via a Mercosur-China Free Trade Agreement, a situation we explored in the article Linking China’s Belt & Road Initiative With South America’s Mercosur

Having Argentina as a BRI member in South America would be a great coup for China and provide a boost to Argentina and the region when the bilateral trade flows are just beginning to show potential. If Argentina can balance its US debt against Chinese trade and investment, then it could become a poster case for balancing the two, in addition to making a case for BRI vs.B3W.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com